Maricopa Arizona Notice of Violation of Fair Debt Act - False Information Disclosed

Description

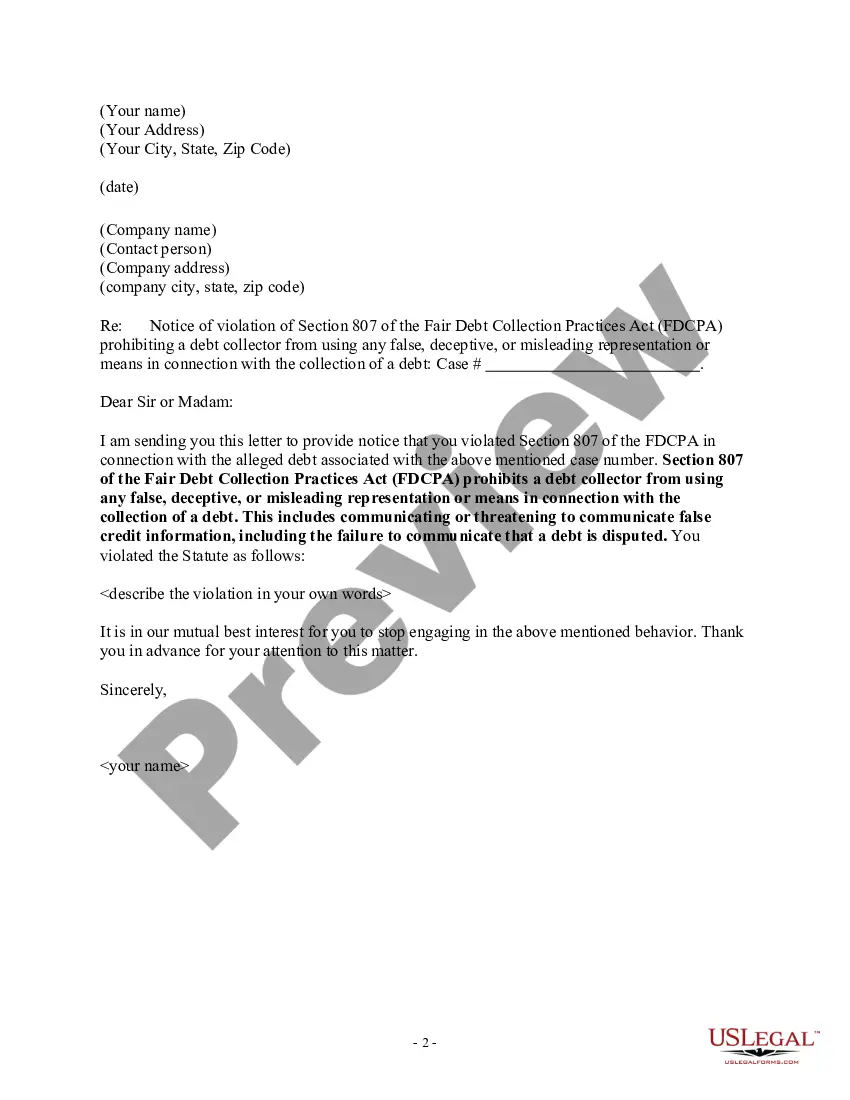

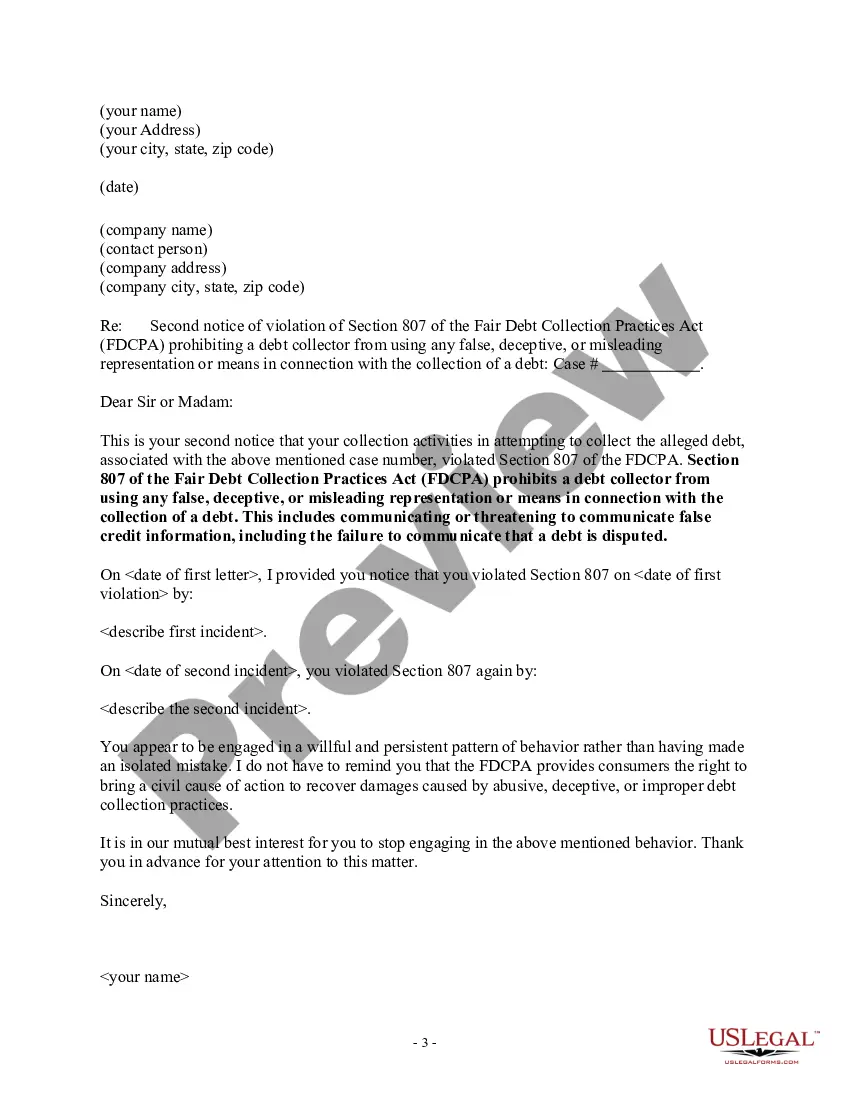

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

Do you require to swiftly generate a legally-enforceable Maricopa Notice of Violation of Fair Debt Act - Misleading Information Disclosed or perhaps any other document to manage your personal or business matters.

You have two choices: reach out to an expert to prepare a legitimate document for you or draft it entirely by yourself.

Initially, meticulously confirm whether the Maricopa Notice of Violation of Fair Debt Act - Misleading Information Disclosed aligns with your state's or county's regulations.

If the document includes a description, make sure to verify for what it is appropriate.

- Fortunately, there's a different option - US Legal Forms.

- It will assist you in obtaining professionally crafted legal documentation without incurring exorbitant costs for legal services.

- US Legal Forms provides an extensive assortment of over 85,000 state-compliant form templates, encompassing Maricopa Notice of Violation of Fair Debt Act - Misleading Information Disclosed and form bundles.

- We supply templates for various use cases: from separation documents to property agreements.

- Having been in operation for over 25 years, we've established an impeccable reputation among our patrons.

- Here's how you can join them and acquire the required template without unnecessary difficulties.

Form popularity

FAQ

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Legal rights when dealing with debt collectors Under the Australian Consumer Law, a debt collector must not: use physical force or coercion (forcing or compelling you to do something) harass or hassle you to an unreasonable extent. mislead or deceive you (or try to do so)

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.