Salt Lake Utah Reduction in Authorized Number of Directors

Description

How to fill out Reduction In Authorized Number Of Directors?

Compiling documents for business or personal purposes is consistently a significant obligation.

When formulating an agreement, a public service application, or a power of attorney, it is vital to consider all national and local statutes and regulations relevant to the area.

However, smaller counties and even towns also possess legislative requirements that must be taken into account.

To find the option that aligns with your needs, use the search tab located in the header of the page.

- These factors render it challenging and labor-intensive to draft a Salt Lake Reduction in Authorized Number of Directors without expert help.

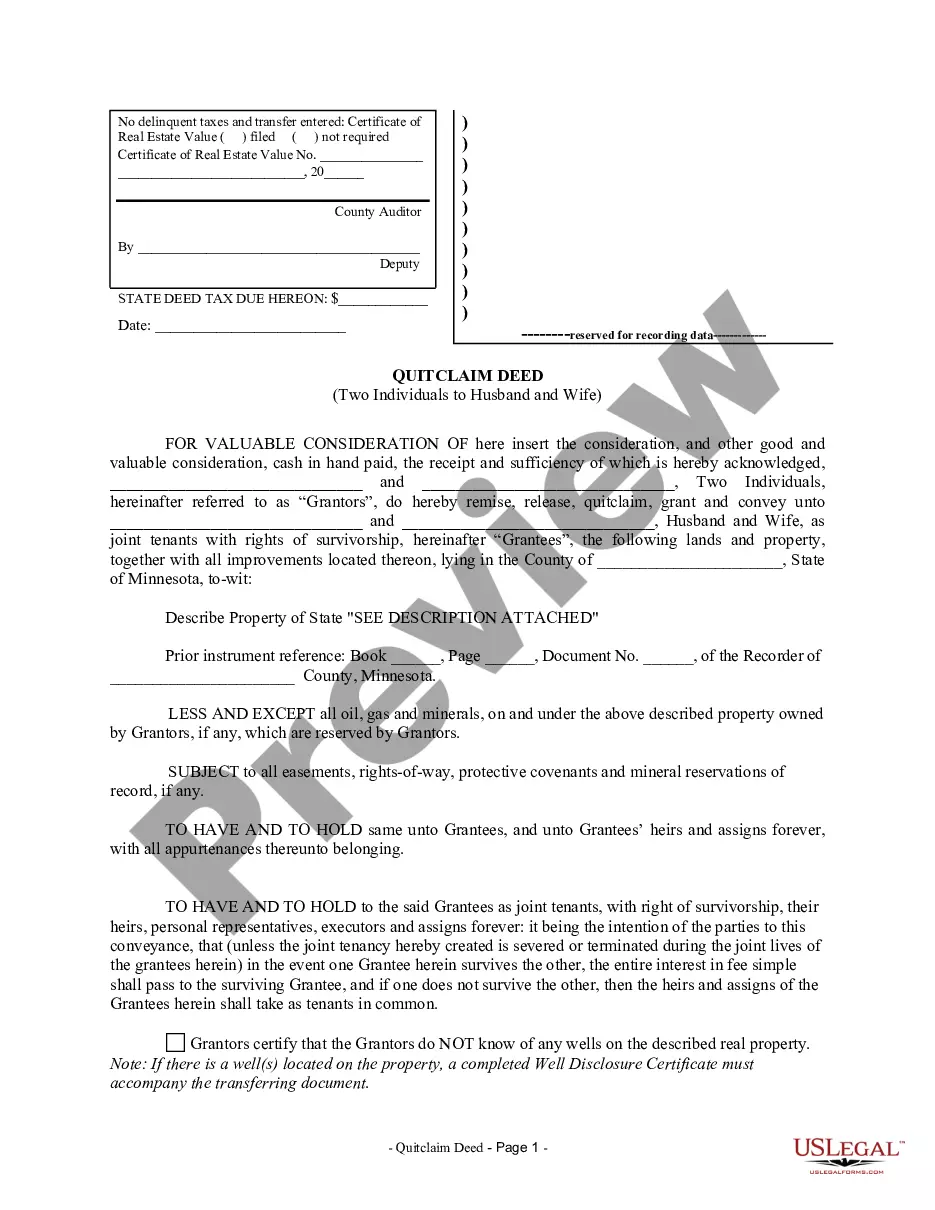

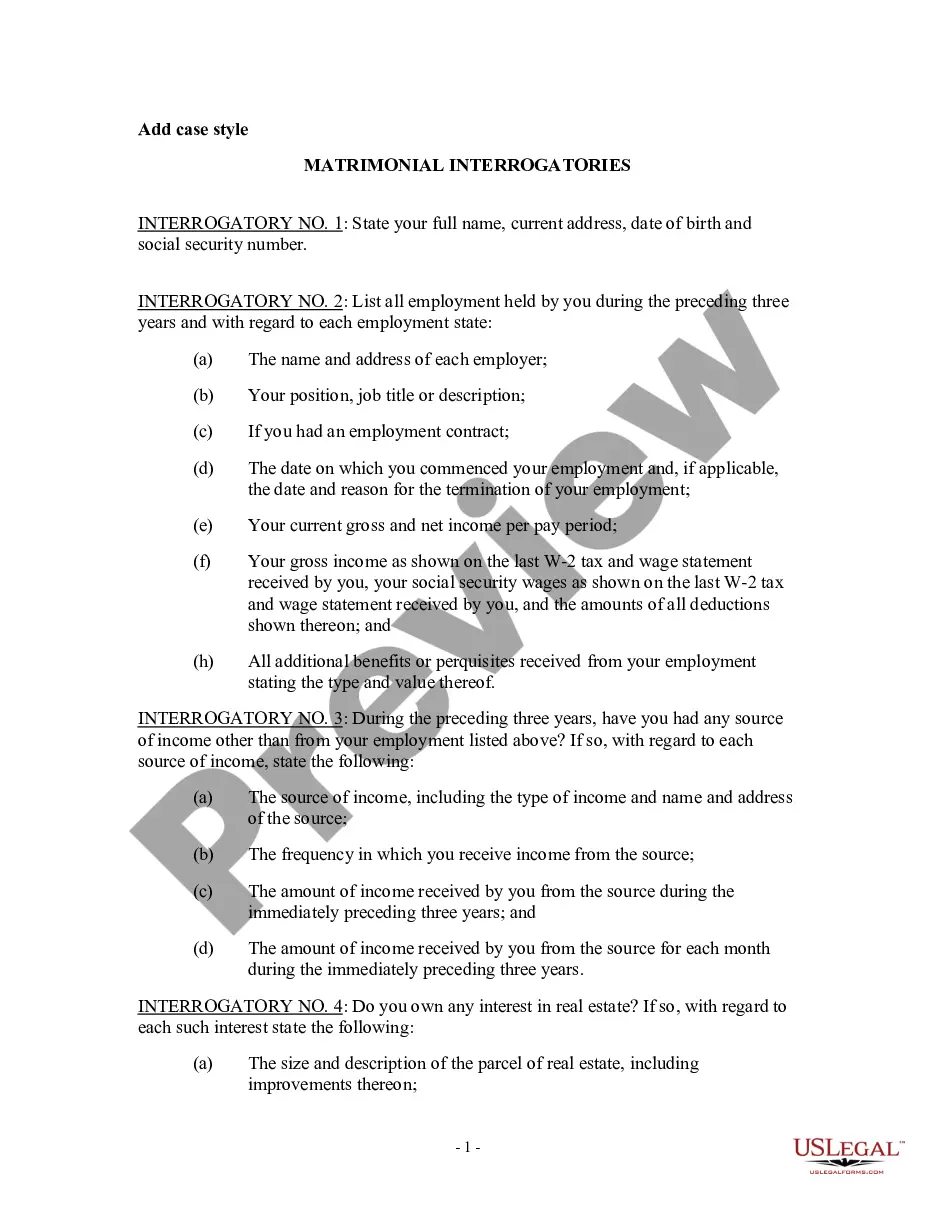

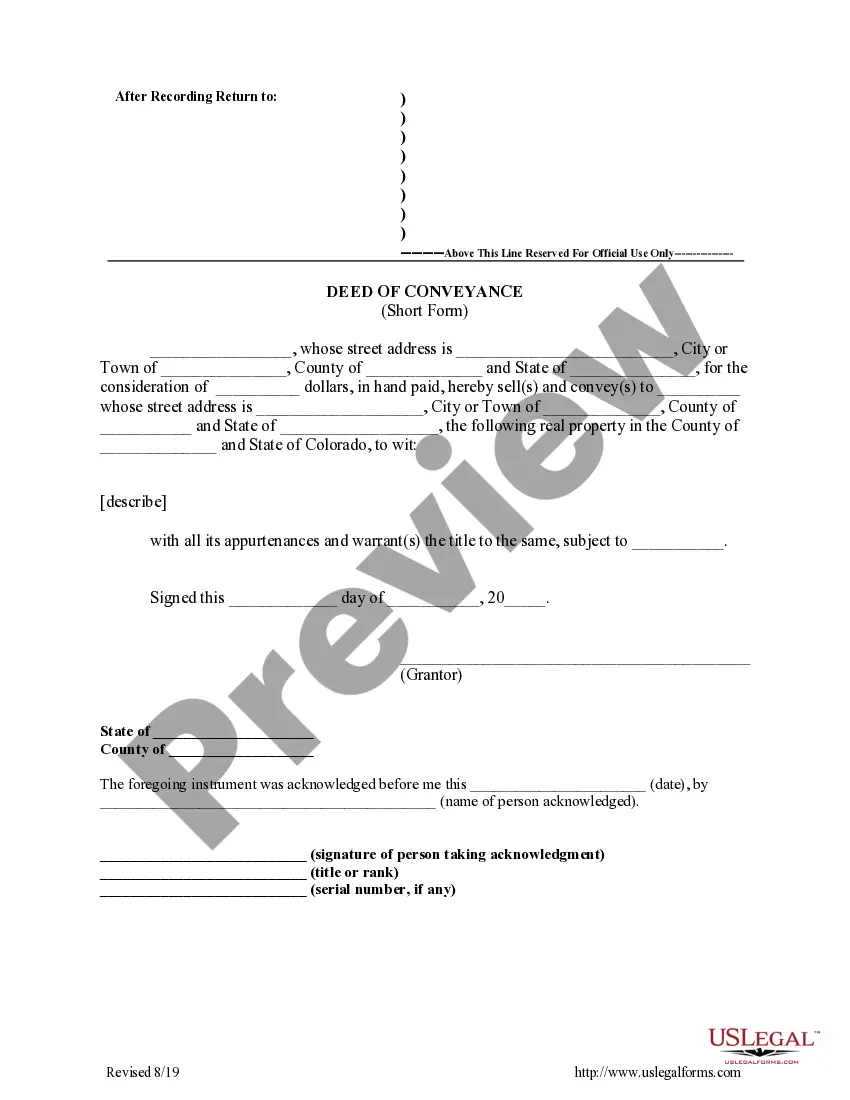

- It is feasible to circumvent unnecessary expenses on lawyers drafting your documents and produce a legally binding Salt Lake Reduction in Authorized Number of Directors independently, utilizing the US Legal Forms online collection.

- It is the most comprehensive online repository of state-specific legal templates that have been professionally validated, ensuring their legitimacy when selecting a sample for your county.

- Formerly subscribed users merely need to Log In to their accounts to retrieve the necessary document.

- Should you not possess a subscription, adhere to the step-by-step guide below to obtain the Salt Lake Reduction in Authorized Number of Directors.

- Browse the page you've accessed and verify if it contains the sample you require.

- To do this, utilize the form description and preview if available on the site.

Form popularity

FAQ

To update articles of organization in Utah, you should file an amendment with the Utah Division of Corporations. This involves creating a new document that outlines the changes and submitting it along with any required fees. The US Legal Forms platform provides the tools you need to create these amendments quickly and accurately. Being aware of the Salt Lake Utah Reduction in Authorized Number of Directors can help you make informed updates that align with your business goals.

Appoint directors. So long as a corporation has just one owner/shareholder, states allow it to have just one director as well. To appoint yourself director, you'll need to prepare meeting minutes that show you (as the shareholder) elected yourself as the sole director of the board.

While there is no set number of members for a corporate board, many pursuing diversity as well as cohesion settle on a range of 8 to 12 directors.

If you want to increase the number of board members within the limit set by the bylaws, simply raise the prospect of filling vacant seats at a regular meeting of the board, recruit candidates, vet their credentials, vote on their candidacy and seat the one who gets the most votes of the existing directors.

3. Minimum number of members: To start a limited liability partnership at least two members are required initially. However, there is no limit on the maximum number of partners. 4.

A) Composition of the Board The Board shall be composed of at least five (5), but not more than fifteen (15), members who are elected by the stockholders.

There must be a minimum of 1 shareholder. There is no maximum number. For directors, generally the minimum number is 1 for non-public companies, while there is no maximum number.

Boards had an average of 11.2 board directors overall. The study revealed that companies with at least $10 billion in annual revenue that had smaller boards typically produced better returns over three years than similar-size companies with larger boards.

Limited liability partnerships (LLPs) allow for a partnership structure where each partner's liabilities are limited to the amount they put into the business. Having business partners means spreading the risk, leveraging individual skills and expertise, and establishing a division of labor.

Minimum number of directors. The Revised Model Nonprofit Corporation Act (1987), adopted in whole or in modified form by 23 states, sets the minimum number at three. Some states, including California, require only one director.