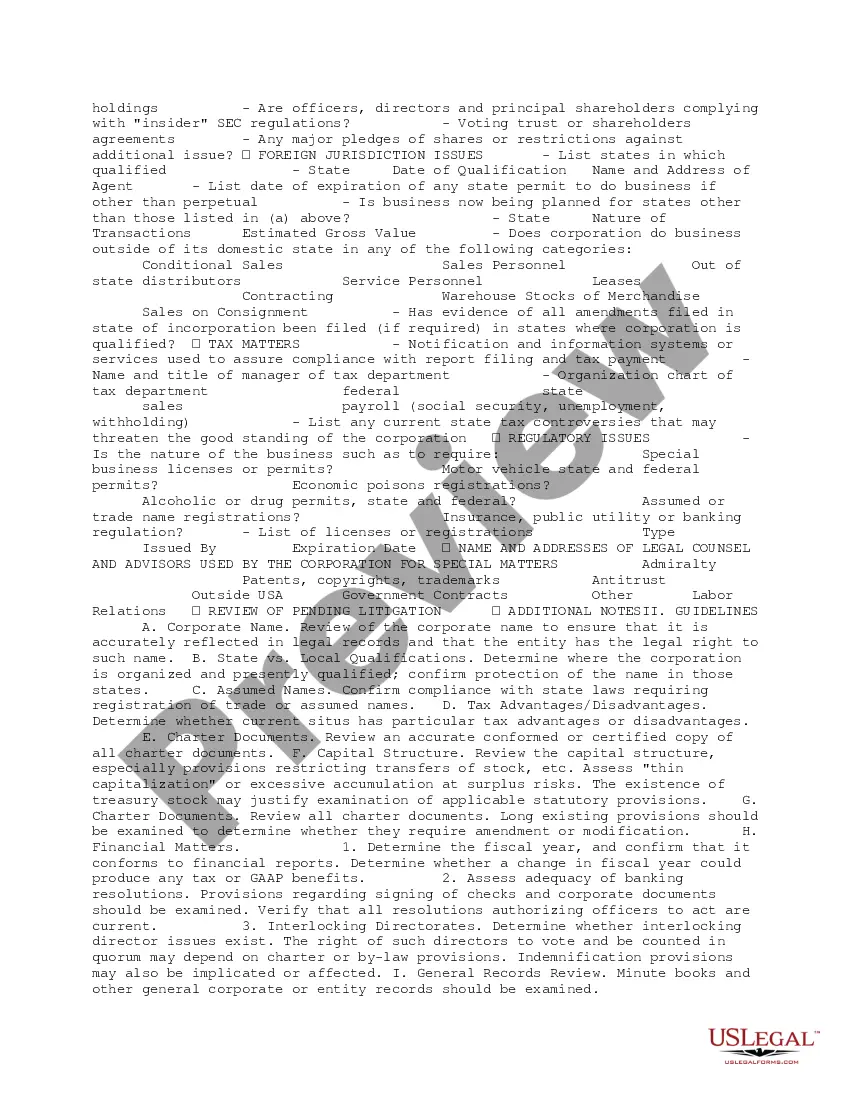

This due diligence checklist identifies the guidelines and general overview of a corporation by providing information and supportive materials regarding business transactions.

Orange California Short Form Checklist and Guidelines for Basic Corporate Entity Overview

Description

How to fill out Orange California Short Form Checklist And Guidelines For Basic Corporate Entity Overview?

Do you need to quickly draft a legally-binding Orange Short Form Checklist and Guidelines for Basic Corporate Entity Overview or probably any other document to take control of your personal or corporate affairs? You can select one of the two options: contact a legal advisor to draft a valid paper for you or draft it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific document templates, including Orange Short Form Checklist and Guidelines for Basic Corporate Entity Overview and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, double-check if the Orange Short Form Checklist and Guidelines for Basic Corporate Entity Overview is adapted to your state's or county's regulations.

- In case the document has a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Orange Short Form Checklist and Guidelines for Basic Corporate Entity Overview template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Moreover, the documents we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Starting an LLC in California is Easy. To start a California LLC you'll need to file your Articles of Organization with the California Secretary of State, which costs $70 online. You can apply online, in person, or by mail or fax.

Newly Incorporated or Qualified Corporations Your first tax year is not subject to the minimum franchise tax. After the first year, your tax is the larger of your California net income multiplied by the appropriate tax rate or the minimum franchise tax.

Checking an LLC status in California is easier when you use the business entities page on the secretary of state's website. This page includes functionality for a free business search, which can be conducted online and allows you to find information for any limited liability company (LLC) registered in California.

To form an LLC in California, go to bizfileOnline.sos.ca.gov, log in, select Register a Business under the Business Entities Tile, Articles of Organization - CA LLC and follow the prompts to complete and submit.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

You can form an LLC in California in 3-5 days if you file online (or 2-3 weeks if you file by mail).

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

LLC fee If the total California income rounded to the nearest whole dollar is:The fee amount is:$250,000 - $499,999$900$500,000 - $999,999$2,500$1,000,000 - $4,999,999$6,000$5,000,000 or more$11,790

Registering Your Business LLCs, Corporations, LPs, LLPs, or GPs operating in California need to register and form their legal entity with the California Secretary of State's Office, file appropriate taxes, register as an employer, and obtain business licenses and other permits from appropriate cities or counties.

To form an LLC in California, go to bizfileOnline.sos.ca.gov, log in, select Register a Business under the Business Entities Tile, Articles of Organization - CA LLC and follow the prompts to complete and submit.