Orange California Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

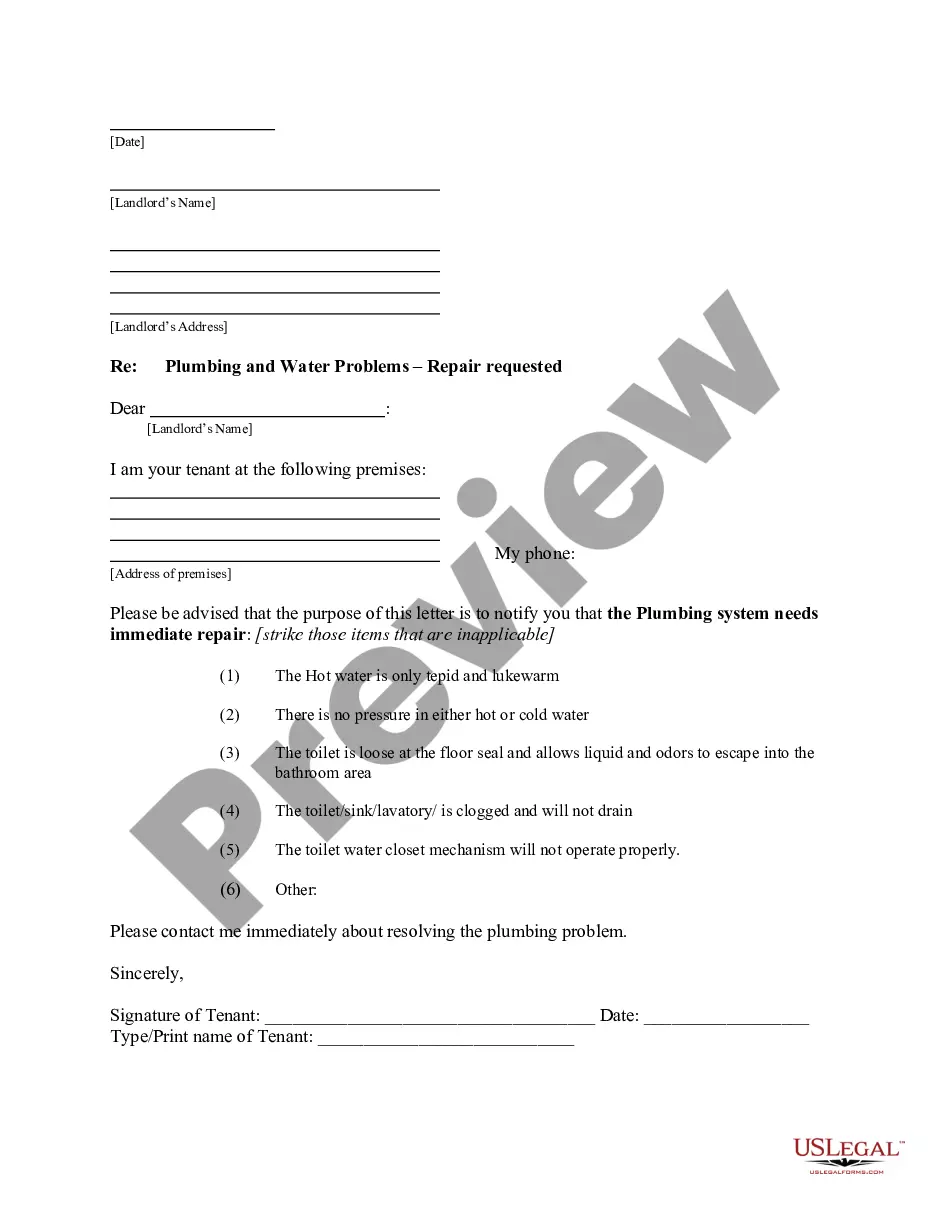

Do you require to promptly create a legally-enforceable Orange Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest or perhaps another type to organize your personal or business affairs.

You have two choices: reach out to an expert to compose a legal document for you or draft it entirely by yourself. Fortunately, there's a third option - US Legal Forms. It can assist you in obtaining professionally crafted legal documents without incurring exorbitant charges for legal assistance.

Initiate the search anew if the form does not meet your expectations by utilizing the search bar in the header.

Select the package that best meets your requirements and proceed with the payment, choose your preferred file format for downloading the document, then print it out, complete it, and sign the designated area.

- US Legal Forms offers an extensive collection of over 85,000 state-compatible form templates, including the Orange Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest and form bundles.

- We provide documents for a variety of scenarios: from divorce forms to real estate document templates.

- We have been in the industry for more than 25 years and have a solid reputation among our clients.

- Here's how you can join their ranks and acquire the required document without unnecessary complications.

- First, thoroughly ensure that the Orange Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest is aligned with your state's or county's regulations.

- If the document features a description, verify its appropriateness for your needs.

Form popularity

FAQ

participating royalty interest owner holds the right to receive royalties from mineral production without participating in the management or operational decisions. This arrangement is common in the context of the Orange California Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, where the grantor retains control over the mineral extraction process. Nonparticipating owners still benefit from royalties without obligations.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

participating royalty interest owner has a right to all or a portion of the royalty from gross production, but does not have the right to execute a lease, receive a bonus or any delay rentals.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.