Drafting legal documents is essential in the current environment.

However, it isn’t always necessary to seek expert assistance to develop some of them from the ground up, such as the Chicago Second Notice to Debt Collector of False or Deceptive Misrepresentations in Collection Efforts - Failure to Inform Debtor in Subsequent Correspondence that the Request for Information Concerning Alleged Debt was from a Debt Collector, using a service like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from in various categories, ranging from living wills to real estate contracts to divorce papers. All documents are categorized according to their legal state, simplifying the search process.

If you are already a member of US Legal Forms, you can locate the necessary Chicago Second Notice to Debt Collector of False or Deceptive Misrepresentations in Collection Efforts - Failure to Inform Debtor in Subsequent Correspondence that the Request for Information Concerning Alleged Debt was from a Debt Collector, Log In to your account, and download it.

It should be noted that our platform cannot fully replace a legal expert. If you are facing a particularly complex situation, we recommend utilizing the services of an attorney to review your document prior to execution and submission. With over 25 years in the industry, US Legal Forms has established itself as a trusted source for various legal documents for millions of clients. Join them today and easily obtain your state-specific forms!

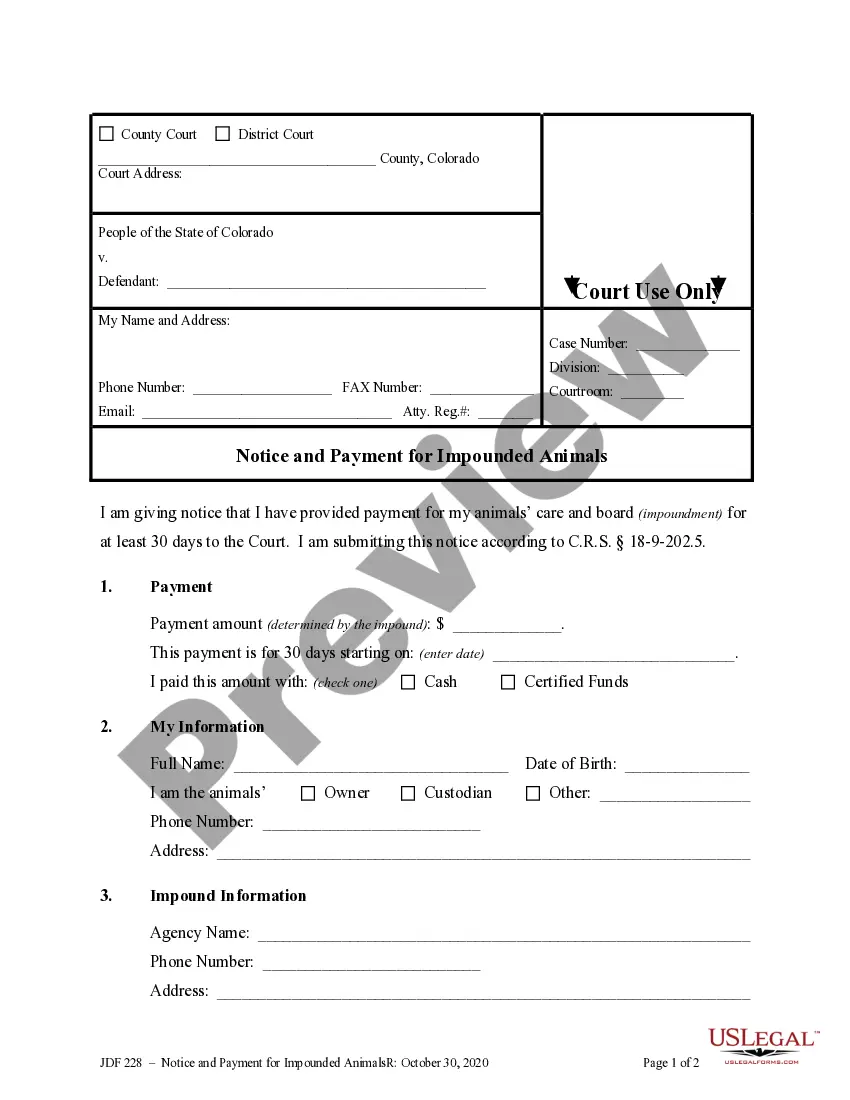

- Review the document's preview and outline (if available) to gain a general understanding of what you will receive after obtaining the document.

- Confirm that the template you select is tailored to your state/county/region as state laws can influence the legality of certain documents.

- Examine similar forms or restart the search to find the suitable file.

- Click Buy now and create your account. If you already possess an account, choose to Log In.

- Select the option, then the required payment method, and purchase the Chicago Second Notice to Debt Collector of False or Deceptive Misrepresentations in Collection Efforts - Failure to Inform Debtor in Subsequent Correspondence that the Request for Information Concerning Alleged Debt was from a Debt Collector.

- Decide to save the form template in any available file format.

- Navigate to the My documents tab to re-download the file.