San Antonio Texas Bankruptcy Client Interview Form

Category:

State:

Multi-State

City:

San Antonio

Control #:

US-B-282

Format:

Word;

Rich Text

Instant download

Description

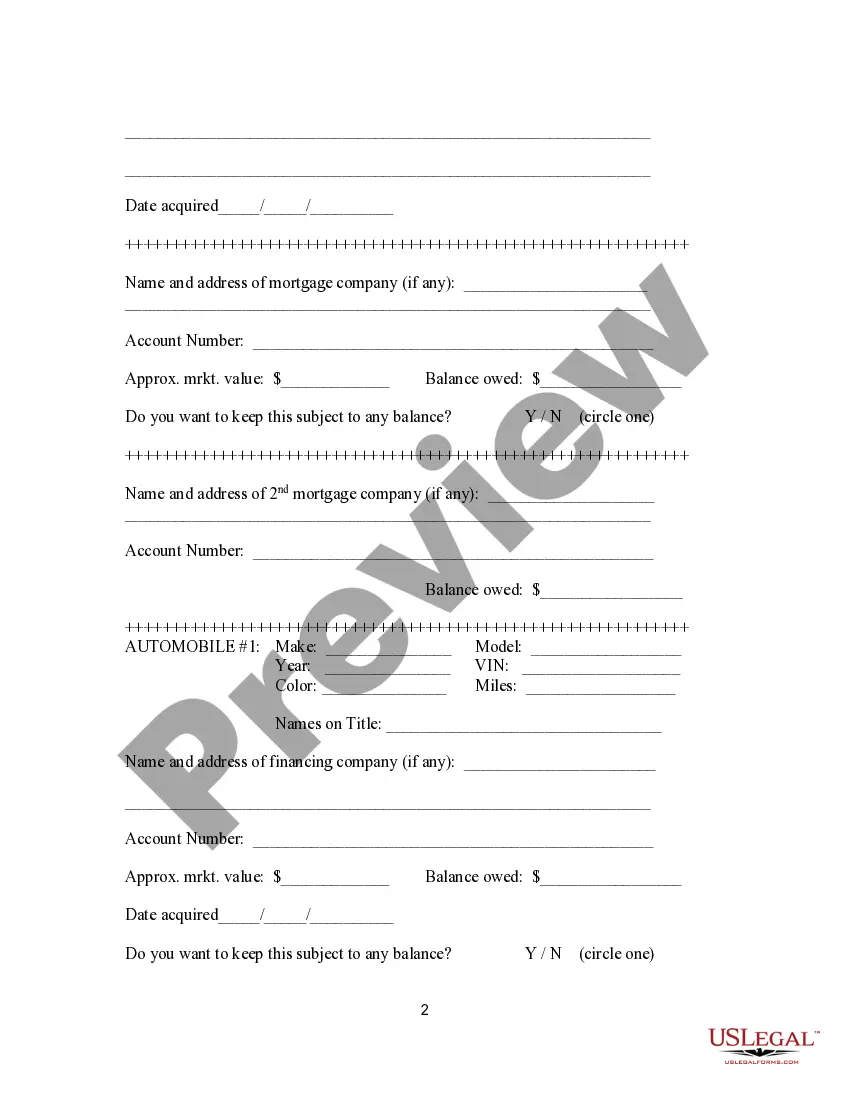

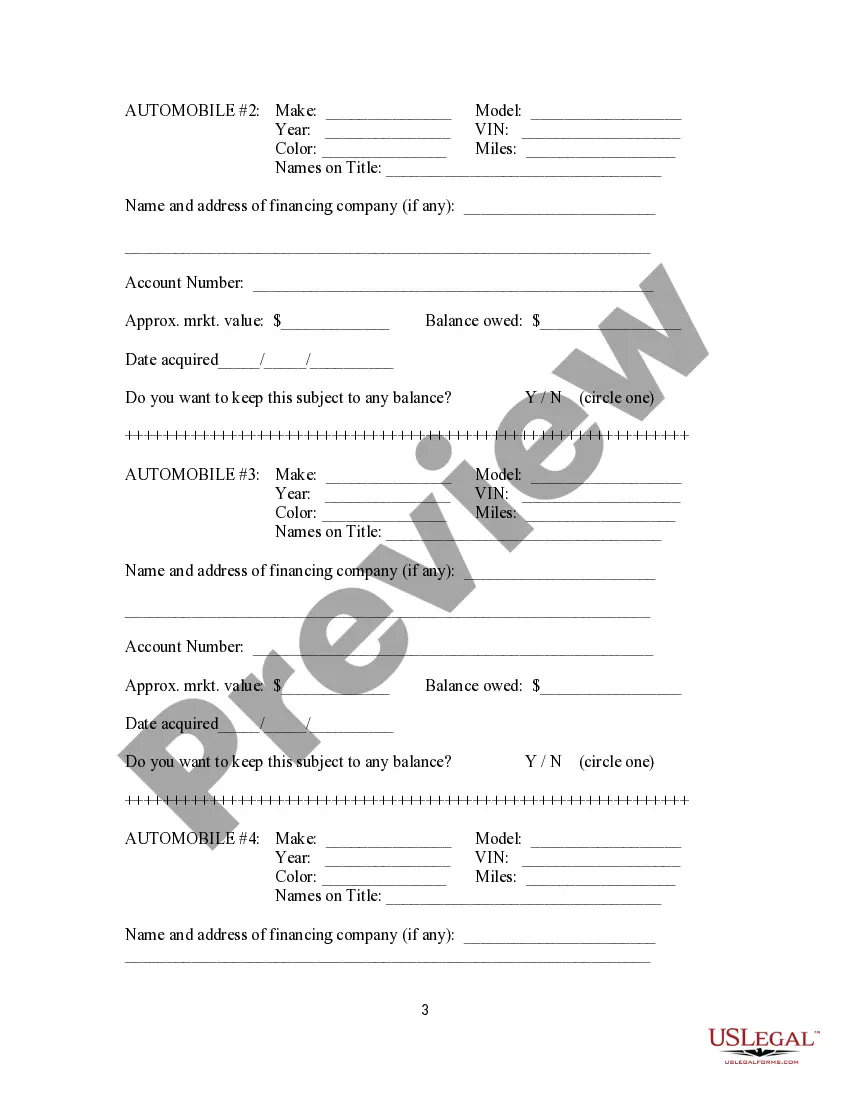

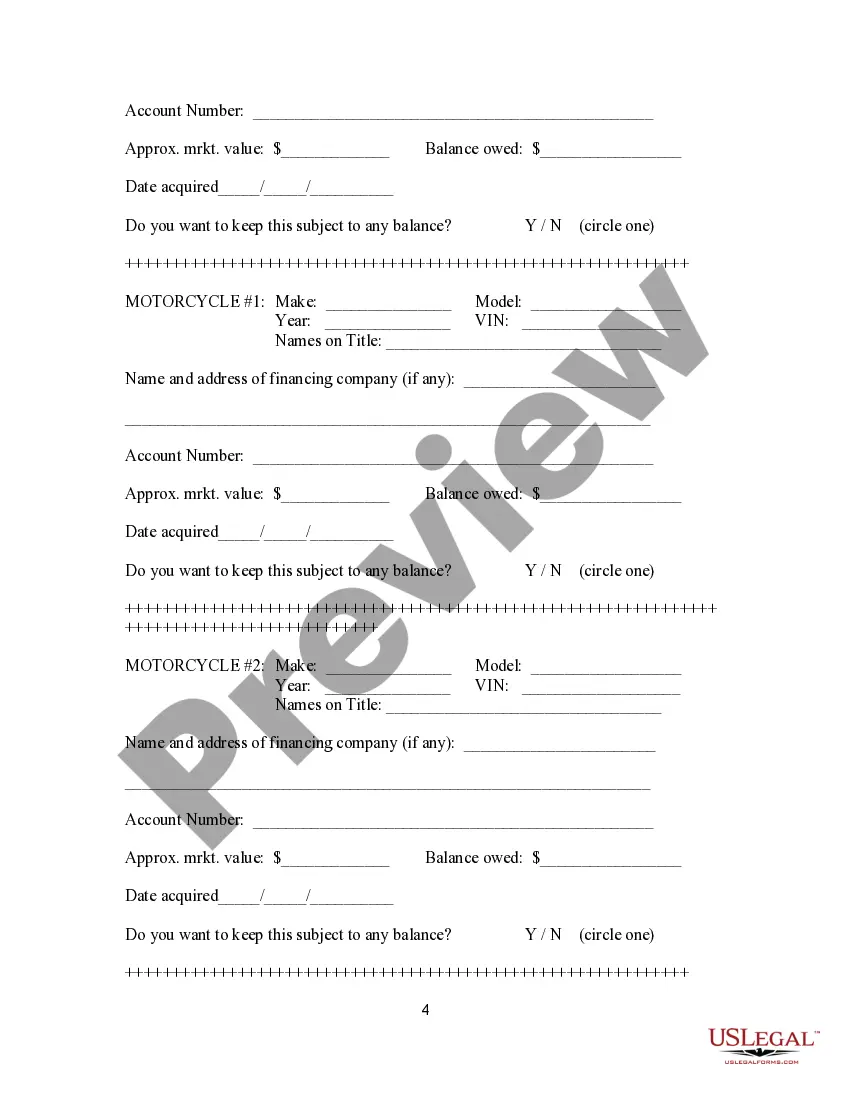

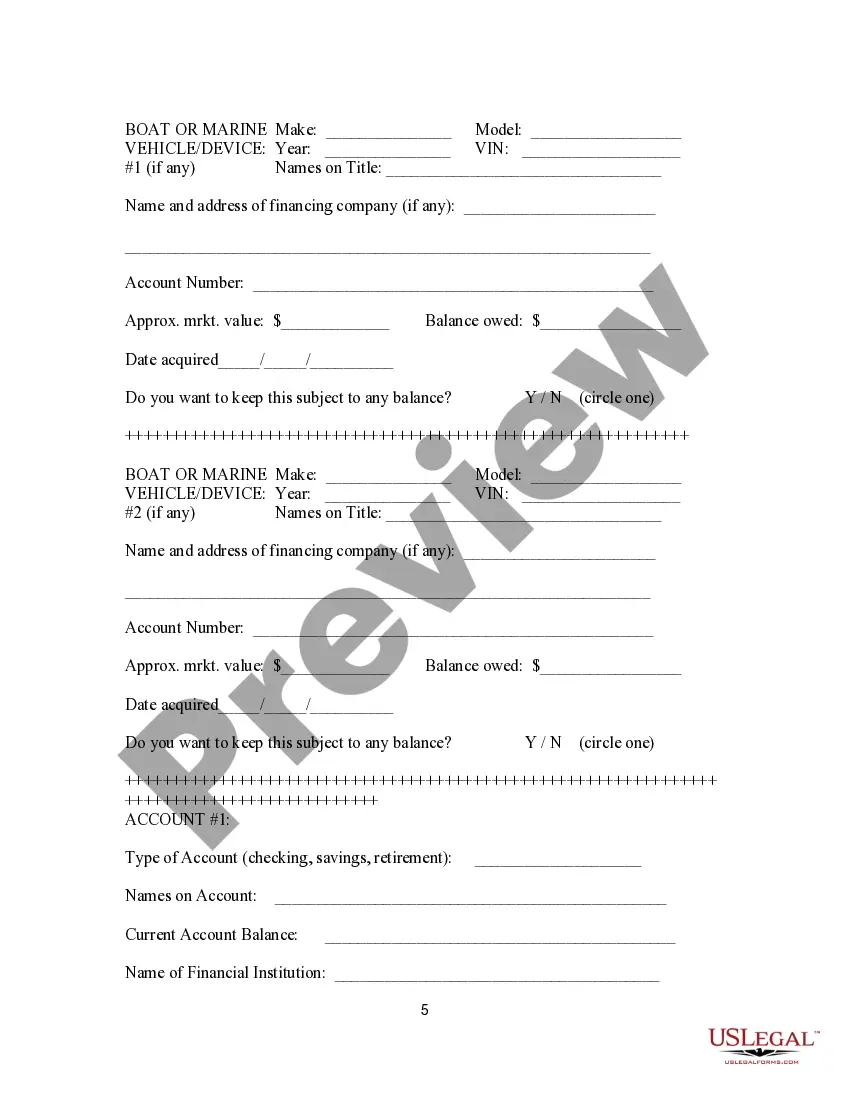

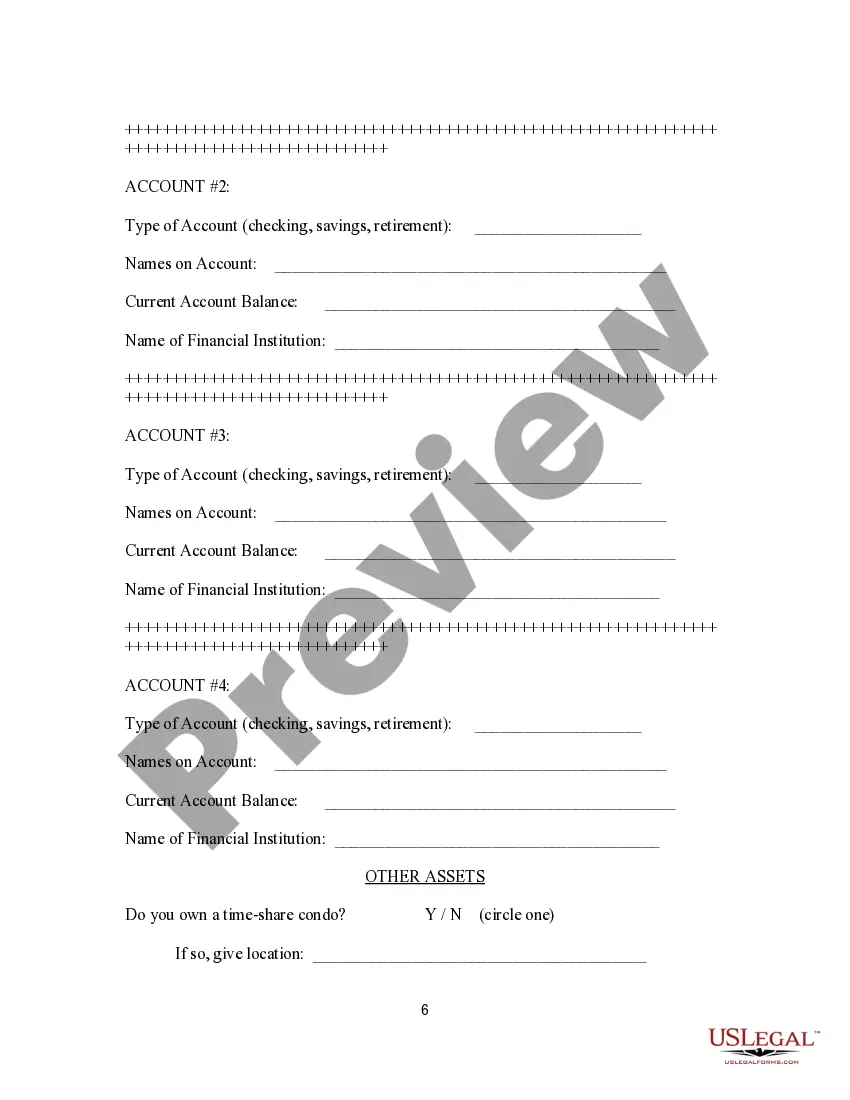

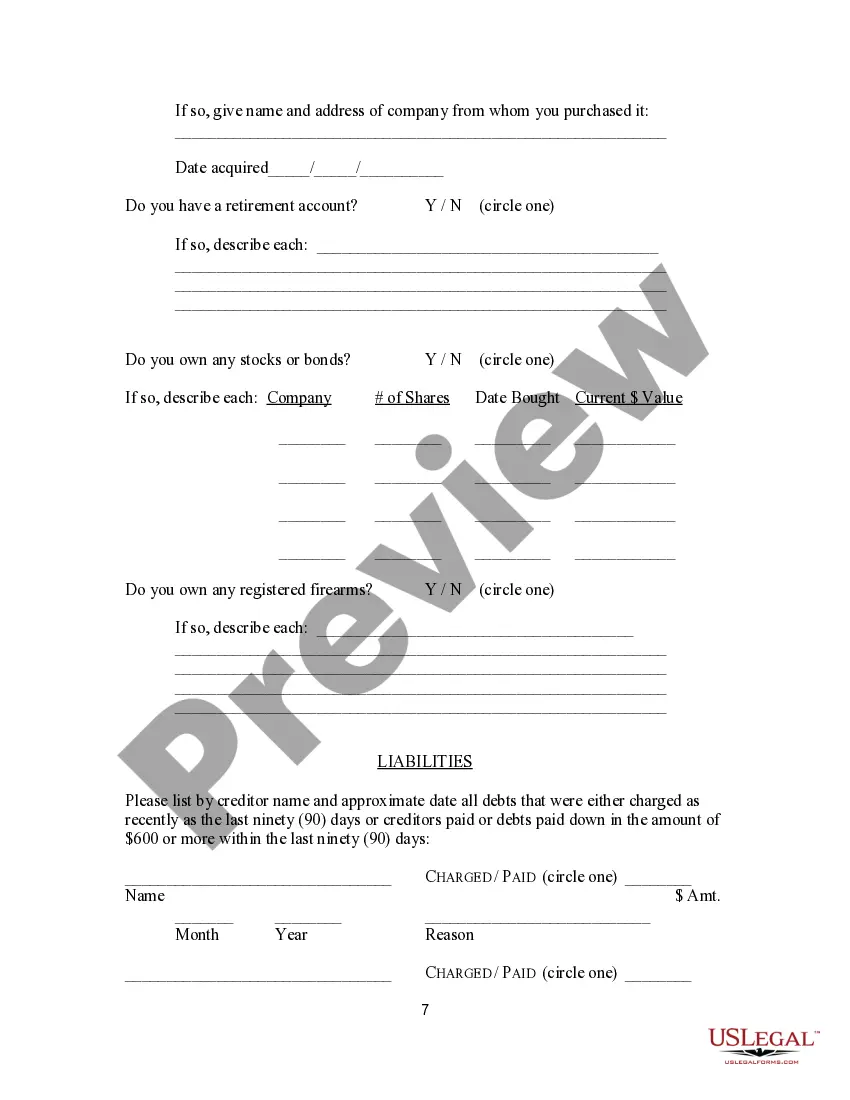

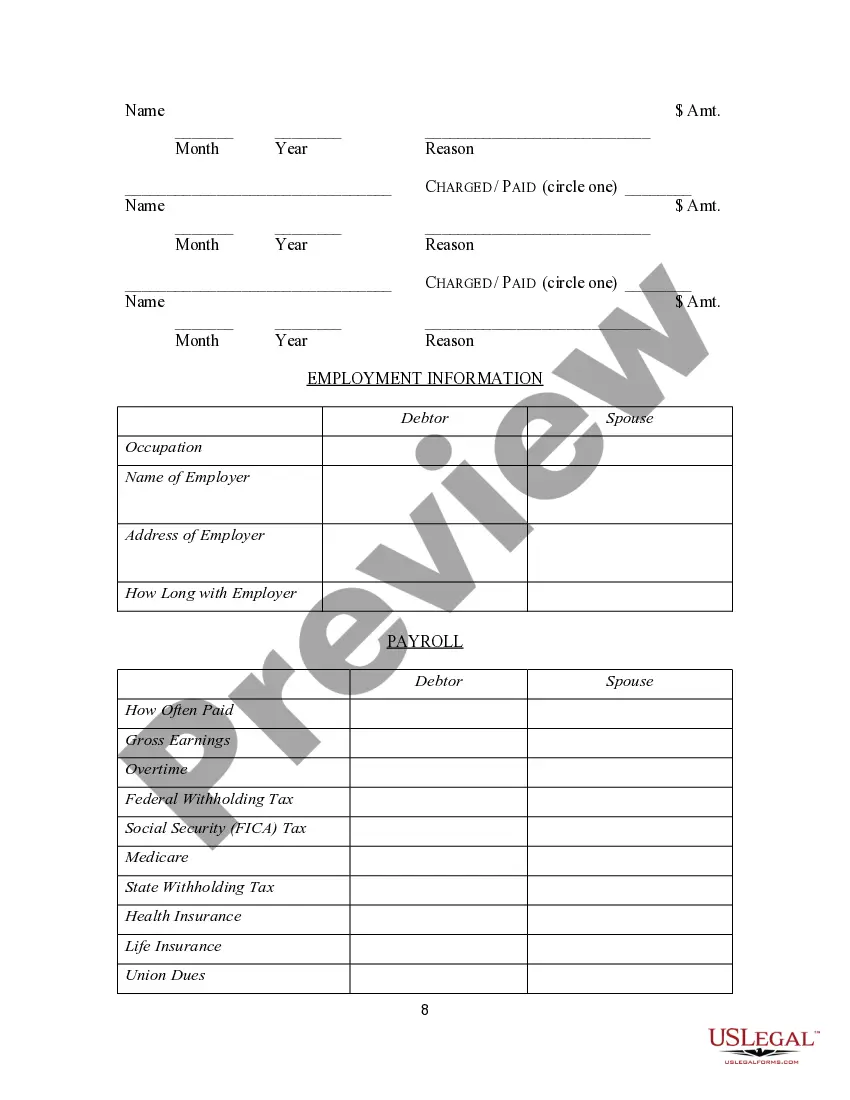

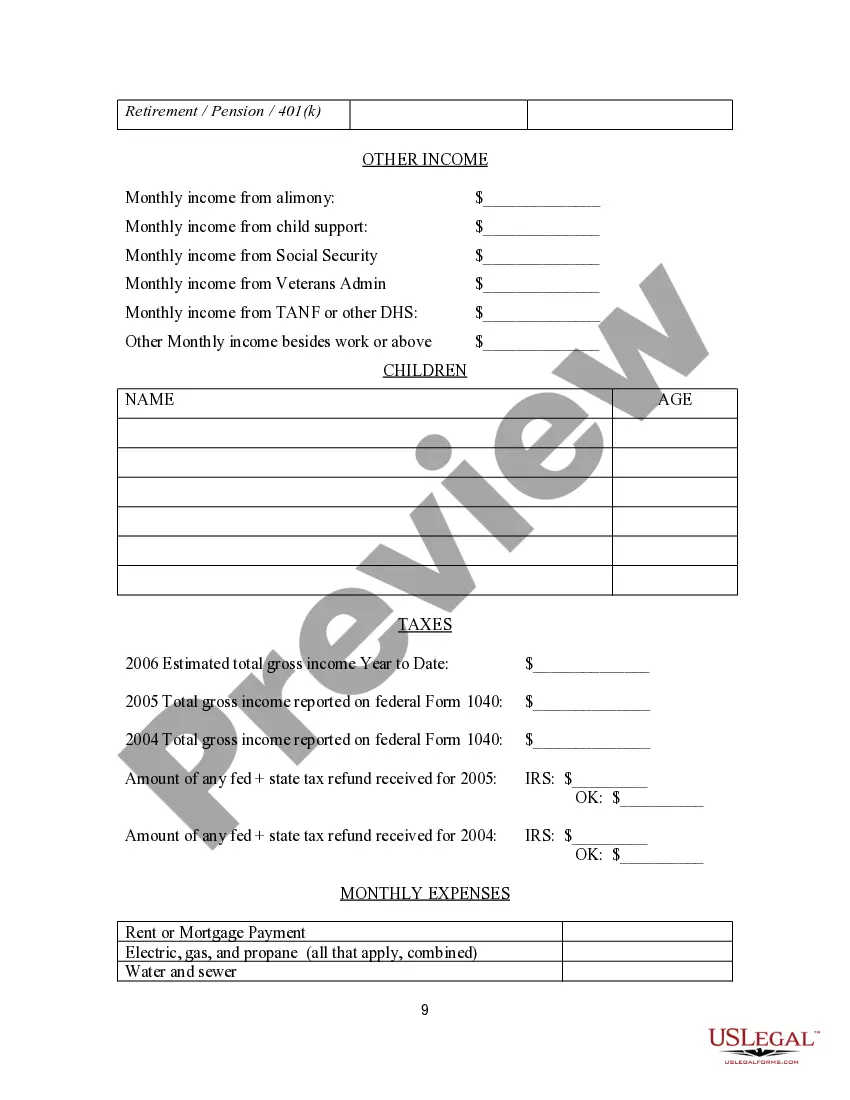

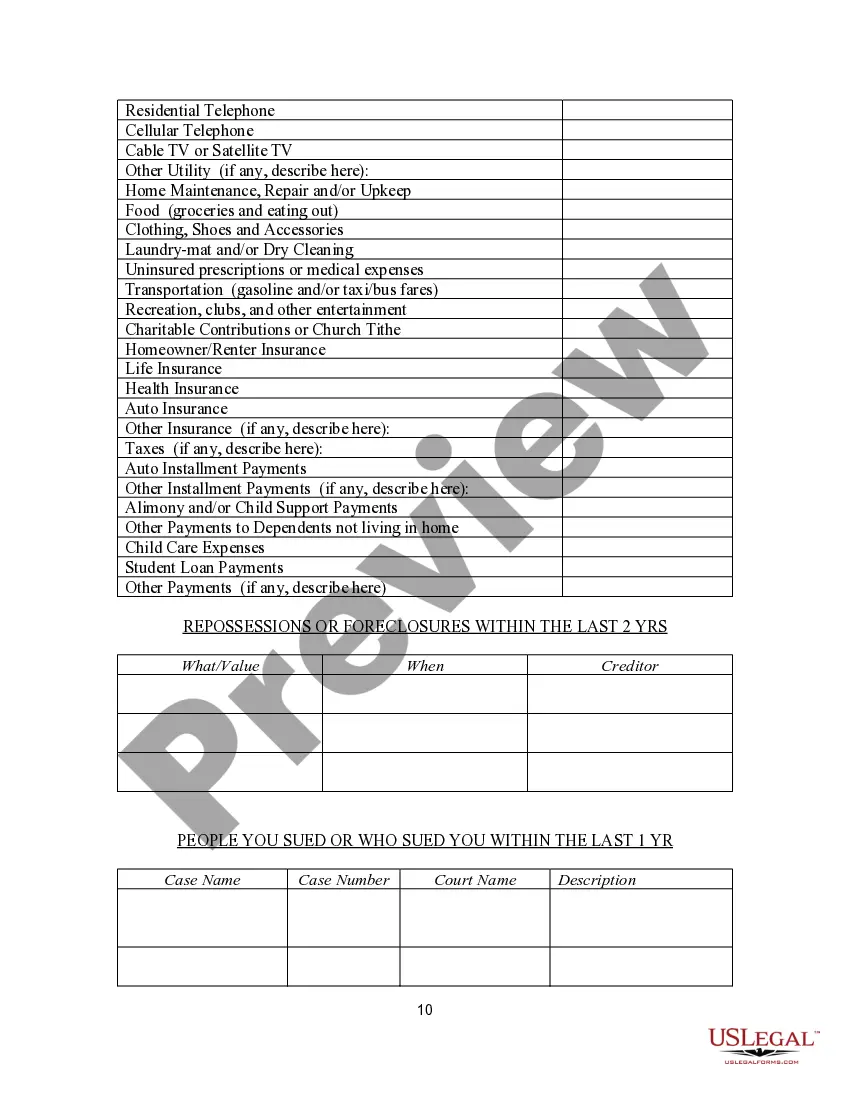

This forms allow the attorney to gather all necessary information about a debtor. The questionaire includes personal, financial, property, employment and debt information.

Free preview