Bexar Texas Affidavit of Heirship for Real Property

Description

How to fill out Affidavit Of Heirship For Real Property?

Drafting documents, such as the Bexar Affidavit of Heirship for Real Estate, to manage your legal affairs is a challenging and time-consuming task.

Numerous situations necessitate an attorney’s involvement, which can also render this endeavor quite expensive.

Yet, you can take your legal affairs into your own hands and address them independently.

The onboarding process for new users is just as uncomplicated! Here’s what you should do before acquiring the Bexar Affidavit of Heirship for Real Estate: Ensure your form aligns with your state/county since the regulations for creating legal documents can differ from one state to another. Gain insight into the form by reviewing it or reading a brief description. If the Bexar Affidavit of Heirship for Real Estate isn’t what you need, utilize the search bar at the top to find an alternative. Log In or establish an account to start using our service and access the form. Everything look good on your end? Click the Buy now button and select a subscription option. Choose the payment method and input your payment details. Your template is ready. You can proceed to download it. It's straightforward to locate and secure the suitable template with US Legal Forms. Thousands of businesses and individuals are already reaping the benefits from our extensive collection. Sign up now if you wish to explore what additional advantages you can obtain with US Legal Forms!

- US Legal Forms is here to assist.

- Our platform contains over 85,000 legal templates designed for various scenarios and life circumstances.

- We ensure every document adheres to state regulations, so you need not fret about potential legal issues related to compliance.

- If you are already familiar with our site and possess a subscription with US, you understand how simple it is to obtain the Bexar Affidavit of Heirship for Real Estate form.

- Just Log In to your account, download the form, and customize it according to your requirements.

- Lost your document? No worries. You can retrieve it from the My documents section in your account, whether on desktop or mobile.

Form popularity

FAQ

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

In Texas, if the deceased had a Will providing for an independent administration, which is standard for lawyers to include in a Will, the cost of probate probably would range from $750 to $1,500 in attorneys' fees. Court costs are about $380 in Texas.

However, Texas Estates Code 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs.

They pay a $232 filing fee and expect approval.

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

Affidavit of Heirship: Instead of going through the probate process to have title to the property transferred to the decedent's heirs, the heirs can, instead, file the Affidavit of Heirship in the deed records of the county in which any piece of real estate owned by the decedent lies.

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

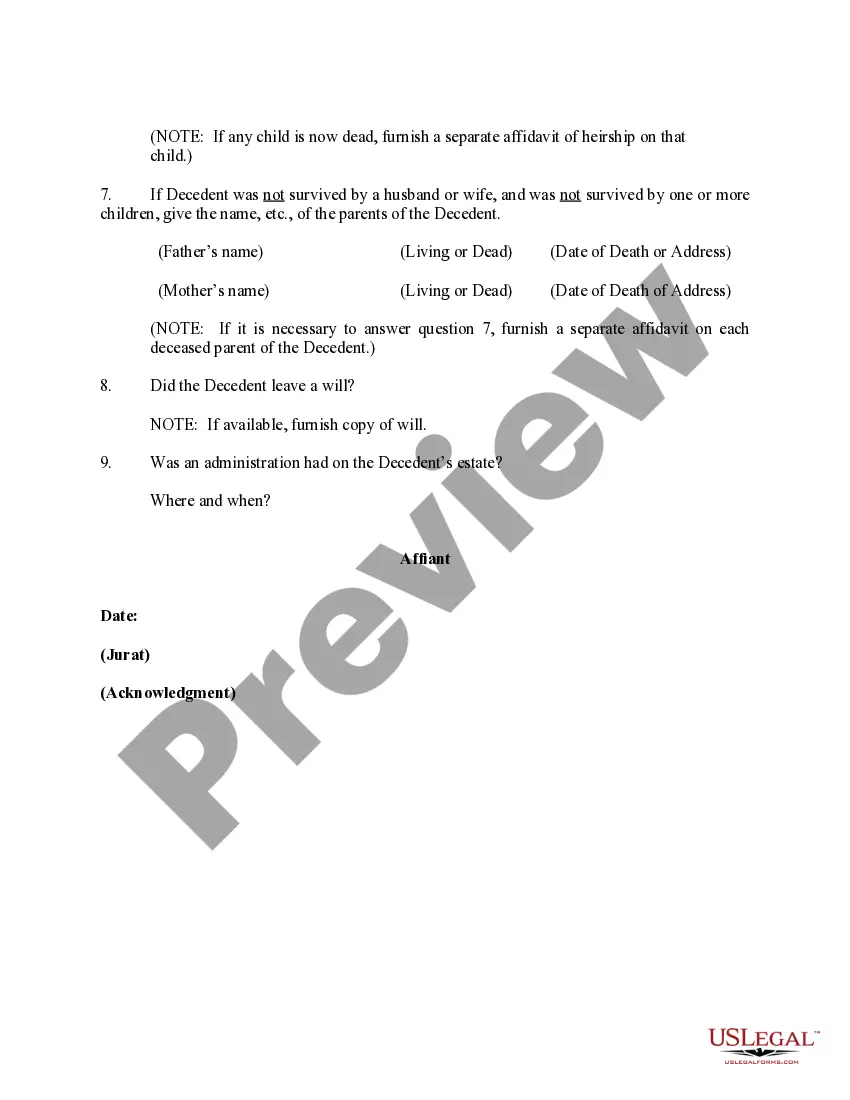

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.