Queens New York Professional Limited Liability Company - PLLC - Formation Questionnaire

Description

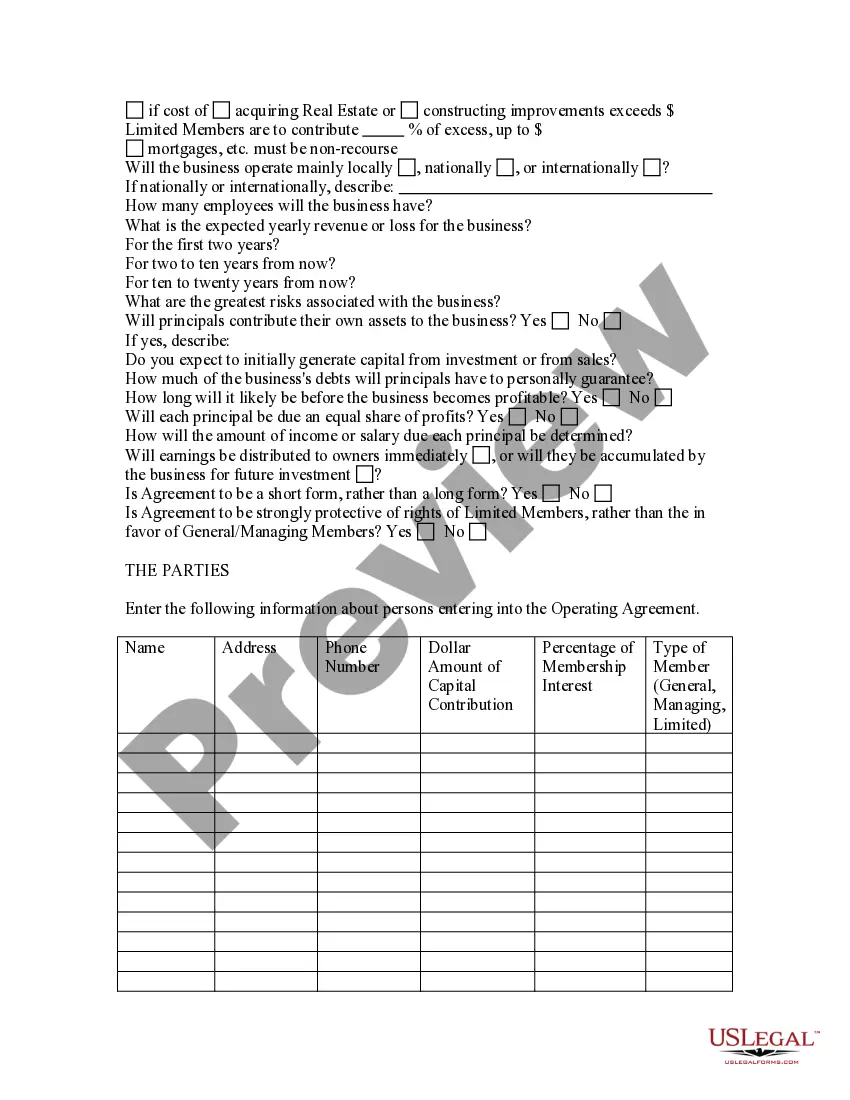

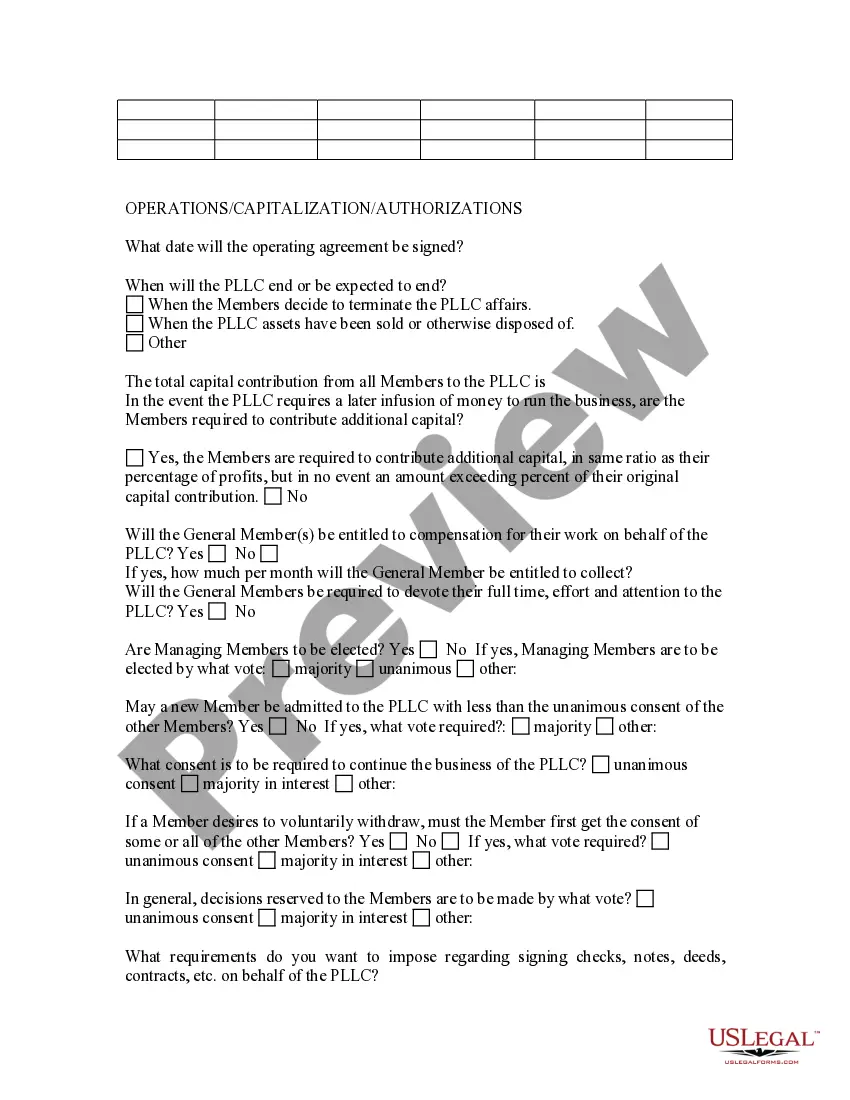

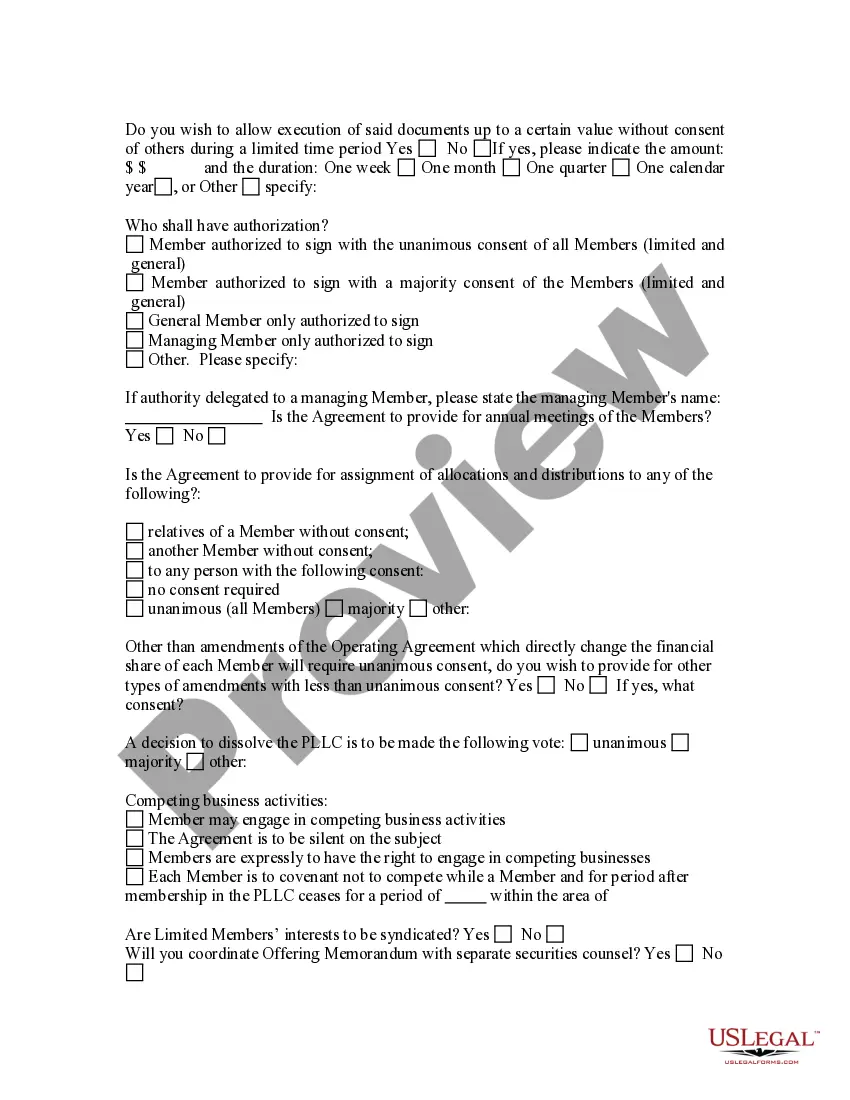

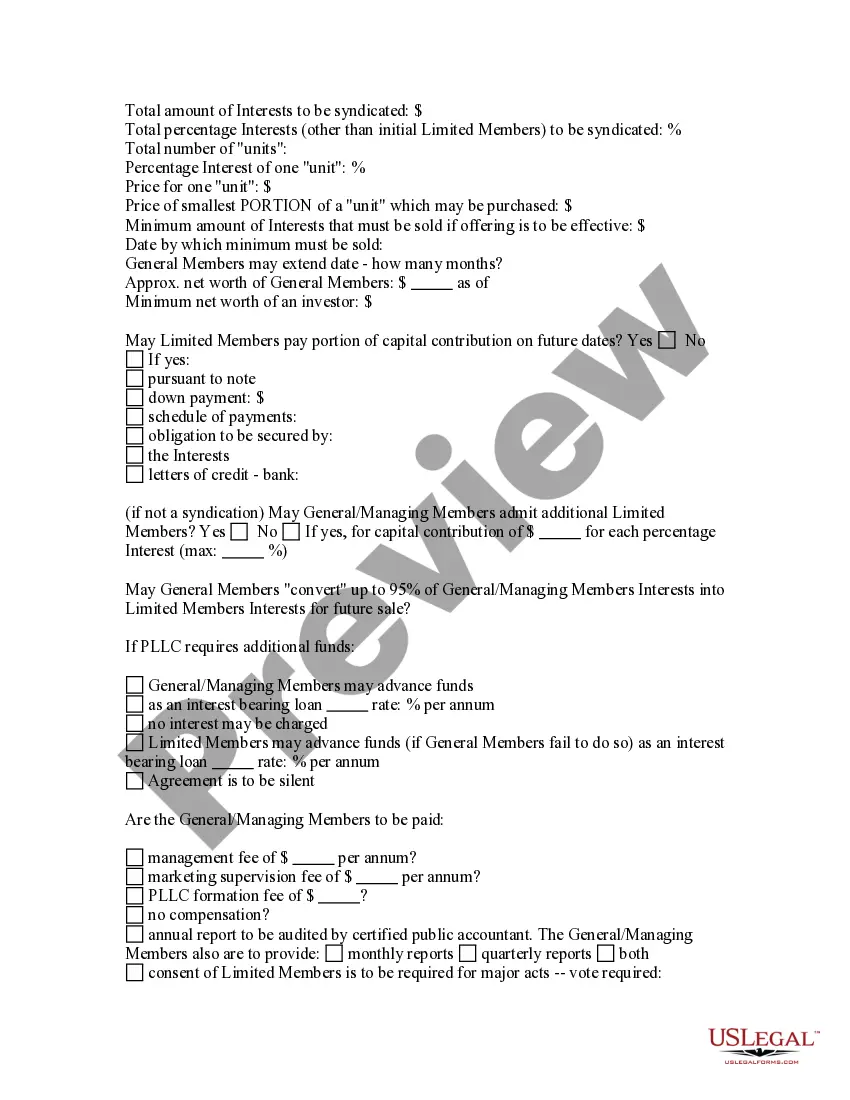

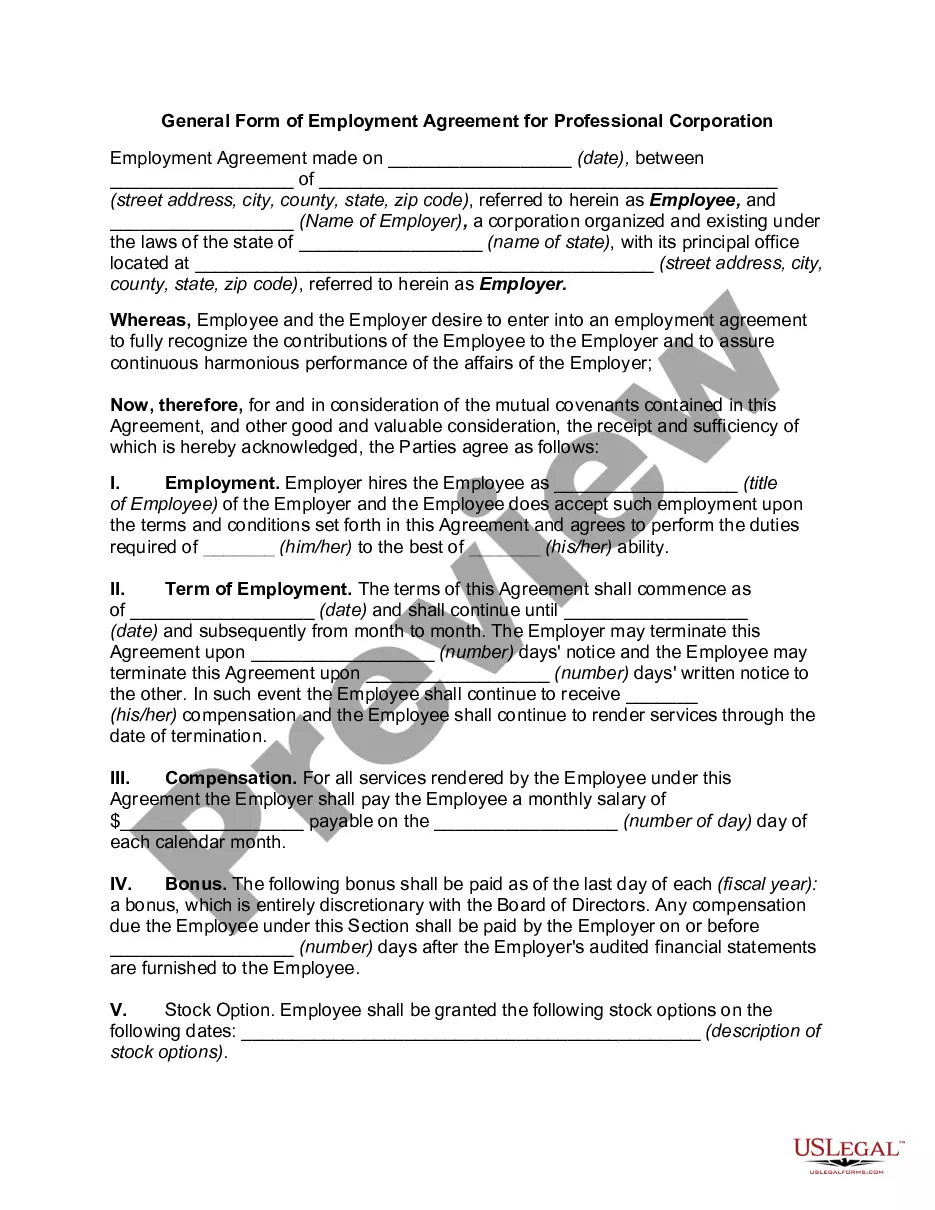

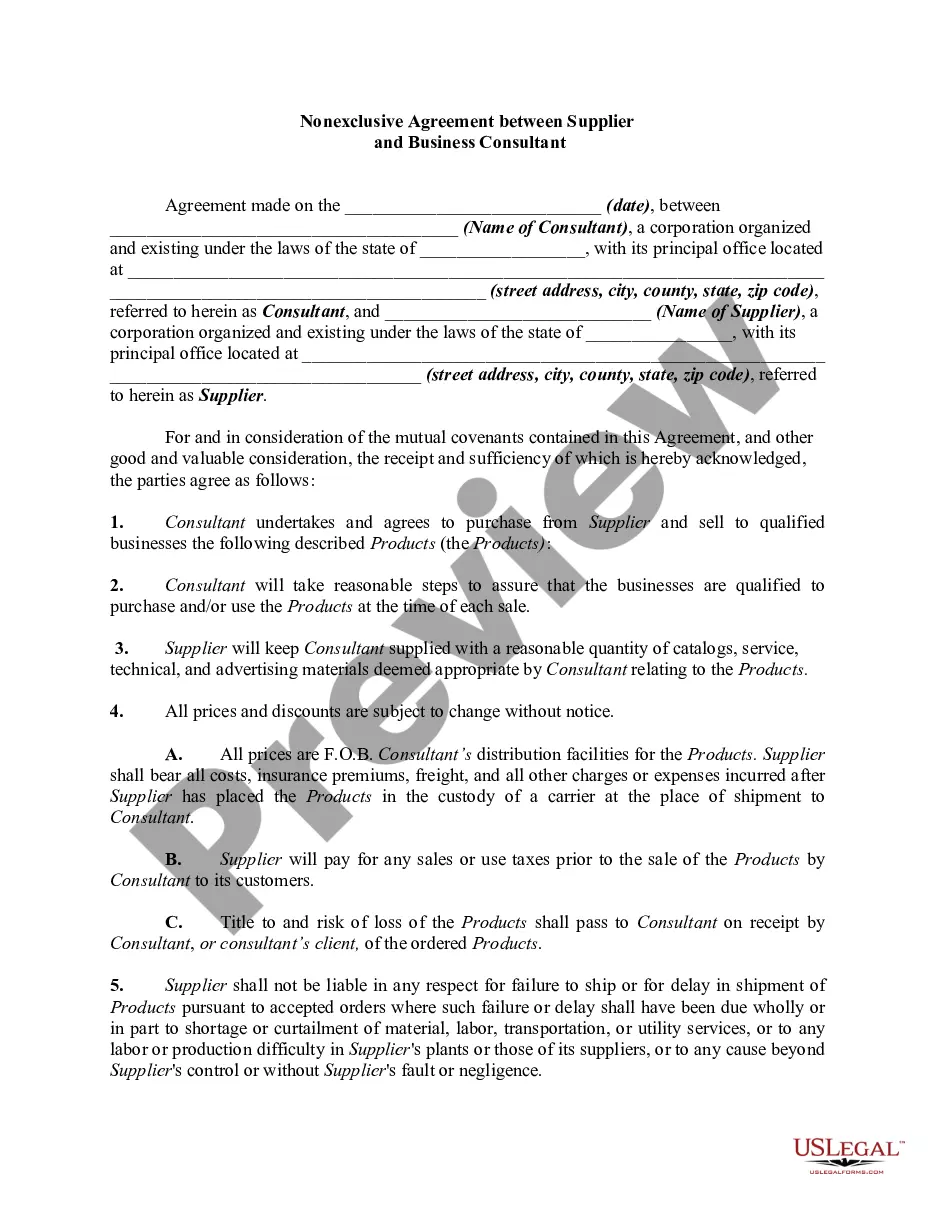

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Professional Limited Liability Company - PLLC - Formation Questionnaire?

Whether you intend to launch your enterprise, enter into a contract, request an update for your identification, or address familial legal matters, it's essential to prepare certain documentation that complies with your regional laws and regulations.

Locating the appropriate documents could require significant time and energy unless you utilize the US Legal Forms library.

This service offers users over 85,000 professionally prepared and verified legal documents suitable for any individual or business event. All documents are categorized by state and purpose, making the selection of something like the Queens Professional Limited Liability Company - PLLC - Formation Questionnaire quick and straightforward.

Afterward, Download the Queens Professional Limited Liability Company - PLLC - Formation Questionnaire in your preferred file format. You can print the document or complete it and sign it digitally through an online editor to save time. Documents available from our library can be reused. With an active subscription, you can access all of your previously acquired documents anytime from the My documents section of your account. Stop wasting time searching for current official documentation. Register for the US Legal Forms platform and organize your paperwork with the most comprehensive online form library!

- Log in to your account on the US Legal Forms library by clicking here and select the Download option next to the necessary template.

- If you are a newcomer to the service, there will be several additional steps to acquire the Queens Professional Limited Liability Company - PLLC - Formation Questionnaire. Follow the instructions below.

- Ensure that the example aligns with your requirements and complies with your state's legal standards.

- Review the form description and utilize the Preview function if accessible on the website.

- Utilize the search feature above to locate an alternative template based on your state.

- Click Buy Now to purchase the document once you've identified the correct one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and complete payment using a credit card or PayPal.

Form popularity

FAQ

The form for PLLCs, unlike the form for regular LLCs, requires additional information such as the names and residential addresses of all PLLCs members or managers. The current filing fee is $200.

Advantages Members of a PLLC aren't personally liable for the malpractice of any other member.PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

A PLLC is a kind of LLC specifically for licensed professionals. The difference between an LLC and a PLLC is mainly that only licensed professionals such as architects, doctors, lawyers and accountants can form PLLCs. Check with your state to determine if they permit licensed professionals to form a standard LLC.

When it comes to taxes, PLLCs pay them in the same way that LLCs do, depending on the number of members. A PLLC with one member pays taxes as a sole proprietorship, while a PLLC with multiple members pays taxes as a partnership. LLCs pay income taxes by passing on the net income or loss of the LLC to its members.

Limited liability companies are required by statute to conduct business under their true legal or real name. If a limited liability wishes to conduct business under a name other than its true legal name, a Certificate of Assumed Name must be filed with the NYS Department of State.

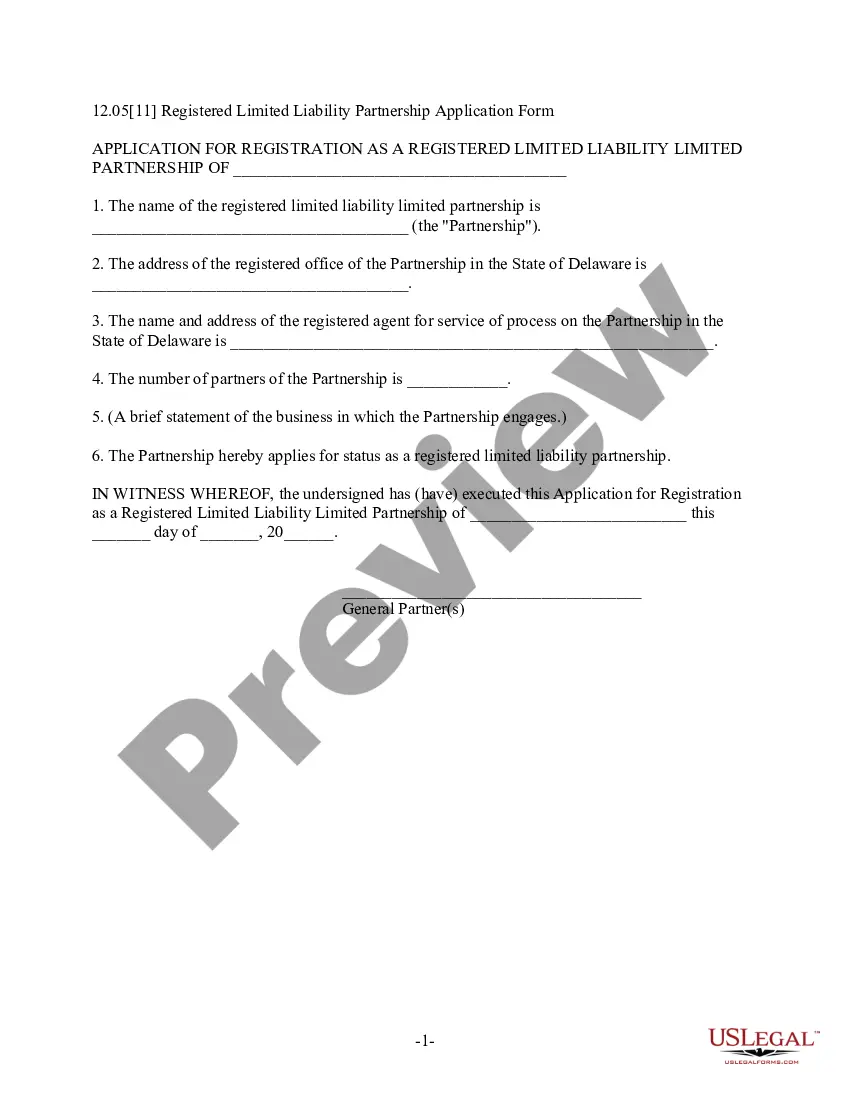

A domestic partnership or limited partnership may be converted into an existing limited liability company or into a new formed limited liability company by filing a Certificate of Conversion pursuant to Section 1006 of the New York State Limited Liability Company Law.

The owners of an LLC are called its members. An LLC member can assume a position resembling a partner, passive investor, or a sole proprietor.

The filing fee for a New York PLLC is $200 for the Articles of Organization. It can be paid by cash, check, money order, or credit card. PLLCs must submit an annual filing fee of $25 or more based on the organization's income although financial statements are only required every other year.

PLLC Owner Liability Protection In general, PLLC members have the same legal protections as members of an LLC. While the PLLC protects members from each other's malpractice suits, it does not protect individual members from their own malpractice suits.

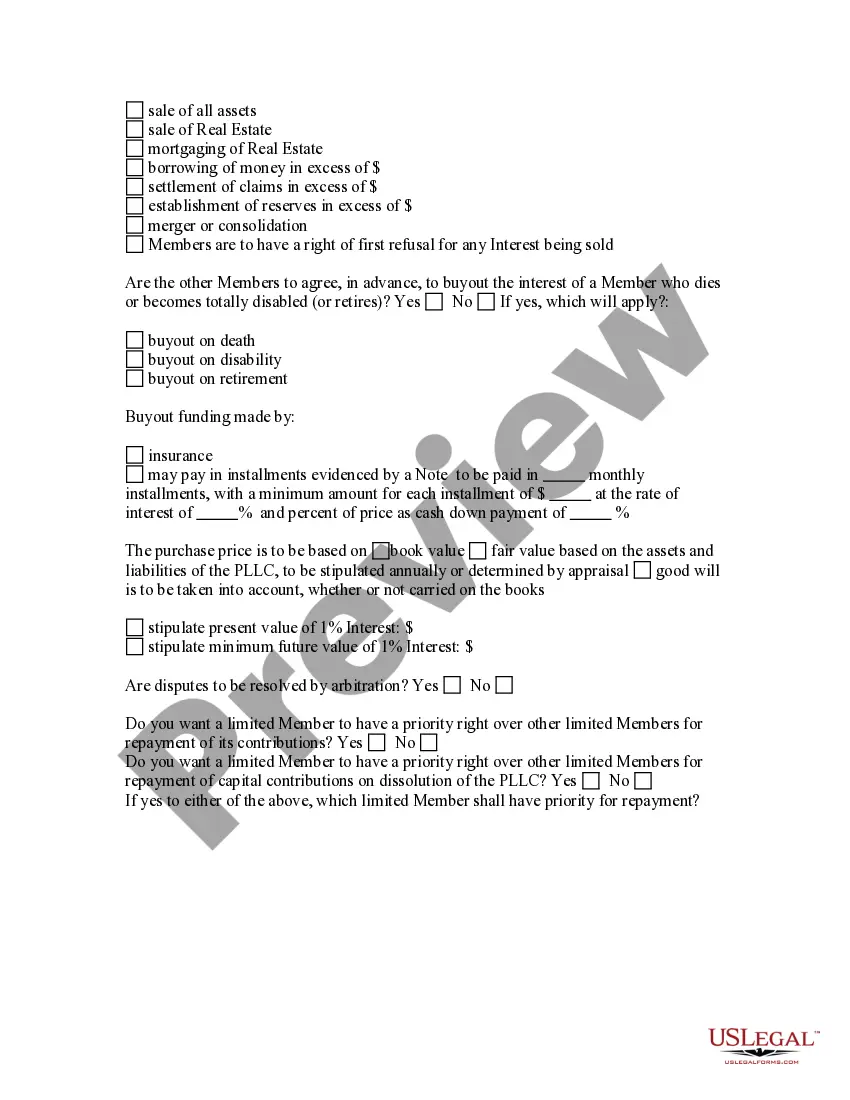

Forming a PLLC in New York (in 6 Steps) Step One) Choose a PLLC Name.Step Two) Designate a Registered Agent.Step Three) File Formation Documents with the State.Step Four) Create an Operating Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.