Pima Arizona Notice to Debt Collector - Unlawful Messages to 3rd Parties

Description

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes leaving telephone messages with neighbors or other 3rd parties when the debt collector knows the consumer's name and telephone number and could have contacted the consumer directly.

How to fill out Notice To Debt Collector - Unlawful Messages To 3rd Parties?

A document procedure consistently accompanies any legal action you undertake.

Launching a business, applying for or accepting a job proposition, transferring ownership, and numerous other life circumstances necessitate you to organize formal paperwork that varies across the nation. That is the reason having everything gathered in one location is immensely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

On this site, you can effortlessly locate and acquire a document for any individual or business purpose used in your area, including the Pima Notice to Debt Collector - Unlawful Messages to 3rd Parties.

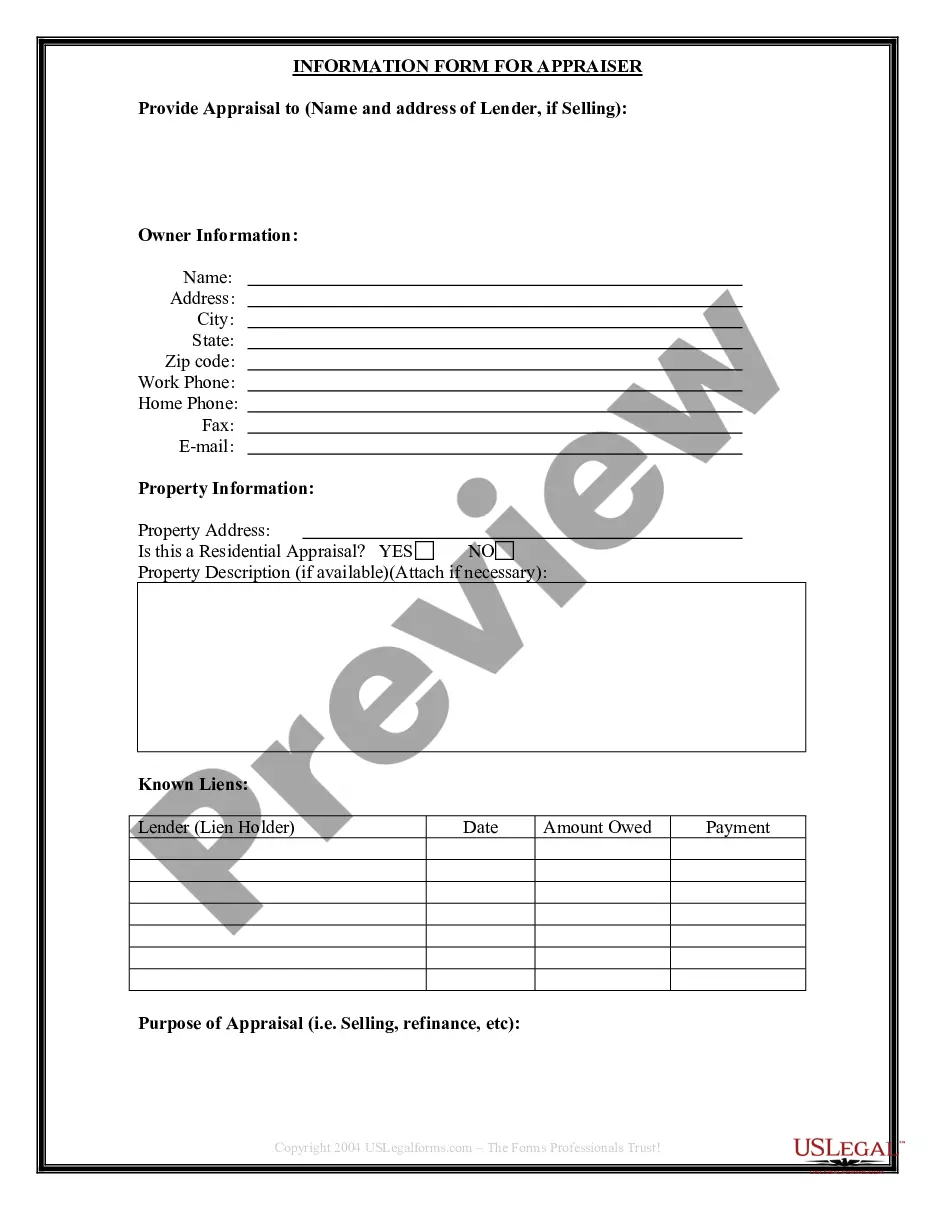

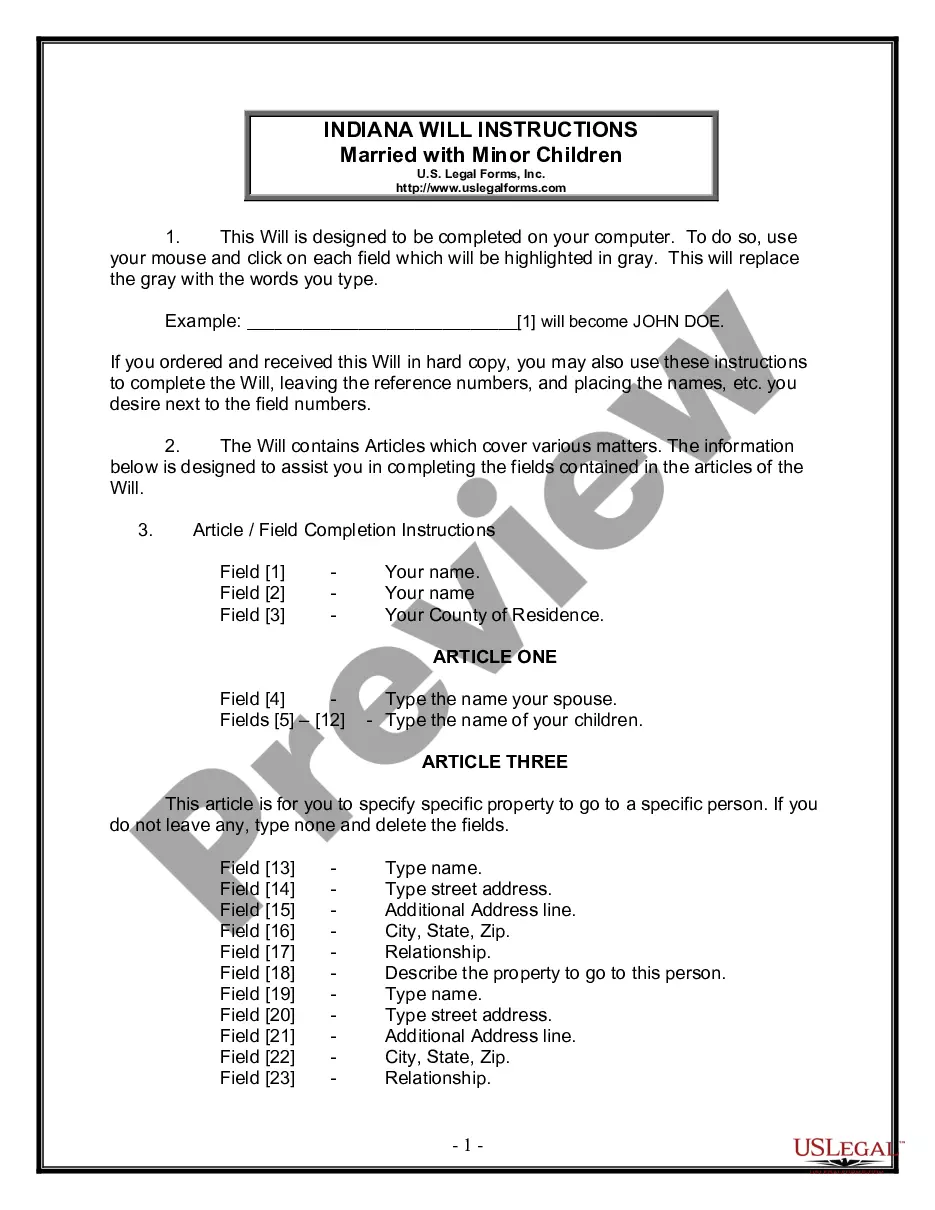

Read the description (if available) to confirm the template meets your needs. Search for another document using the search option if the sample does not suit you. Click Buy Now once you identify the required template. Select the appropriate subscription plan, then Log In or register for an account. Choose the preferred payment method (with credit card or PayPal) to continue. Opt for file format and save the Pima Notice to Debt Collector - Unlawful Messages to 3rd Parties to your device. Utilize it as needed: print it or fill it out electronically, sign it, and submit where necessary. This is the easiest and most dependable approach to acquiring legal documents. All templates offered by our library are professionally composed and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters effectively with US Legal Forms!

- Finding templates on the site is remarkably simple.

- If you already possess a membership to our library, Log In to your account, locate the sample via the search bar, and click Download to store it on your device.

- Subsequently, the Pima Notice to Debt Collector - Unlawful Messages to 3rd Parties will be available for further use in the My documents section of your profile.

- If you are using US Legal Forms for the first time, follow this straightforward guide to obtain the Pima Notice to Debt Collector - Unlawful Messages to 3rd Parties.

- Ensure you are on the correct page with your local form.

- Utilize the Preview mode (if offered) and review the template.

Form popularity

FAQ

State Debt Recovery Act 2018 No 11 - NSW Legislation.

"Collection agency" is another term used to describe third-party debt collectors. These agencies are companies that specialize in recovering unpaid debt in collections. Creditors usually offload collection efforts onto agencies after unsuccessfully trying to get debt payments themselves.

If the debt collector knows an attorney is representing you about the debt, the debt collector must contact the attorney instead of you. The debt collector may contact you if your attorney fails to respond to the collector within a reasonable period of time or your attorney agrees that the collector can contact you.

In addi tion, a debt collector who is unable to locate a consumer may ask a third party for the consumer's home address, telephone number, and place of employment (location information).

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

The Australian Collectors & Debt Buyers Association Code of Practice (Code) is the industry code of the Australian Collectors & Debt Buyers Association (ACDBA). Compliance with this Code is a compulsory obligation for ACDBA members.

The FDCPA does not permit debt collectors to disclose your personal information to any third party. This means that if your voicemail is shared with your family or roommates or if it is monitored by your employer, debt collectors are not allowed to leave a message. Messages can only be left on private voicemail.

Communicating with Third Parties The only third parties that a debt collector may contact when trying to collect a debt are: 2022 The consumer. The consumer's attorney. A consumer reporting agency (if permitted by local law).

Debt collectors are allowed to contact third parties to obtain or confirm location information, but the FDCPA does not allow debt collectors to leave messages with third parties. Location information is defined as a consumer's home address and home phone number or workplace and workplace address.