San Diego California Executor's Deed of Distribution

Description

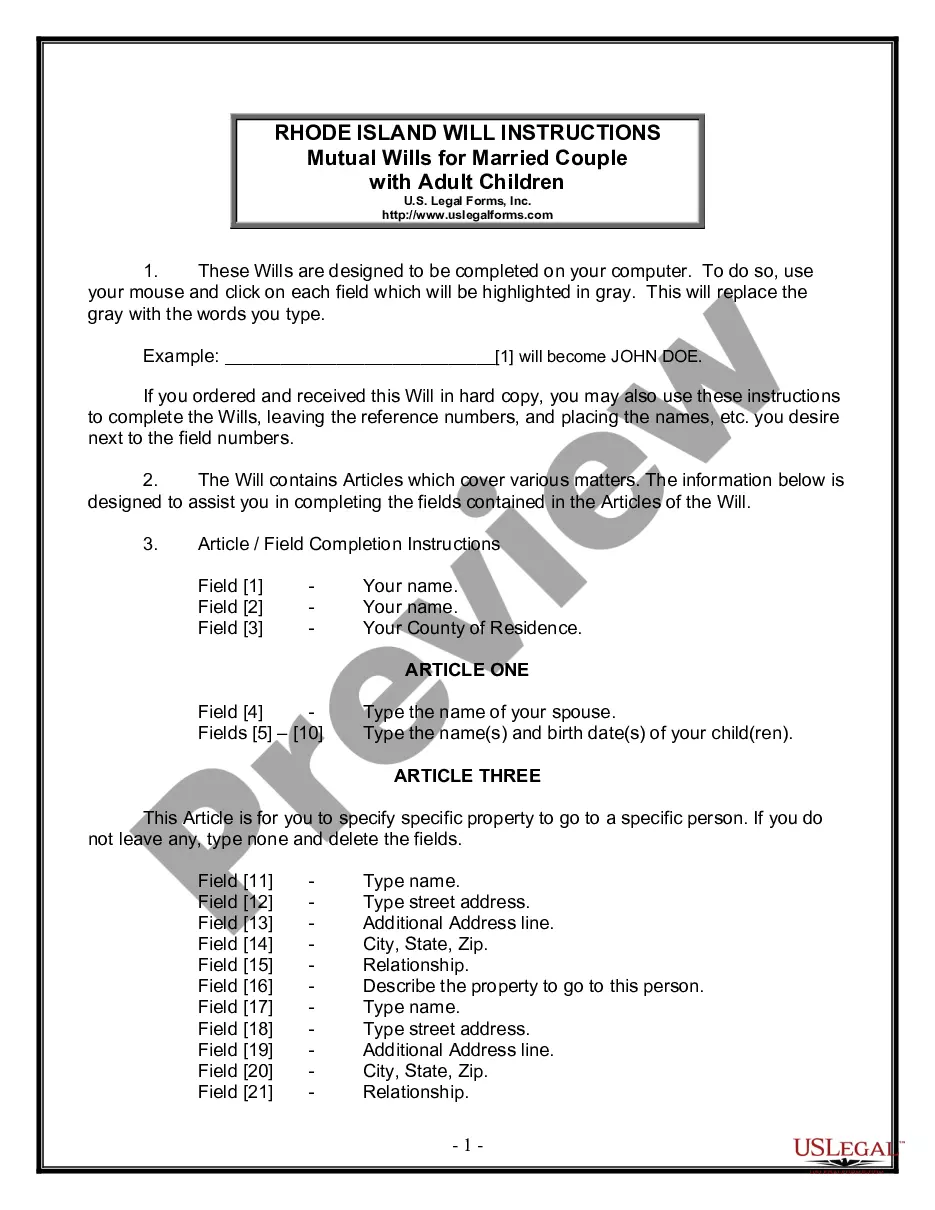

How to fill out Executor's Deed Of Distribution?

If you are looking to discover a trustworthy legal document provider to acquire the San Diego Executor's Deed of Distribution, search no more than US Legal Forms. Regardless of whether you wish to start your LLC enterprise or manage your asset allocation, we have you covered. You don't have to be an expert in legal matters to find and download the required form.

You can effortlessly type to search or peruse the San Diego Executor's Deed of Distribution, either using a keyword or by the state/county intended for the form.

After discovering the necessary form, you can Log In and download it or save it in the My documents section.

Don't have an account? It's easy to begin! Simply locate the San Diego Executor's Deed of Distribution template and review the form's preview and short introductory details (if available). If you're comfortable with the template’s legal jargon, proceed to hit Buy now.

Establish an account and choose a subscription plan. The template will be instantly accessible for download as soon as the payment is finalized. Now you can fulfill the form.

- You can explore from over 85,000 forms categorized by state/county and case.

- The intuitive interface, abundance of supporting resources, and dedicated assistance make it easy to find and complete various documents.

- US Legal Forms is a dependable service providing legal forms to millions of clients since 1997.

Form popularity

FAQ

The earliest date the personal representative can file a California petition for final distribution of the decedent's estate and personal property is four months after the court issued letters of administration.

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate. The Grant of Probate is the document obtained from the court which gives the legal authority for you to deal with the estate.

If you need to close a bank account of someone who has died, and probate is required to do so, then the bank won't release the money until they have the grant of probate. Once the bank has all the necessary documents, typically, they will release the funds within two weeks.

However, California probate typically takes upward of nine months. Depending on the estate's size, the number of beneficiaries and whether the court contests the will, probate can take anywhere from 18 months to three years.

Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate.

Order of distribution of assets In California, all creditor claims must be submitted within four months after the executor or administrator is appointed by the court. Next, the estate taxes must be paid to the federal government and the State of California. The final distributions are to the heirs or beneficiaries.

Probate is the analysis and transfer administration of estate assets previously owned by a deceased person. When a property owner dies, his assets are commonly reviewed by a probate court. The probate court provides the final ruling on the division and distribution of assets to beneficiaries.