Wake North Carolina Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

How to fill out Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

Whether you plan to launch your enterprise, enter into an agreement, request your identification renewal, or address familial legal issues, you must organize particular documentation that complies with your local statutes and regulations.

Finding the appropriate documents may require significant time and effort unless you utilize the US Legal Forms library.

The service offers users over 85,000 professionally composed and verified legal documents for any personal or business event. All documents are categorized by state and purpose, making it easy and swift to select a form like Wake Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005.

Forms provided through our website are reusable. With an active subscription, you can access all of the documents you’ve previously obtained at any time in the My documents section of your account. Stop spending time in an endless search for current official documents. Enroll in the US Legal Forms platform and keep your paperwork organized with the largest online document library!

- Ensure the template meets your specific requirements and state legislation.

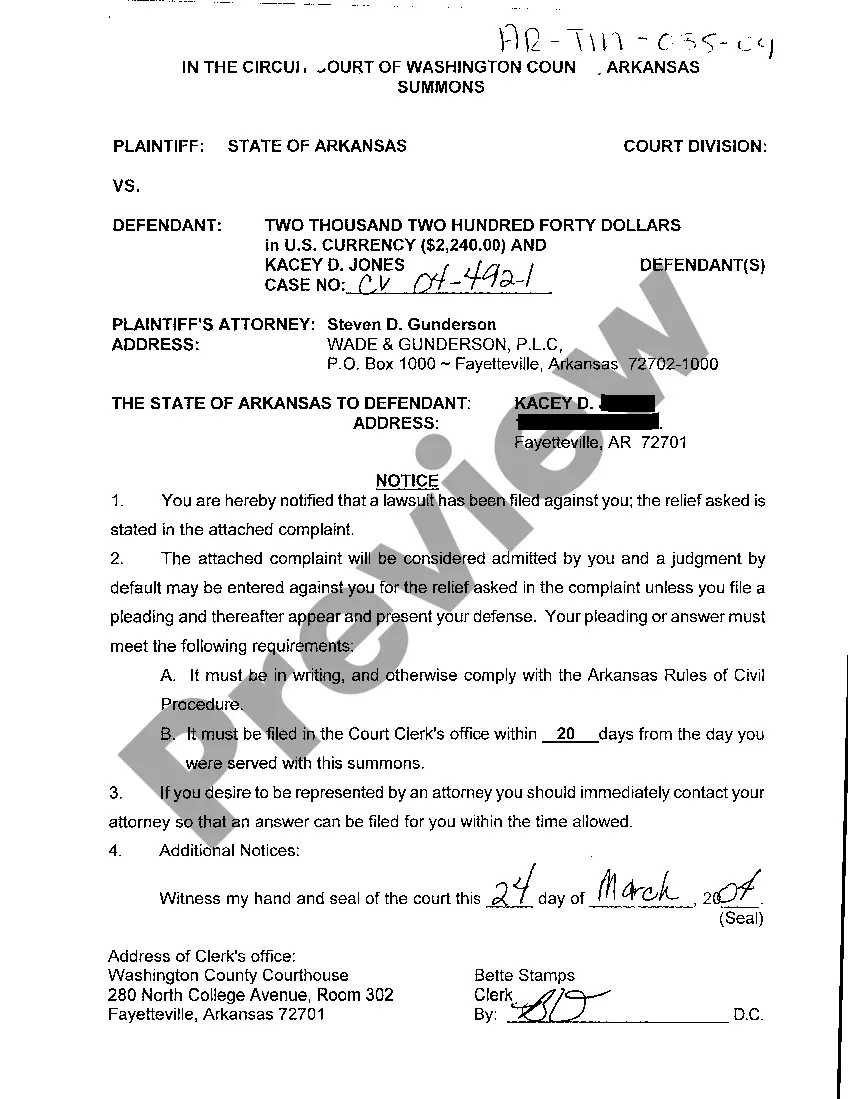

- Examine the form description and review the Preview if available on the page.

- Utilize the search bar above to locate another template by entering your state.

- Select Buy Now to purchase the document once you identify the correct one.

- Choose the subscription plan that best fits your needs to continue.

- Log in to your account and complete the payment using a credit card or PayPal.

- Download the Wake Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005 in your desired file format.

- Print the document or complete it and sign it electronically through an online editor to save time.

Form popularity

FAQ

For example, when the company borrows the money from the bank, it may record the debt as note payable or loan payable for the liability it owes to the bank....Payment to creditors journal entry. AccountDebitCreditPayables$$$Cash$$$

On Schedule E/F, you'll list all of your debts that aren't secured by property. In other words, all debts that you didn't already list on Schedule D: Creditors Who Have Claims Secured by Property. You'll list your priority unsecured debts first, followed by your nonpriority, unsecured debts.

While a priority claim is not secured by collateral, it is however treated with higher priority over other claims by Federal law. A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims.

Here are examples of common priority claims: costs to administer the bankruptcy (such as accounting or legal fees) child and spousal support obligations. up to $15,150 in compensation earned 180 days before bankruptcy (wages, commissions, and other compensation)

General unsecured claims are claims that have no priority and are not backed by a security interest in property. General unsecured debts include credit card debts, student loans, personal loans, some utilities and medical bills. General unsecured claims have the lowest priority of all claims.

The equation to calculate Creditor Days is as follows: Creditor Days = (trade payables/cost of sales) 365 days (or a different period of time such as financial year) Trade payables the amount that your business owes to sellers or suppliers.

A list of creditors that hold secured claims, meaning they have an interest in the property. The list includes the creditor's name, address, amount of the debt, and date of when the debt was incurred.

Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. (3) Secured claims are those for which the creditor has the right take back certain property (i.e., the collateral) if the debtor does not pay the underlying debt.

Form 8 proof of debt (POD) is a form for creditors for detailing debts and supporting information. If money is being paid due to a sale of assets or compulsory payments from the person who is bankrupt, the trustee will let you know.

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.