Fulton Georgia I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

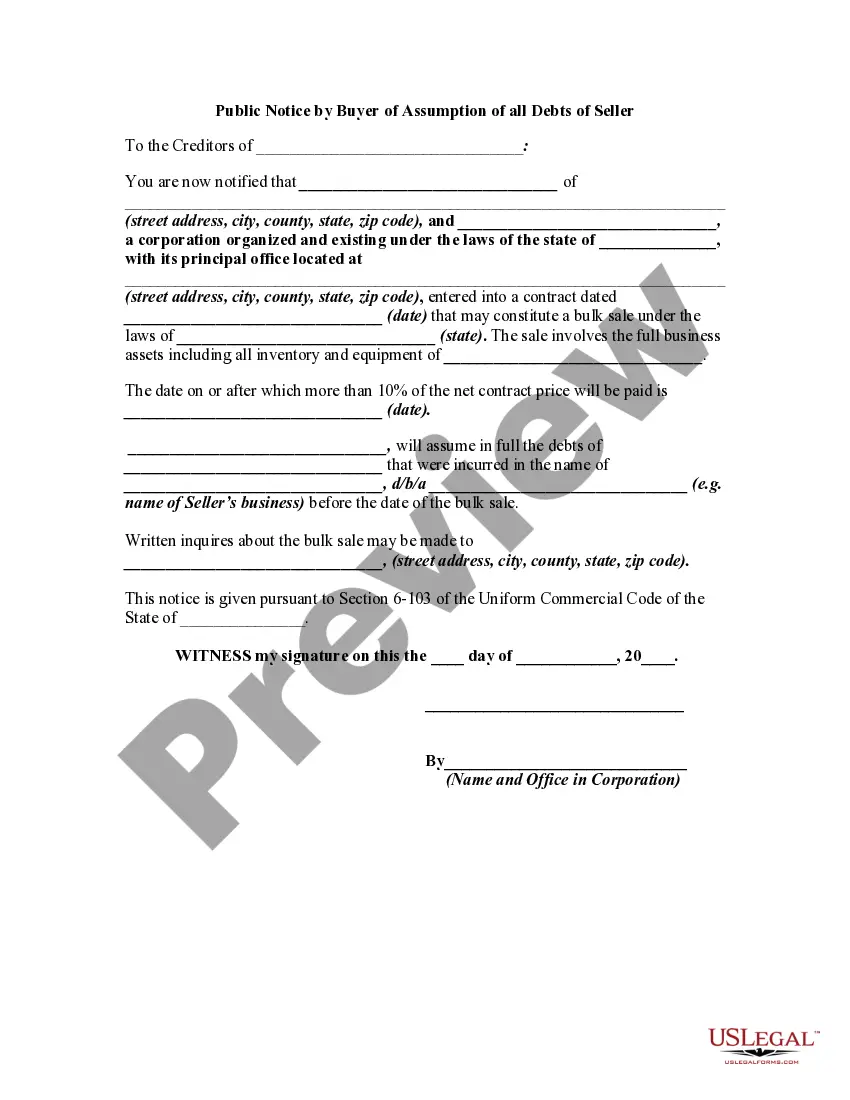

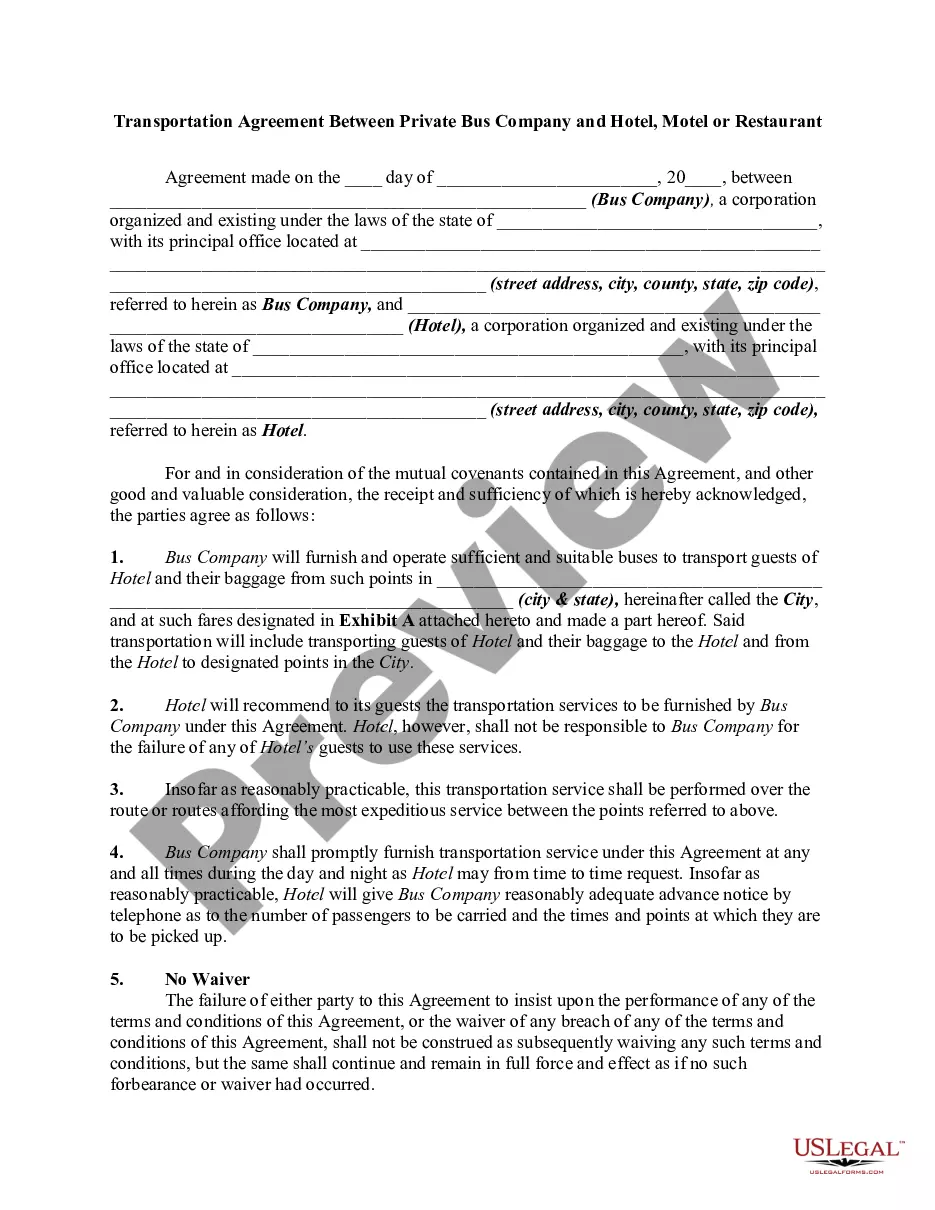

Handling legal paperwork is essential in the modern era. However, you don't always have to seek expert help to develop some of them from scratch, such as Fulton I.R.S. Form SS-4 (to acquire your federal identification number), using a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across various categories ranging from living wills to real estate documents to divorce forms. All forms are categorized according to their respective state, simplifying the search process.

You can also find comprehensive resources and guides on the site to make any tasks related to document handling easy.

Navigate to the My documents section to re-download the document.

If you're already subscribed to US Legal Forms, you can find the required Fulton I.R.S. Form SS-4 (to acquire your federal identification number), Log In to your account, and download it. Of course, our platform cannot entirely replace a lawyer. If you are dealing with an especially complex case, we recommend consulting a lawyer to review your document prior to signing and submitting it.

With over 25 years of experience in the industry, US Legal Forms has established itself as a reliable platform for various legal forms for millions of customers. Join them today and obtain your state-specific documents with ease!

- Check out the preview and outline of the document (if available) to gain basic insight into what you will receive after obtaining the form.

- Verify that the selected document corresponds to your state/county/area since state laws can influence the validity of certain records.

- Review related forms or restart your search to find the correct document.

- Click Buy now and create your account. If you already have one, choose to Log In.

- Select the option, then an appropriate payment method, and purchase Fulton I.R.S. Form SS-4 (to acquire your federal identification number).

- Decide to save the form template in any available file format.

Form popularity

FAQ

The IRS uses the EIN to identify the taxpayer. EINs must be used by business entities--corporations, partnerships, and limited liability companies. However, most sole proprietors don't need to obtain an EIN and can use their Social Security numbers instead. Even so, you may want to obtain an EIN anyway.

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

Apply for an EIN with the IRS assistance tool. It will guide you through questions and ask for your name, social security number, address, and your "doing business as" (DBA) name. Your nine-digit federal tax ID becomes available immediately upon verification.

Call 800-829-4933 to verify a number or to ask about the status of an application by mail. Form SS-4 downloaded from IRS.gov is a fillable form and, when completed, is suitable for faxing or mailing to the IRS. Fax: 855-215-1627 (within the U.S.) Fax: 304-707-9471 (outside the U.S.)

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone. Request a 147c letter when you speak with an agent on the phone.

Your accountant might have completed your EIN application form for you and may have a copy. Call the IRS Business and Specialty Tax Line at (800) 829-4933. After providing your EIN and identifying information about your business, the IRS sends a copy of your EIN assignment letter by mail or by fax.

An EIN is to a business as a SSN is to a person. The IRS tracks your personal tax filings with your SSN, just as it uses your EIN to keep tabs on your business filings.

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.

More In Forms and Instructions Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

If you don't have a copy of Form SS-4, or have not yet applied for an EIN, you can now use the IRS' online application tool to submit your Form SS-4 and obtain it.