Contra Costa California Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

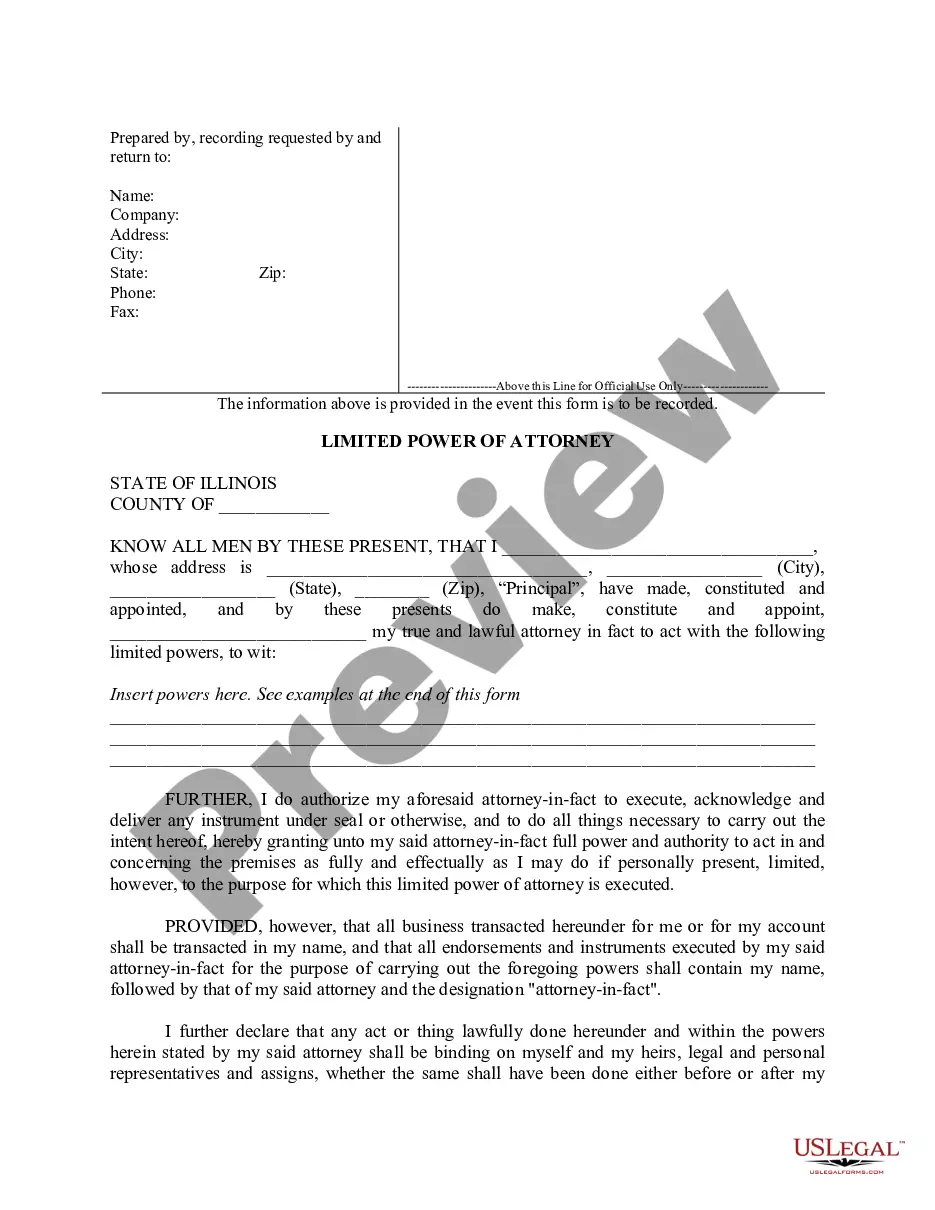

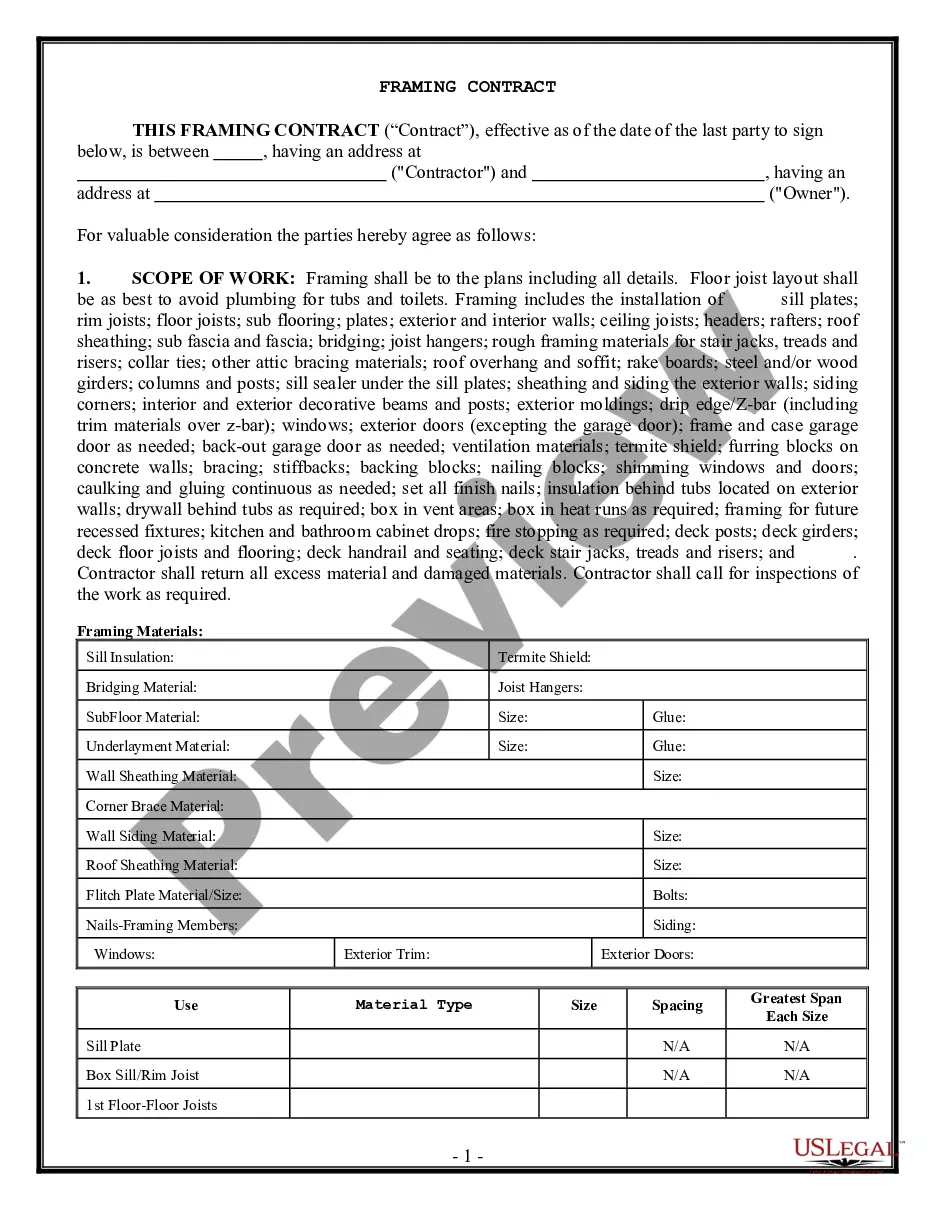

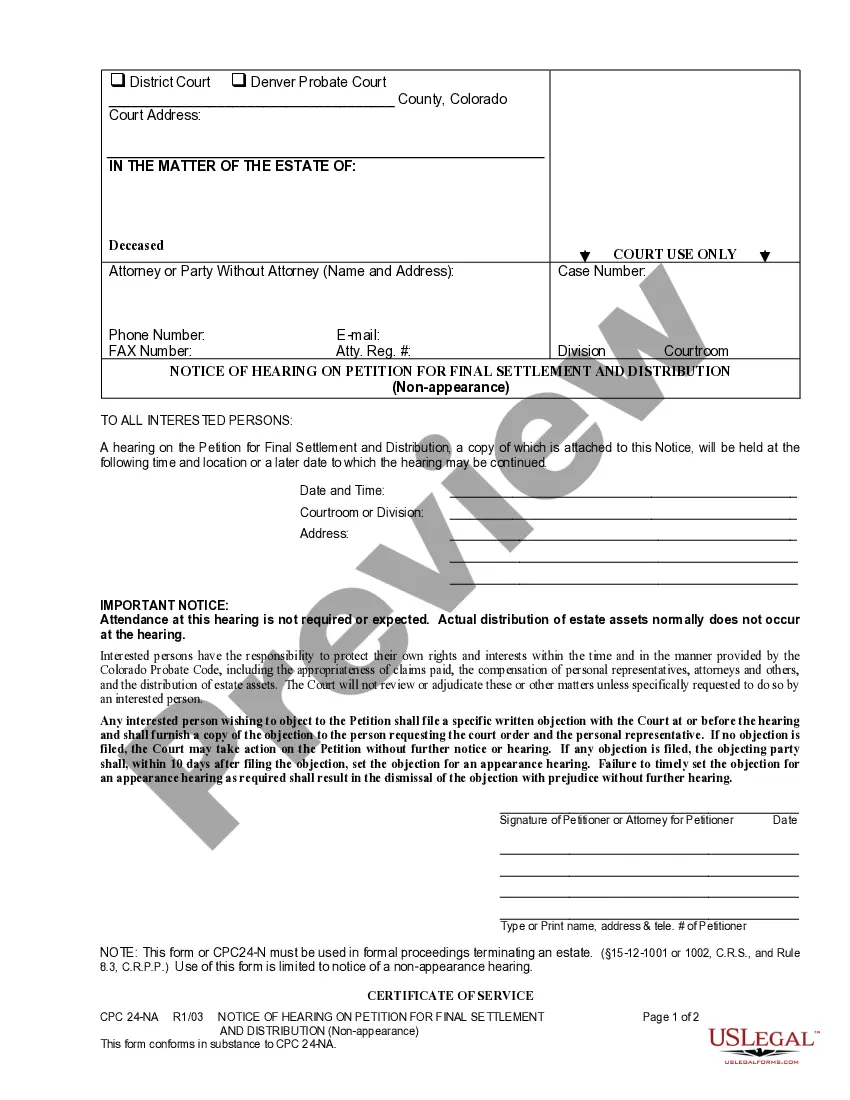

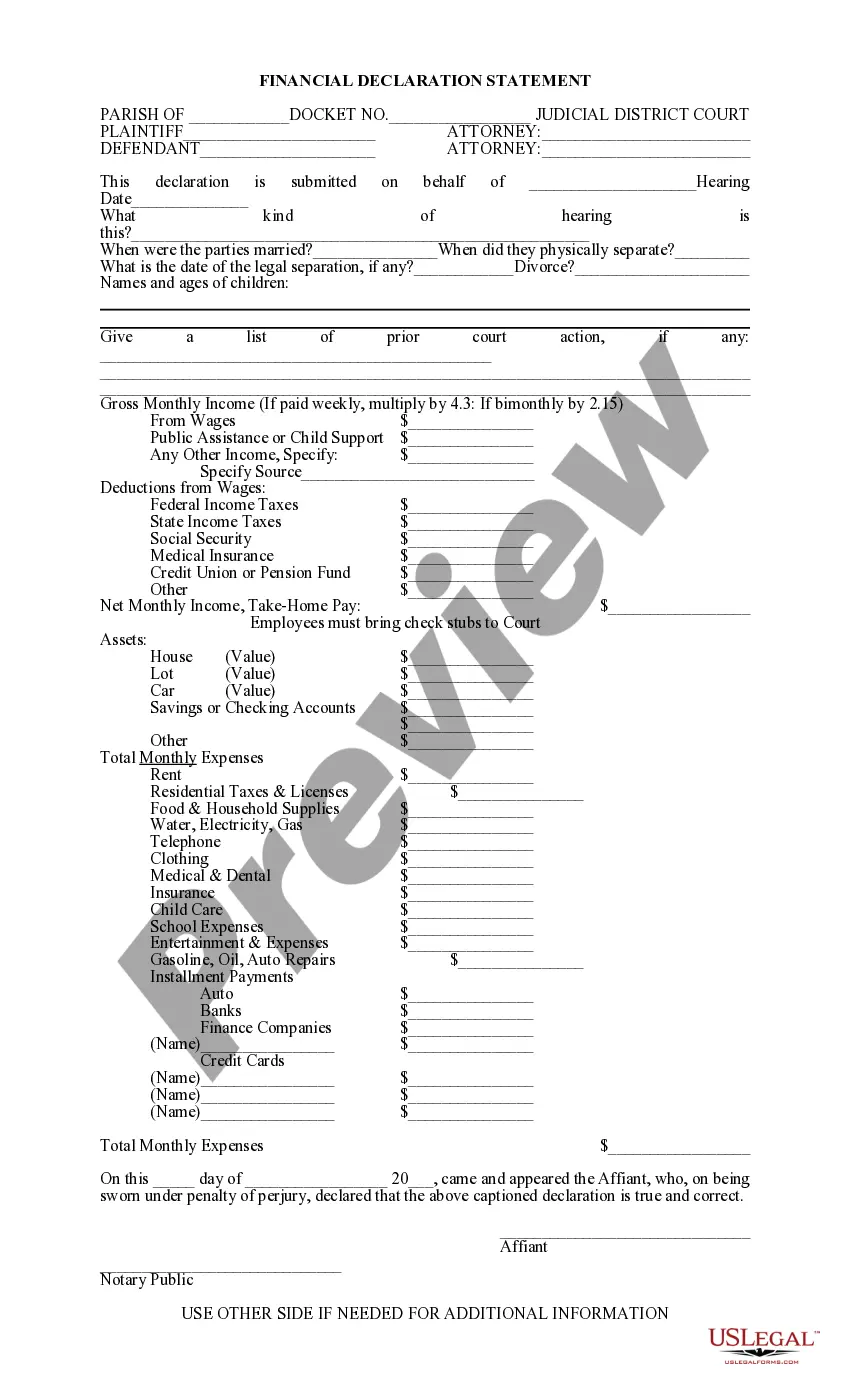

Producing legal documents is essential in contemporary society. However, you don't always have to seek expert help to create some of them from the ground up, including Contra Costa Clauses Related to Initial Capital contributions, with a service like US Legal Forms.

US Legal Forms offers over 85,000 documents to choose from across diverse categories ranging from living wills to real estate contracts to divorce agreements. All documents are organized according to their respective state, making the searching experience less daunting. You can also access informative resources and guides on the site to simplify any processes associated with document completion.

Here’s how to acquire and download Contra Costa Clauses Related to Initial Capital contributions.

Access the My documents tab to download the document again.

If you’re already a subscriber of US Legal Forms, you can find the necessary Contra Costa Clauses Related to Initial Capital contributions, Log In to your account, and download it. Obviously, our website cannot replace a legal expert entirely. If you have to handle an exceptionally complex case, we recommend having an attorney evaluate your form before you proceed with execution and filing.

With over 25 years in the industry, US Legal Forms has become a reliable source for various legal documents for millions of users. Join them today and obtain your state-compliant paperwork with ease!

- Review the document's preview and outline (if available) to grasp an overview of what you will receive after downloading the form.

- Make sure that the template you select is tailored to your state/county/region as state regulations can influence the legitimacy of certain records.

- Inspect similar document templates or restart the search to find the proper document.

- Click Buy now and create your account. If you already have one, choose to Log In.

- Choose the option, then a suitable payment method, and acquire Contra Costa Clauses Related to Initial Capital contributions.

- Opt to save the form template in any available format.

Form popularity

FAQ

Capital is defined as the cash or assets in an LLC (or any type of entity for that matter). Capital can include cash, accounts receivable, equipment, and even physical property. Naturally, putting the words together, a capital contribution is a member's contribution of assets, usually cash, into the LLC.

A Partner's Original Capital Contribution shall be the amount of the cash, or in the sole and absolute discretion of the General Partner, assets, contributed by such party upon such Partner's admission as a Partner.

The accounting treatment in the subsidiary of the return of a capital contribution is, therefore, that it is treated as a distribution. A dividend can only be paid if a company has distributable reserves; therefore, if there are no distributable reserves, then no distribution can be made under company law.

Original Capital means the actual capital raised by the Company and or any of its subsidiaries, if any are formed, to produce and/or exploit one or more of the Musicals. Original Capital may include, without limitation, Loans, Commitments and other Company revenue, income and proceeds. Sample 1.

Seller shall have made a capital contribution to the Issuer in the amount of the expenses payable by the Issuer pursuant to SECTION 10.13(a)(i).

Contributed capital is reported on the balance sheet under the shareholders' equity section. On the balance sheet, the contributed capital contains two separate accounts: common stock account and additional paid-in capital.

No Member shall have any obligation to make any Capital Contributions to the Company other than as expressly set forth herein.

The owner's capital contribution is the total value of the cash and assets contributed. The capital contribution amount is factored into the owner's equity as well as the amount that the owner would get out of the company should it be sold or liquidated.

Business Law Definition In business and partnership law, contribution may refer to a capital contribution, which is an amount of money or assets given to a business or partnership by one of the owners or partners. The capital contribution increases the owner or partner's equity interest in the entity.

Initial Contribution means the first contribution (if any) of Receivables and Receivables Assets related thereto, made pursuant to Section 2.01 of the Contribution Agreement.