Fairfax Virginia IRS 20 Quiz to Determine 1099 vs Employee Status

Description

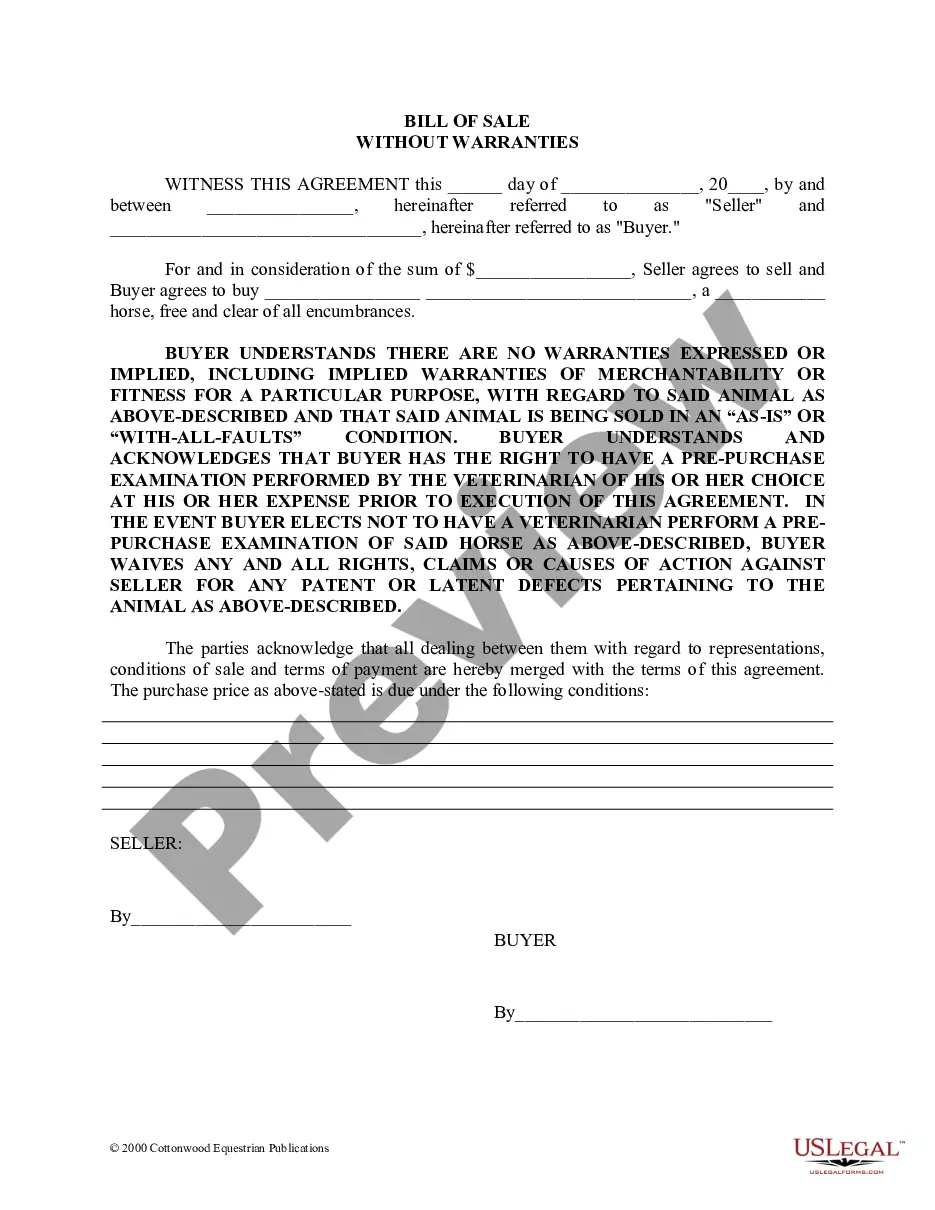

How to fill out IRS 20 Quiz To Determine 1099 Vs Employee Status?

How much duration does it typically take you to compose a legal document.

Since each state has its own laws and regulations for every aspect of life, finding a Fairfax IRS 20 Quiz to Determine 1099 vs Employee Status that meets all local requirements can be exhausting, and obtaining it from a professional attorney is frequently expensive.

Numerous online platforms provide the most common state-specific templates for download, but utilizing the US Legal Forms library is the most advantageous.

Click Buy Now when you are certain about the chosen document, choose the subscription plan that fits you best, create an account on the platform or Log In to continue to payment options, pay via PayPal or with your credit card, adjust the file format if necessary, and click Download to save the Fairfax IRS 20 Quiz to Determine 1099 vs Employee Status. Print the sample or utilize any preferred online editor to complete it electronically. Regardless of how many times you need to use the acquired template, you can find all the samples you have ever saved in your account by accessing the My documents tab. Give it a try!

- US Legal Forms is the most extensive online directory of templates, categorized by states and fields of use.

- Apart from the Fairfax IRS 20 Quiz to Determine 1099 vs Employee Status, here you can access any specific document necessary for managing your business or personal affairs, adhering to your local requirements.

- Experts validate all samples for their accuracy, so you can be confident in preparing your documentation correctly.

- Using the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, choose the necessary form, and download it.

- You can keep the document in your account at any time later on.

- On the other hand, if you are a newcomer to the platform, there will be a few additional steps to undertake before you acquire your Fairfax IRS 20 Quiz to Determine 1099 vs Employee Status.

- Examine the content of the page you are on.

- Review the description of the sample or Preview it (if accessible).

- Search for another document using the related option in the header.

Form popularity

FAQ

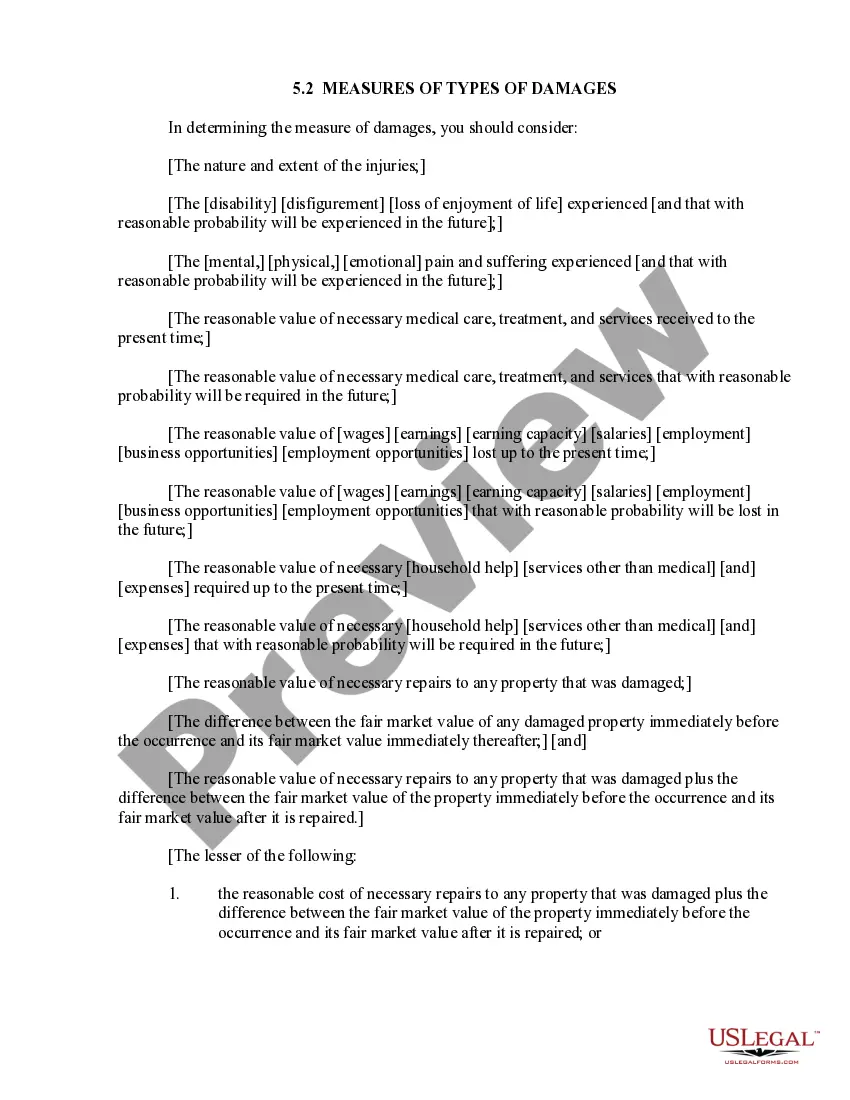

For purposes of determining whether a worker is an independent contractor or an employee, the most important factor to the IRS is: the degree of control the business exercises over the worker.

The 5 personality traits that make a successful contractor Confidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

There are three different tests commonly used to determine if a worker is an employee or independent contractor: 1) the IRS 20-factor analysis; 2) the economic realities test; and, 3) the common law agency test.

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

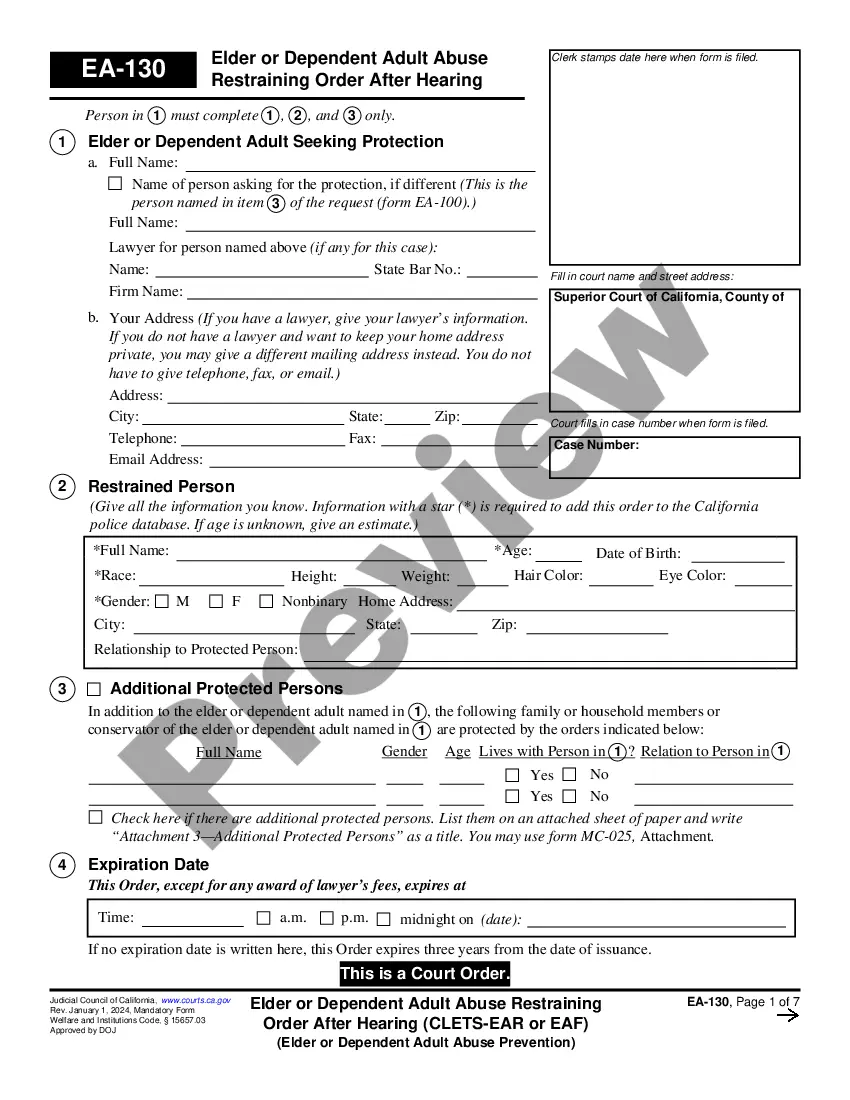

If you have a written contract to complete a specific task or project for a predetermined sum of money, you are probably a 1099 worker. However, if your employment is open-ended, without a contract and subject to a job description, you will typically be considered an employee.

Pursuant to California labor law, the basic test for determining whether a worker is an independent contractor versus an employee is whether the employer has the right to direct and control the manner and means by which the work is performed.

AB 5 requires the application of the ABC test to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission (IWC) wage orders.