Harris Texas Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Do you require to swiftly produce a legally-enforceable Harris Affidavit of Heirship for Real Estate or potentially any other document to manage your personal or corporate matters.

You can choose one of two alternatives: engage a legal consultant to draft a legitimate document for you or compose it entirely on your own. The good news is, there’s a third alternative - US Legal Forms. It will assist you in obtaining expertly crafted legal documents without exorbitant costs for legal services.

If the template isn’t what you were looking for, restart your search using the search bar in the header.

Select the subscription that best fits your requirements and proceed to the payment. Choose the file format you wish to receive your form in and download it. Print it, complete it, and sign on the dotted line. If you’ve already set up an account, you can easily Log In to it, find the Harris Affidavit of Heirship for Real Property template, and download it. To re-download the form, just navigate to the My documents tab. It’s simple to locate and download legal forms when you utilize our catalog. Furthermore, the templates we provide are revised by legal professionals, giving you increased assurance when handling legal matters. Try US Legal Forms today and experience it for yourself!

- US Legal Forms provides an extensive library of over 85,000 state-specific document templates, encompassing Harris Affidavit of Heirship for Real Property and form packages.

- We offer templates for various scenarios: from divorce documentation to real estate form templates.

- We have been in business for more than 25 years and hold a stellar reputation among our clientele.

- Here’s how you can join them and acquire the required document without added hassles.

- First and foremost, thoroughly confirm if the Harris Affidavit of Heirship for Real Property complies with your state’s or county’s regulations.

- If the form contains a description, be sure to verify its appropriateness.

Form popularity

FAQ

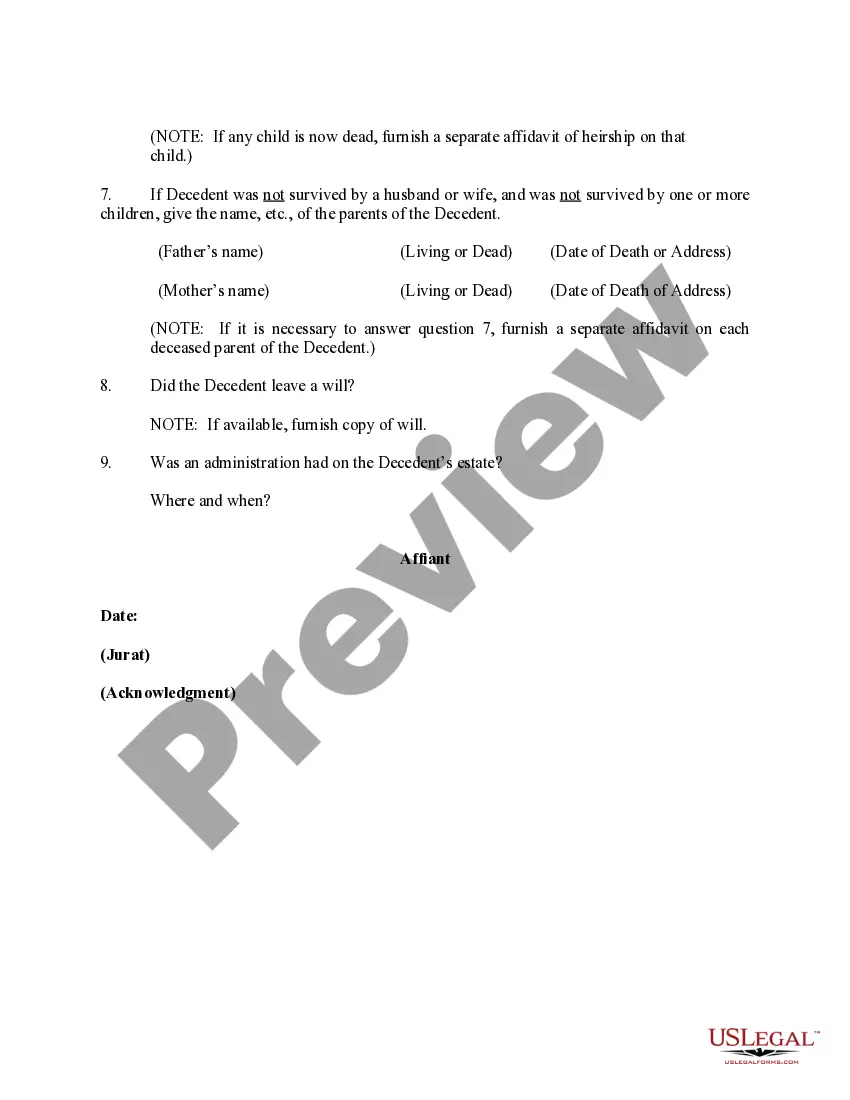

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

To transfer real estate, a Texas Affidavit of Heirship should be signed by 1 heir and 2 people that are (a) familiar with the decedent's family history and (b) not interested in the estate (not an heir of the decedent and do not stand to gain anything financially from the estate).

However, Texas Estates Code 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs. An affidavit of heirship should be signed by two disinterested witnesses.

With an affidavit of heirship in Texas, the witnesses must swear that they knew the decedent for an extended period; the descendent did not owe any debts; the identity of the descendent's family members and heirs; where and when the descendent died; and that they will not have any financial gain from the descendent's

The Heirship Affidavit need only be signed Page 2 and sworn by the disinterested parties. All signatures must be in the presence of a Notary Public. Clerk of the county of decedent's residence, along with an Order for the Judge to sign approving it as conforming with the requirements of TPC §137.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.