Dallas Texas Simple Agreement for Future Equity

Description

How to fill out Simple Agreement For Future Equity?

Regardless of whether you intend to initiate your enterprise, enter into a contract, request your identification renewal, or address familial legal matters, it is essential to prepare specific documentation in line with your local statutes and regulations.

Finding the appropriate documents can be quite time-consuming and labor-intensive unless you utilize the US Legal Forms library.

The service offers users access to over 85,000 expertly crafted and verified legal templates for any personal or business situation. All documents are organized by state and purpose of use, making it easy and efficient to choose a template such as the Dallas Simple Agreement for Future Equity.

Documents provided by our library are reusable. With an active subscription, you can access all previously obtained paperwork at any time in the My documents section of your profile. Stop wasting time on an endless quest for up-to-date official documents. Register for the US Legal Forms platform and keep your paperwork organized with the most comprehensive online form collection!

- Ensure the template meets your personal requirements and complies with state laws.

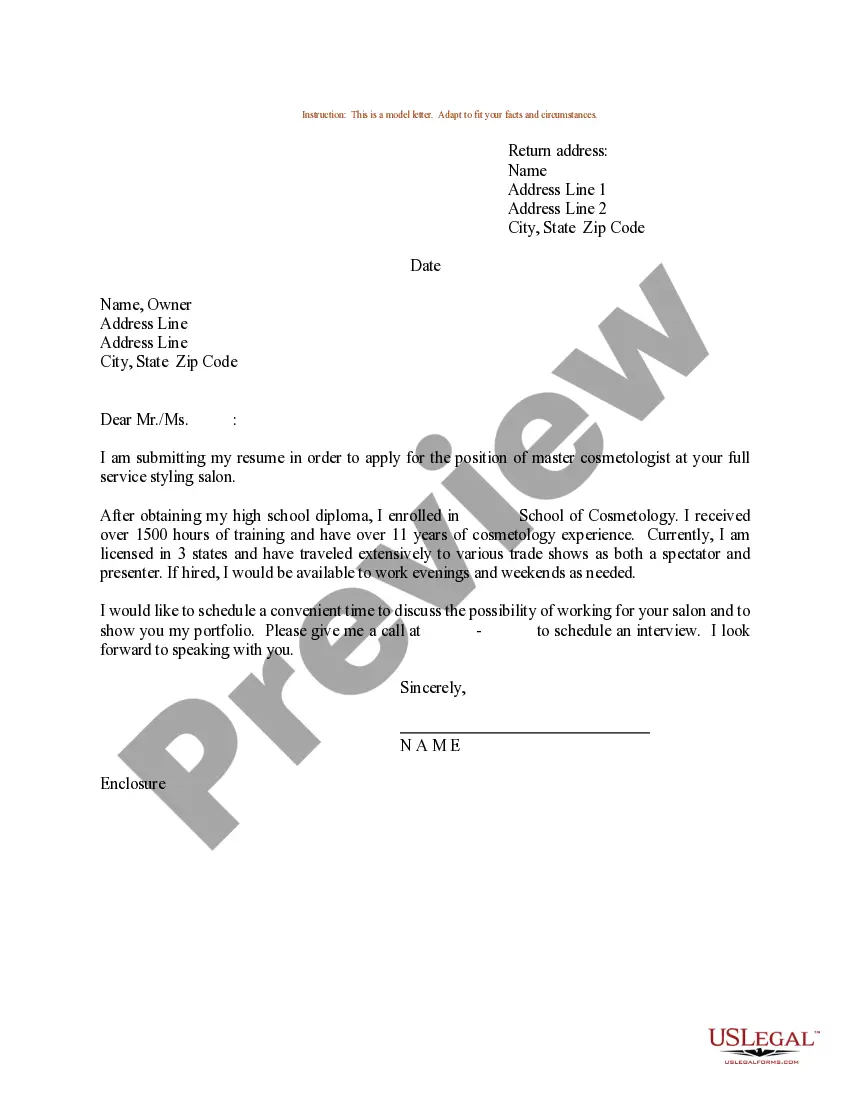

- Review the form description and check the Preview if available on the webpage.

- Utilize the search feature provided above to locate another template specific to your state.

- Press Buy Now to acquire the document once you identify the appropriate one.

- Select the subscription plan that is most suitable for you to continue.

- Log in to your account and remit payment through a credit card or PayPal.

- Download the Dallas Simple Agreement for Future Equity in your preferred file format.

- Print the document or fill it out and sign it electronically via an online editor to save time.

Form popularity

FAQ

A simple agreement for future stocks is similar to a SAFE, allowing investors to contribute funds to a company in exchange for the right to ownership in future shares. This agreement is particularly beneficial in a fast-paced business environment, as it enables startups to secure funding quickly while delaying the valuation process. The Dallas Texas Simple Agreement for Future Equity facilitates smoother transactions and can pave the way for beneficial partnerships.

The Dallas Texas Simple Agreement for Future Equity, often called SAFE, is a straightforward investment contract between investors and startups. This agreement allows investors to convert their investment into equity at a future financing round while simplifying the process. Unlike traditional equity agreements, a SAFE does not require an immediate valuation, making it a flexible option for early-stage companies seeking funding. By choosing a Dallas Texas Simple Agreement for Future Equity, startups can secure capital without complicated negotiations or immediate ownership transfers.

A simple agreement for future equity (SAFE) is an agreement between an investor and a company that provides rights to the investor for future equity in the company similar to a warrant, except without determining a specific price per share at the time of the initial investment.

SAFE agreements are powerful investing tools. However, there are important terms in SAFE Agreements that you must understand. The five terms we'll consider in this article include discounts, valuation caps, pre-money or post-money, pro-rata rights, and the most favored nations provision.

Here are the best low-risk investments in June 2022: High-yield savings accounts. Series I savings bonds. Short-term certificates of deposit. Money market funds. Treasury bills, notes, bonds and TIPS. Corporate bonds. Dividend-paying stocks. Preferred stocks.

Yes, there is a simple and safe way to invest in equity. You can invest in equity without the abovementioned problems. You can invest in equity with practically zero possibility of losing your entire capital. The answer isSIP in index funds.

A KISS agreement (which is a Keep It Simple Security), is a simplified investment structure that is similar to a convertible note, which gets capital into your company much faster than more conventional methods.

SAFEs do not represent a current equity stake in the company in which you are investing. Instead, the terms of the SAFE have to be met for you to receive any shares in the company.

U.S. Treasury bonds are widely considered the safest investments on earth. Because the United States government has never defaulted on its debt, investors see U.S. Treasuries as highly secure investment vehicles.

Equity Mutual Funds as a category are considered 'High Risk' investment products. While all equity funds are exposed to market risks, the degree of risk varies from fund to fund and depends on the type of equity fund.