King Washington Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out King Washington Stock Option Grants And Exercises And Fiscal Year-End Values?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, finding a King Stock Option Grants and Exercises and Fiscal Year-End Values meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Apart from the King Stock Option Grants and Exercises and Fiscal Year-End Values, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your King Stock Option Grants and Exercises and Fiscal Year-End Values:

- Check the content of the page you’re on.

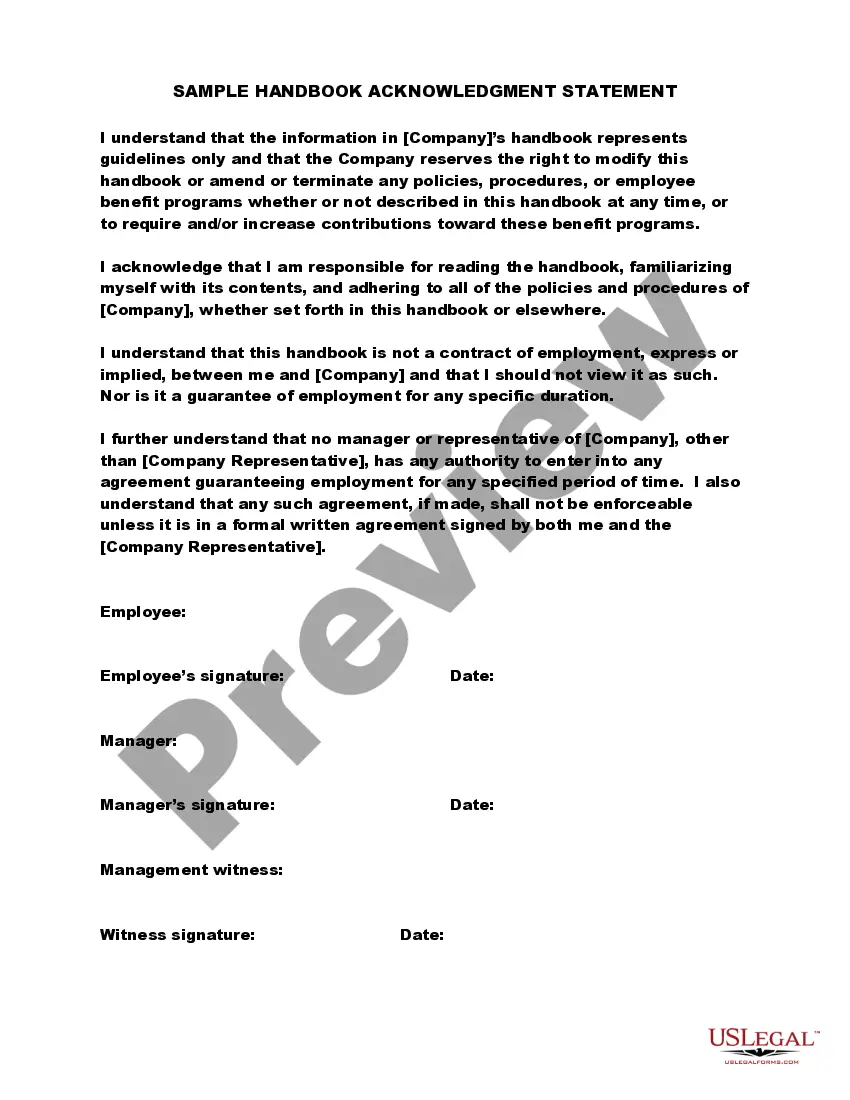

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the King Stock Option Grants and Exercises and Fiscal Year-End Values.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Definition: Exercise date refers to the date on which a trader decides to exercise an option (Call/Put) on an exchange or with a brokerage whether bought or written/sold where 'exercise' means making use of the actual right specified in the contract.

When stock options are exercised, the company needs to issue some additional shares to compensate the employees or investors who have exercised them. Due to this, the total number of outstanding shares. It is shown as a part of the owner's equity in the liability side of the company's balance sheet.

In addition to being reported on the income statement, the option grant should also appear on the balance sheet. In our opinion, the cost of options issued represents an increase in shareholders' equity at the time of grant and should be reported as paid-in capital.

Stock options may be considered a form of compensation which gives the employee the right to buy an amount of company stock at a set price during a certain time period. Under U.S. accounting methods, stock options are expensed according to the stock options' fair value.

This annual expense is reported on the income statement and under stockholder's equity on the balance sheet. When the options are exercised or expire, the related amounts will be reported in accounts that are part of the stockholder's equity section of the balance sheet.

Stock options that are in-the-money at the time of expiration will be automatically exercised. For puts, your options are considered in-the-money if the stock price is trading below the strike price. Conversely, call options are considered in-the-money when the stock price is trading above the strike price.

As long as you have held the stock for the required holding period at least one year from the exercise date and two years from the grant date the entire difference between the stock's selling price and your cost basis will be taxed as a long-term capital gain.

Rather than recording the expense as the current stock price, the business must calculate the fair market value of the stock option. The accountant will then book accounting entries to record compensation expense, the exercise of stock options and the expiration of stock options.

Stock-based compensation that is redeemable at the employee's option is a considered an employer obligation, and thus a liability while awards that are redeemable at the employer's option are classified as equity.

The first important part of the vesting schedule is your Cliff Date. This is the first date that any of your options will become eligible for exercise. The Cliff Date is typically 1 year after the issue date of the grant or the Vesting Calculation Date.