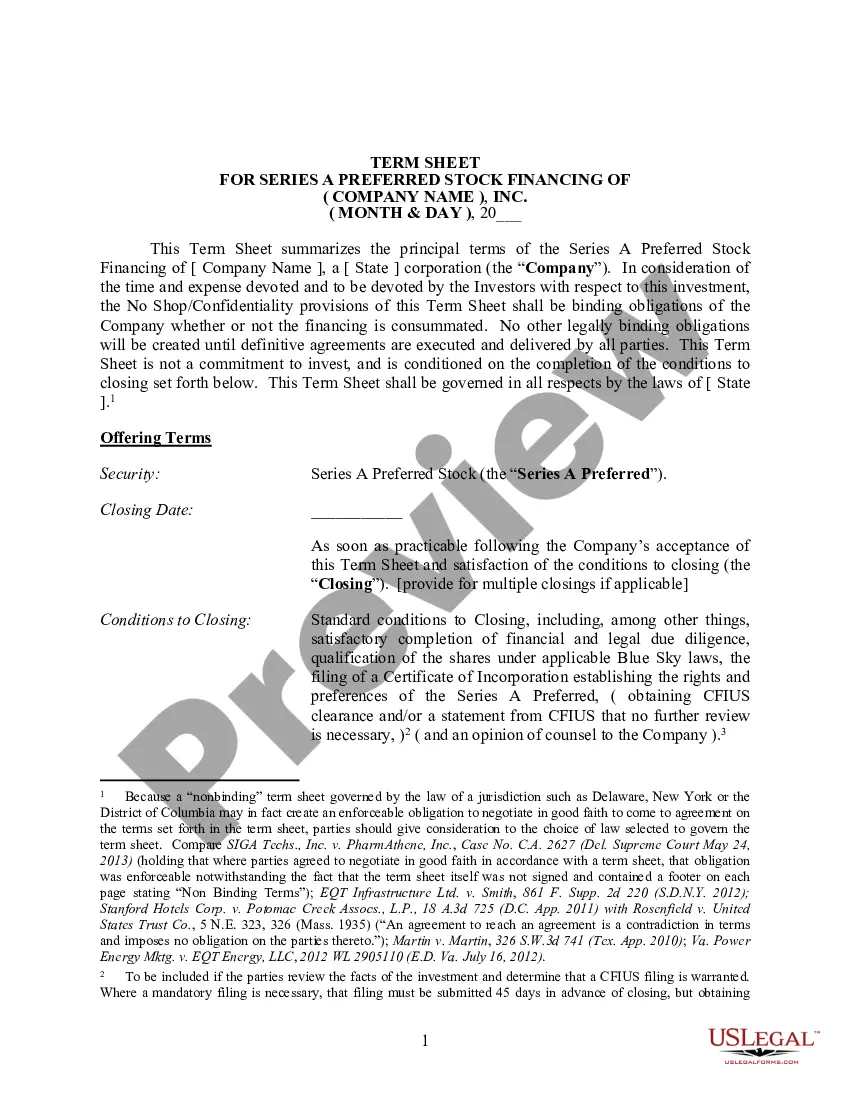

Philadelphia Pennsylvania Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Laws and statutes in each field vary across the nation.

If you aren't an attorney, it's simple to become confused by different standards when it comes to creating legal documents.

To steer clear of pricey legal help when drafting the Philadelphia Term Sheet - Series A Preferred Stock Financing of a Corporation, you require a verified template that is valid for your area.

This is the most straightforward and affordable method to attain current templates for any legal needs. Discover them all easily and maintain your documentation organized with the US Legal Forms!

- That’s when utilizing the US Legal Forms platform proves to be advantageous.

- US Legal Forms is endorsed by millions and features a web catalog of over 85,000 state-specific legal forms.

- It’s an outstanding solution for professionals and individuals seeking do-it-yourself templates for a variety of life and business circumstances.

- All the forms can be reused: once you select a template, it stays available in your profile for future access.

- Thus, when you possess an account with an active subscription, you can easily Log In and re-download the Philadelphia Term Sheet - Series A Preferred Stock Financing of a Company from the My documents section.

- For new users, there are additional steps required to acquire the Philadelphia Term Sheet - Series A Preferred Stock Financing of a Company.

- Review the page content to ensure you have located the suitable sample.

- Utilize the Preview feature or read the form description if provided.

Form popularity

FAQ

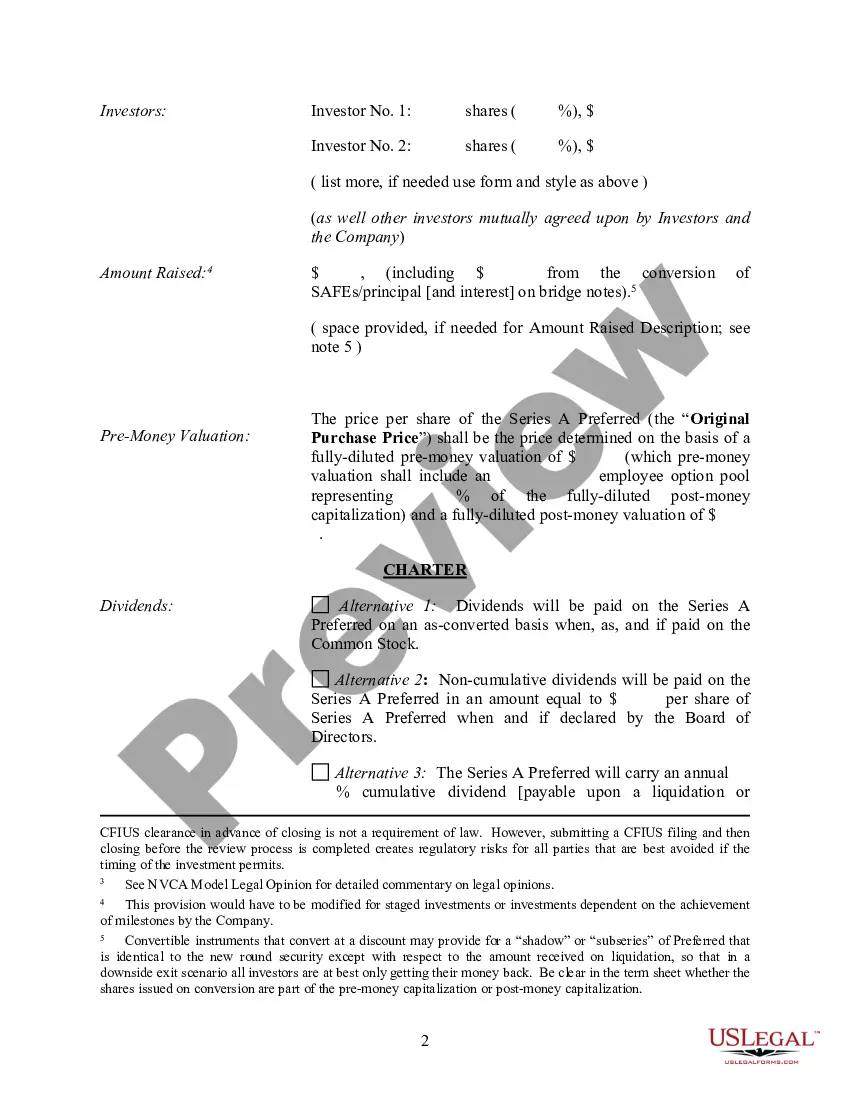

In a seed round, the investor will typically be the one providing the term sheet. This may change, especially when there are multiple investors in later and larger rounds. Common items in a term sheet include: Who is issuing the note or stock.

Series A Note means the promissory note dated the Closing Date, executed and delivered by the Company to the Authority evidencing the Series A Loan; Sample 2.

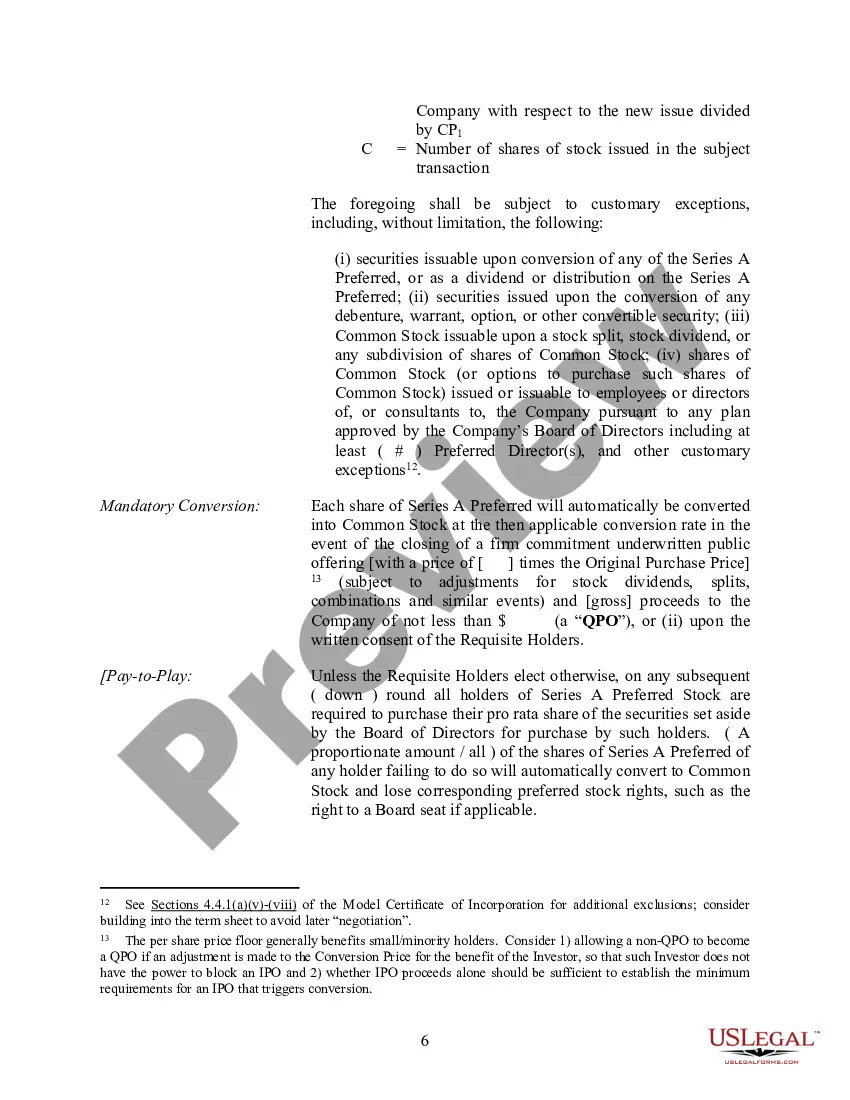

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

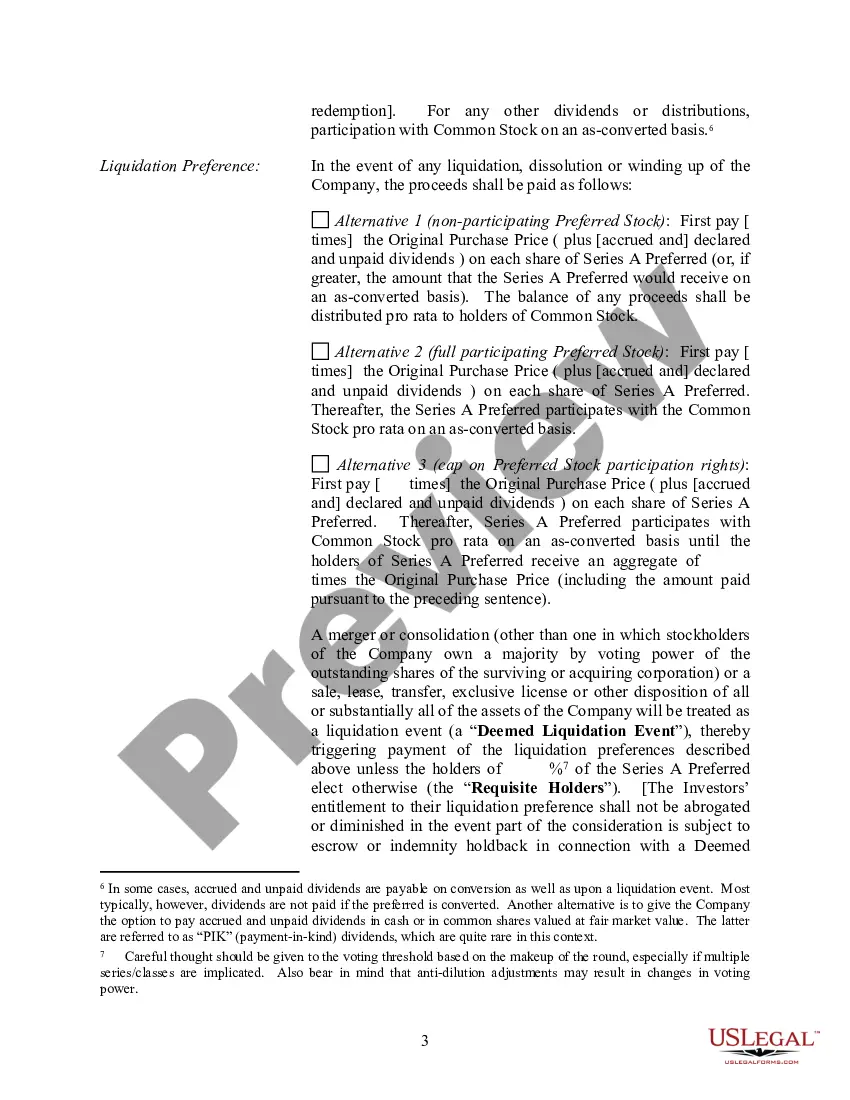

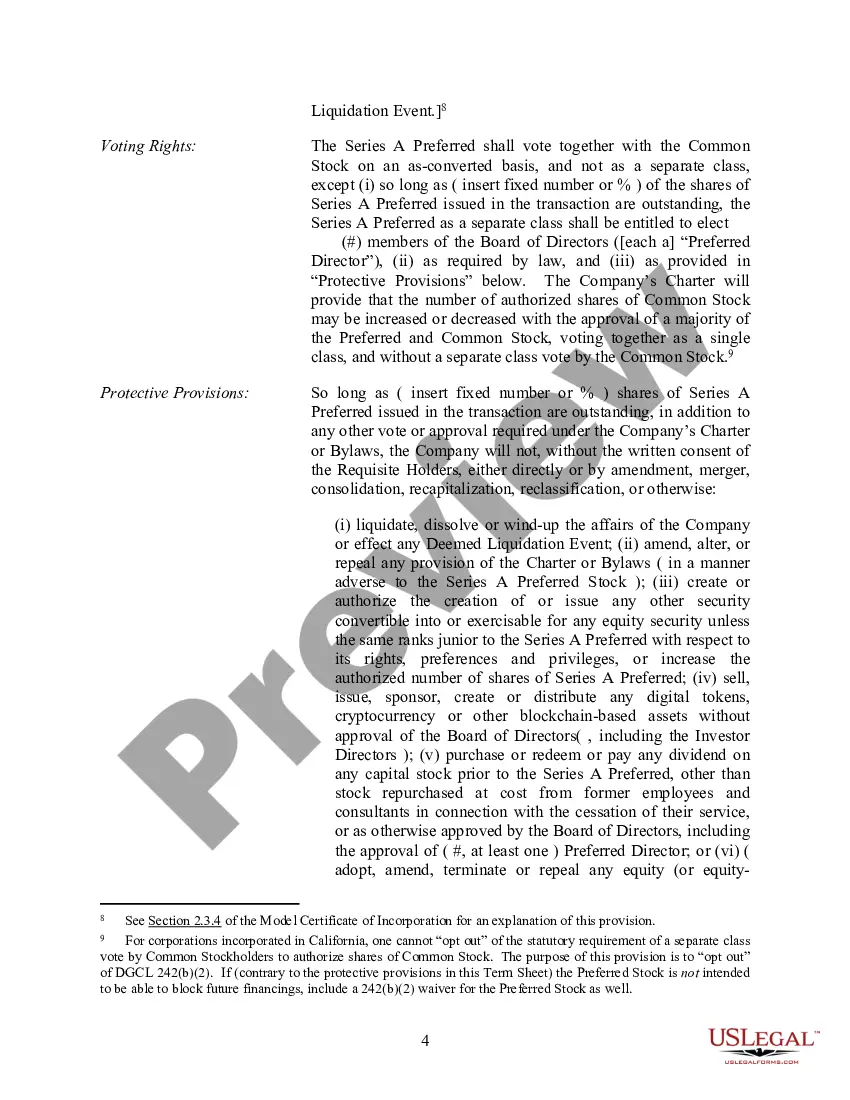

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

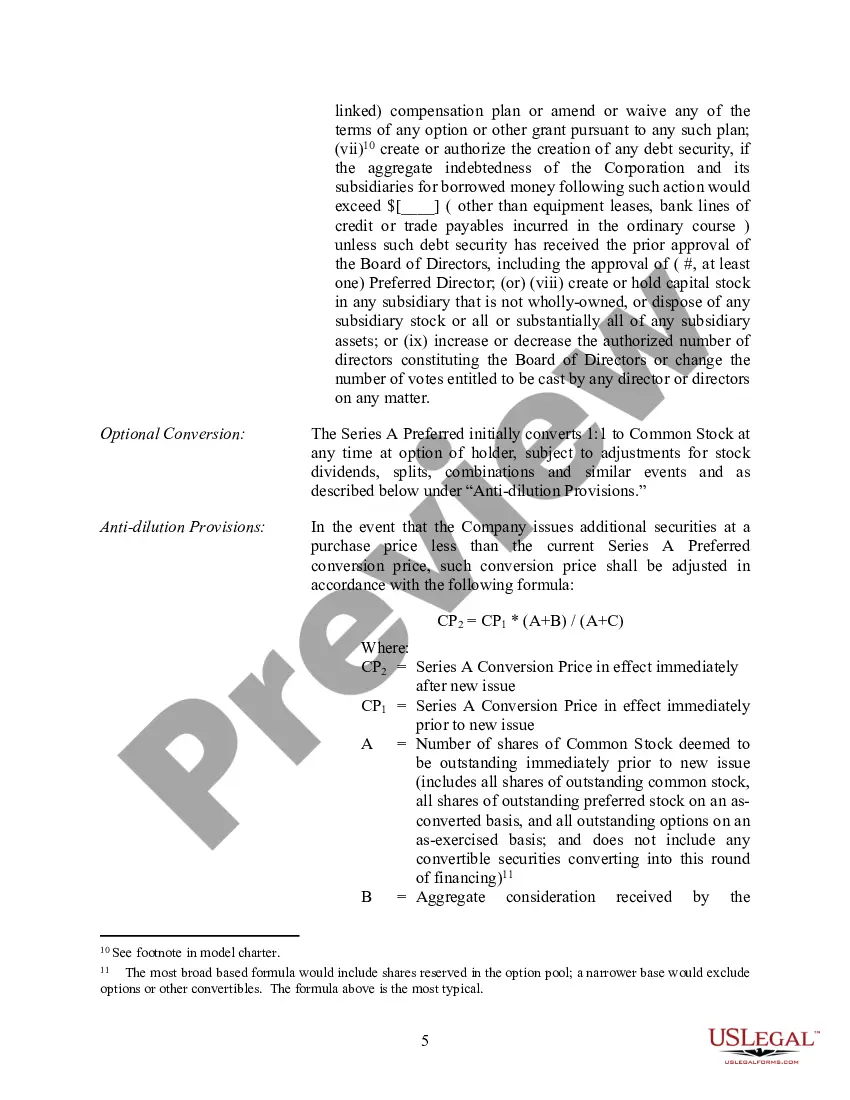

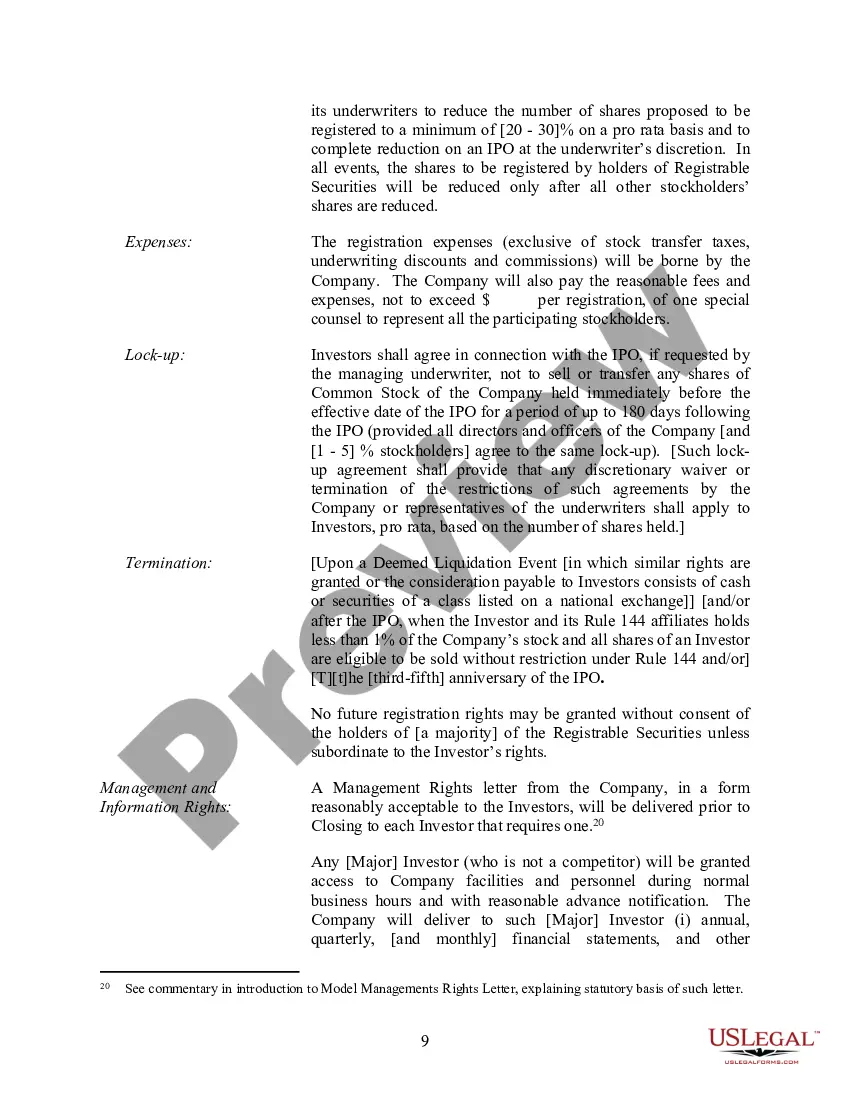

A Series A term sheet is a basic agreement that outlines all the terms and conditions of the investment. Term sheets usually focus on two key areas; control of company shares and how financials will be divided if an exit occurs.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with startups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

The company valuation, investment amount, percentage stake, voting rights, liquidation preference, anti-dilutive provisions, and investor commitment are some items that should be spelled out in the term sheet.

A term sheet is an important document that is part of a tentative business deal. It is a summary of the terms and conditions of the tentative agreement. It is generally formatted as bullet points. It should be as detailed as possible so that the parties involved understand the information and are on the same page.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

Series A startups are those that have the very beginnings of a business with a customer base, proof of concept, etc. Series B funding is typically for startups that are looking to increase production or sales.