Los Angeles, California, is renowned for its diverse real estate market, offering various properties that individuals and businesses can claim as exempt on Schedule C, Form 6C, following the updated regulations implemented post-2005. This process allows property owners to protect specific assets from potential creditors. There are different types of properties commonly claimed as exempt in Los Angeles, California, under Schedule C — Form 6C, post-2005. 1. Primary Residence: One of the most common types of property claimed as exempt in Los Angeles is the primary residence, also referred to as a homestead. It includes single-family houses, condominiums, townhouses, and mobile homes. The exemption aims to ensure individuals and families maintain their essential housing despite financial setbacks. 2. Vacation Homes: Another type of property frequently claimed as exempt is vacation homes or second residences. These properties serve as a refuge for relaxation and may include beach houses, mountain cabins, or lakefront retreats. To be eligible for exemption, the property must not be used for commercial purposes or rented out for more than a specific number of days per year. 3. Investment Properties: Certain investment properties may also be classified as exempt under Schedule C — Form 6C, post-2005. This category encompasses rental properties, such as apartments, duplexes, or multifamily units. However, it's crucial to determine whether the property generates significant income, as high rental revenue may affect the exemption status. 4. Land and Vacant Lots: Land and vacant lots owned within Los Angeles County can be claimed as exempt under Schedule C, Form 6C, in specific circumstances. These properties are often categorized as non-improved land without permanent structures. However, it's important to consider any potential zoning restrictions or commercial activities that may impact the exemption status. 5. Personal Property: In addition to real estate, certain personal properties can be claimed as exempt on Schedule C — Form 6C post-2005. This can include household goods, furniture, electronics, clothing, jewelry, and vehicles, up to a certain value. The exemption safeguards essential personal belongings from being seized or liquidated during bankruptcy or other legal proceedings. It's crucial for property owners in Los Angeles, California, to understand the different types of property that they can claim as exempt under Schedule C — Form 6C, post-2005. To ensure compliance with the regulations, individuals should consult with a reputable attorney or financial advisor who specializes in bankruptcy or property exemptions. Professionals can provide customized guidance based on an individual's specific situation, ensuring the maximum protection of assets while navigating the exemptions process.

Los Angeles California Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Los Angeles California Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

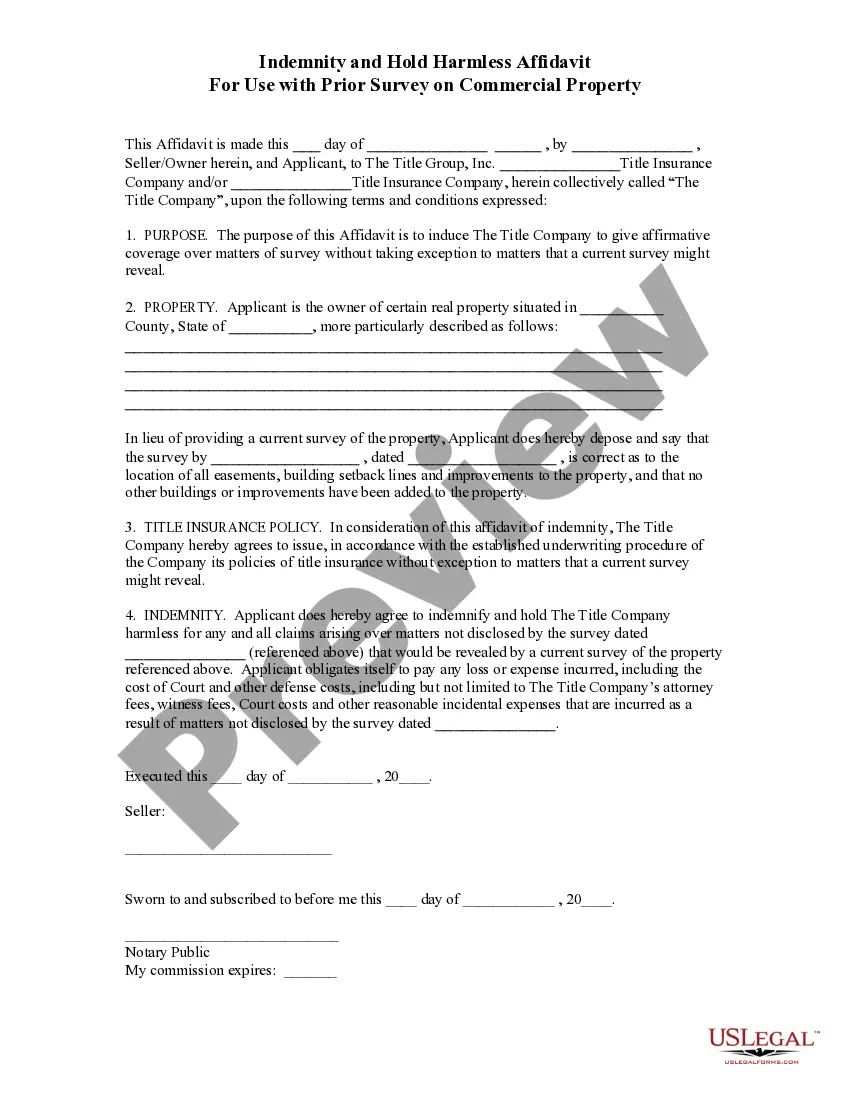

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Los Angeles Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed materials and tutorials on the website to make any activities related to paperwork execution simple.

Here's how you can locate and download Los Angeles Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some records.

- Check the related document templates or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment gateway, and buy Los Angeles Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Los Angeles Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally difficult situation, we recommend getting a lawyer to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific documents with ease!

Form popularity

FAQ

Form Number: B 106C. Category: Individual Debtors. Effective onApril 1, 2022. This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Schedule-C, mentions the undivided share of the land (UDS) associated with the unit being transacted.

Florida exemption laws protect equity in your residence up to an unlimited amount. So in Florida, no matter how much equity you have in your home, you get to keep it if you file for Chapter 7 bankruptcy. (By contrast, most states don't offer an exemption that covers near as much.)

Current value of the portion you own? This is where you list your share of the current market value of the property. So if the property is worth $120,000, but you have a 50% interest in the property, you would list $60,000. (Learn more about valuing your real estate in bankruptcy.)

Chapter 7 bankruptcy is a liquidation bankruptcy that allows you to wipe out most of your unsecured debt. Chapter 7 bankruptcy filers in Georgia often ask if they can keep their houses and cars in bankruptcy. Yes, you can even keep your house and your car in a Chapter 7.

Virginia bankruptcy laws let you keep the property or assets on your exemption list during the bankruptcy process while your trustee collects and sells only your nonexempt assets in order to repay your creditors.

The inheritance is not protected and would be used to satisfy the beneficiary's creditors. However, if on the deceased's death the assets were held in a testamentary trust, then as the assets are not owned by the bankrupt beneficiary, they are not available to the bankrupt's creditors.