Bronx New York Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock

Description

How to fill out Proposal To Amend Articles Of Incorporation To Effect A Reverse Stock Split Of Common Stock And Authorize A Share Dividend On Common Stock?

What is the standard duration for you to draft a legal document.

Considering that each state has distinct laws and regulations for every life scenario, finding a Bronx Proposal to revise articles of incorporation to implement a reverse stock split of common shares and authorize a share dividend on common shares that meets all local standards can be daunting, and acquiring it from a qualified attorney is frequently expensive. Numerous online platforms provide the most frequently used state-specific templates for download, yet utilizing the US Legal Forms repository is the most beneficial.

US Legal Forms boasts the largest online assortment of templates, categorized by states and areas of application. Besides the Bronx Proposal to revise articles of incorporation to implement a reverse stock split of common shares and authorize a share dividend on common shares, here you can obtain any particular document necessary for operating your business or managing personal matters in accordance with your county's stipulations. Experts validate all templates for their relevance, assuring you that your documents will be prepared correctly.

Settle your payment through PayPal or a credit card. Adjust the file format if necessary. Press Download to store the Bronx Proposal to revise articles of incorporation to implement a reverse stock split of common shares and authorize a share dividend on common shares. Print the document or utilize any chosen online editor for electronic completion. Regardless of how frequently you need the purchased document, you can retrieve all saved files in your profile by accessing the My documents section. Give it a try!

- If you possess an account on the site and your membership is active, Log In.

- Select the desired template, and download it.

- You can access the document in your account at any time in the future.

- If you are a newcomer to the website, additional steps are required before obtaining your Bronx Proposal to revise articles of incorporation to implement a reverse stock split of common shares and authorize a share dividend on common shares.

- Review the information on the page you're currently on.

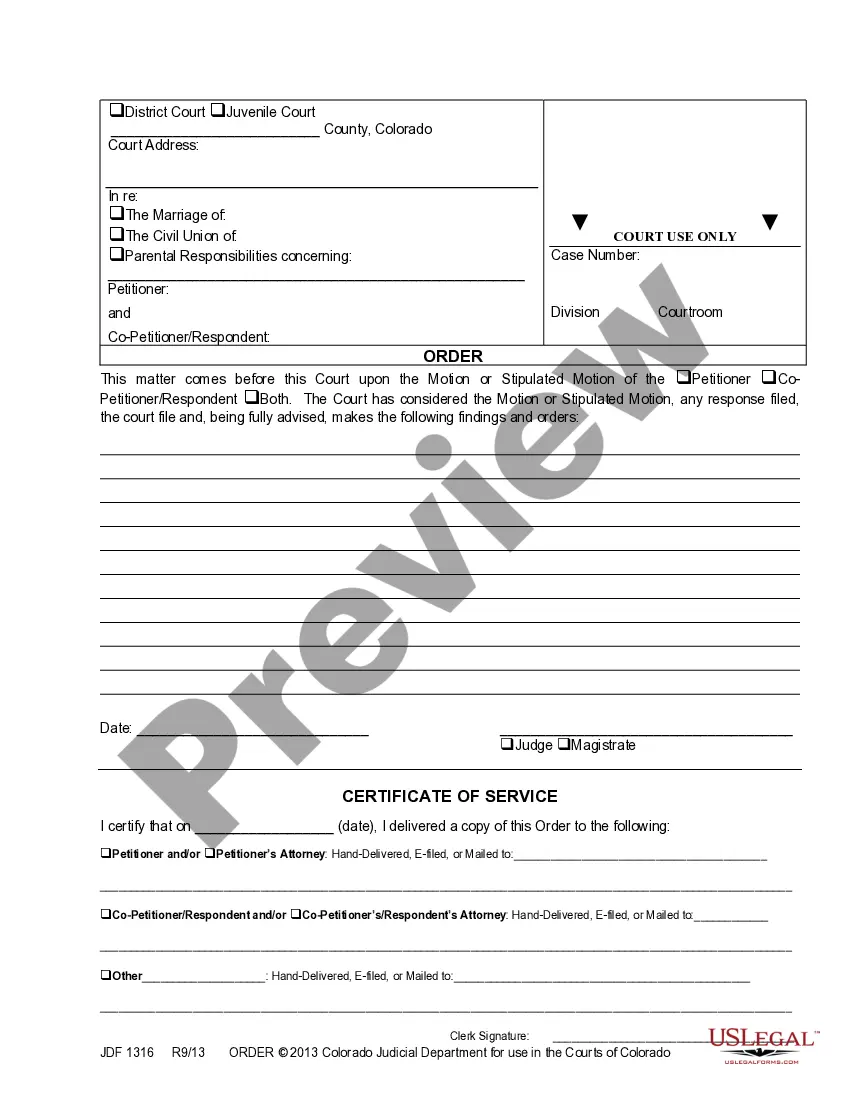

- Examine the description of the template or Preview it (if available).

- Search for additional documents using the related option in the header.

- Press Buy Now once you are confident in the document chosen.

- Select the subscription plan that best suits you.

- Create an account on the platform or Log In to continue to payment options.

Form popularity

FAQ

Many companies do survive after undergoing a reverse stock split. The Bronx New York Proposal to amend articles of incorporation to effect a reverse stock split of common stock and authorize a share dividend on common stock often signals a company's intent to reposition itself. This action can help restructure capital, improve financial ratios, and enhance the company’s market standing. Historical data reflects that with the right strategy, companies can not only survive but thrive following a reverse stock split.

A reverse stock split itself shouldn't impact an investortheir overall investment value remains the same, even as stocks are consolidated at a higher price. But the reasons behind the reverse stock split are worth investigating, and the split itself has the potential to drive stock prices down.

A corporation may change its name by merely amending its charter in the manner prescribed by law. The change of name of the corporation does not result in dissolution. The changing of the name of a corporation is no more the creation of a corporation than the changing of the name of a natural person.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

A reverse stock split occurs when a publicly traded company divides the number of outstanding shares by a certain amount. This serves to decrease the number of outstanding shares and increase the price per share of those outstanding shares.

A reverse stock split is when a company decreases the number of shares outstanding in the market by canceling the current shares and issuing fewer new shares based on a predetermined ratio. For example, in a reverse stock split, a company would take every two shares and replace them with one share.

In some reverse stock splits, small shareholders are "cashed out" (receiving a proportionate amount of cash in lieu of partial shares) so that they no longer own the company's shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

Can a Company Change Its Authorized Shares? Yes, a company can change the number of authorized shares it is allowed to issue. Public companies must often notify existing shareholders and call for a shareholder vote.

During a reverse stock split, a company cancels its current outstanding stock and distributes new shares to its shareholders in proportion to the number of shares they owned before the reverse split.

Reverse stock splits don't affect the number of authorized shares, but a forward stock split issues new stock from the company's authorized shares. When new shares are issued by a company, it adds to the number of outstanding shares and reduces each shareholder's percentage of ownership in the company.