San Diego California Assignment of Production Payment Measured by Value Received

Description

How to fill out San Diego California Assignment Of Production Payment Measured By Value Received?

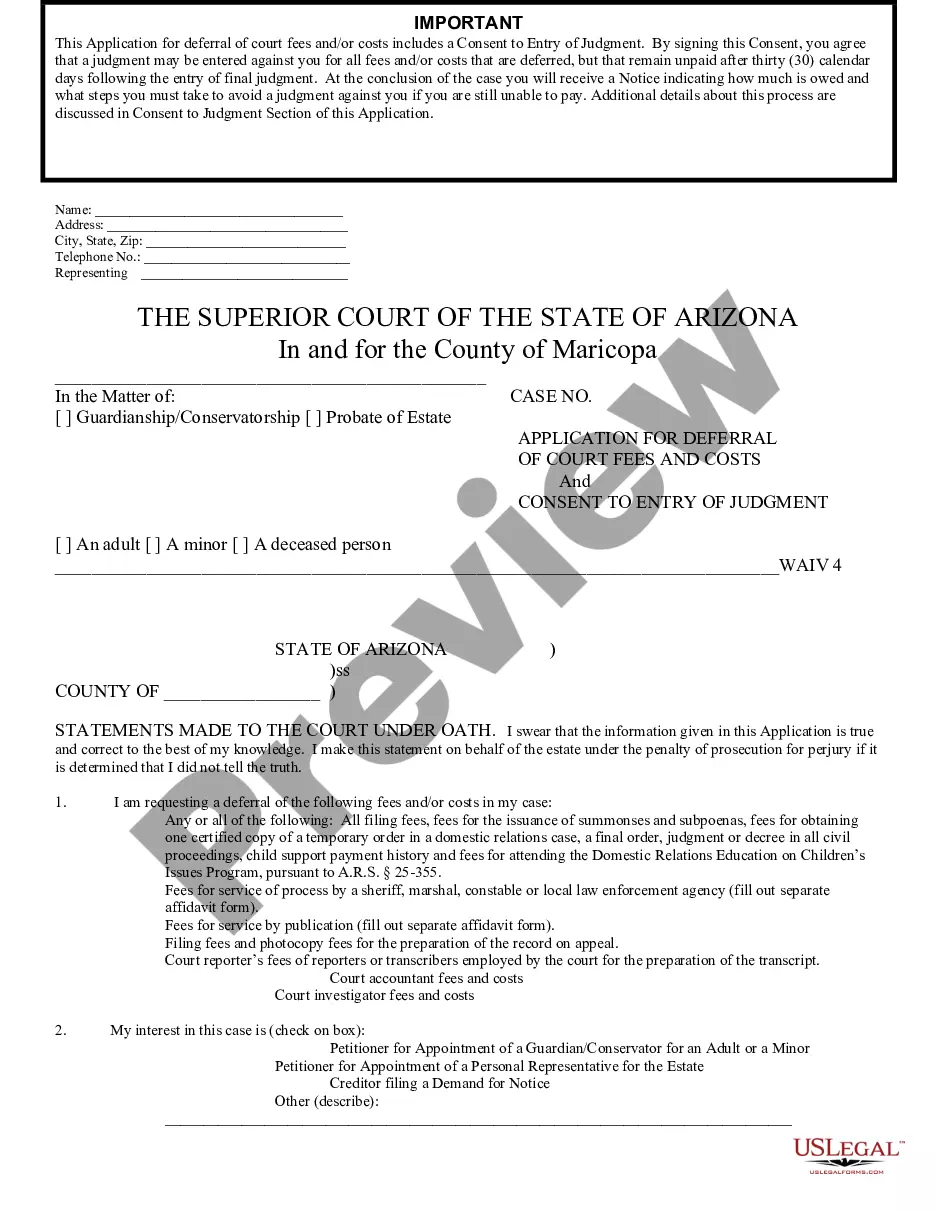

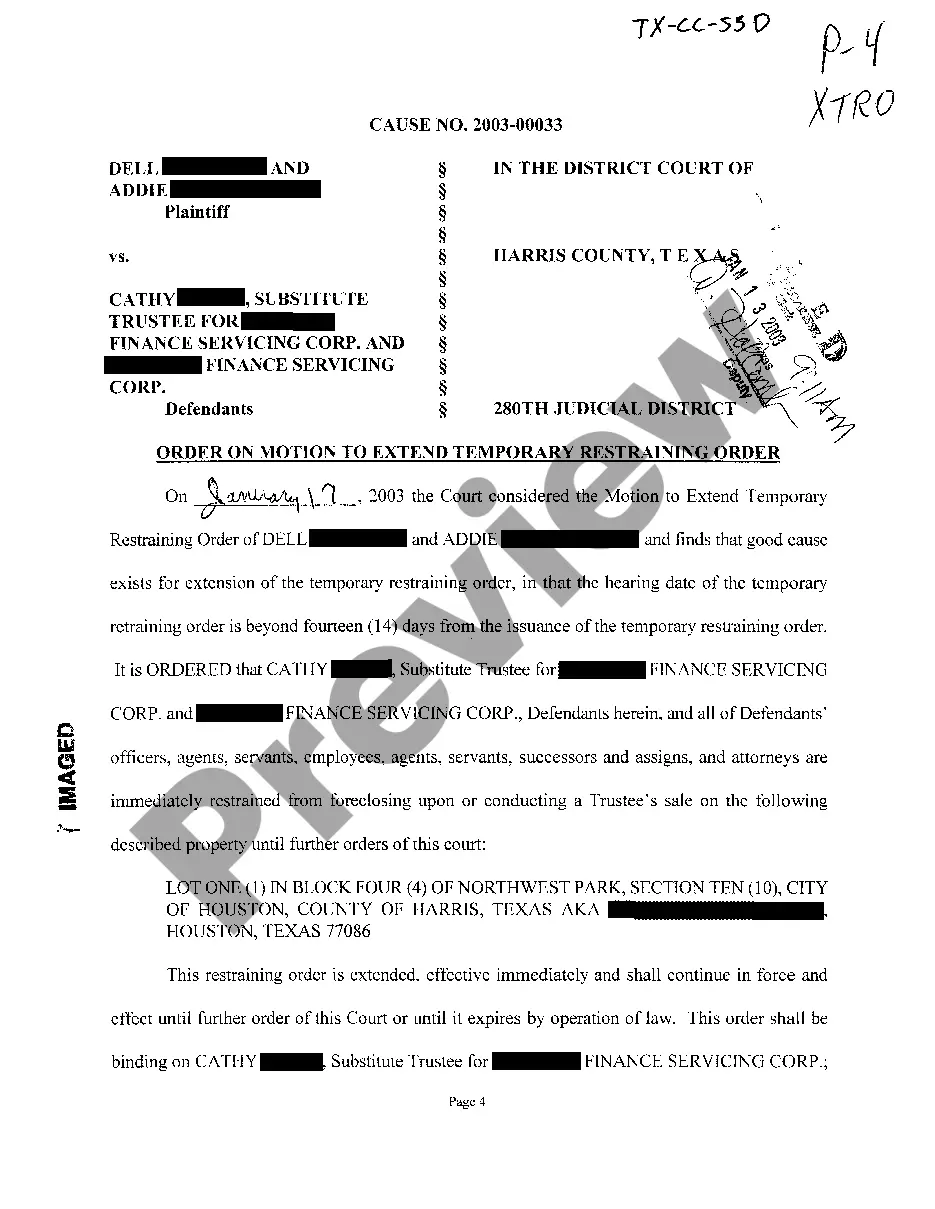

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the San Diego Assignment of Production Payment Measured by Value Received, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Therefore, if you need the recent version of the San Diego Assignment of Production Payment Measured by Value Received, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Diego Assignment of Production Payment Measured by Value Received:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your San Diego Assignment of Production Payment Measured by Value Received and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

Working Interest a percentage of ownership in a mineral lease granting its owner the right to explore, drill, and produce oil and gas from the leased property.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

(1) The term production payment means, in general, a right to a specified share of the production from mineral in place (if, as, and when produced), or the proceeds from such production. Such right must be an economic interest in such mineral in place.

Oil and Gas Interest means any oil, gas and/or mineral lease or sublease, royalty, overriding royalty, production payment, net profits interest, mineral fee interest, carried interest or other right to explore, develop or produce Hydrocarbons.

To calculate the net revenue interest, you deduct the royalty interests from the total amount generated from production. To calculate the net revenue of the working interest, you subtract the RI share from the total percentage of the working interest. Then multiply the remaining shares by the sum of the subtraction.

Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

An overriding royalty interest is the right to receive revenue from the production of oil and gas from a well. The overriding royalty is carved out of the lessee's (operator's) working interest and entitles its owner to a fraction of production.

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

More info

CPI is the official measure of price change for the purposes of federal tax reporting and classification. The Bureau of Labor Statistics adjusts the basket on the basis of actual inflation, not what the government thinks inflation will be in the future. CPI is an important index that is used by investors. The CPI is widely used in the marketplace because it is a relatively simple measure, does not require a lot of sophisticated technical knowledge and is relatively easy to understand by the public. Who decides what prices are used by the Bureau of Labor Statistics in the CPI? The Bureau of Labor Statistics makes the final decision. Who is behind the CPI? The Consumer Price Index is a government program that measures the average change in prices for a group of consumers. To participate in the CPI, one must provide information about the purchase price of a typical U.S. resident for a year.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.