Allegheny Pennsylvania Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005

Description

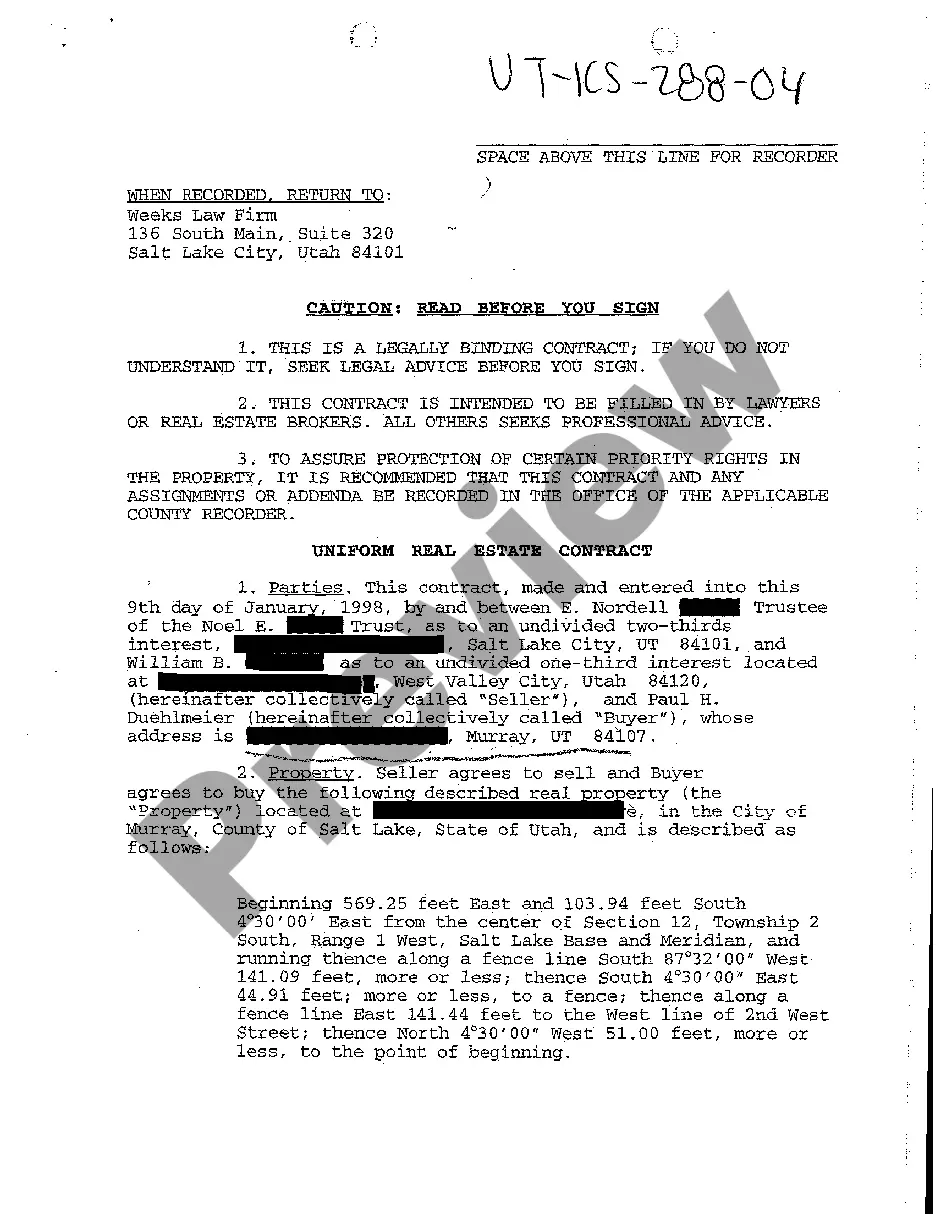

How to fill out Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005?

Drafting legal documents can be challenging.

Moreover, if you choose to enlist a lawyer to create a business contract, documents for property transfer, prenuptial agreement, divorce filings, or the Allegheny Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, it might be quite expensive.

Browse the page and confirm there is a sample for your area.

- So what is the most effective way to save both time and money while producing valid documents that comply entirely with your state and local regulations.

- US Legal Forms is a fantastic option, whether you’re looking for forms for personal or business purposes.

- US Legal Forms is the largest online archive of state-specific legal documents, offering users current and professionally vetted templates for any situation consolidated in one location.

- Thus, if you need the most recent version of the Allegheny Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005, you can swiftly find it on our platform.

- Acquiring the documents requires minimal time.

- Those with an account should verify that their subscription is active, Log In, and select the template using the Download button.

- If you haven’t registered yet, here’s how to obtain the Allegheny Creditors Holding Unsecured Nonpriority Claims - Schedule F - Form 6F - Post 2005.

Form popularity

FAQ

An unsecured claim is a payment request made to the bankruptcy court by a creditor who doesn't have the right to sell property to satisfy the underlying debt. Credit card companies, medical providers, and utility companies often file unsecured claims.

A regulated debtor is a bankrupt, a person whose property is subject to control under Division 2 of Part X, a debtor under a personal insolvency agreement or a deceased person whose estate is being administered under Part XI.

The equation to calculate Creditor Days is as follows: Creditor Days = (trade payables/cost of sales) 365 days (or a different period of time such as financial year) Trade payables the amount that your business owes to sellers or suppliers.

Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. (3) Secured claims are those for which the creditor has the right take back certain property (i.e., the collateral) if the debtor does not pay the underlying debt.

For example, when the company borrows the money from the bank, it may record the debt as note payable or loan payable for the liability it owes to the bank....Payment to creditors journal entry. AccountDebitCreditPayables$$$Cash$$$

General unsecured claims are claims that have no priority and are not backed by a security interest in property. General unsecured debts include credit card debts, student loans, personal loans, some utilities and medical bills. General unsecured claims have the lowest priority of all claims.

On Schedule E/F, you'll list all of your debts that aren't secured by property. In other words, all debts that you didn't already list on Schedule D: Creditors Who Have Claims Secured by Property. You'll list your priority unsecured debts first, followed by your nonpriority, unsecured debts.

While a priority claim is not secured by collateral, it is however treated with higher priority over other claims by Federal law. A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims.

Form 8 proof of debt (POD) is a form for creditors for detailing debts and supporting information. If money is being paid due to a sale of assets or compulsory payments from the person who is bankrupt, the trustee will let you know.

A list of creditors that hold secured claims, meaning they have an interest in the property. The list includes the creditor's name, address, amount of the debt, and date of when the debt was incurred.