This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Palm Beach Florida Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Palm Beach Florida Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Palm Beach Option to Renew that Updates the Tenant Operating Expense and Tax Basis without expert assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Palm Beach Option to Renew that Updates the Tenant Operating Expense and Tax Basis on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to get the Palm Beach Option to Renew that Updates the Tenant Operating Expense and Tax Basis:

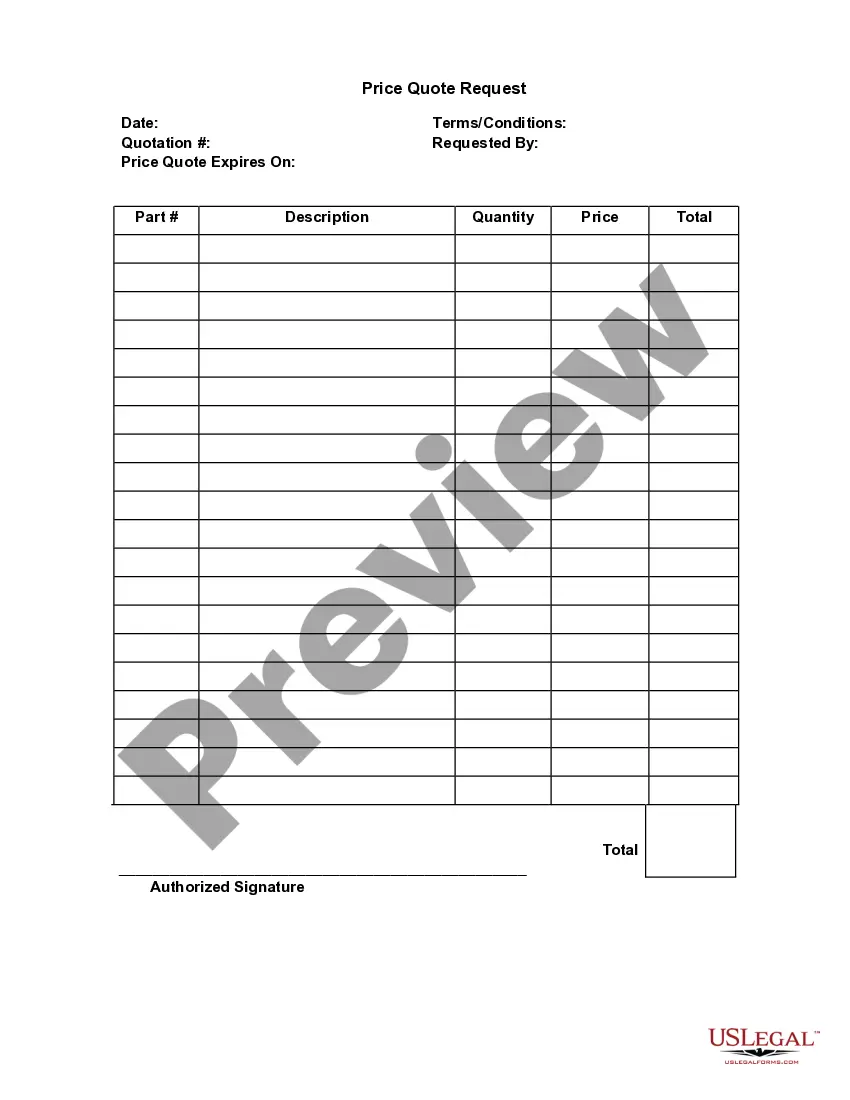

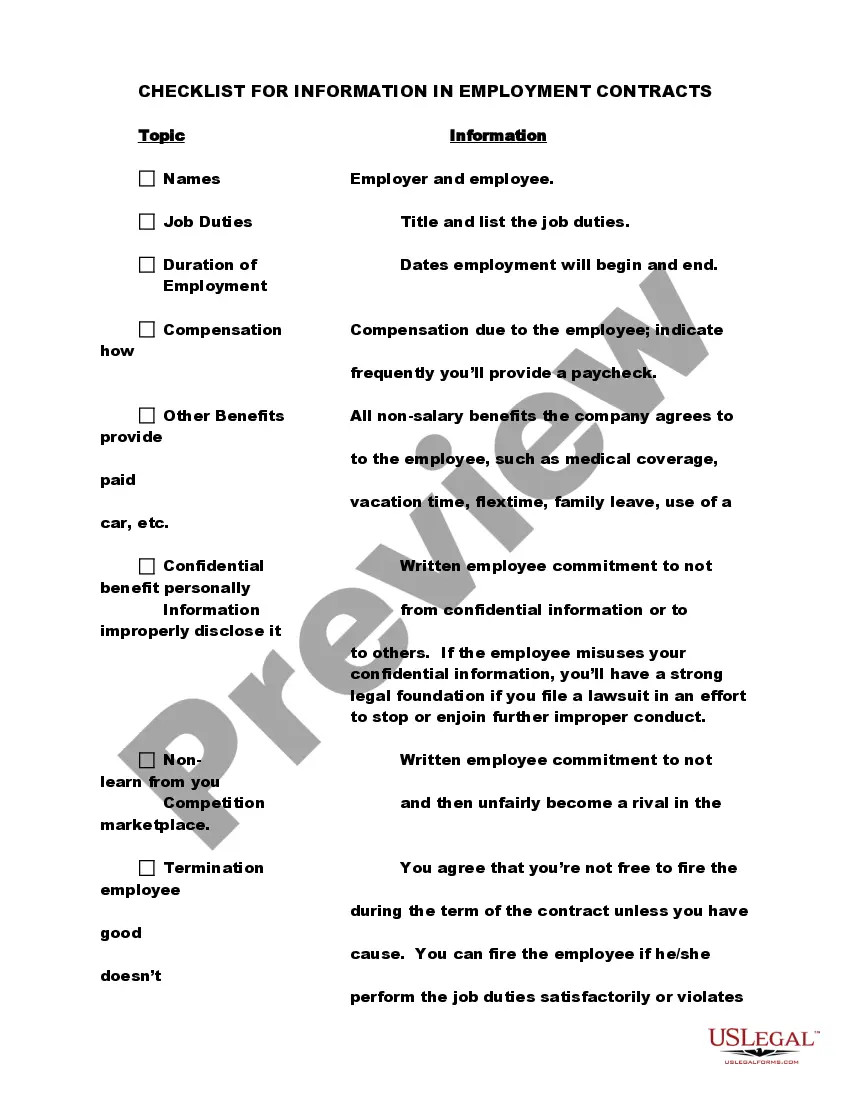

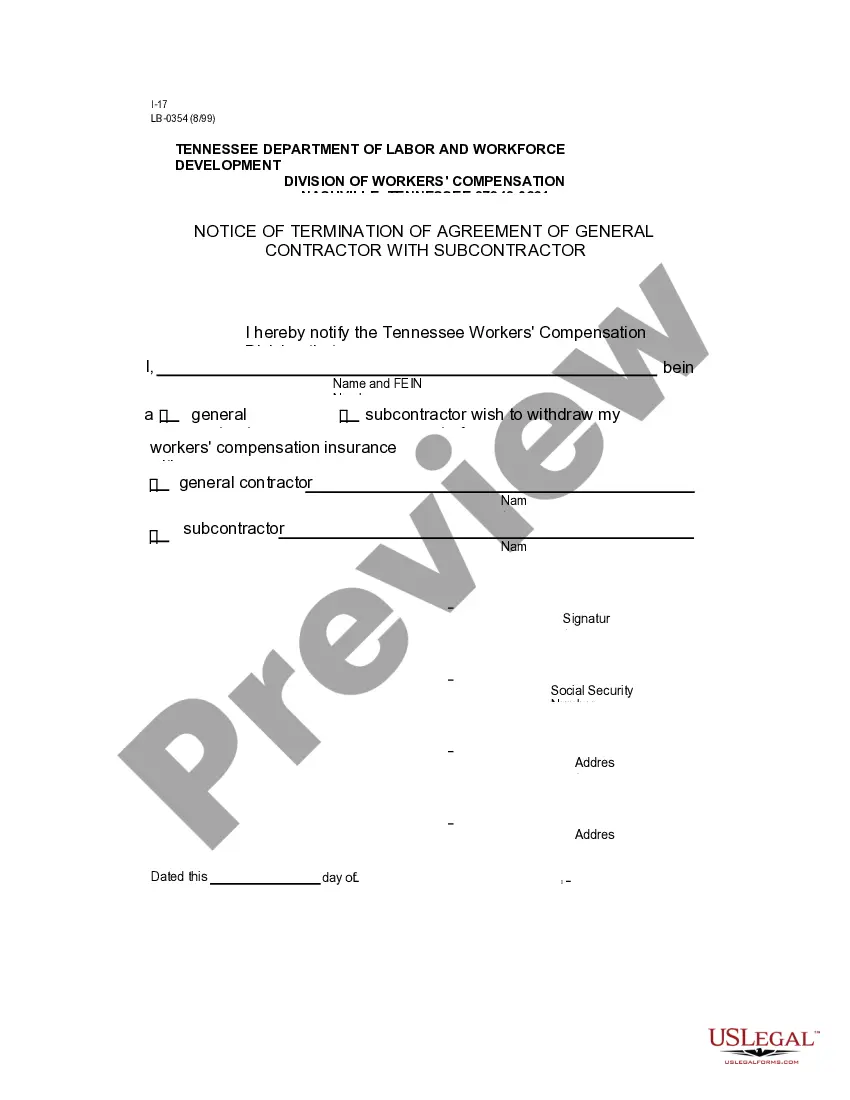

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Tenant improvements are treated as ordinary capital expenditures on the landlord's financial statements. The total amount of the expenditures are recorded as an asset on the landlord's balance sheet. Then, each month, the depreciation expense is recorded on the landlord's income statements.

Renew or extend a fixed-term tenancy This agreement has to be in writing and signed by both parties. Sometimes the tenancy agreement says the tenant has the right to renew the fixed-term tenancy. In this case, if the tenant wants to renew they must tell the landlord in writing.

In a commercial real estate context, expenses that are necessary for the operation, management, and maintenance of a commercial property. A tenant typically pays its proportionate share of operating expenses as additional rent.

A renewal agreement is a new contract, usually for another fixed term. The tenancy terms may not be exactly the same as your current fixed term tenancy. Before you sign, check important things like the: rent.

What isn't included in operating expenses? Operating expenses should not include debt service, CAPEX, property marketing costs, capital reserves for future large repair projects, leasing commissions or tenant improvements allowances.

The Base Year is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year. In a new lease, the Base Year is most often the year the lease is executed or the year in which the lease commences.

They will stay a tenant and will be entitled to remain in the property until evicted through the courts. Another worry landlords have is that if tenants stay in the property a long time, they will suddenly acquire extra rights, such the right to buy the property. This won't happen, either.

Frequently referred to as OPEX, operating expenses are all of the costs that go into running a building. These include utilities, repairs and maintenance, exterior work, insurance, management, and property tax.

A tenancy agreement cannot usually be changed unless both parties agree to the changes. If both parties agree, the change should be recorded in writing either by drawing up a new tenancy agreement or by amending the existing agreement.

A renewal option is a clause in a financial agreement that outlines the terms for renewing or extending an original agreement. The renewal option appears as a covenant in the original agreement and provides specifications under which the entities can renew or extend the original terms for an additional, specified time.