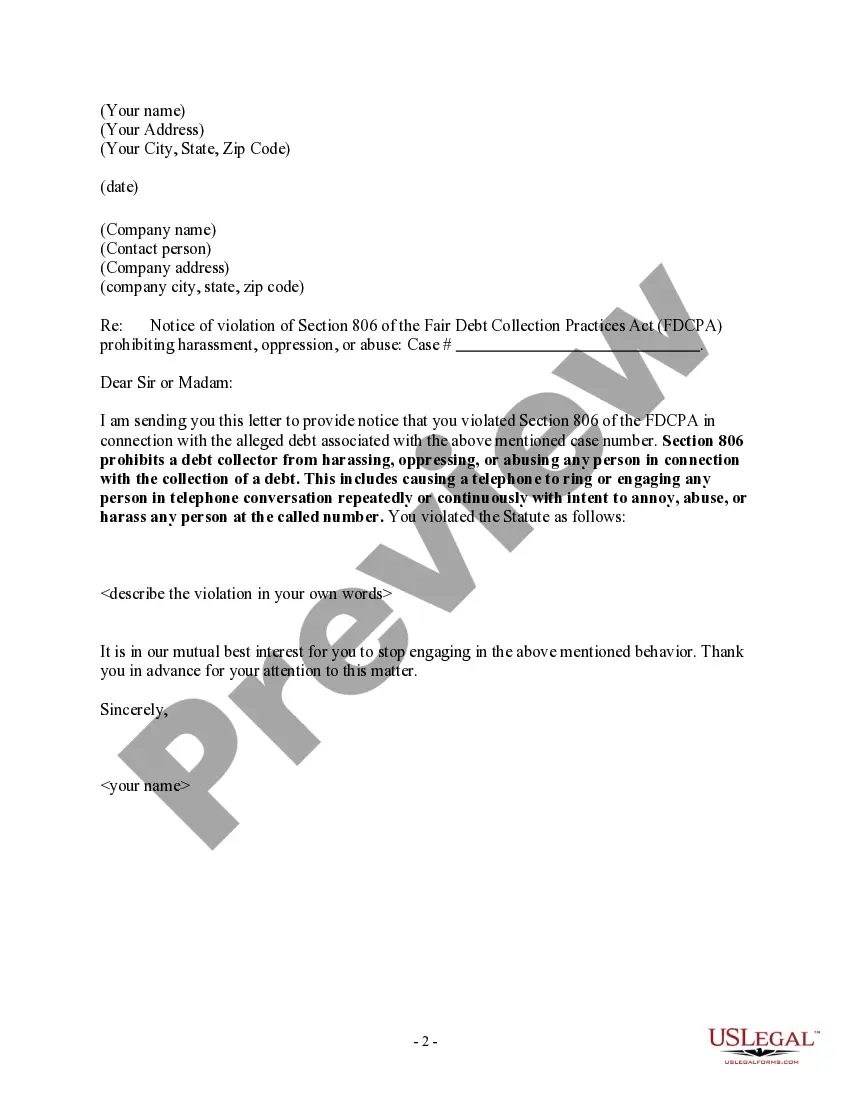

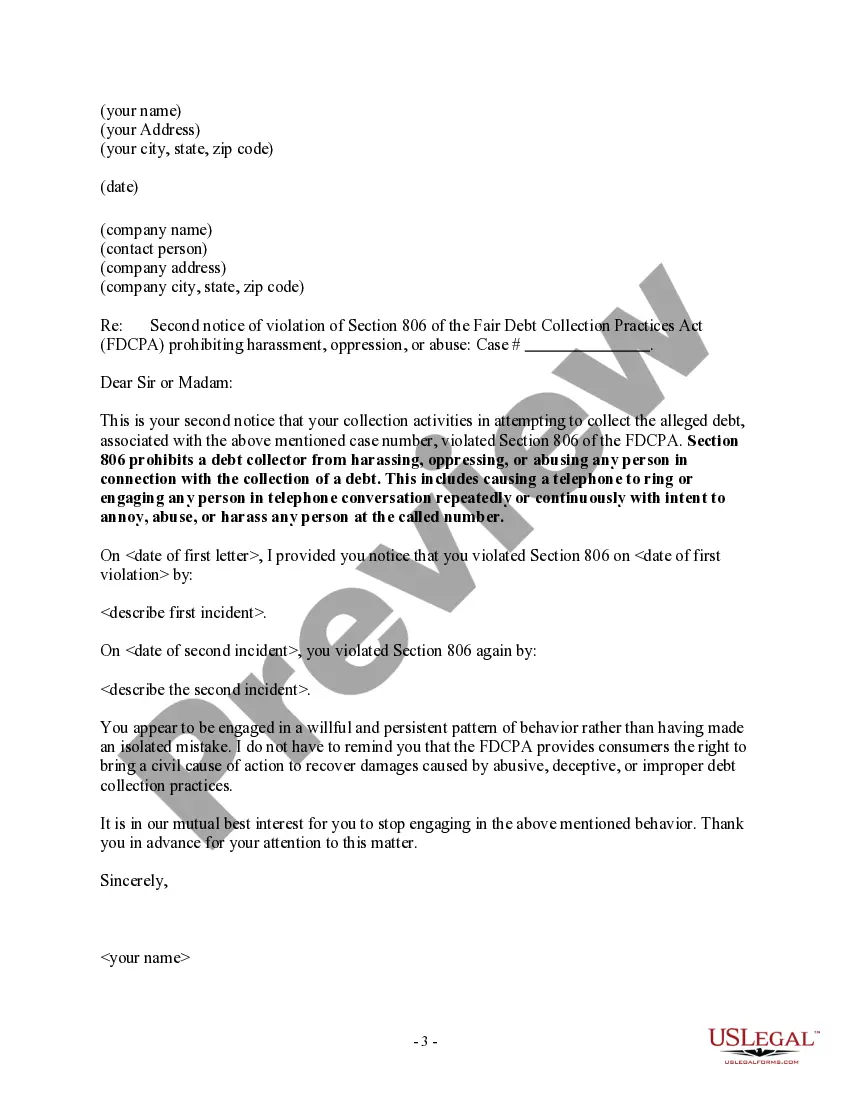

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

Fulton Georgia Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls

Description

How to fill out Notice To Debt Collector - Unlawful Repeated Or Continuous Telephone Calls?

Laws and statutes across different areas differ from region to region.

If you’re not a lawyer, it’s straightforward to become confused with different standards regarding the creation of legal paperwork.

To prevent costly legal help when drafting the Fulton Notice to Debt Collector - Unlawful Repeated or Continuous Phone Calls, you require a validated template applicable to your jurisdiction.

Select one of the subscription options and log in or register for an account. Choose your preferred method to pay for your subscription (via credit card or PayPal). Opt for the file format you wish to save the document in and click Download. Complete and sign the document on paper after printing it or do everything electronically. This is the easiest and most cost-effective method to obtain current templates for any legal needs. Access all of them in just a few clicks and keep your documentation organized with US Legal Forms!

- That's where the US Legal Forms platform proves advantageous.

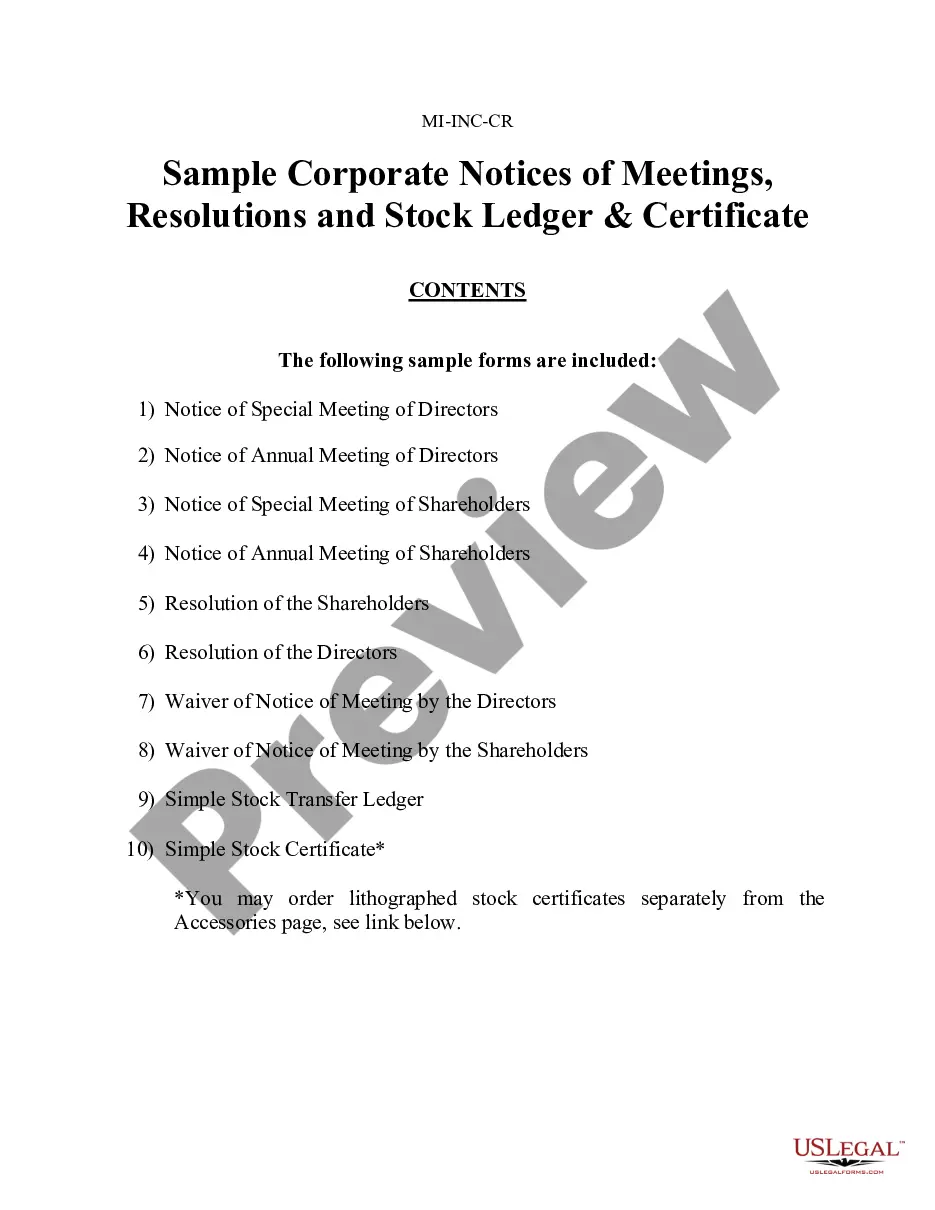

- US Legal Forms is a reliable online repository utilized by millions, containing over 85,000 state-specific legal documents.

- It serves as an excellent resource for individuals and professionals seeking DIY templates for a variety of personal and business situations.

- All forms can be reused: upon selecting a sample, it remains available in your account for later access.

- Hence, if you possess an account with an active subscription, you can conveniently Log In and re-download the Fulton Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls from the My documents section.

- For newcomers, a few additional steps are required to acquire the Fulton Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls.

- Review the web content to confirm that you've located the suitable sample.

- Utilize the Preview feature or read the form description if it is provided.

- Search for an alternative document if there are any discrepancies with your requirements.

- Employ the Buy Now button to purchase the template once you identify the appropriate one.

Form popularity

FAQ

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

Debt collectors cannot call you at unusual or inconvenient times or places. Generally, they may call between 8 a.m. and 9 p.m., but you may ask them to call at other times if those hours are inconvenient for you.

Nevertheless, creditors may not call you more than 7 times within 7 consecutive days or call you within 7 days of talking to you about the debt. If your creditor calls you multiple times a day or continues calling even after you answer the phone and speak with them, you are likely facing creditor harassment.

According to the FDCPA, a debt collector cannot call a debtor more than once per day for each debt. This means that if you only have one outstanding debt, then your debt collector is only allowed to call you one time per day.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

If you continue to ignore communicating with the debt collector, they will likely file a collections lawsuit against you in court. If you are served with a lawsuit and ignore this court filing, the debt collection company will then be able to get a default judgment against you.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.