Houston Texas Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

Compiling paperwork for business or personal purposes is consistently a significant obligation.

When formulating a contract, a public service inquiry, or a power of attorney, it is vital to take into account all federal and state laws and regulations of the specific jurisdiction.

However, smaller counties and even municipalities also have legislative stipulations that you need to regard.

The wonderful aspect of the US Legal Forms library is that all the documents you have ever bought are never lost - you can access them in your profile under the My documents tab at any time. Register on the platform and swiftly obtain verified legal forms for any situation with just a few clicks!

- All these aspects contribute to the anxiety and time-consuming nature of drafting the Houston Form of Parent Guaranty without expert aid.

- It is feasible to evade expenditures on attorneys for preparing your documents and create a legally recognized Houston Form of Parent Guaranty on your own, utilizing the US Legal Forms web repository.

- This is the largest online assemblage of state-specific legal templates that are professionally verified, ensuring validity when selecting a document for your locality.

- Previously subscribed users only need to Log In to their accounts to acquire the required form.

- If you do not possess a subscription yet, adhere to the step-by-step instructions below to obtain the Houston Form of Parent Guaranty.

- Browse the page you have accessed and verify if it contains the document you need.

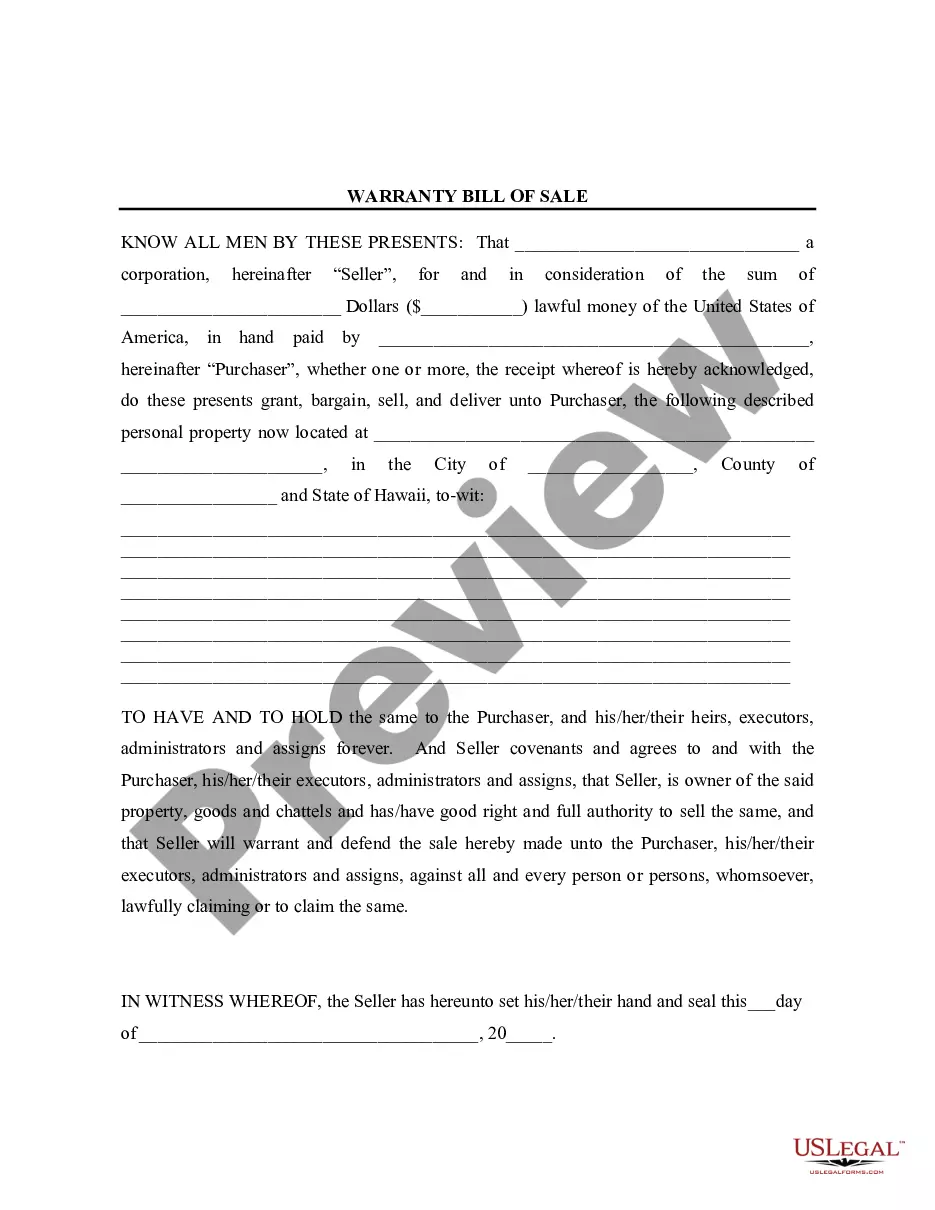

- To achieve this, utilize the form description and preview if these features are available.

Form popularity

FAQ

Yes, a parent can serve as a personal guarantor when it comes to financial obligations. In the context of a Houston Texas Form of Parent Guaranty, this role involves a parent legally committing to cover the debts or obligations of their child. This agreement provides landlords, lenders, or service providers with added security, knowing that a responsible adult is backing the agreement. Furthermore, using a form specifically designed for Texas ensures that all local laws and regulations are properly addressed, allowing for a smooth process.

A parent guarantee works by pledging the parent company's assets or creditworthiness to back the subsidiary's debts. This arrangement assures creditors that the parent company will fulfill financial obligations if the subsidiary defaults. It is a valuable tool for improving the subsidiary's standing in negotiations, allowing them to secure better terms. You can easily obtain the Houston Texas Form of Parent Guaranty through our platform, which simplifies the process.

The parent company guarantee rule establishes the conditions under which a parent company agrees to support its subsidiary’s financial commitments. This rule is particularly significant in the context of leasing and financing agreements, where lessors or lenders require assurances. When crafting a Houston Texas Form of Parent Guaranty, understanding this rule can help ensure compliance and protect all parties involved. Utilizing our platform can streamline the creation of this important document.

An owner parent guaranty is a legal document that ensures a parent company will assume financial responsibility for its subsidiary's obligations. Essentially, it provides security for lenders and landlords by mitigating risk. This document is vital in transactions where the subsidiary may lack sufficient credit history or financial strength. For those looking for the Houston Texas Form of Parent Guaranty, this document is readily available and can offer peace of mind.

A short form guaranty is a simplified version of a guaranty document, focusing on the essential terms without excessive detail. It typically outlines the core responsibilities of the guarantor in a straightforward manner. When dealing with transactions involving the Houston Texas Form of Parent Guaranty, a short form may expedite the process, making it easier for parties to understand their obligations quickly.

A form of guarantee is an official document that provides assurance to a creditor about the fulfillment of a debtor's obligations. This document delineates the responsibilities of the guarantor and usually lays out the terms for repaying any debts. The Houston Texas Form of Parent Guaranty specifically helps address the needs of companies in Houston seeking reassurance for their financial engagements.

A form of guaranty is a standardized document that outlines the terms and conditions under which a guarantor agrees to assume responsibility for another party's obligations. This legal instrument spells out the obligations, rights, and limitations of the involved parties. In the context of a Houston Texas Form of Parent Guaranty, it clarifies the parent company's role in ensuring financial commitments, making it a vital tool for many businesses.

You might require a parent company guarantee in situations involving significant loans, leases, or contracts where the borrower is a subsidiary. If the subsidiary has limited financial resources, lenders may seek assurance from the parent company to mitigate risk. Utilizing a Houston Texas Form of Parent Guaranty can help secure financing and stabilize business relationships by providing an additional safety net.

The three types of guarantees include personal guarantees, corporate guarantees, and parent company guarantees. Each type serves to ensure a lender or creditor that debts will be repaid. In the context of a Houston Texas Form of Parent Guaranty, the parent company guarantee is crucial as it protects the lender by leveraging the resources of a financially sound parent organization. This arrangement can benefit both the borrower and lender by providing additional security.

A parental guarantor form is a legal document that outlines the responsibilities of a parent as a guarantor in a specific agreement. This form plays a crucial role in establishing the parent's obligations and ensuring they are legally bound to cover any default by the other party. Utilizing the Houston Texas Form of Parent Guaranty can streamline this process and provide clarity to all involved. It is essential to understand the terms of this form before signing.