Franklin Ohio Changing state of incorporation

Description

How to fill out Changing State Of Incorporation?

A document process invariably accompanies any legal undertaking you engage in.

Launching a business, applying for or accepting a job offer, transferring ownership, and numerous other life circumstances require you to prepare official documentation that varies by state.

This is why having everything consolidated in one location is extremely beneficial.

US Legal Forms represents the largest online repository of current federal and state-specific legal documents.

Utilize it as necessary: print, fill it out electronically, sign it, and submit it where required. This is the most efficient and reliable method to acquire legal documents. All templates available in our library are expertly drafted and verified for compliance with local laws and regulations. Organize your documentation and manage your legal responsibilities effectively with US Legal Forms!

- On this site, you can effortlessly locate and download a document for any personal or business purpose relevant to your area, including the Franklin Changing state of incorporation.

- Finding forms on the website is exceptionally straightforward.

- If you currently have a subscription to our library, Log In to your account, locate the form using the search field, and click Download to store it on your device.

- Subsequently, the Franklin Changing state of incorporation will be accessible for additional use in the My documents section of your profile.

- If you are interacting with US Legal Forms for the first time, follow this brief guide to obtain the Franklin Changing state of incorporation.

- Ensure you have navigated to the correct page featuring your localized form.

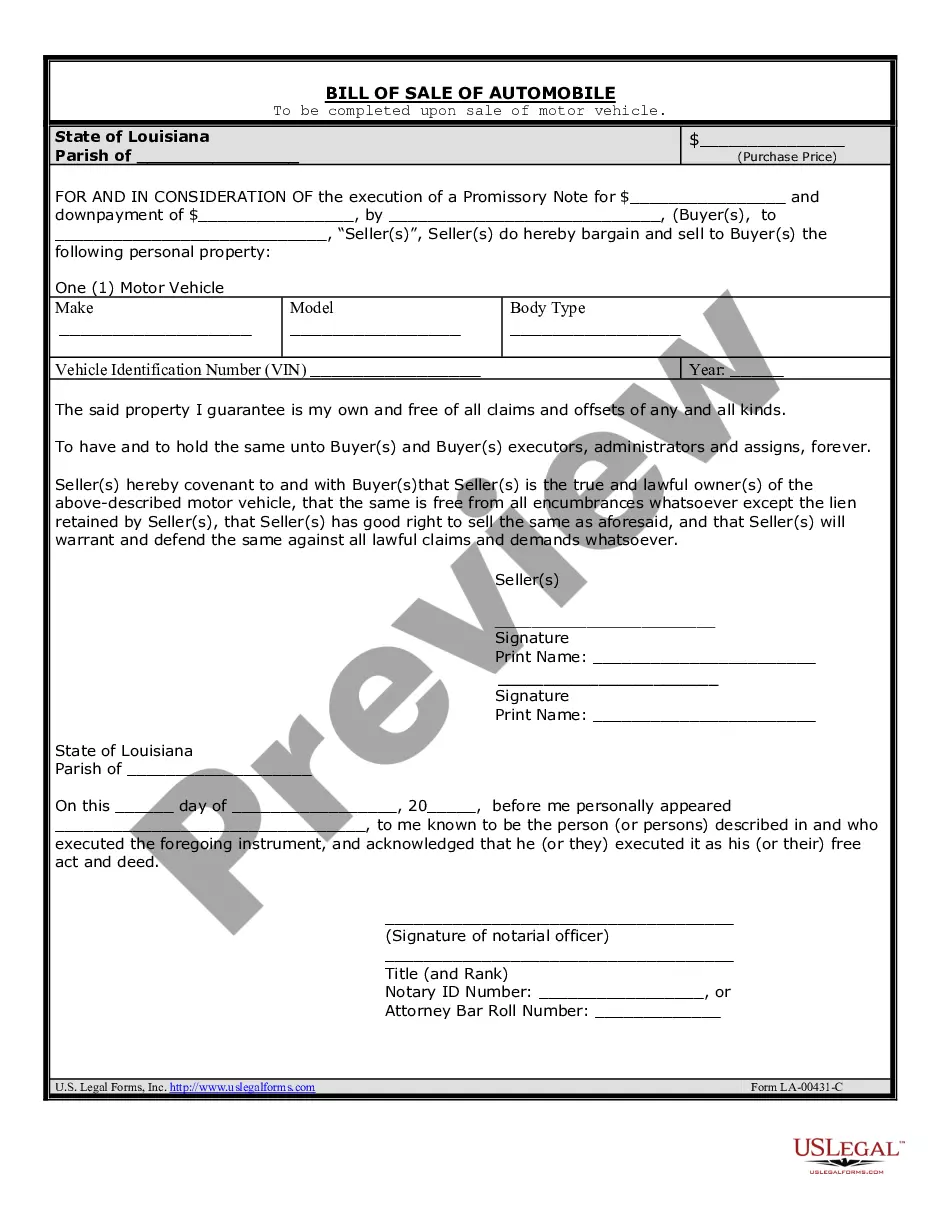

- Utilize the Preview mode (if available) and peruse through the sample.

- Examine the description (if provided) to confirm the template aligns with your needs.

- Search for another document using the search option if the sample does not suit you.

- Click Buy Now when you find the required template.

- Select an appropriate subscription plan, then Log In or create an account.

- Choose the favorite payment option (via credit card or PayPal) to continue.

- Select the file format and download the Franklin Changing state of incorporation onto your device.

Form popularity

FAQ

The best option for most S Corps moving to a new state is to form a new corporation in your new state and then merge your existing corporation into the new one. By completing this merger, you will avoid most tax-related fees and penalties that come along with operating a corporation in multiple states.

To alter your business's state of incorporation, you have three options: Dissolve your company and then form a new company in another state. Form a new corporation and then merge it with your previous company. Dissolve your corporation and then file a conversion certificate to reincorporate.

From the legal perspective, there can be three ways to move a corporation to another state. Form the new-state corporation. Transfer assets and liabilities of the existing corporation to the new-state corporation.Form the new-state corporation.Convert the existing corporation to a new-state corporation.

Thankfully, California LLCs can be easily transferred to Florida without interrupting the business's continuity through a process known as statutory conversion. A full version of the conditions can be found in Chapter 605 of the Florida Revised Limited Liability Company Act.

The only way to officially move your company's registration to another country is to dissolve it and incorporate a new company in the preferred jurisdiction. When your new company is set up, you can transfer your business assets from the existing company.

Generally, there are three ways to change the state of incorporation: dissolve the corporation in the original state and start a corporation in the new state; form a corporation in the new state and merge the old corporation into it (a reorganization); or dissolve the old corporation and reincorporate in the new

Create a new entity in Arizona through the Arizona Corporation Commission and pay the corresponding filing fee. Create and sign a Merger Agreement. Submit the Statement of Merger to the Arizona Corporation Commission and request a Certified Copy of the Merger Certificate. Pay the corresponding filing fees.

Statutory conversion/domestication The easiest way to change the state of formation is through a statutory transaction. In some states, this is called a conversion; in other states, it is called a domestication. This is a one-entity transaction.

To permanently move a corporation or LLC to a new state, you must close the business in the original state and then register a new corporation or LLC in the new state. Specific requirements vary from state-to-state, but the typical steps of how to do it include: Agree to close the business and move the business.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.