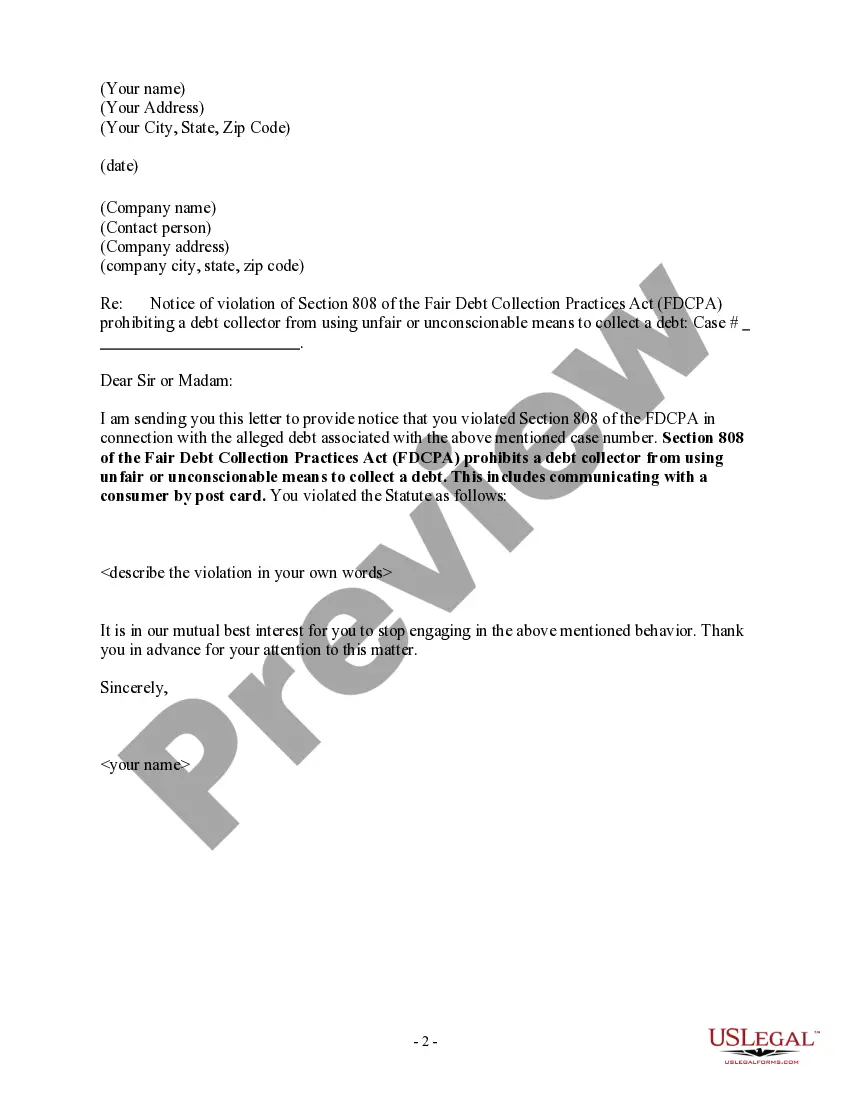

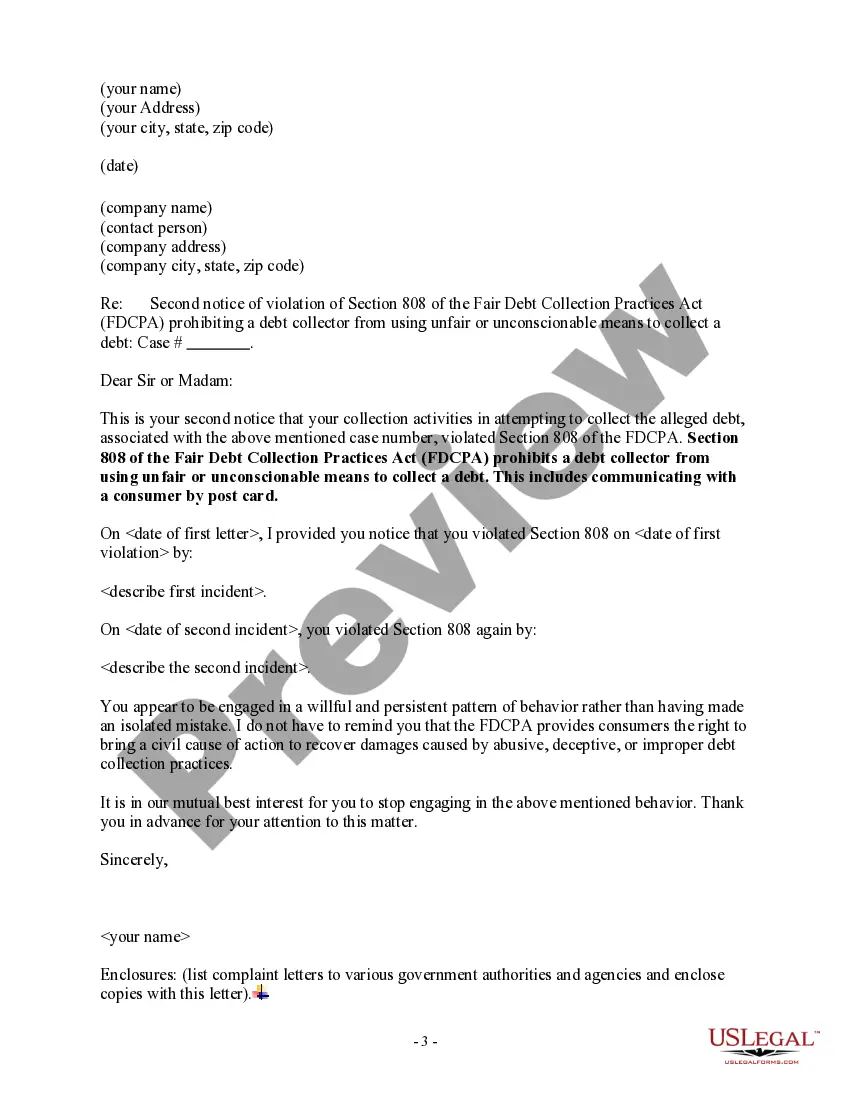

Franklin Ohio Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

A documentation routine consistently accompanies any legal activity you engage in.

Establishing a business, applying for or accepting a job offer, shifting ownership, and numerous other life situations necessitate that you prepare official paperwork that varies from state to state. Thus, having everything consolidated in one place is extremely beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal forms. Here, you can effortlessly find and obtain a document for any personal or professional purpose used in your county, including the Franklin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Finding templates on the platform is incredibly easy. If you already have a subscription to our library, Log In to your account, search for the sample in the search field, and click Download to save it to your device. Subsequently, the Franklin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard will be accessible for further use in the My documents section of your profile.

Utilize it as needed: print it or complete it electronically, sign it, and transmit it where required. This is the simplest and most dependable method to acquire legal documents. All the templates in our library are professionally crafted and authenticated for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Ensure you have accessed the correct page containing your localized form.

- Use the Preview mode (if available) to peruse the sample.

- Review the description (if available) to confirm the form meets your needs.

- Look for another document using the search tab if the sample doesn't suit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then Log In or create an account.

- Opt for your preferred payment method (either credit card or PayPal) to proceed.

- Choose the file format and save the Franklin Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard to your device.

Form popularity

FAQ

By law, a debt collector is not allowed to threaten or use physical force of any kind towards you, any member of your family or a third party connected to you to try and collect your debt. They can, however, contact a family member, friend of third party to obtain location information on you.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

6 YEAR LIMITATION PERIOD For most debts, a creditor must begin court action to recover the debt within 6 years of the date: that you last made a payment; or. that you admitted in writing that you owed the debt.

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Can you go to jail for not paying debt in South Africa? The kind of loan that you owe determines if you will go to jail for not paying it or not. If you refuse to pay your taxes or child support, for instance, you might be sent to jail.

A debt collector may contact you in person, or by mail, telephone, telegram, or fax. A debt collector may NOT contact you by postcard. These days, most debt collection contacts occur by telephone.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

What are the provisions of the FDCPA? Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.