Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes placing telephone calls without meaningful disclosure of the caller's identity.

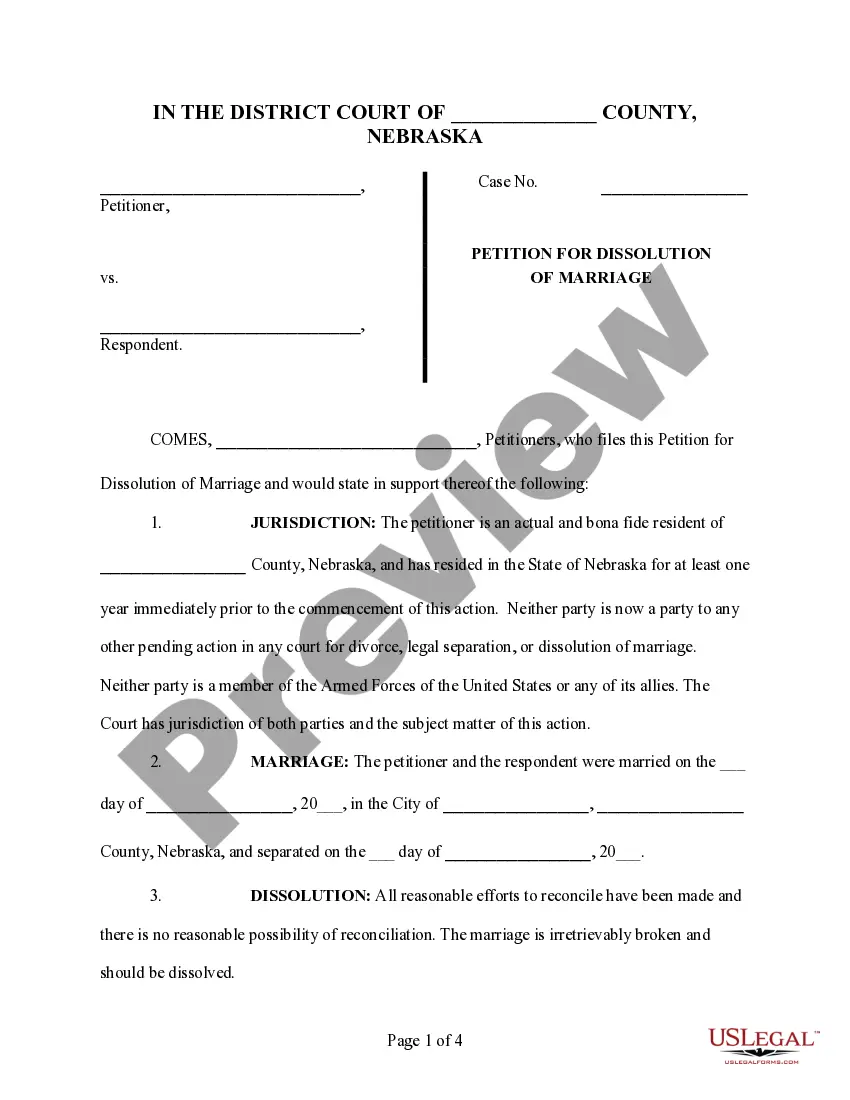

Bexar Texas Notice to Debt Collector - Not Disclosing the Caller's Identity

Description

How to fill out Notice To Debt Collector - Not Disclosing The Caller's Identity?

Composing documents for corporate or individual purposes is always a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it is crucial to consider all federal and state regulations pertinent to the particular area.

Nonetheless, small counties and even municipalities also have legislative processes that you must take into account.

To locate the one that fits your requirements, use the search tab in the page header.

- All these elements make it stressful and labor-intensive to prepare Bexar Notice to Debt Collector - Not Disclosing the Caller's Identity without professional assistance.

- It is feasible to sidestep incurring costs for attorneys crafting your documents and produce a legally acceptable Bexar Notice to Debt Collector - Not Disclosing the Caller's Identity independently, utilizing the US Legal Forms online library.

- It is the leading online directory of state-specific legal templates that are thoroughly validated, ensuring their legitimacy when choosing a template for your county.

- Previously subscribed users just need to Log In to their accounts to retrieve the necessary form.

- If you do not have a subscription yet, follow the step-by-step guide below to obtain the Bexar Notice to Debt Collector - Not Disclosing the Caller's Identity.

- Browse the page you have opened and confirm if it contains the document you require.

- To do this, utilize the form description and preview if these features are present.

Form popularity

FAQ

Since it's not illegal, collectors do it sometimes because it's more scary to get a call from a blocked number. Also, since the number doesn't show up on caller ID, it's harder to block.

While these procedures may vary by company and whether the call is inbound or outbound, there is a common thread: generally debt collectors ask the consumer to verify some piece of personal information, such as the last four digits of the consumer's social security number or the consumer's birth date, to ensure they

Creditor harassment is any type of unsolicited and repeated contact from the creditor or a debt collection agency that disturbs you, frightens you, or makes you feel threatened.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

They are not required to reveal their name, but they must convey the name of the agency they are representing. Most importantly, they cannot use a number that would misrepresent them as someone calling from a law firm or any official government agency. Respond to debt collectors fast with SoloSuit.

You are not required to give out your personal information to anyone. You will always want to take steps to make sure you are not giving out your personal information to debt collection or identity theft scammers. Generally, legitimate debt collectors will ask questions to verify your identity.

The Fair Debt Collection Practices Act (FDCPA) prohibits debt collectors from placing repeated or continuous telephone calls or conversations to you with the intent to harass, oppress, or abuse you.

6 YEAR LIMITATION PERIOD For most debts, a creditor must begin court action to recover the debt within 6 years of the date: that you last made a payment; or. that you admitted in writing that you owed the debt.

Fortunately, there are legal actions you can take to stop this harassment: Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).