Alameda California Stipulation of Leasehold Ownership to Clarify Previous Assignment

Description

How to fill out Stipulation Of Leasehold Ownership To Clarify Previous Assignment?

Legislation and guidelines in every domain differ across the nation.

If you're not an attorney, it's simple to become confused by a range of regulations when it comes to creating legal paperwork.

To prevent costly legal support when drafting the Alameda Stipulation of Leasehold Ownership to Clarify Previous Assignment, you require an authenticated template valid for your jurisdiction.

It's the most straightforward and cost-effective method to acquire current templates for any legal purposes. Easily find them with a few clicks and manage your documents efficiently with US Legal Forms!

- That's where utilizing the US Legal Forms platform proves to be advantageous.

- US Legal Forms is relied upon by millions as a reputable online repository of over 85,000 state-specific legal documents.

- It's a great resource for professionals and individuals seeking self-service templates for various personal and business circumstances.

- All forms can be reused: once you select a template, it remains accessible in your account for future access.

- Therefore, if you have an account with an active subscription, you can simply Log In and re-download the Alameda Stipulation of Leasehold Ownership to Clarify Previous Assignment from the My documents section.

- For new users, several additional steps are required to obtain the Alameda Stipulation of Leasehold Ownership to Clarify Previous Assignment.

- Review the page content to ensure you have located the correct template.

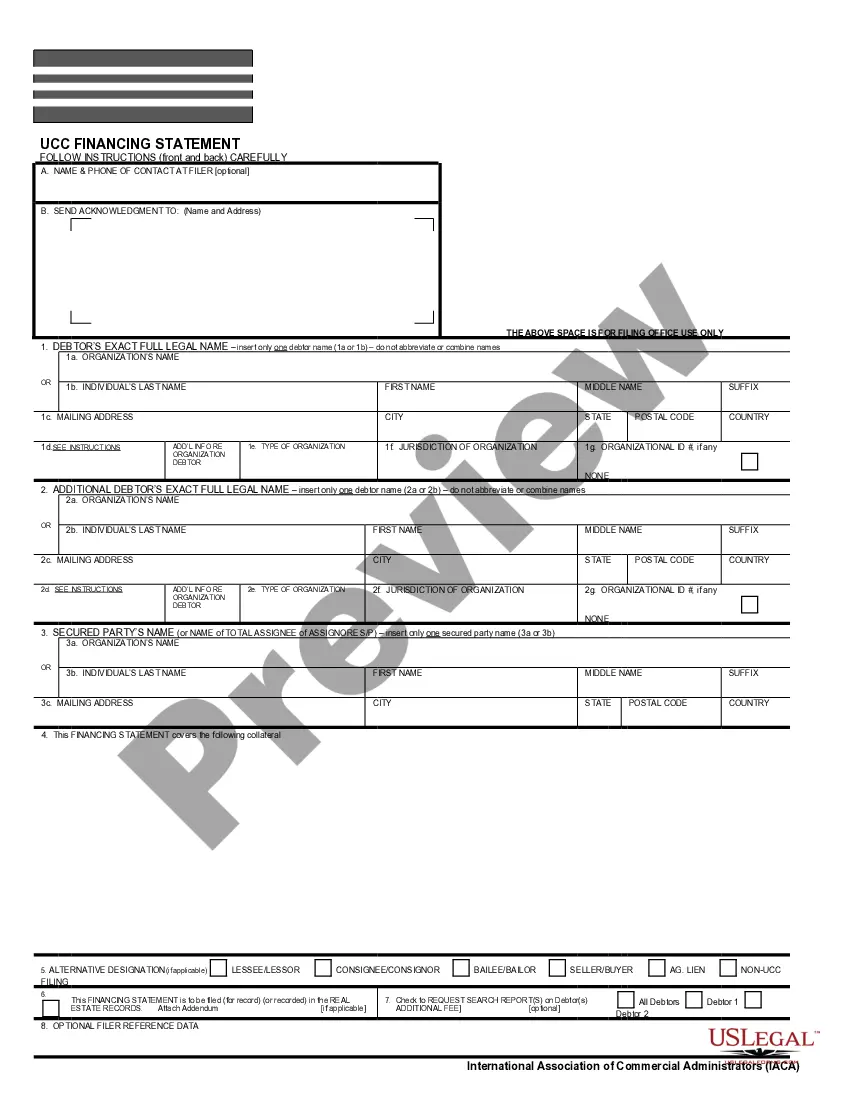

- Utilize the Preview function or check the form description if it is available.

Form popularity

FAQ

Most Estates are open about a year since the various tasks of paying taxes, selling property, locating heirs, etc, often take that long. At the very least, one can expect six to nine months of time before the Estate can close and if there is litigation outstanding, the Estate can stay open for years.

You must go to court and start a probate case. To do this, you must file a Petition for Probate (form DE-111.NOTE: If there is no will and a court case is needed, the court will appoint an administrator to manage the estate during the probate process.

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

In order to close a probate estate in California, the appointed personal representative must file a petition with the probate court which reports everything he/she has done in regards to the estate. The personal representative must file a Petition for Final Distribution within one year after Letters are issued.

See California Probate Code § 8961. The minimum fee for a probate referee is $75, and the maximum fee is $10,000. Pursuant to California Probate Code § 8963, the probate referee can apply to the court to be allowed a greater commission in excess of $10,000.

From Longman Business DictionaryRelated topics: Finance 02ccfinal distri02c8bution singular the last DIVIDEND paid during a financial year, if a company pays dividends more than once during the year 2192 distribution.

The earliest date the personal representative can file a California petition for final distribution of the decedent's estate and personal property is four months after the court issued letters of administration.

The California petition for final distribution gives the court a detailed history of the probate case. More specifically, it explains why the estate is ready to close and outlines the distributions to beneficiaries.