Collin Texas Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

How to fill out Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

Handling legal documentation is essential in the modern era.

Nonetheless, it is not always necessary to seek professional expertise to develop some of these documents from the ground up, including the Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is the Discrepancy Between Designated Percentage and Existing Leasehold Obligations, using a service such as US Legal Forms.

US Legal Forms offers more than 85,000 templates to choose from across a variety of categories, including advance directives, property agreements, and matrimonial legal forms.

Choose the pricing option, followed by a convenient payment method, and purchase the Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is the Discrepancy Between Designated Percentage and Existing Leasehold Obligations.

Opt to save the form template in one of the available file formats. Visit the My documents section to redownload your file. If you’re already a US Legal Forms member, you can locate the necessary Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is the Discrepancy Between Designated Percentage and Existing Leasehold Obligations, Log In to your account, and download it. It’s important to note that our site cannot fully substitute a legal expert. For complicated situations, seeking an attorney to review your document prior to signing and submitting is recommended. With over 25 years of experience, US Legal Forms has become a trusted resource for various legal documents for countless users. Join them today and easily obtain your state-specific forms!

- All templates are organized based on their applicable state, simplifying the search process.

- You can also access comprehensive resources and guides on the site to facilitate any tasks related to document filling.

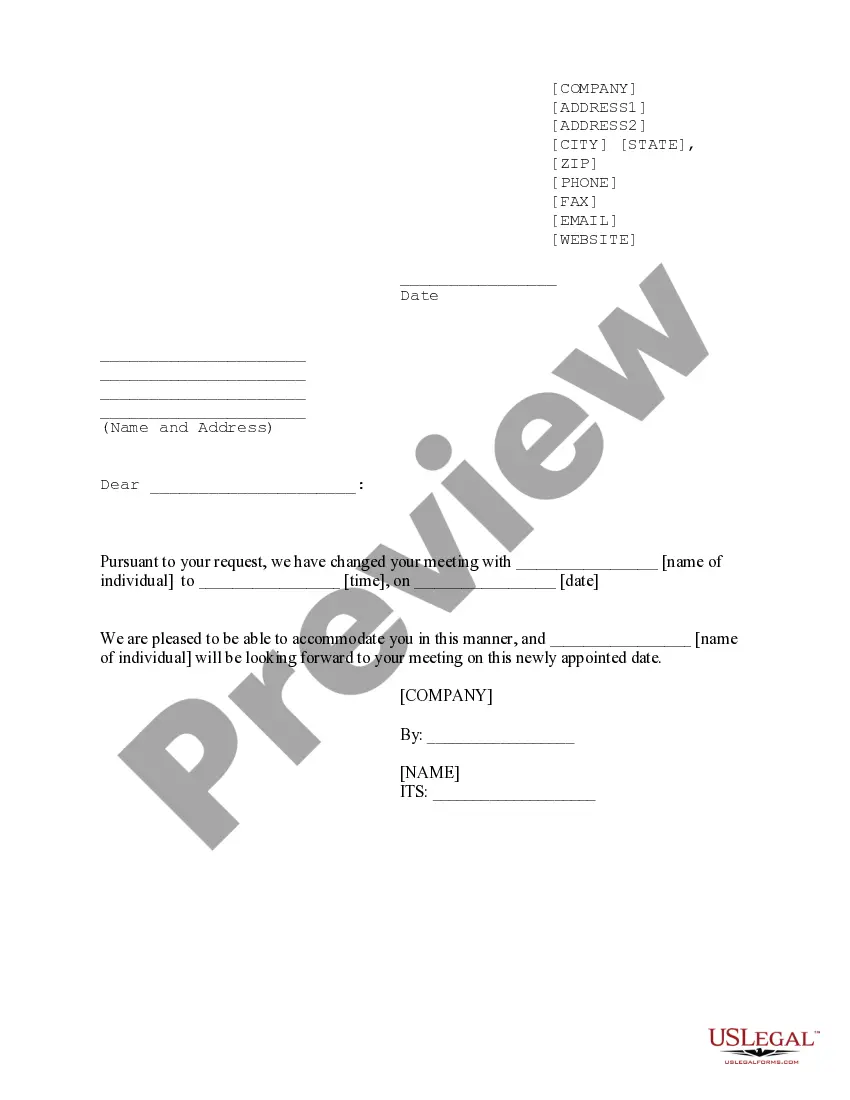

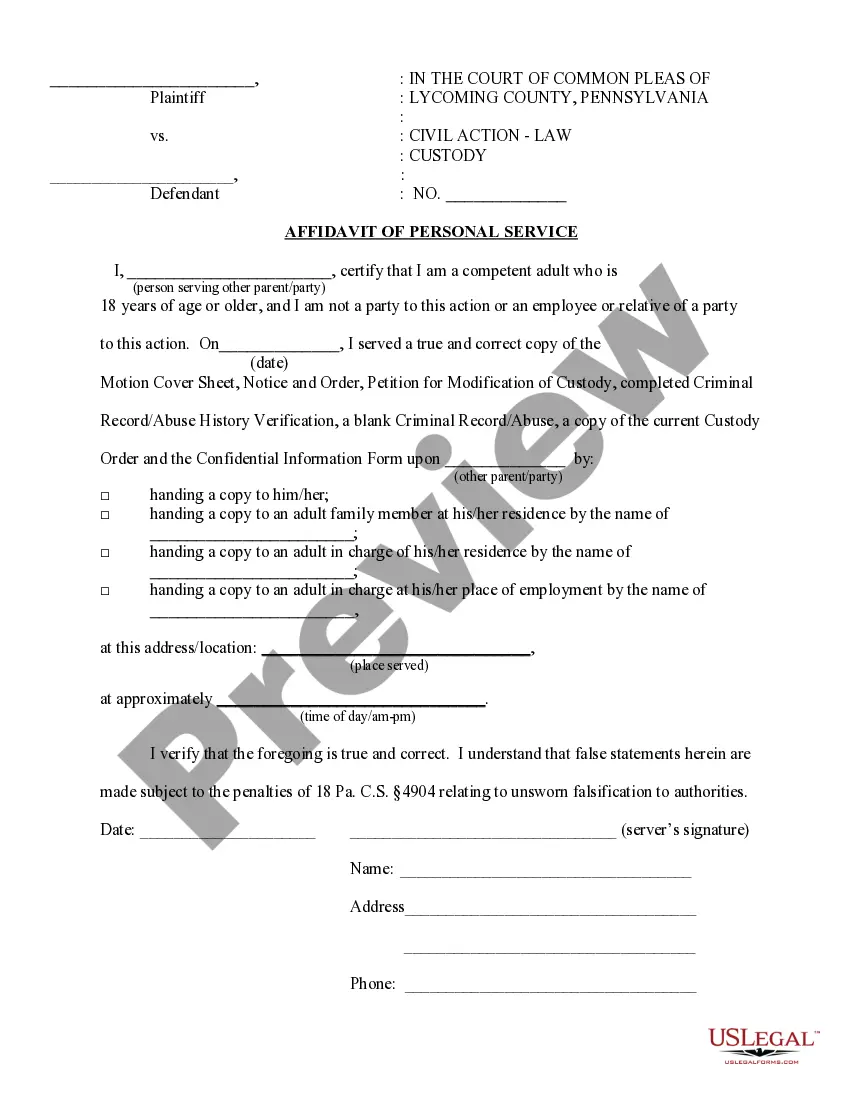

- Here’s a guide on how to find and download the Collin Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is the Discrepancy Between Designated Percentage and Existing Leasehold Obligations.

- Review the document's preview and outline (if accessible) to gain an initial understanding of what you’ll acquire post-download.

- Make sure that the template you select is tailored to your state/county/locale since state regulations can influence the legality of certain records.

- Explore related document templates or restart your search to locate the correct file.

- Click Buy now and create your account. If you have one already, opt to Log In.

Form popularity

FAQ

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.