A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Franklin Ohio Notice to Debt Collector - Falsely Representing a Document's Authority

Description

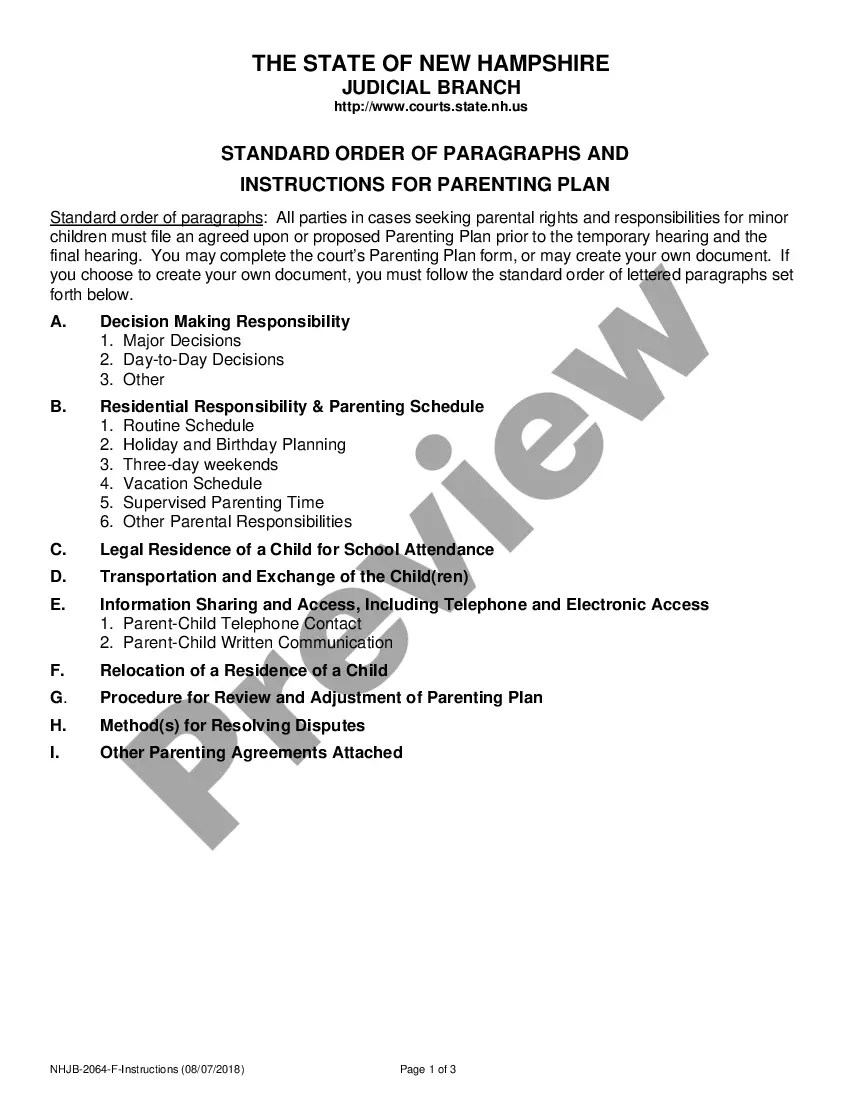

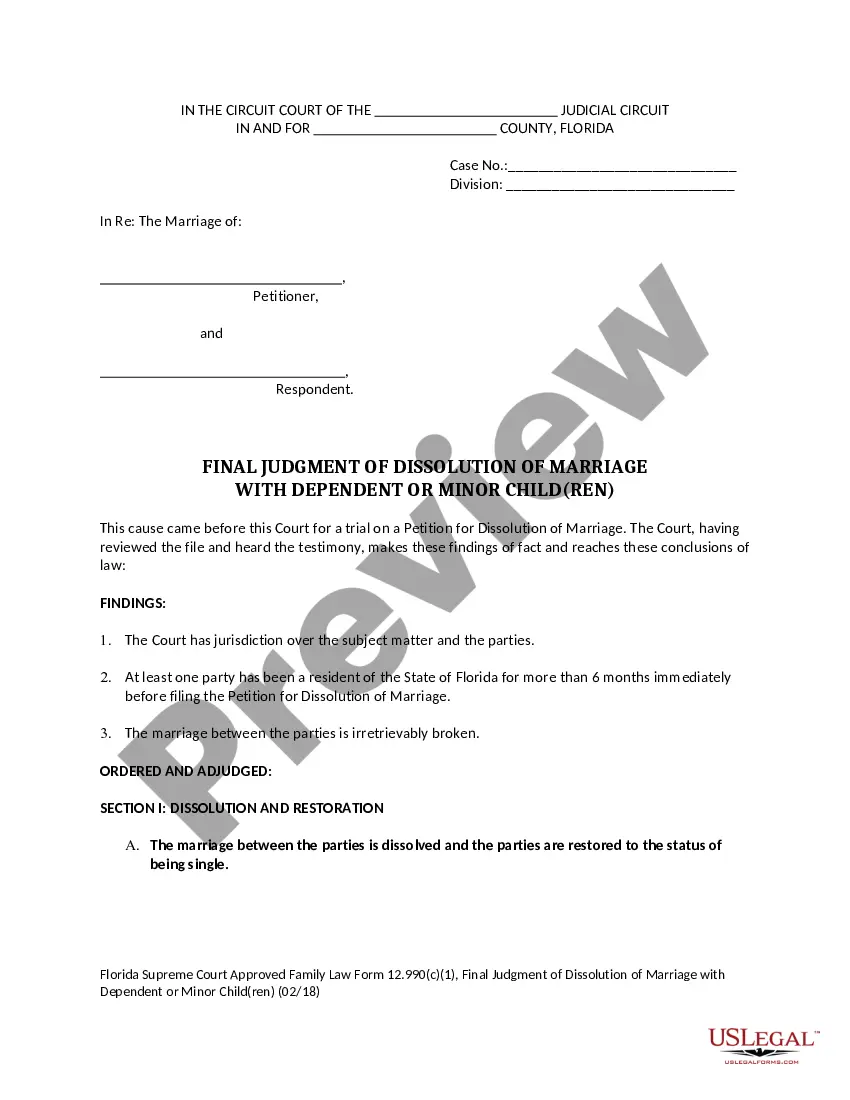

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

A document process always accompanies any legal action you undertake. Establishing a business, submitting or accepting a job proposal, transferring ownership, and numerous other life situations require you to prepare formal paperwork that differs across the nation. This is why having it all consolidated in one location is so advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal templates. Here, you can readily find and download a document for any personal or business purpose relevant to your area, including the Franklin Notice to Debt Collector - Falsely Representing a Document's Authority.

Finding templates on the site is exceptionally simple. If you already hold a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it on your device. Subsequently, the Franklin Notice to Debt Collector - Falsely Representing a Document's Authority will be accessible for additional use in the My documents section of your profile.

If you are accessing US Legal Forms for the first time, follow this straightforward guideline to acquire the Franklin Notice to Debt Collector - Falsely Representing a Document's Authority: Ensure you are on the correct page containing your localized form. Use the Preview mode (if available) and scroll through the template. Review the description (if any) to confirm that the template fits your needs. Search for another document using the search function if the sample is not suitable. Click Buy Now once you identify the required template. Choose the appropriate subscription plan, then sign in or create an account. Select the preferred payment method (with credit card or PayPal) to proceed. Choose the file format and download the Franklin Notice to Debt Collector - Falsely Representing a Document's Authority on your device. Utilize it as needed: print it or fill it out electronically, sign it, and submit where necessary.

- This is the easiest and most reliable method to obtain legal documents.

- All templates present in our library are professionally crafted and validated for compliance with local laws and regulations.

- Prepare your documentation and manage your legal matters effectively with US Legal Forms!

Form popularity

FAQ

Legal rights when dealing with debt collectors Under the Australian Consumer Law, a debt collector must not: use physical force or coercion (forcing or compelling you to do something) harass or hassle you to an unreasonable extent. mislead or deceive you (or try to do so)

By law, a debt collector is not allowed to threaten or use physical force of any kind towards you, any member of your family or a third party connected to you to try and collect your debt. They can, however, contact a family member, friend of third party to obtain location information on you.

Plan and modify arrangements with them and the creditor. Organise a settlement offer with you that may make it easier to pay off the debt. Sell your debt to another company who will have the same arrangements and powers as the original creditor. Obtain an order from a court to repossess some of your property.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Creditor harassment is any type of unsolicited and repeated contact from the creditor or a debt collection agency that disturbs you, frightens you, or makes you feel threatened.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

State Debt Recovery Act 2018 No 11 - NSW Legislation.

Here are a few suggestions that might work in your favor: Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing.Dispute the debt on your credit report.Lodge a complaint.Respond to a lawsuit.Hire an attorney.