Mesa Arizona Indemnities

Category:

State:

Multi-State

City:

Mesa

Control #:

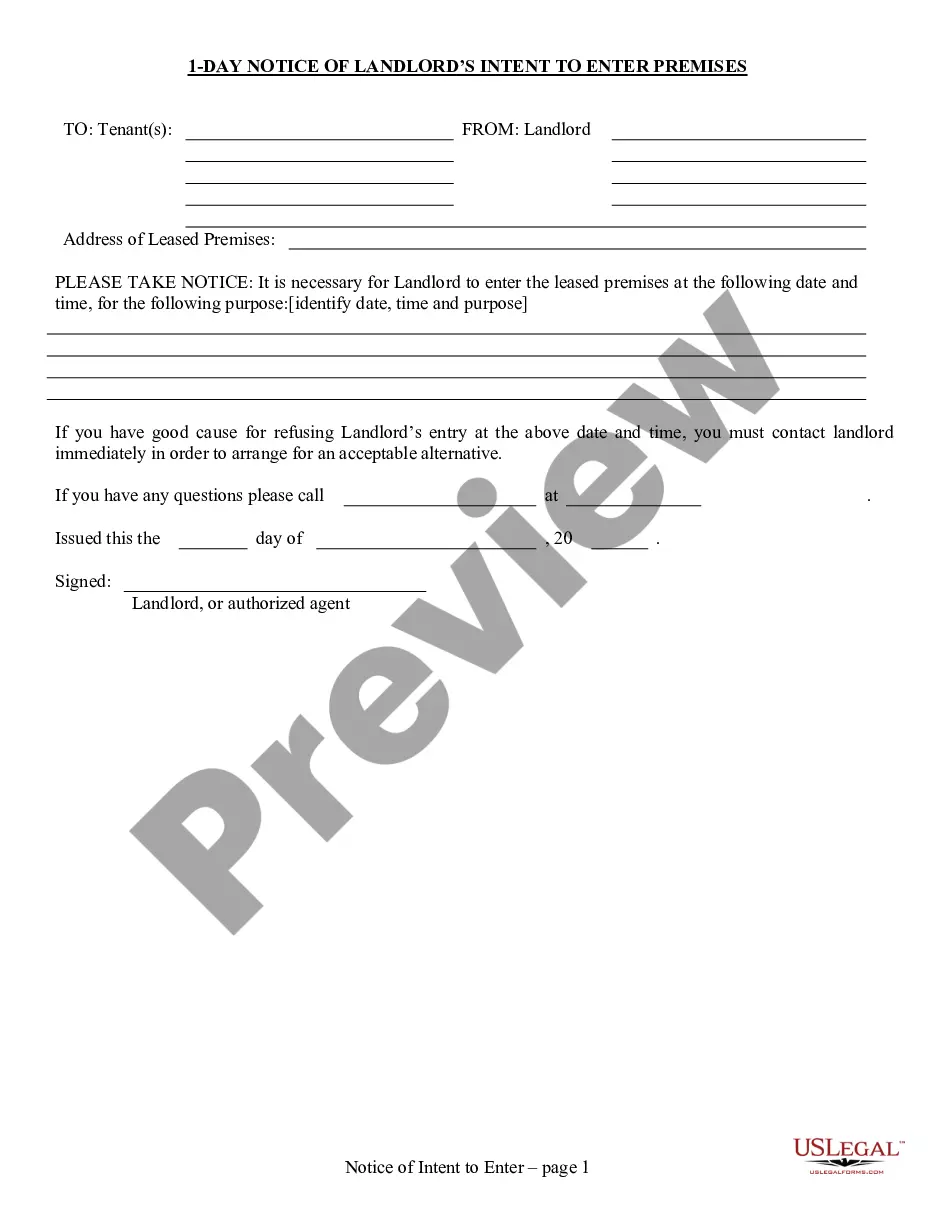

US-OG-499

Format:

Word;

Rich Text

Instant download

Description

The Indemnities form, the assignor agrees the indemnities and holds the assignee free from any.