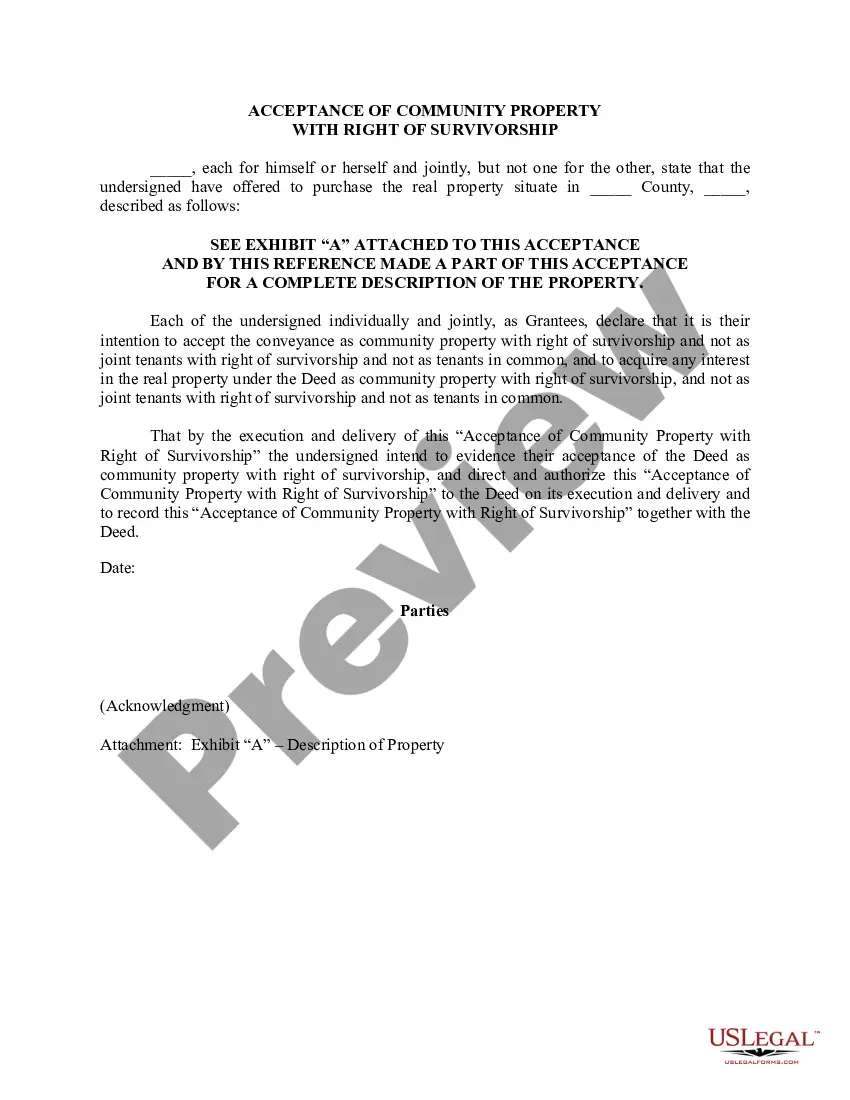

San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

If you require a dependable legal document provider to acquire the San Jose Deed (Including Acceptance of Community Property with Right of Survivorship), your search ends here with US Legal Forms. Whether you're looking to start your LLC enterprise or manage your asset distribution, we have got you covered. You don’t need to be an expert in law to find and download the necessary template.

Just choose to search for or navigate to the San Jose Deed (Including Acceptance of Community Property with Right of Survivorship), either by keyword or by the state/county the form is intended for.

Once you locate the essential template, you can Log In and download it or save it in the My documents section.

Don't have an account? It's simple to get started! Just find the San Jose Deed (Including Acceptance of Community Property with Right of Survivorship) template and review the form's preview and description (if available). If you're satisfied with the template’s wording, proceed to select Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is processed. Then you can fill out the form.

Managing your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove that. Our extensive array of legal templates makes these tasks more affordable and budget-friendly. Establish your first company, organize your advance care planning, draft a real estate contract, or complete the San Jose Deed (Including Acceptance of Community Property with Right of Survivorship) - all from the comfort of your couch. Sign up for US Legal Forms today!

- You can browse from more than 85,000 forms categorized by state/county and case.

- The user-friendly interface, range of educational resources, and dedicated support staff make it simple to obtain and complete various documents.

- US Legal Forms is a trustworthy service providing legal templates to millions of users since 1997.

Form popularity

FAQ

You can obtain a survivorship deed in San Jose, California, from various sources. You might visit your local county clerk's office, or you can streamline the process by using an online platform like US Legal Forms. This service offers the necessary forms and guidance to create a valid San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship), ensuring you meet all legal requirements.

The rules of survivorship state that when one owner of a property passes away, their share automatically transfers to the surviving owner, without going through probate. In San Jose, California, this arrangement applies to deeds that include 'Community Property with Right of Survivorship.' Make sure the title reflects this ownership type to ensure the seamless transfer upon death.

To get a survivorship deed in San Jose, California, you first need to obtain a current property title. Next, you can create the deed by including the specific language for 'Community Property with Right of Survivorship.' It’s advisable to consult an attorney or use an online service like US Legal Forms, which provides forms and guidance tailored for your state requirements.

While you can add someone to a deed without a lawyer by completing the appropriate forms, legal guidance can help prevent potential errors. Consulting with an attorney ensures the new ownership structure aligns with your long-term estate goals. If you are considering a San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship), expert advice becomes especially crucial in navigating the implications correctly.

Yes, California does allow community property with rights of survivorship, which can offer significant advantages for married couples and domestic partners. This arrangement ensures that when one partner passes away, the other automatically inherits the property. The San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship) can facilitate this process, enhancing both legal clarity and financial security for surviving spouses.

To file a survivorship deed, begin by preparing the deed documentation that states the joint ownership and the right of survivorship. Ensure all parties sign the deed before a notary. Then, submit the deed to the county recorder's office in San Jose to make your San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship) official. Using platforms like uslegalforms can provide you with the necessary templates and guidance throughout this process.

One disadvantage of the right of survivorship is that the property automatically goes to the surviving owner, which may not align with one's estate planning wishes. This can complicate matters if the deceased owner intended for their share to go to other beneficiaries. Therefore, when creating a San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship), it’s crucial to consider how this arrangement fits within your broader estate planning strategy.

Yes, a survivorship deed typically overrides a will when it comes to the property covered by the deed. The property automatically passes to the surviving owner upon the death of one owner, regardless of what the will states. This ensures that your San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship) provides clear succession of ownership. It’s essential to understand this to prevent potential conflicts among heirs.

To file a survivorship deed, you first need to complete the deed form correctly, ensuring that it includes the necessary details about the property and the owners involved. After that, you must sign the deed in front of a notary public. Finally, file the deed with the appropriate county recorder's office in San Jose, ensuring your San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship) is officially recognized. Utilizing services like uslegalforms can simplify this process with clear instructions.

The step-up basis for community property with a right of survivorship allows the property value to be adjusted to its fair market value at the time of one owner's death. This means that if the property is sold after the death, capital gains taxes are reduced. For those holding a San Jose California Deed (Including Acceptance of Community Property with Right of Survivorship), this can lead to significant tax savings for heirs. Understanding this can help navigate future financial implications.