Wake North Carolina Investment - Grade Bond Optional Redemption (with a Par Call)

Description

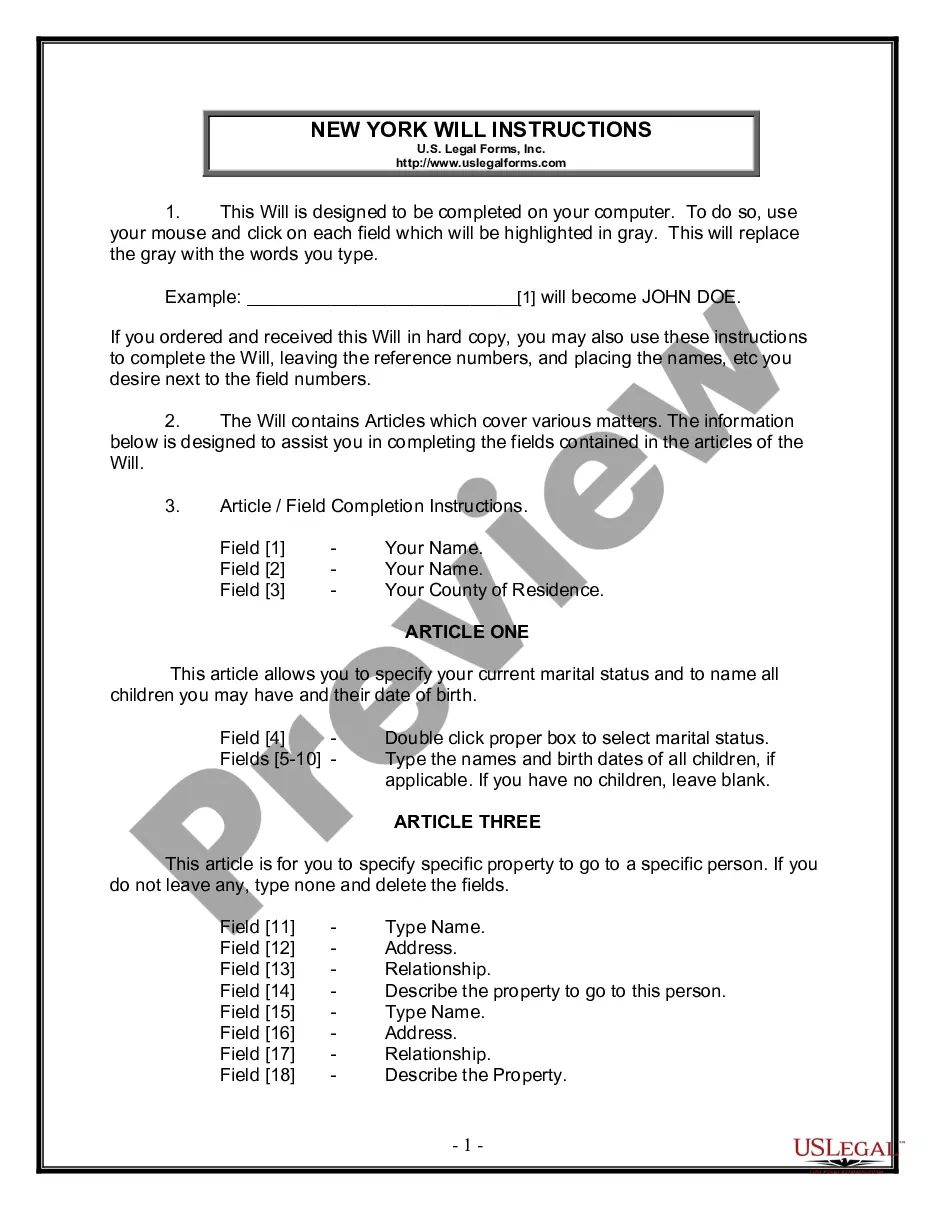

How to fill out Investment - Grade Bond Optional Redemption (with A Par Call)?

Preparing documents for business or personal purposes is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it's crucial to take into account all federal and state statutes and regulations pertinent to the specific region.

However, smaller counties and even towns also possess legislative measures that you must consider.

The advantage of the US Legal Forms library is that all the documents you have ever acquired remain accessible - you can find them in your profile under the My documents section at any time. Sign up for the platform and effortlessly acquire authenticated legal forms for any situation with just a few clicks!

- All these elements contribute to the stress and lengthy process of generating Wake Investment - Grade Bond Optional Redemption (with a Par Call) without expert help.

- You can prevent incurring costs for attorneys drafting your documents and create a legally binding Wake Investment - Grade Bond Optional Redemption (with a Par Call) on your own, utilizing the US Legal Forms online repository.

- It is the largest digital collection of state-specific legal templates that are professionally vetted, allowing you to be confident in their authenticity when choosing a sample for your area.

- Previously registered users only need to Log In to their accounts to access the necessary form.

- If you don't yet have a subscription, follow the detailed steps below to obtain the Wake Investment - Grade Bond Optional Redemption (with a Par Call).

- Browse the page you opened and verify if it contains the document you need.

- To do this, use the form description and preview if these options are available.

Form popularity

FAQ

A type of bond that provides the issuer the right but not the obligation to redeem the bond before the maturity date. Updated October 28, 2021.

whole payment made to an investor is typically equal to the net present value (NPV) of these future payments calculated based on the market discount rate. The makewhole provision is a yield maintenance provision typically included in the bond indenture, credit agreement, or other forms of debt documents.

"Par Call Date" means (the date that is three months prior to the maturity date of the notes).

Redemption value is the price paid to the investor when the issuing company repurchases the security either before or at the maturity date. When called bonds are redeemed, they are redeemed at a price above par value. The earlier the bond is called by the issuer, the higher the bond's redemption value.

whole call provision is a type of call provision on a bond allowing the issuer to pay off remaining debt early. The payment is derived from a formula based on the net present value (NPV) of previously scheduled coupon payments and the principal that the investor would have received.

If, when a company issues a new bond, it receives the face value of the security, the bond is said to have been issued at par. If the issuer receives less than the face value for the security, it is issued at a discount. If the issuer receives more than the face value for the security, it is issued at a premium.

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

A callableredeemablebond is typically called at a value that is slightly above the par value of the debt. The earlier in a bond's life span that it is called, the higher its call value will be. For example, a bond maturing in 2030 can be called in 2020. It may show a callable price of 102.

A par bond is a bond that sells at its exact face value. This typically means that a bond sells for $1,000, since this is the face value of most bonds. A par bond will have a yield to the investor that matches the coupon amount attached to the bond.

2022 Principal (a.k.a. maturity value or redemption value) the amount paid by the. issuer to the bondholder when the bond is surrendered. Most bonds are redeemable at par (i.e. redeemed at their face value). Some bonds are callable and can be redeemed prior to the maturity date.