Philadelphia Pennsylvania Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Whether you plan to launch your business, enter into a contract, request an update for your identification, or address familial legal issues, you must prepare certain documentation that complies with your local laws and regulations.

Finding the appropriate documents can require significant time and effort unless you utilize the US Legal Forms library.

The platform offers users access to over 85,000 professionally drafted and verified legal documents for any personal or business situation. All documents are organized by state and area of use, making it easy to select a template like Philadelphia Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Documents available on our website are reusable. With an active subscription, you can access all of your previously obtained paperwork anytime in the My documents section of your account. Stop expending time on an ongoing search for current formal documentation. Register for the US Legal Forms platform and maintain your paperwork organized with the most extensive online form collection!

- Ensure the sample meets your specific requirements and state legal guidelines.

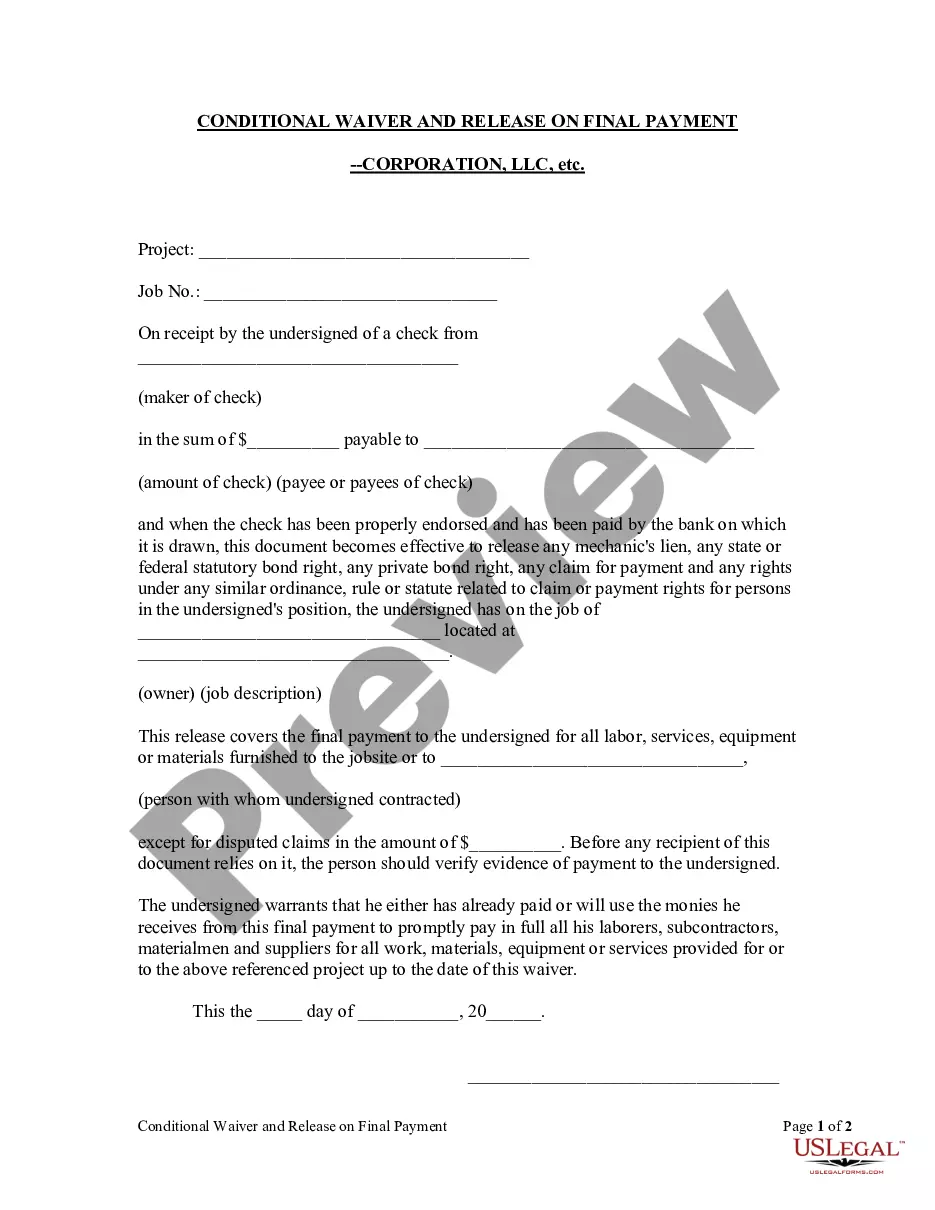

- Review the form description and check the Preview if accessible on the page.

- Utilize the search bar indicating your state above to locate another template.

- Click Buy Now to acquire the document once you find the appropriate one.

- Select the subscription plan that best fits your needs to continue.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Philadelphia Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in your preferred file format.

- Print the document or complete it and sign it electronically through an online editor to save time.

Form popularity

FAQ

The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

Educational institutions and properties owned by the Council of Legal Education, Government-owned lands, Lands owned by the Local Authorities, Hospitals, and.

?What is the Homestead Exemption benefit? The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

A person aged 65 years or older; A person who lives in the same household with a spouse who is aged 65 years or older; or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

Nonprofit organizations are eligible for a real estate tax exemption from the City of Philadelphia. The property must be used for the organization's tax-exempt purpose.

The city, village, or township summer tax deferment is a beneficial tax break for certain people over the age of 62. This provides those with a household income of not more than $25,000 for the preceding year the benefit of deferring summer property taxes until February 15 of the following year.

Letter 106C notifies you that a claim, credit, deduction or amended return you submitted has been partially disallowed.

The Homestead Exemption reduces the taxable portion of your property assessment by $80,000 if you own a home in Philadelphia and use it as your primary residence. Homeowners will typically save up to $1,119 each year with Homestead starting in 2023.

The City of Philadelphia offers a Homestead Exemption program, which reduces the taxable portion of your property assessment by $30,000. If you are approved, your real estate tax bill will likely be lower the next year. To qualify you must own and live in your home as your primary residence.

You can apply by using the Homestead Exemption application on the Philadelphia Tax Center. You don't need to create a username and password to submit your application online. If a previous owner is listed, call (215) 686-9200 or submit a paper application instead.