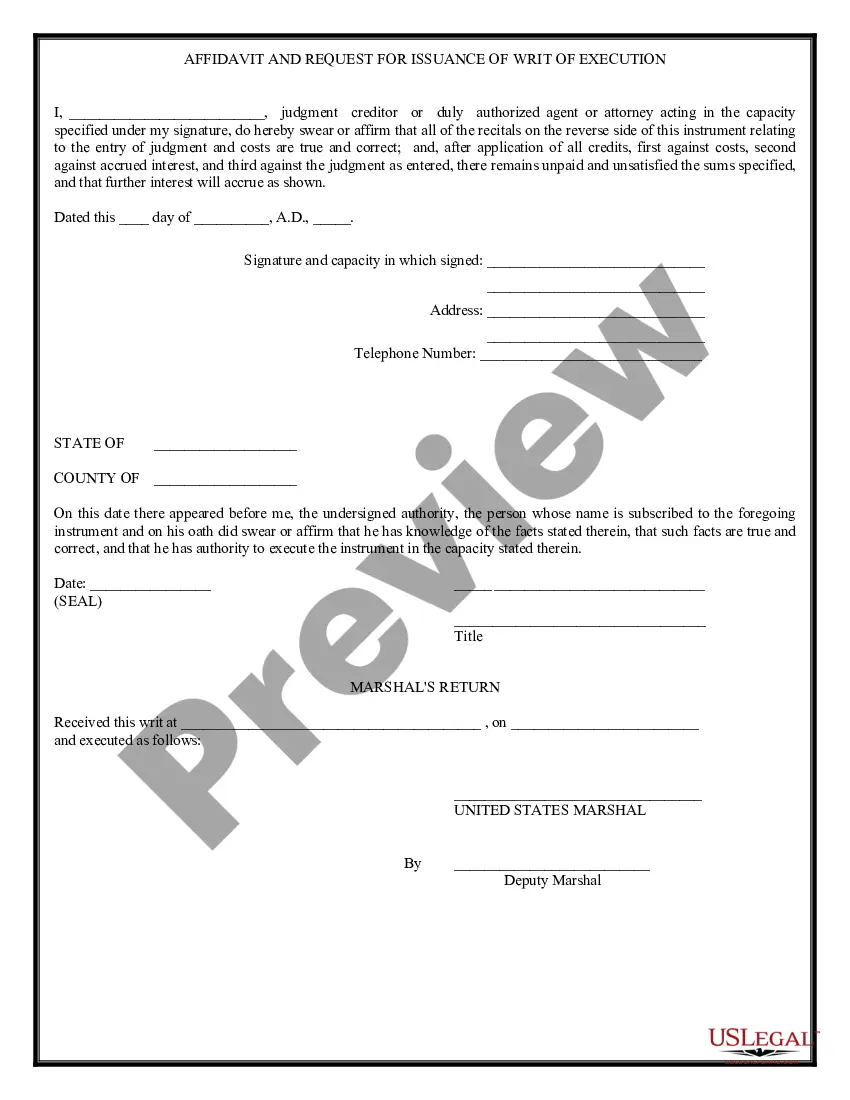

Hillsborough Florida Writ of Execution

Description

How to fill out Writ Of Execution?

Drafting legal paperwork can be tedious.

Furthermore, if you opt to hire a lawyer to create a commercial agreement, documents for property transfer, prenuptial contract, divorce forms, or the Hillsborough Writ of Execution, it might set you back significantly.

Browse the page to ensure a sample exists for your area. Review the form description and utilize the Preview option if available to confirm it’s the template you require. Don’t fret if the form doesn’t meet your needs—search for the appropriate one using the header. Click Buy Now once you locate the desired sample and choose the most suitable subscription. Log In or create an account to pay for your subscription. Complete the payment using a credit card or PayPal. Select the file format for your Hillsborough Writ of Execution and store it. Afterward, you can either print it out and fill it in manually or upload the forms to an online editor for a quicker and more efficient completion. US Legal Forms enables you to access all the documents purchased indefinitely—find your templates in the My documents tab in your profile. Give it a try today!

- What is the most efficient way to save both time and money while creating valid forms that fully adhere to your state and local laws.

- US Legal Forms is a fantastic option, whether you’re looking for templates for personal or professional purposes.

- US Legal Forms is the largest online repository of state-specific legal documents, offering users access to current and thoroughly reviewed forms for any situation, all conveniently gathered in one location.

- Therefore, if you need the latest edition of the Hillsborough Writ of Execution, you can swiftly find it on our site.

- Acquiring the documents takes minimal time.

- Users with existing accounts should confirm their subscription is active, Log In, and select the form using the Download button.

- If you are not yet a subscriber, here’s how to obtain the Hillsborough Writ of Execution.

Form popularity

FAQ

Levy: The process of seizing a judgment debtor's property to pay the judgment debt. In Florida, the sheriff's department levies the property. The sheriff's department sells the levied property in order to pay the creditor.

A Writ of Execution is a method directed by the Court to attempt to enforce a judgment that has been granted. It authorizes a sheriff to levy on property belonging to the defendant within the State of Florida.

The Clerk of Court Recording Department records, indexes, and archives all documents that create the Official Records of Hillsborough County.

(1) Any lien created by a writ of execution which has been delivered to the sheriff of any county before October 1, 2001, remains in effect for 2 years thereafter as to any property of the judgment debtor located in that county before October 1, 2001, and remaining within that county after that date.

Once you have located property the sheriff can seize, you take your judgment to the Clerk of the Court that issued the judgment and ask for a document called a Writ of Execution. This tells the sheriff to seize property of the judgment debtor to satisfy your judgment.

A levy is the legal seizure of property to satisfy an outstanding debt. If you fail to pay your taxes, the Internal Revenue Service may respond by levying your tax return or property. Tax authorities can also levy other assets, such as bank accounts, rental income, or retirement accounts.

1. Legally ordered seizure and sale of property to satisfy a delinquent debt or judgment. The money obtained from such action is also called a levy.

Levy. 1) v. to seize (take) property upon a writ of execution (an order to seize property) issued by the court to pay a money judgment granted in a lawsuit.

Getting a Writ of Execution ), the court directs the sheriff or marshal to enforce the judgment in your case in the county where the assets are located. Writs of execution are only good for 180 days.

How Long Is a Writ of Execution Good for? According to Texas Rule of Civil Procedure 34.001, a Writ of Execution for a money judgment can be applied for within 10 years of the entry of a judgment and is good for just as long. Within the 10 year period, the writ can be renewed at any time for an additional 10 years.