The Kings New York Grant Writer Agreement is a comprehensive document that outlines the terms and conditions of a contractual arrangement between Kings New York and a self-employed independent contractor, specifically a grant writer. This agreement serves as a legal framework to protect the rights and responsibilities of both parties involved in the grant writing process. The Kings New York Grant Writer Agreement covers various aspects essential to the collaboration between the organization and the grant writer. It includes key terms such as project scope, compensation details, copyright ownership, confidentiality provisions, termination rights, and liability limitations. Additionally, it may outline any specific guidelines or requirements specific to Kings New York. There might be different types of Kings New York Grant Writer Agreements for self-employed independent contractors, each with their own unique focus or terms. These agreements can be categorized based on the type of grant being pursued or the specific project or program being funded. Some variations of the Kings New York Grant Writer Agreement may include: 1. Research Grant Writer Agreement: This specific agreement is tailored for grant writers working on research-oriented grants, focusing on scientific, academic, or medical research projects. It may include additional provisions related to data management, research protocols, and intellectual property. 2. Community Development Grant Writer Agreement: This type of agreement is designed for grant writers specializing in community development projects, such as affordable housing, social services, or urban revitalization initiatives. It may include clauses related to community engagement, impact assessment, and collaboration with local stakeholders. 3. Education Grant Writer Agreement: This agreement is specifically crafted for grant writers working on grants related to educational programs, scholarships, or school improvement projects. It may incorporate clauses concerning curriculum development, student assessment, and educational standards' compliance. 4. Non-Profit Grant Writer Agreement: This type of agreement is aimed at grant writers collaborating with non-profit organizations seeking funding. It may include provisions related to nonprofit governance, tax-exempt status, and accountability reporting. Overall, the Kings New York Grant Writer Agreement — Self-Employed Independent Contractor is a crucial tool in establishing a clear understanding between Kings New York and a grant writer, ensuring a mutually beneficial working relationship throughout the grant application process. It protects the interests of both parties involved, facilitating a smooth and productive partnership in securing crucial funding for Kings New York's mission and initiatives.

Kings New York Grant Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Kings New York Grant Writer Agreement - Self-Employed Independent Contractor?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Kings Grant Writer Agreement - Self-Employed Independent Contractor, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you pick a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Kings Grant Writer Agreement - Self-Employed Independent Contractor from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Kings Grant Writer Agreement - Self-Employed Independent Contractor:

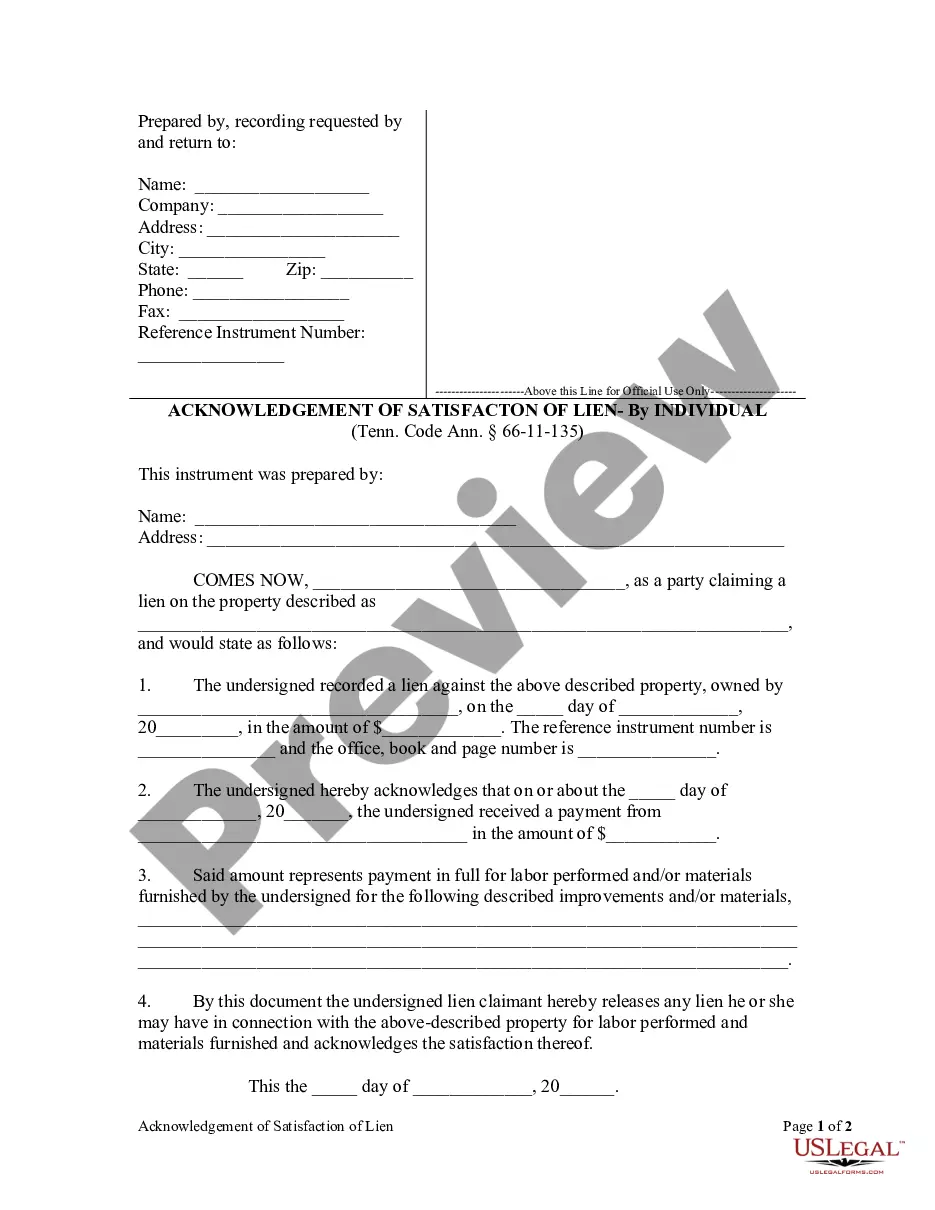

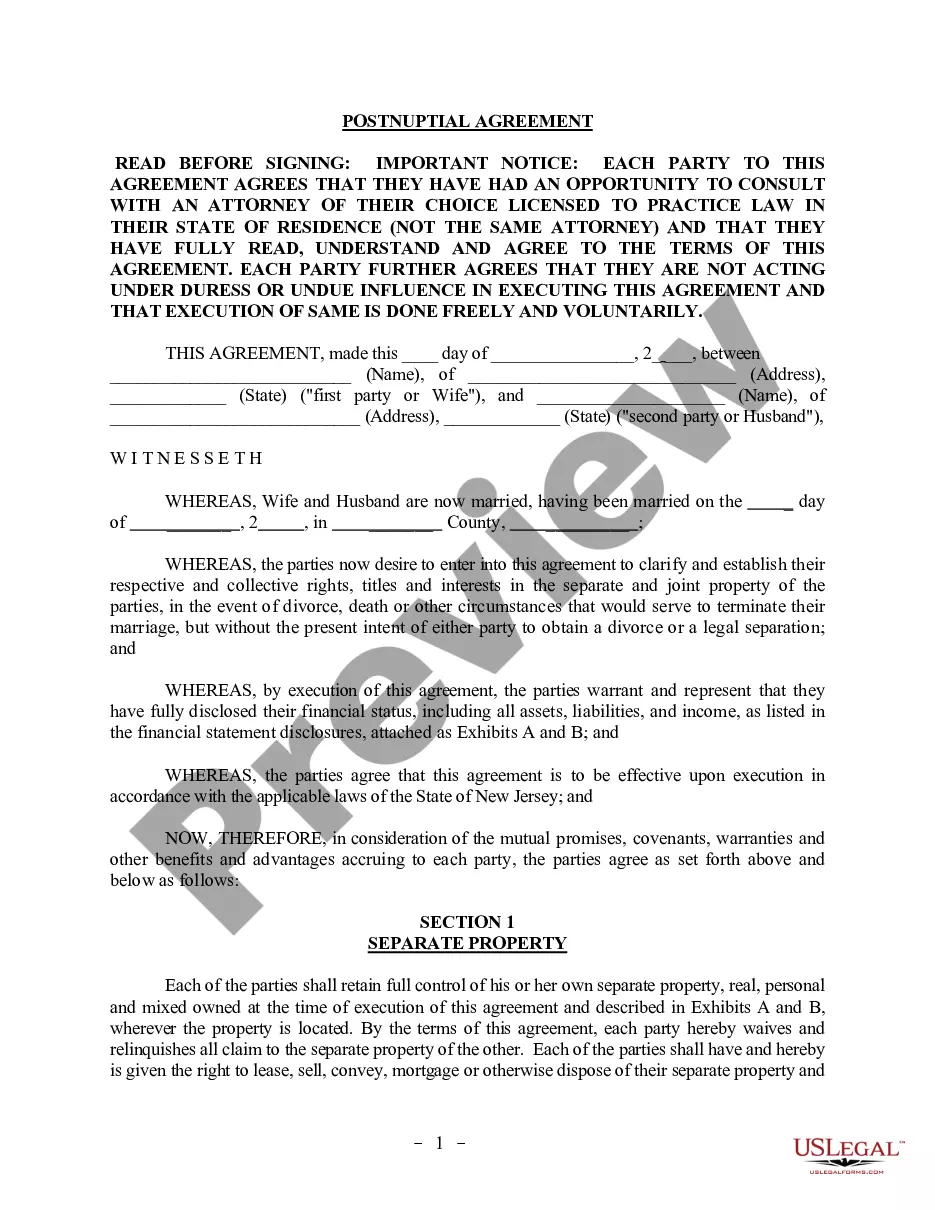

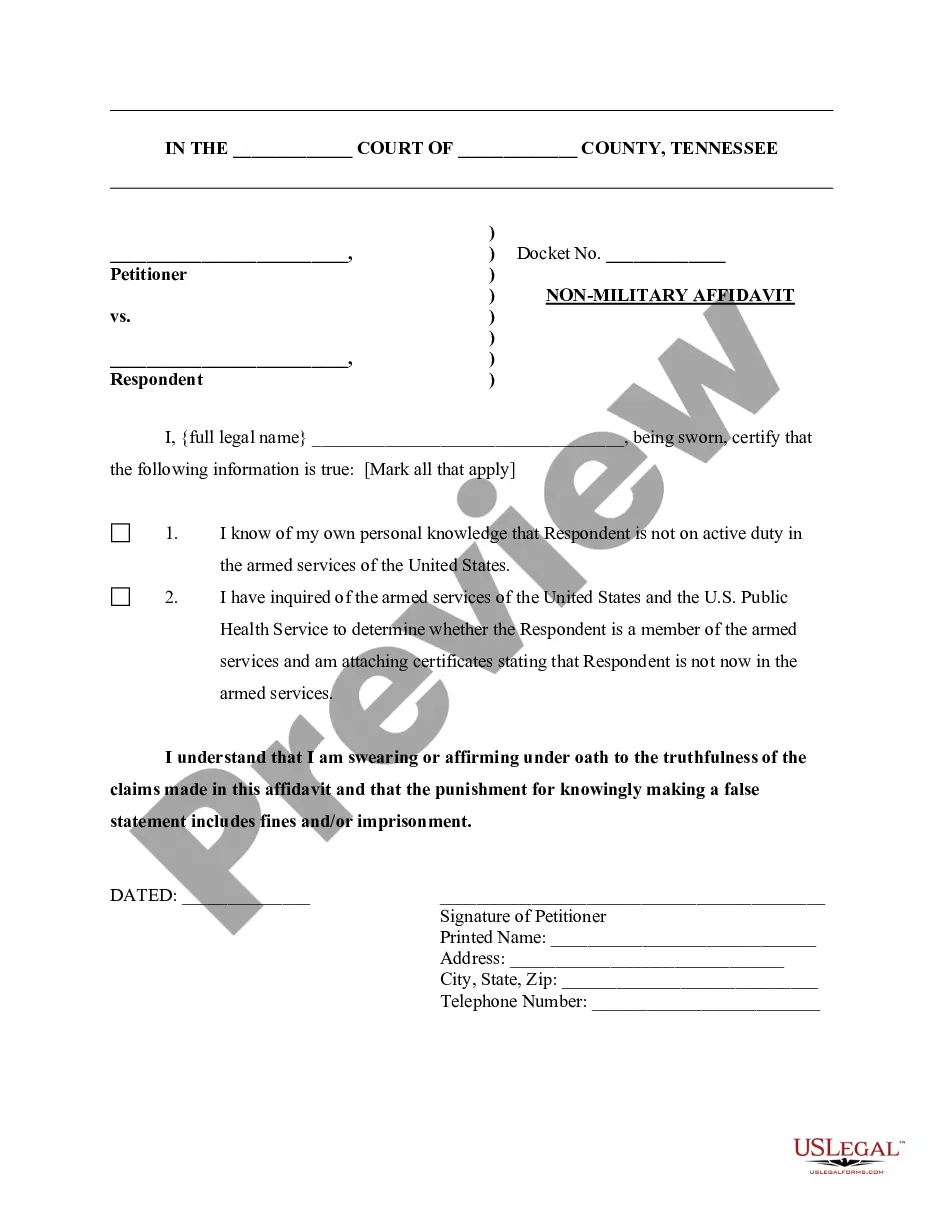

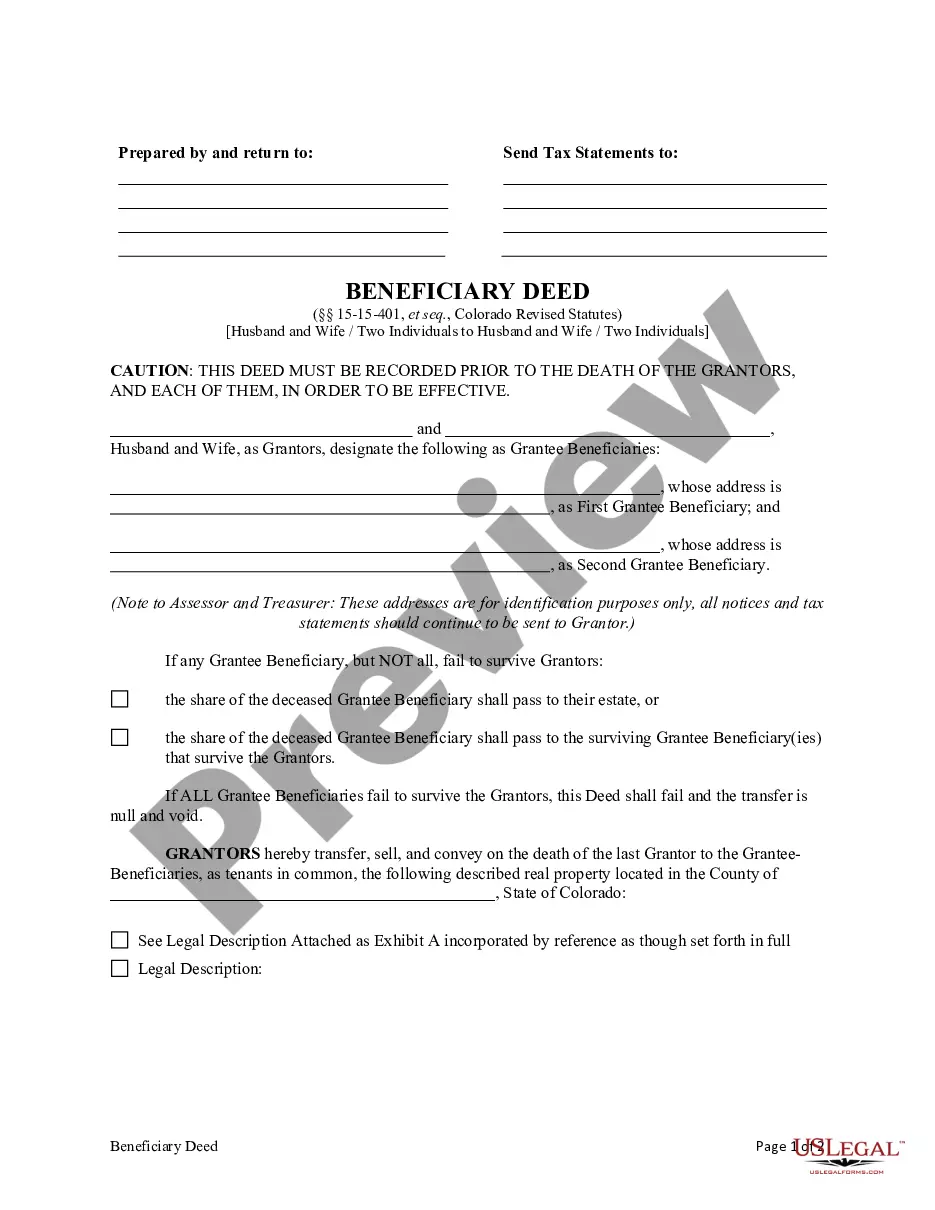

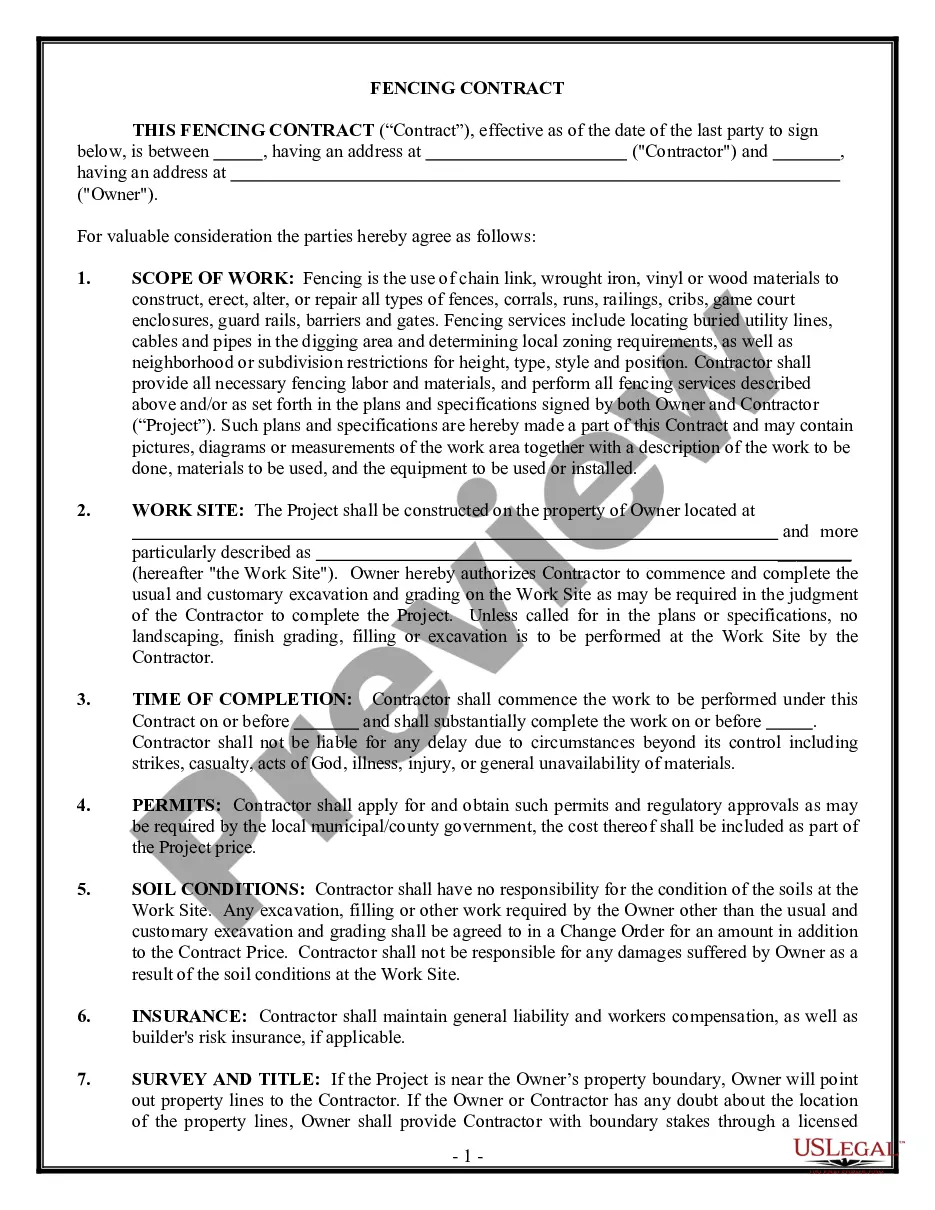

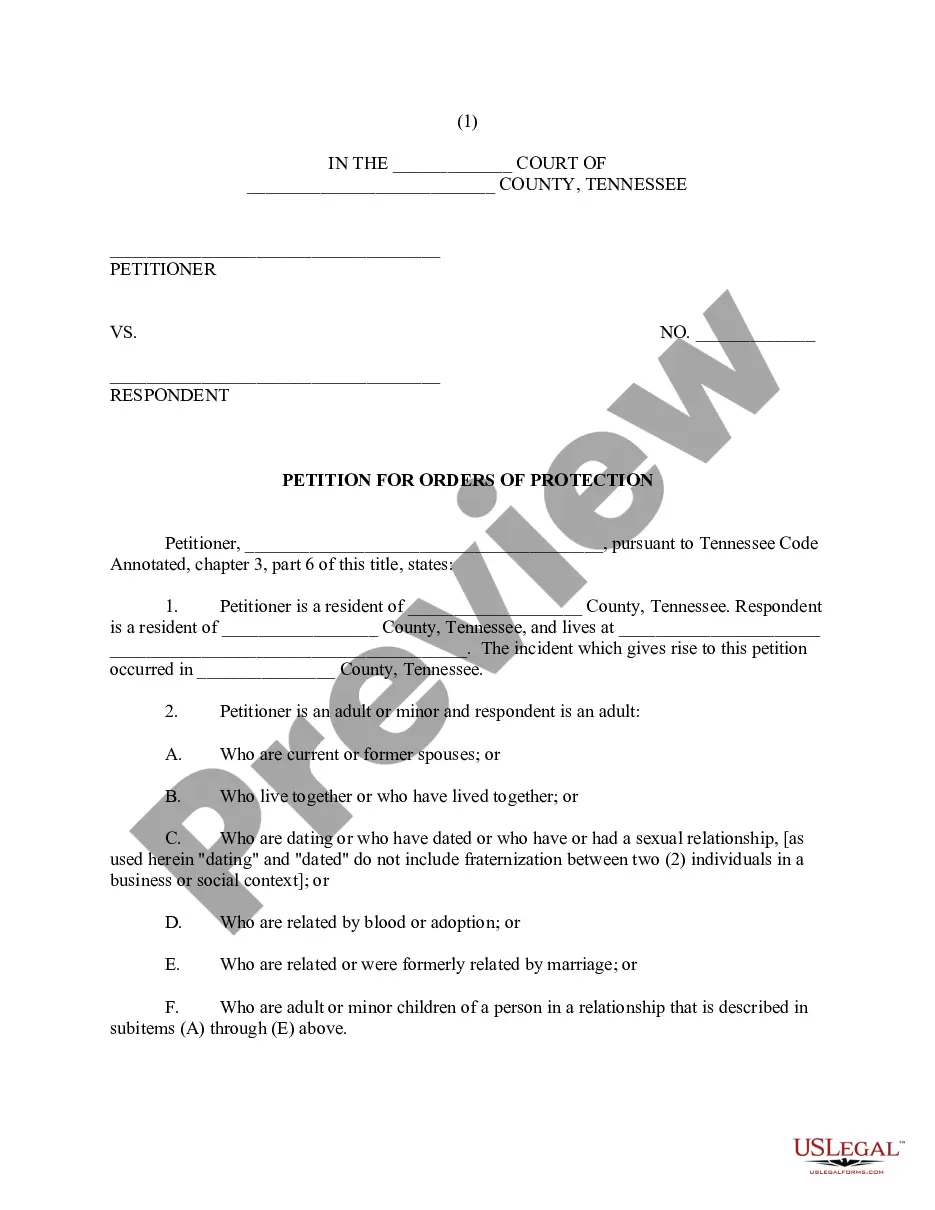

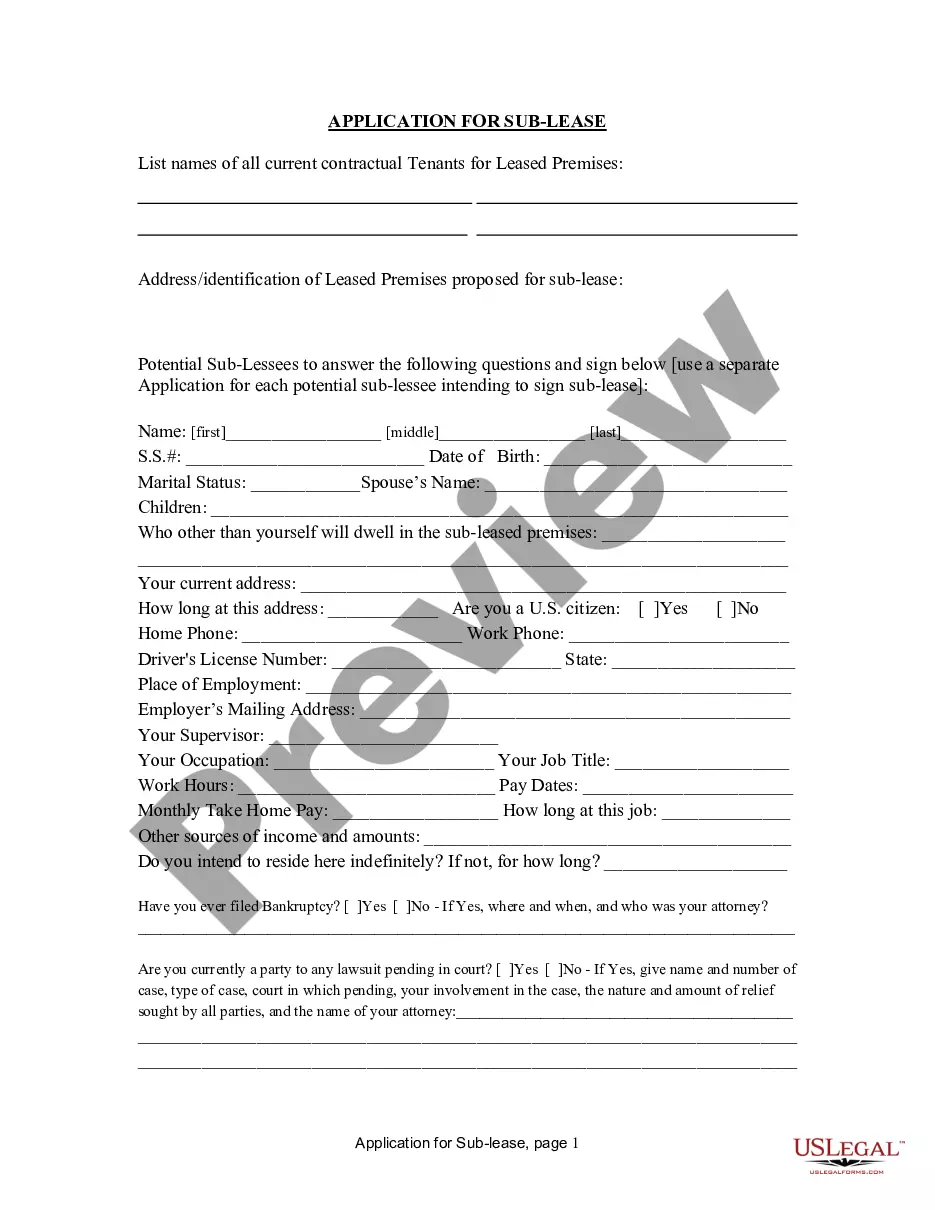

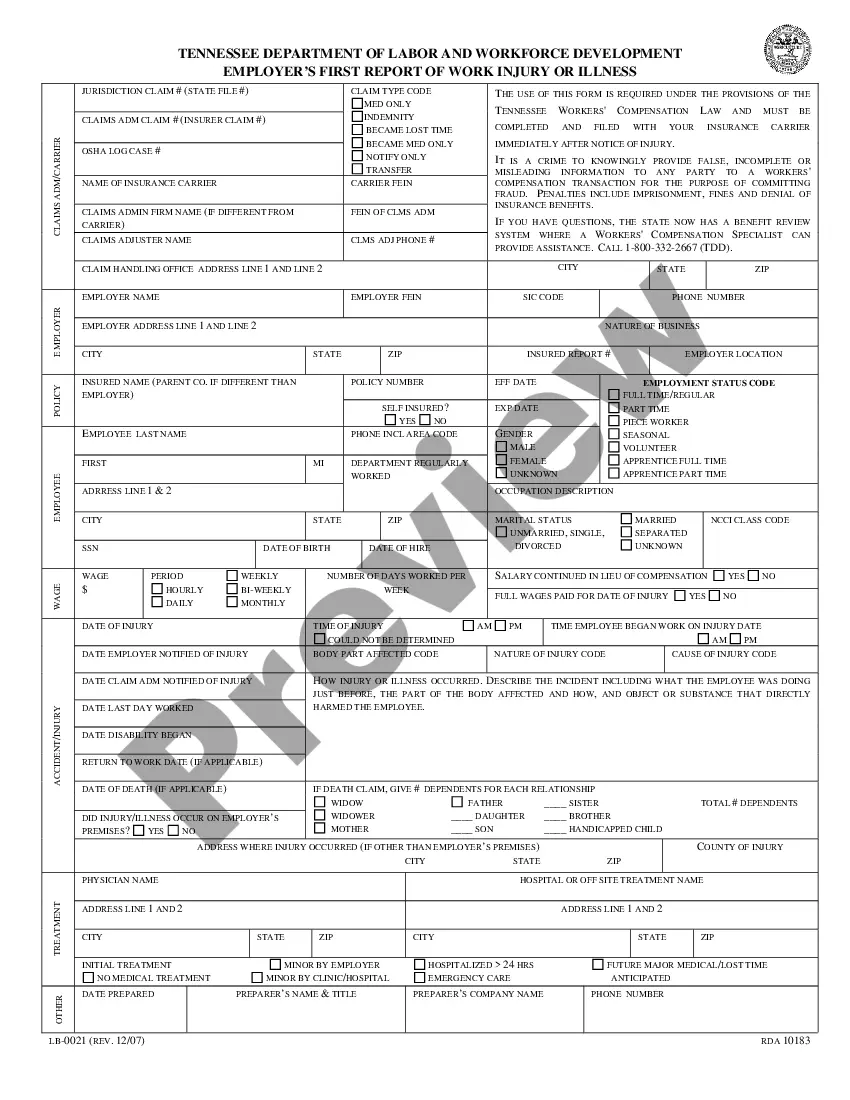

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!