Montgomery Maryland Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

A document process always accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job offer, transferring property, and numerous other life circumstances require you to prepare formal paperwork that varies across the country.

That’s why consolidating it all in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This is the easiest and most reliable method to obtain legal documentation. All the templates available in our library are professionally crafted and verified for compliance with local laws and regulations. Prepare your documents and manage your legal matters effectively with US Legal Forms!

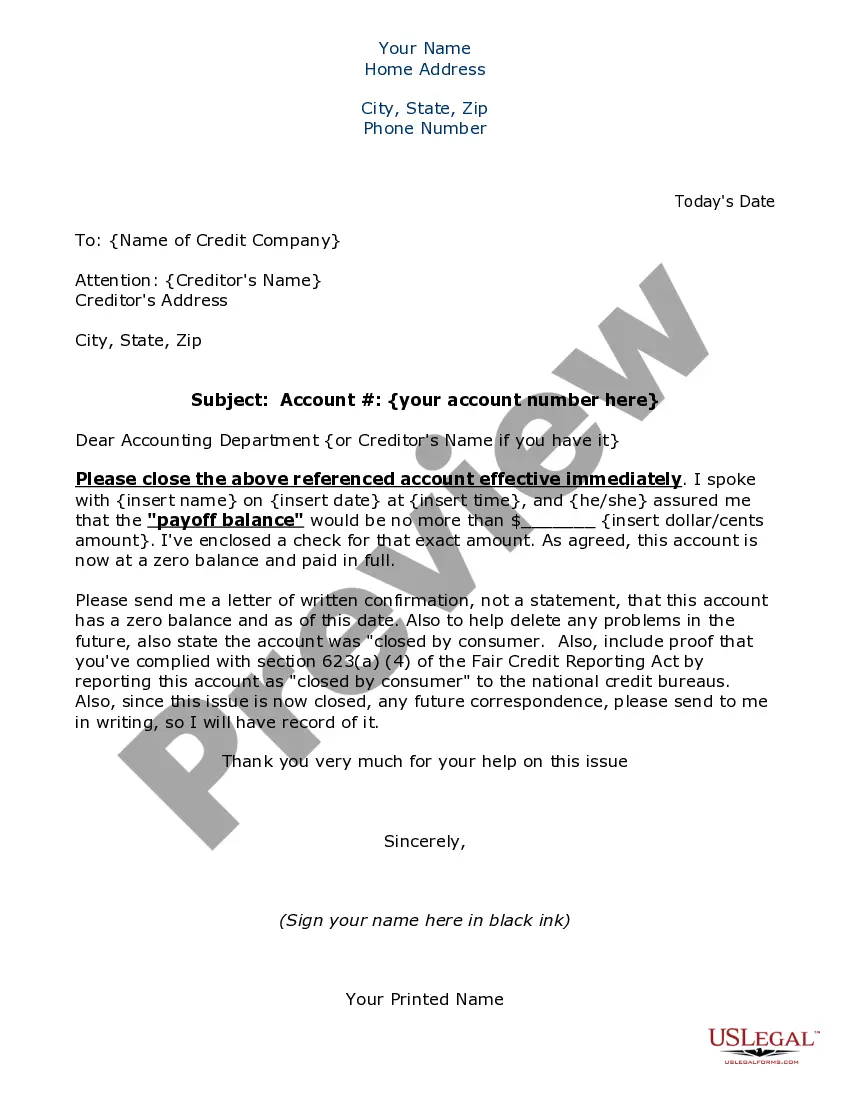

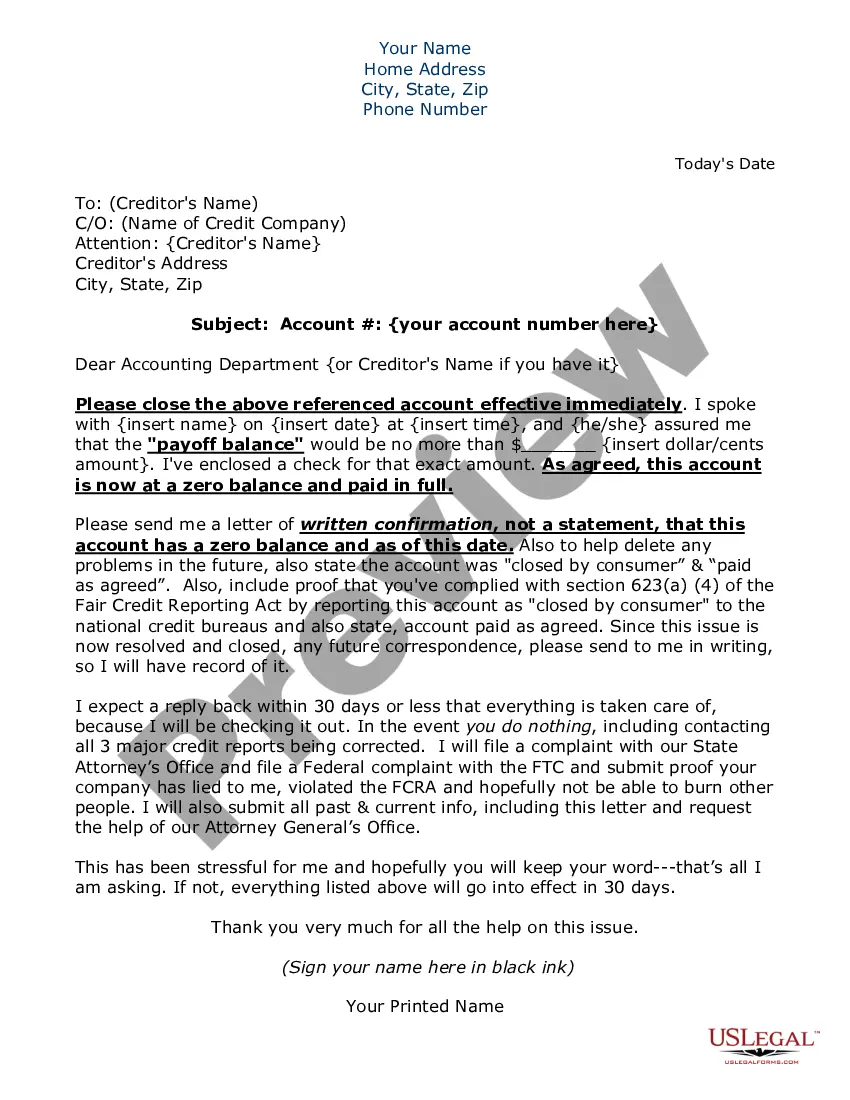

- Here, you can conveniently locate and download a form for any personal or business purpose used in your region, including the Montgomery Statement to Add to Credit Report.

- Finding forms on the platform is remarkably simple.

- If you already have a membership with our service, Log In to your account, use the search bar to find the sample, and click Download to save it on your device.

- After that, the Montgomery Statement to Add to Credit Report will be available for future use in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow this easy guideline to acquire the Montgomery Statement to Add to Credit Report.

- Ensure you’re on the correct page for your local form.

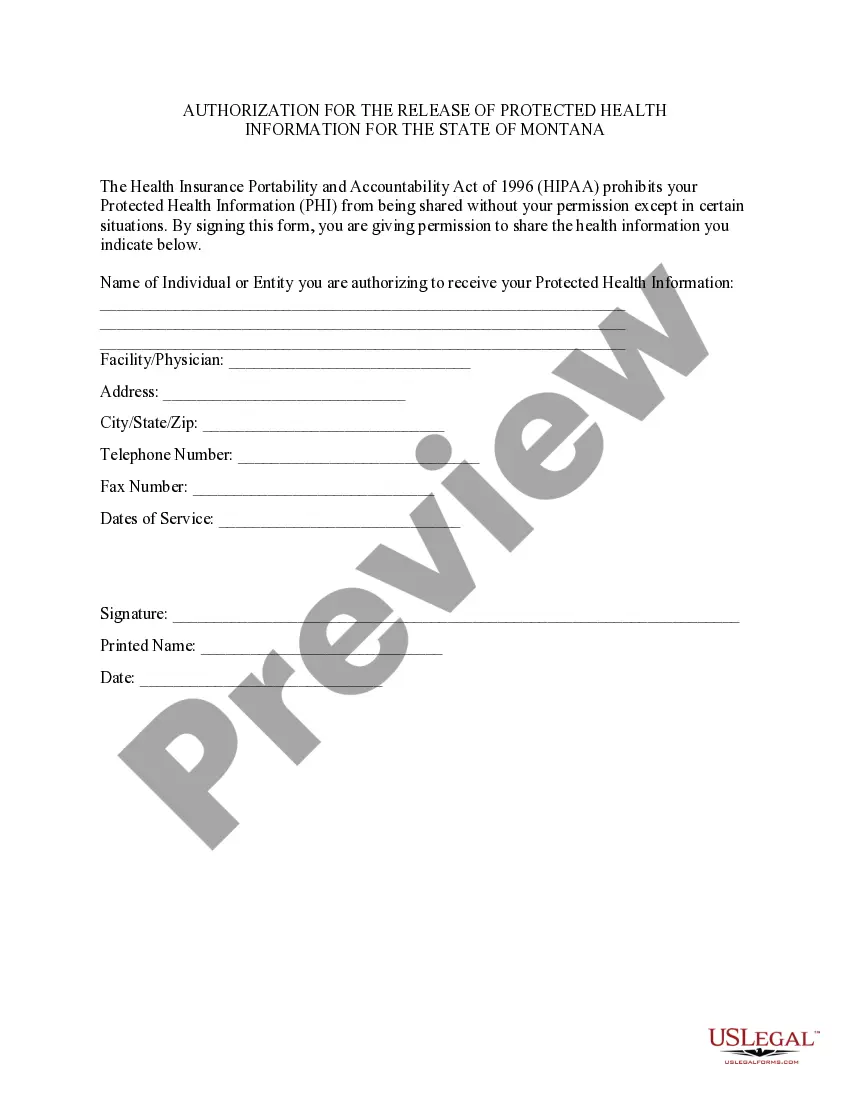

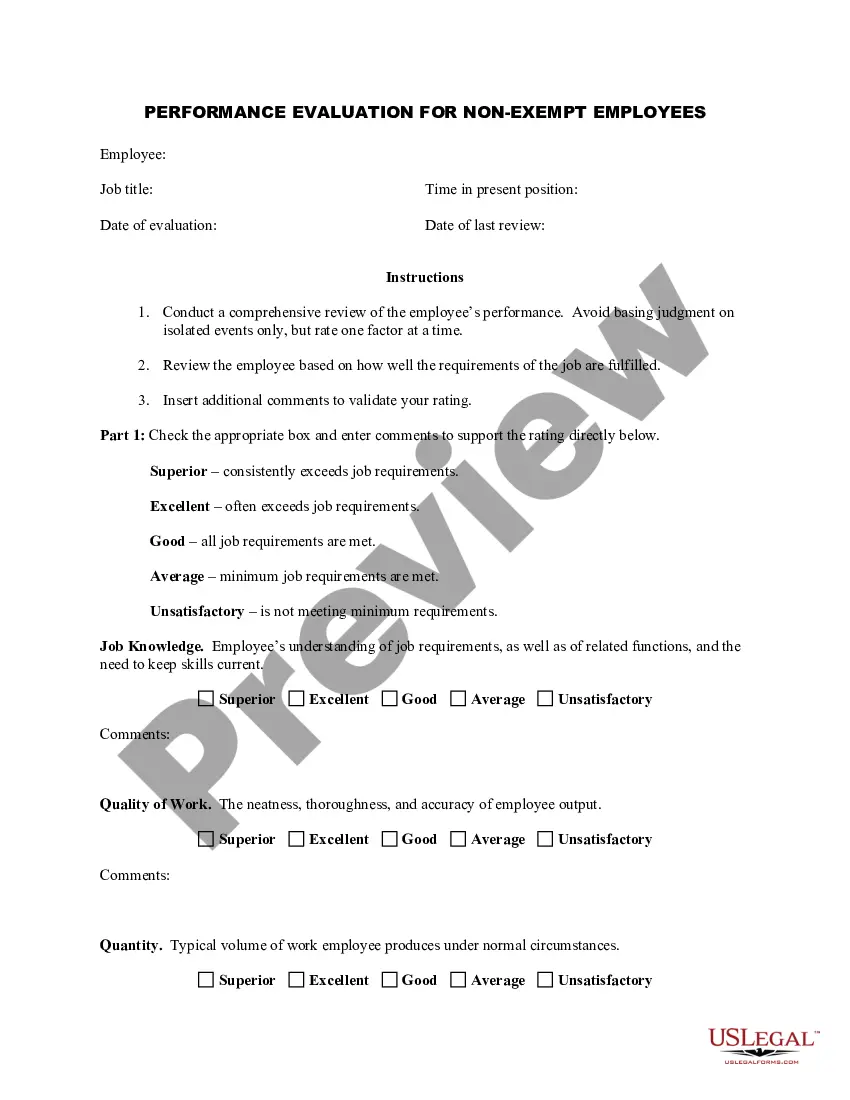

- Use the Preview mode (if available) to review the template.

- Examine the description (if provided) to verify the form meets your needs.

- Search for another form using the search bar if the sample does not fit your requirements.

- Select Buy Now once you find the appropriate template.

Form popularity

FAQ

The Montgomery Ward Credit Account is an unsecured store credit card that people with bad credit can get. Although it only works for Montgomery Ward purchases online or through the company's catalogue, the Montgomery Ward credit card reports to the credit bureaus on a monthly basis and has a $0 annual fee.

How long will it take to get my Montgomery Ward Credit? Generally, approval only takes a few seconds. Once approved, expect your card to arrive within seven to 10 business days.

Montgomery Ward is not affiliated with Fingerhut. These two businesses do not have the same parent company, as Montgomery Ward is a subsidiary of Colony Brands, Inc., while Fingerhut is a subsidiary of Bluestem Brands, Inc.

You can't directly add things to your credit report, even if they are bills you pay each month. Instead, you must depend on your creditors and lenders to send updates to the credit bureaus based on your account history. There are three major credit bureaus in the U.S.: Equifax, Experian, and TransUnion.

The Montgomery Ward Credit Account is one of the easiest credit lines to get approved for. Like many other issuers, Montgomery Ward will pull an applicant's credit history while evaluating a new credit application.

All You Can Do Is Ask Credit reporting is a voluntary process. There's nothing you can do to force a creditor to report an account to the credit bureaus. And you can't make a creditor update your account outside of its normal credit reporting cycle.

Report your small business' bad debts to the Better Business Bureau as well as the credit reporting agencies. Visit the BBB website and navigate to the local chapter of the city where the debtor resides or does business, and report his bad debt to the appropriate BBB office.

Yes. Montgomery Ward reports to the credit bureaus Experian, Equifax, and TransUnion every 30 days. Reports are sent to these three major credit bureaus for all open Montgomery Ward Credit Accounts, and each report includes information such as the account's statement balance and payment history.

The Montgomery Ward credit card credit score requirement is 300+ for people who already have an established credit history, and the issuer will also consider applicants with little or no credit history. Since the lowest credit score possible is 300, there really is no credit score requirement for a Wards credit line.