A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Travis Texas Notice to Debt Collector - Falsely Representing a Document's Authority

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

Laws and statutes in various sectors differ across the nation.

If you aren't an attorney, it's simple to become confused amid numerous standards concerning the creation of legal documents.

To prevent expensive legal help when drafting the Travis Notice to Debt Collector - Falsely Representing a Document's Authority, you require a validated template suitable for your jurisdiction.

Search for another document if there are discrepancies with any of your needs. Utilize the Buy Now button to acquire the document once you've identified the right one. Choose one of the subscription plans and log in or create an account. Select how you wish to pay for your subscription (via credit card or PayPal). Choose the format you wish to save the file in and click Download. Fill out and sign the document on paper after printing it, or complete it electronically. This is the easiest and most cost-effective method to access current templates for any legal situations. Find them all in just a few clicks and keep your documentation orderly with US Legal Forms!

- That's when the US Legal Forms platform becomes extremely beneficial.

- US Legal Forms is relied upon by millions as an online repository of over 85,000 state-specific legal documents.

- It's an ideal answer for professionals and individuals looking for do-it-yourself templates for various personal and business situations.

- All forms can be reused: once you acquire a sample, it stays in your profile for future use.

- Hence, if you possess an account with an active subscription, you can easily Log In and re-download the Travis Notice to Debt Collector - Falsely Representing a Document's Authority from the My documents section.

- For newcomers, a few additional steps are necessary to obtain the Travis Notice to Debt Collector - Falsely Representing a Document's Authority.

- Review the page content to ensure you have located the correct sample.

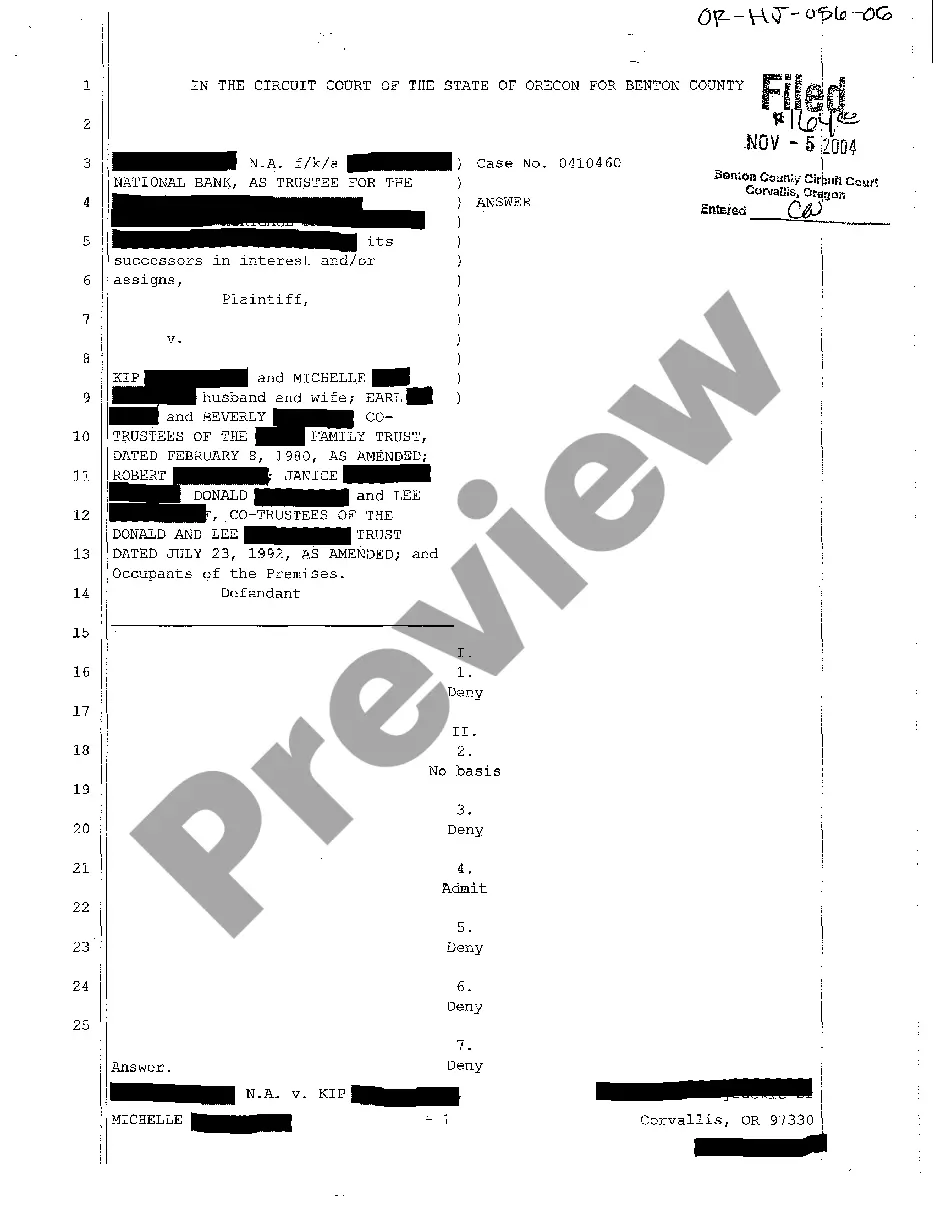

- Use the Preview feature or read the form description if available.

Form popularity

FAQ

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

State Debt Recovery Act 2018 No 11 - NSW Legislation.

Unfair Practices Collect any interest, fee, charge or expense incidental to the principal obligation unless it was authorized by the original debt agreement or is otherwise permitted by law.

Legal rights when dealing with debt collectors Under the Australian Consumer Law, a debt collector must not: use physical force or coercion (forcing or compelling you to do something) harass or hassle you to an unreasonable extent. mislead or deceive you (or try to do so)

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

The Australian Collectors & Debt Buyers Association Code of Practice (Code) is the industry code of the Australian Collectors & Debt Buyers Association (ACDBA). Compliance with this Code is a compulsory obligation for ACDBA members.

Here are a few suggestions that might work in your favor: Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.