Bexar Texas Clauses Relating to Initial Capital contributions

Description

How to fill out Bexar Texas Clauses Relating To Initial Capital Contributions?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Bexar Clauses Relating to Initial Capital contributions is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Bexar Clauses Relating to Initial Capital contributions. Adhere to the guide below:

- Make sure the sample meets your individual needs and state law requirements.

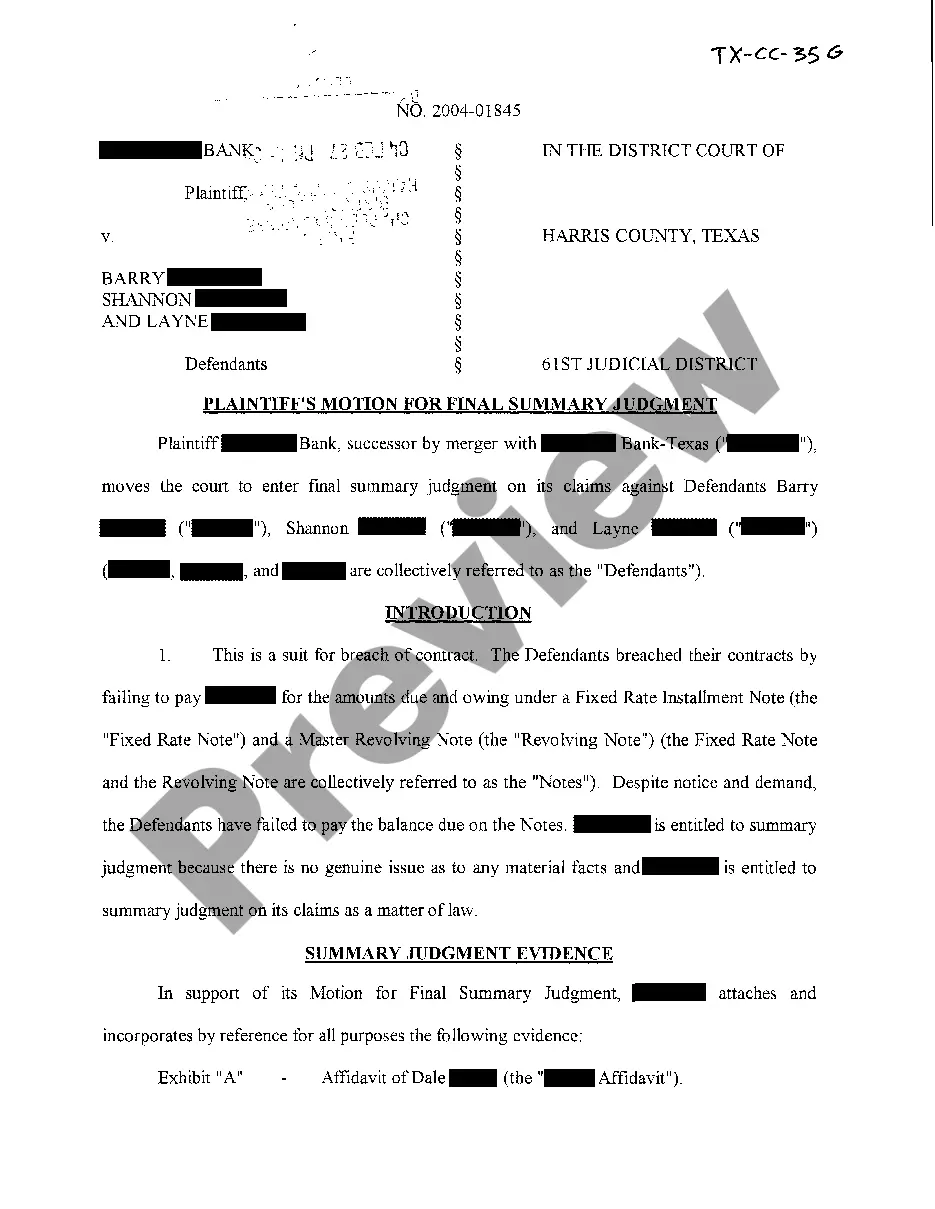

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Clauses Relating to Initial Capital contributions in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Our LLC capital contribution agreement documents the following essential information: Name of each member making a contribution. The valuation of previous membership interests. Each member's previous percentage of LLC ownership. The date contributions are being made. The LLC name. The LLC date and state of formation.

No Member shall have any obligation to make any Capital Contributions to the Company other than as expressly set forth herein.

Business Law Definition In business and partnership law, contribution may refer to a capital contribution, which is an amount of money or assets given to a business or partnership by one of the owners or partners. The capital contribution increases the owner or partner's equity interest in the entity.

Capital Contributions For example, an owner might take out a loan and use the proceeds to make a capital contribution to the company. Businesses can also receive capital contributions in the form of non-cash assets such as buildings and equipment.

Initial Contribution means the first contribution (if any) of Receivables and Receivables Assets related thereto, made pursuant to Section 2.01 of the Contribution Agreement.

A capital contribution is a contribution of capital, in the form of money or property, to a business by an owner, partner, or shareholder. The contribution increases the owner's equity interest in the business.

Cash or assets given to an entity in exchange for an equity interest or as part of an ongoing obligation, or capital commitment, to fund the entity. For example, a capital contribution is often made in exchange for additional common stock, partnership interests or limited liability company interests of an entity.

An initial capital contribution is commonly seen as being given in exchange for membership in an LLC. However, while not typical, a person could contribute something to a company without being given membership, and a person could also be given membership without making any contribution.

Loans are advances made to a third party with the expectation of repayment. They entitle the lender to interest usually. Capital contributions are more akin to investments. They are transfers made with the hope of earning a profit or gain.