Tarrant Texas Certificate of Cancellation of Certificate of Limited Partnership

Description

How to fill out Tarrant Texas Certificate Of Cancellation Of Certificate Of Limited Partnership?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Tarrant Certificate of Cancellation of Certificate of Limited Partnership.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Tarrant Certificate of Cancellation of Certificate of Limited Partnership will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Tarrant Certificate of Cancellation of Certificate of Limited Partnership:

- Make sure you have opened the correct page with your regional form.

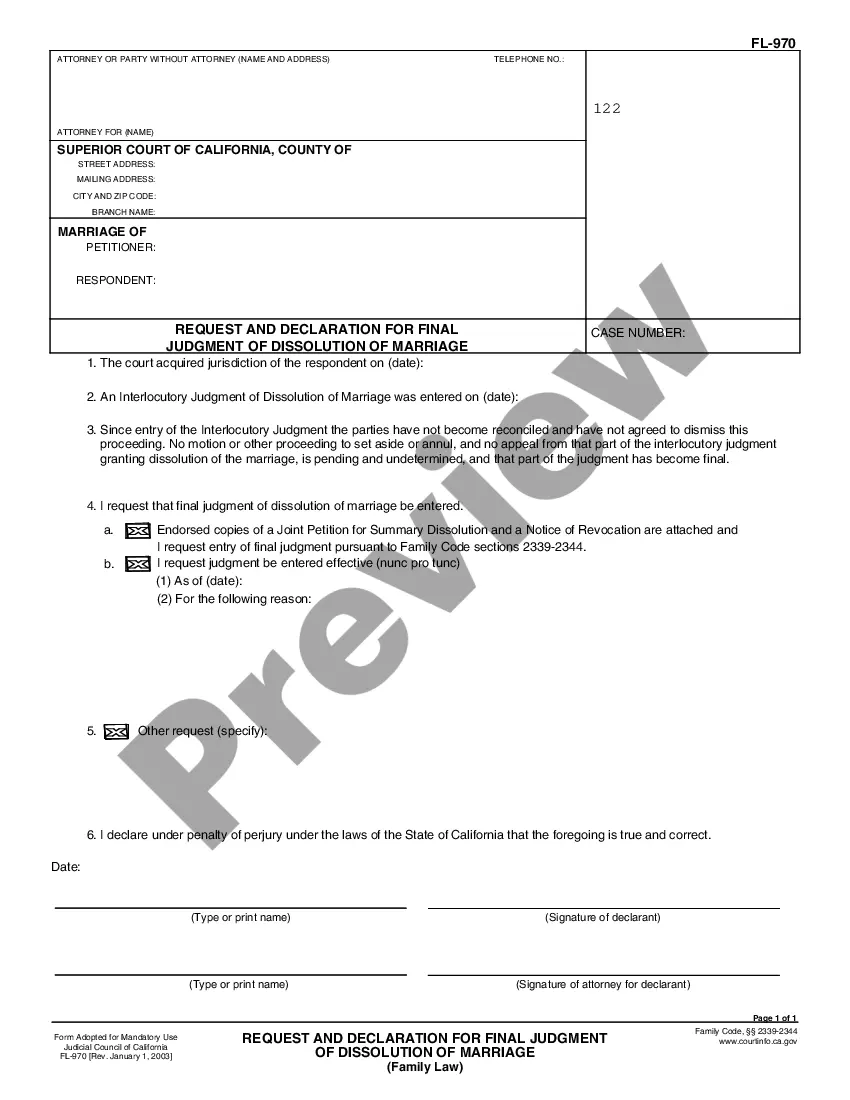

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Tarrant Certificate of Cancellation of Certificate of Limited Partnership on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee. The form can be filed online. If you'd like to save yourself some time, you can hire us to dissolve your LLC for you.

The entity must: Take the necessary internal steps to wind up its affairs.Submit two signed copies of the certificate of termination.Unless the entity is a nonprofit corporation, attach a Certificate of Account Status for Dissolution/Termination issued by the Texas Comptroller.Pay the appropriate filing fee.

When and if your DBA expires, the state will allow you to renew the DBA application online for a fee, plus a small renewal form. DBA renewals should take place before they expire, so be sure to know your state's renewal frequency to ensure you DBA application filing is a smoother process for your and your business.

Do I need to tell the Comptroller's office I am closing or selling my business? Yes. You can notify the Comptroller's office that you are closing your account by entering the information on the Close Business Location webpage and selecting Close all outlets for this taxpayer number.

1. Call the Texas State Comptroller to make sure your tax ID and permit are still active. Your permit is valid only if you are engaged in business as a seller. If the Comptroller learns that you are no longer selling taxable items, the office may cancel your permit automatically.

The Assumed Name Certificate can be filed electronically via SOSDirect, by mail to the address in the Form 503 instructions, or delivered in person to the James Earl Rudder Office Building in Austin, Texas.

Their phone number is 800-252-5555. They will update your account within 24-48 hours. After such time, when you log back into your account, you will see a final return. If your business is registered with the Secretary of State, you need to request a Certificate of Termination.

The Secretary of State charges a $40 filing fee for dissolving an LLC. If submitting via the website, you can pay online when you submit the forms. Checks should be payable to the secretary of state, and if you're paying by credit card via fax, make sure you also attach Form 807.

To dissolve your Texas LLC, you must file a Certificate of Termination with the Secretary of State. There is a $40 filing fee. The form can be filed online. If you'd like to save yourself some time, you can hire us to dissolve your LLC for you.

You can apply online or by mail. Read our Form an LLC in Texas guide for details. Or use a professional service like ZenBusiness or to form your LLC for you. To register your Texas corporation, you'll need to file the Certificate of Incorporation with the Texas Secretary of State.