Cuyahoga Ohio I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

A document procedure always accompanies any legal action you undertake.

Launching a business, applying for or accepting a job proposal, transferring property, and numerous other life circumstances necessitate that you prepare official documentation that varies by state.

That is why having everything gathered in one location is incredibly advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents. This platform allows you to easily locate and acquire a document for any personal or business requirement relevant to your area, including the Cuyahoga I.R.S. Form SS-4 (to procure your federal identification number).

This is the simplest and most dependable way to acquire legal documents. All samples provided by our library are professionally crafted and validated for compliance with local laws and regulations. Prepare your documents and manage your legal matters efficiently with US Legal Forms!

- Finding templates on the platform is remarkably simple.

- If you already hold a subscription to our service, Log In to your account, locate the sample through the search bar, and click Download to save it on your device.

- Following that, the Cuyahoga I.R.S. Form SS-4 (to procure your federal identification number) will be available for further use in the My documents section of your profile.

- If you are utilizing US Legal Forms for the first time, adhere to this brief guideline to obtain the Cuyahoga I.R.S. Form SS-4 (to procure your federal identification number).

- Confirm that you have accessed the correct page with your local form.

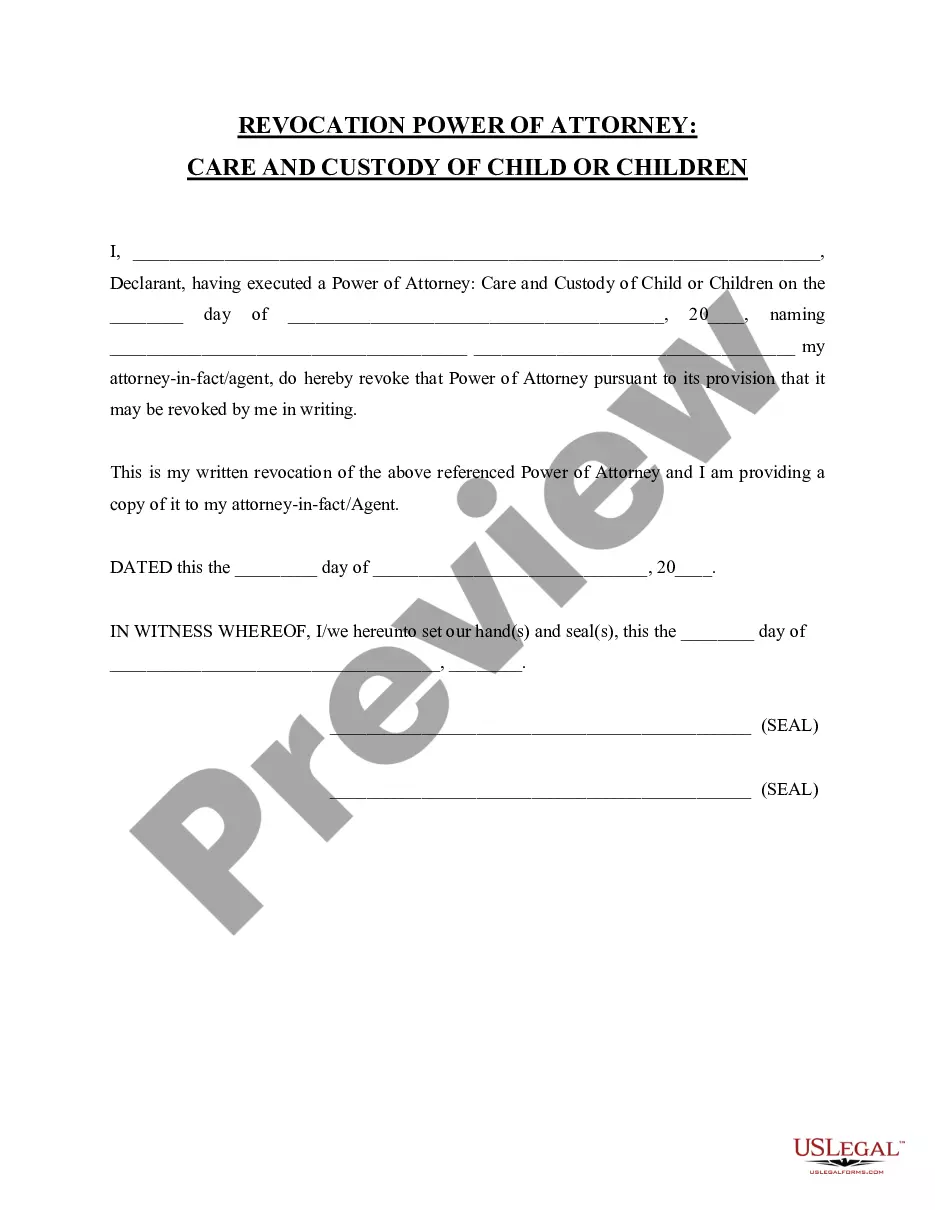

- Employ the Preview mode (if accessible) and scroll through the template.

- Review the description (if available) to ensure the template meets your needs.

- Look for another document using the search tab if the sample does not conform to your needs.

- Hit Buy Now once you identify the necessary template.

Form popularity

FAQ

Call 800-829-4933 to verify a number or to ask about the status of an application by mail. Form SS-4 downloaded from IRS.gov is a fillable form and, when completed, is suitable for faxing or mailing to the IRS. Fax: 855-215-1627 (within the U.S.) Fax: 304-707-9471 (outside the U.S.)

To apply for an employer identification number, you should obtain Form SS-4PDF and its InstructionsPDF. You can apply for an EIN on-line, by mail, or by fax. You may also apply by telephone if your organization was formed outside the U.S. or U.S. territories.

Your accountant might have completed your EIN application form for you and may have a copy. Call the IRS Business and Specialty Tax Line at (800) 829-4933. After providing your EIN and identifying information about your business, the IRS sends a copy of your EIN assignment letter by mail or by fax.

based banks require a copy of the IRS Form SS4 notice in order to open a business bank account. Your banker may be able to get you a copy. Your accountant might have completed your EIN application form for you and may have a copy. Call the IRS Business and Specialty Tax Line at (800) 8294933.

Call the IRS Business and Specialty Tax Line at (800) 829-4933.

If you don't have a copy of Form SS-4, or have not yet applied for an EIN, you can now use the IRS' online application tool to submit your Form SS-4 and obtain it.

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

For public companies, you can look up the EIN on the SEC's website. Search the company's name, and pull up the most recent 10-Q or 10K. All non-profit EINs are public information, and you can find them in the IRS database. If none of these suggestions yield results, you likely won't be able to find the number for free.

Form SS-4, the application for an EIN, is available online. You'll need information about your business, including the administrator or trustee of your business, and name of responsible party along with their social security number or tax ID.

The only way to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933. For security reasons, the IRS will never send anything by email.