Wake North Carolina Simple Agreement for Future Equity

Description

How to fill out Simple Agreement For Future Equity?

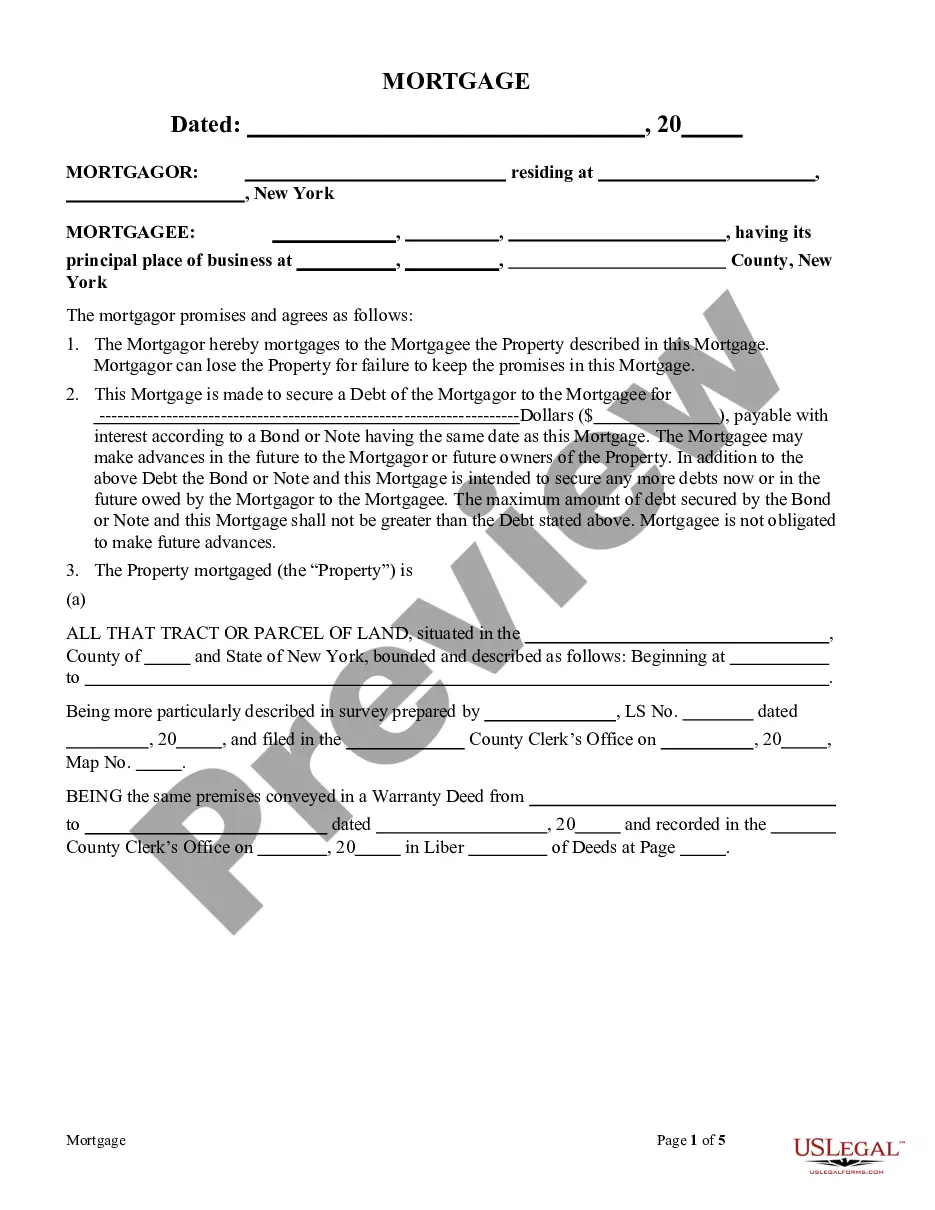

If you are looking for a reliable legal document provider to obtain the Wake Simple Agreement for Future Equity, consider US Legal Forms. Whether you aim to start your LLC enterprise or oversee your asset distribution, we've got you covered. You don't need to possess legal expertise to find and download the correct document.

You can easily type to search or explore Wake Simple Agreement for Future Equity, either by a keyword or by the state/county the document pertains to.

After locating the needed document, you can Log In and download it or save it in the My documents section.

Don't have an account? It's simple to begin! Just locate the Wake Simple Agreement for Future Equity template and review the document's preview and brief introductory details (if applicable). If you're confident about the template’s legal terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be ready for download immediately after payment is processed. Now you can fill out the document.

Managing your legal matters doesn’t have to be costly or time-consuming. US Legal Forms is here to demonstrate that. Our extensive selection of legal documents makes these tasks more budget-friendly and accessible. Establish your first business, plan your advanced care directives, draft a real estate agreement, or execute the Wake Simple Agreement for Future Equity - all from the comfort of your home. Sign up for US Legal Forms today!

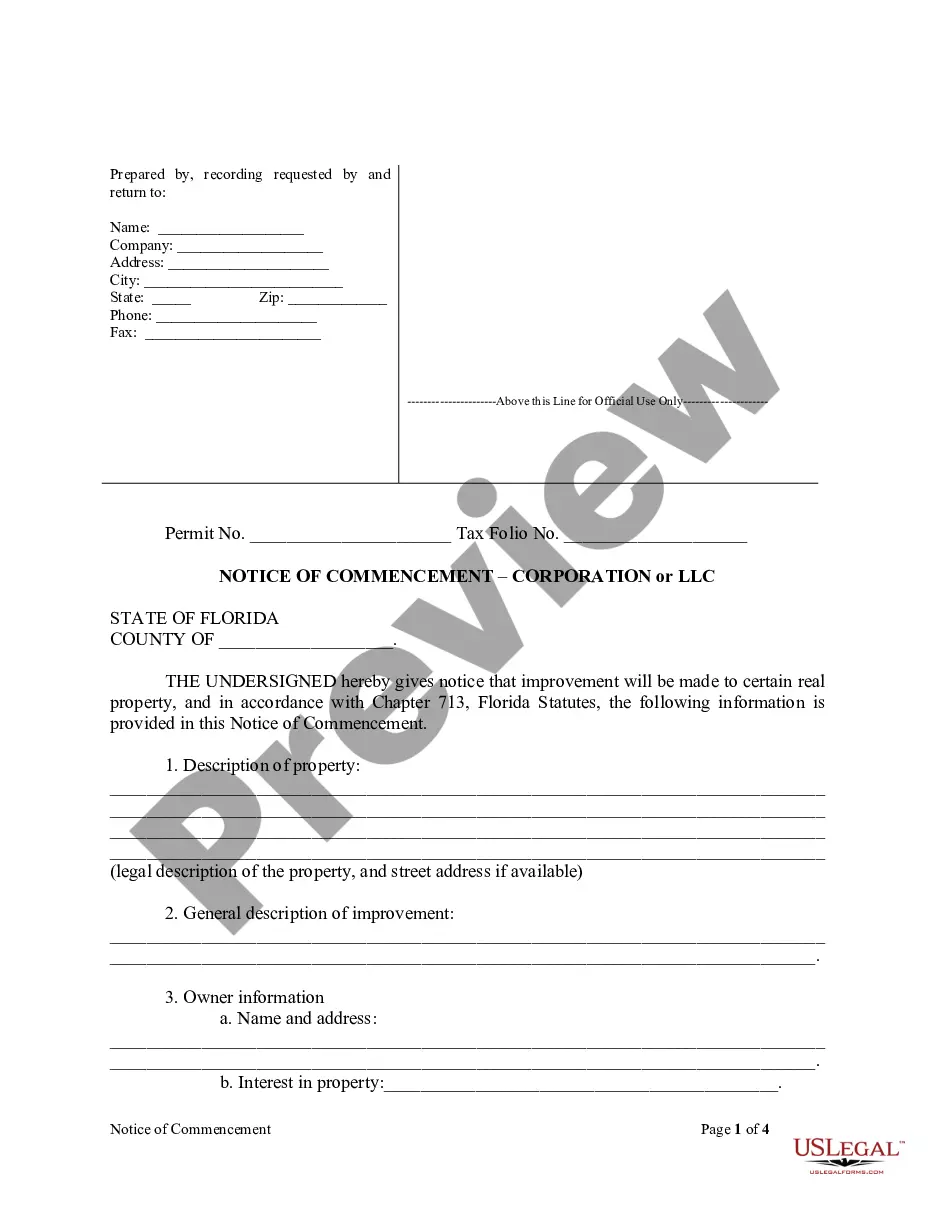

- You can choose from more than 85,000 documents organized by state/county and case.

- The intuitive interface, abundance of educational resources, and dedicated assistance simplify the process of obtaining and completing various paperwork.

- US Legal Forms has been a trusted service delivering legal documents to millions since 1997.

Form popularity

FAQ

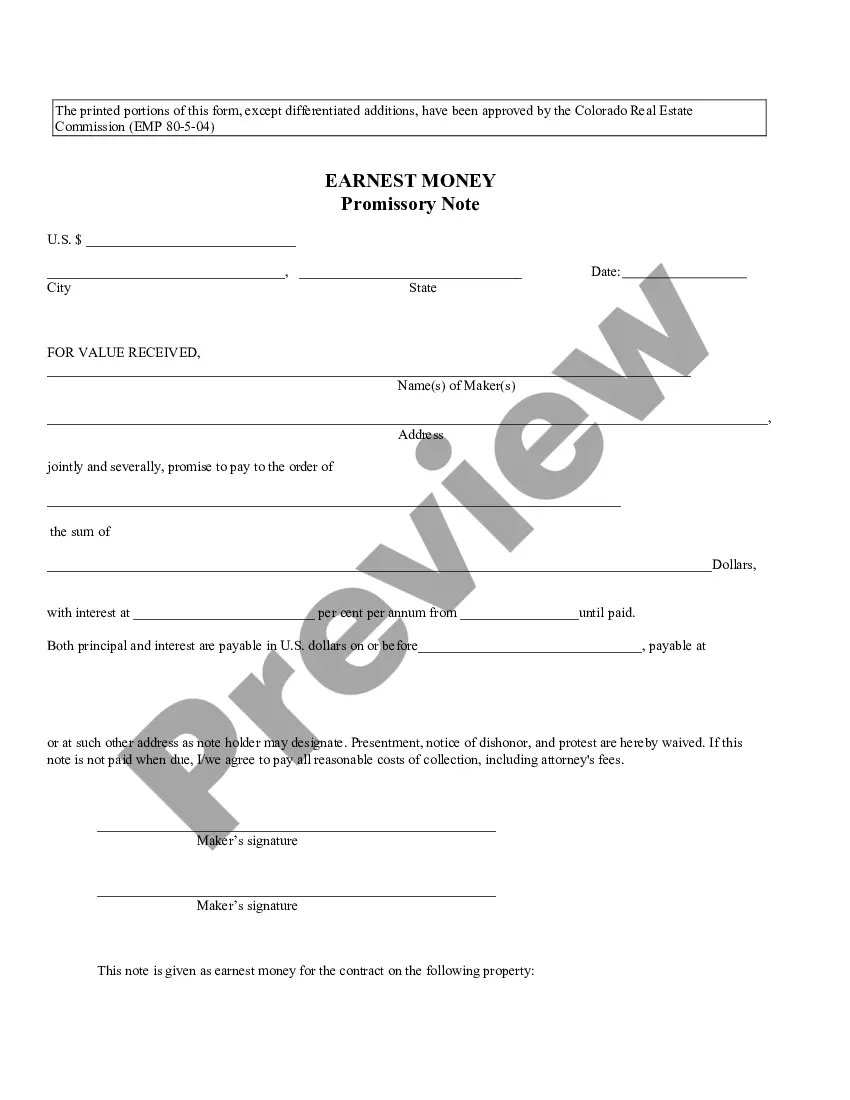

Futures are a type of derivative contract agreement to buy or sell a specific commodity asset or security at a set future date for a set price. Futures contracts, or simply "futures," are traded on futures exchanges like the CME Group and require a brokerage account that's approved to trade futures.

SAFE agreements are powerful investing tools. However, there are important terms in SAFE Agreements that you must understand. The five terms we'll consider in this article include discounts, valuation caps, pre-money or post-money, pro-rata rights, and the most favored nations provision.

An equity futures contract is a type of derivative whereby parties involved must transact shares of a specific company at a predetermined future date and price. The price of the contract is namely determined by the spot price of the underlying stock.

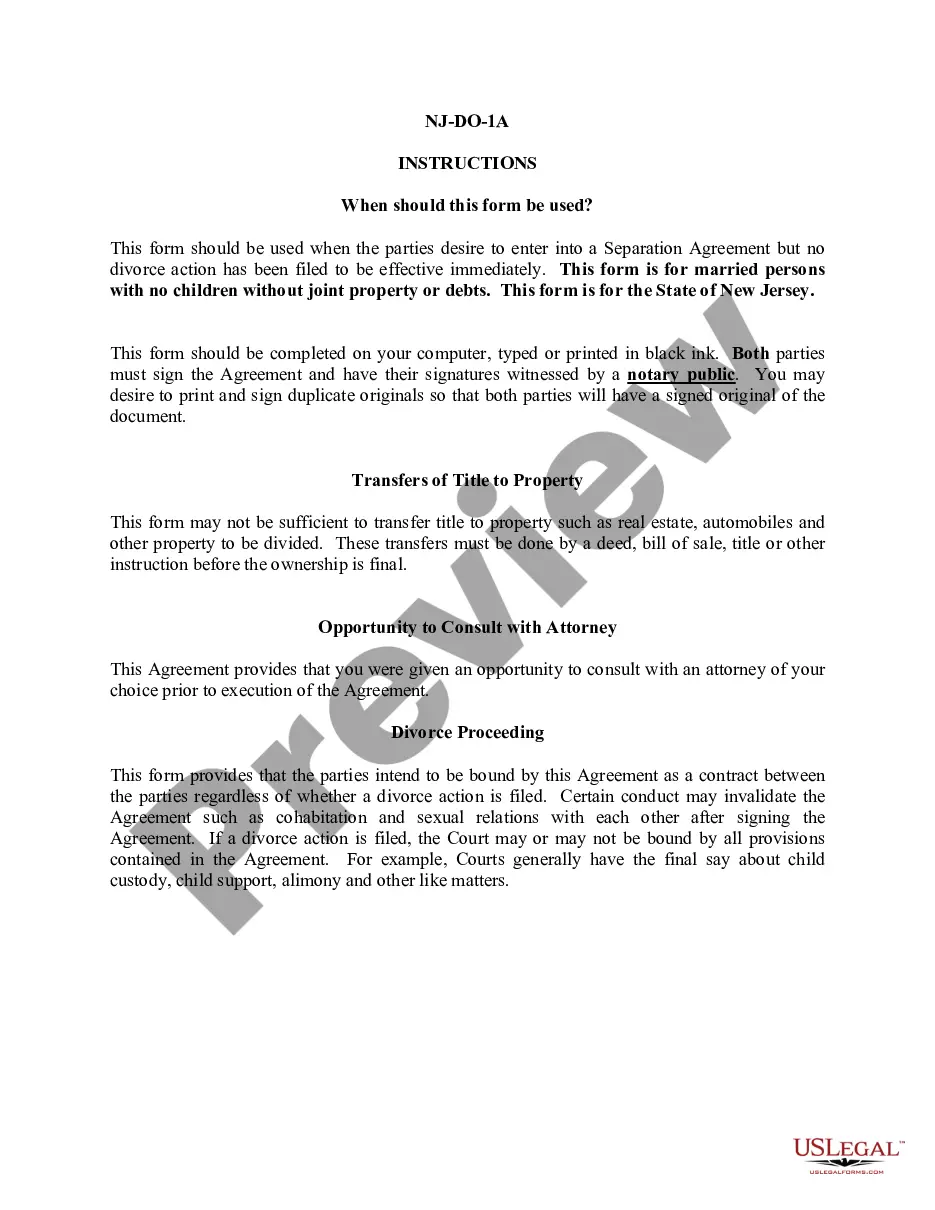

These agreements are made between a company and an investor and create potential future equity in the company for the investor in exchange for immediate cash to the company. The SAFE converts to equity at a later round of financing but only if a particular triggering event (outlined in the agreement) takes place.

A SAFT is different from a Simple Agreement for Future Equity (SAFE), which allows investors who put cash into a startup to convert that stake into equity at a later date.

SAFE notes are a type of convertible security, while convertible notes are a form of debt that can convert into equity once certain milestones are met. Because of this, convertible notes usually have a maturity rate and an interest rate.

The SEC does not state anywhere in the article that a SAFE is a liability or equity, but is quick to note that SAFEs are not traditional equity.

A KISS agreement (which is a Keep It Simple Security), is a simplified investment structure that is similar to a convertible note, which gets capital into your company much faster than more conventional methods.

In essence, a SAFE instrument involves making an up-front investment, with a future conversion into equity at a valuation to be determined at that time based upon the occurrence of a future funding round, which can incorporate an optional conversion cap and/or conversion discount.

A simple agreement for future equity (SAFE) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes.