Nassau New York Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Creating documents for business or personal requirements is consistently a significant obligation.

When formulating a contract, a public service request, or a power of attorney, it is crucial to take into account all federal and state statutes of the specific area.

Nonetheless, small counties and even municipalities also possess legislative frameworks that you must contemplate.

To find the one that matches your requirements, use the search tab in the page header.

- All these particulars render it stressful and lengthy to formulate Nassau Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form without professional assistance.

- It is simple to prevent unnecessary expenses on lawyers preparing your documents and produce a legally sound Nassau Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form independently, utilizing the US Legal Forms online database.

- It is the most comprehensive online collection of state-specific legal forms that are professionally verified, ensuring their validity when selecting a template for your county.

- Users who have previously subscribed only need to Log In to their accounts to retrieve the necessary form.

- If you do not have a subscription yet, follow the step-by-step guidelines below to acquire the Nassau Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

- Browse the page you've opened and verify if it includes the document you need.

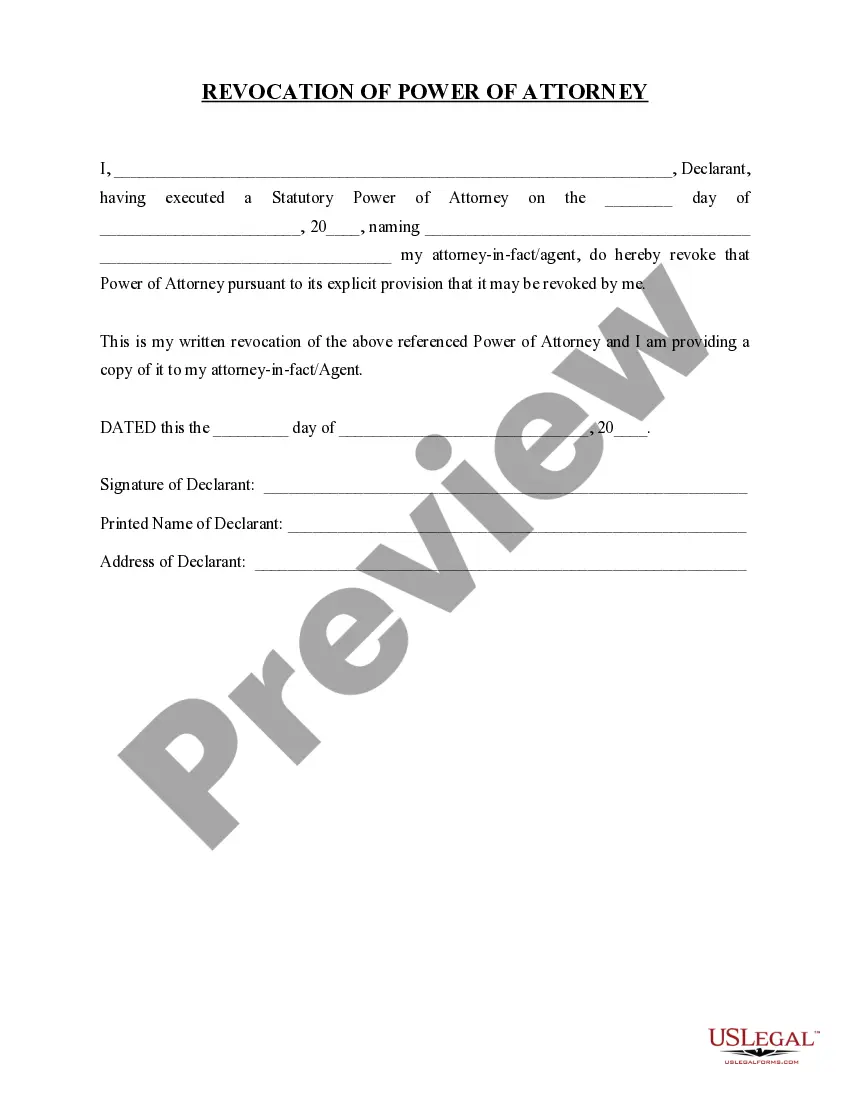

- To check this, utilize the form description and preview if such features are available.

Form popularity

FAQ

What Debts Are Discharged in Chapter 7 Bankruptcy? Child support. Alimony. Student loans. Some tax debt. Homeowners association fees. Court fees and penalties. Personal injury debts you owe due to an accident while you were intoxicated. Unsecured debts that you intentionally left off your filing.

If you stop making your required payments on general consumer debts (like a line of credit, overdraft or credit card), your creditors will generally charge you a fee for defaulting on (missing) payments and start reporting those defaults on your credit history.

Government entities have 180 days after the petition filing date to file a proof of claim. If a creditor doesn't file a proof of claim, it can't get paid through your bankruptcy. In a no-asset Chapter 7 case, creditors won't file proof of claim forms because there won't be any assets to distribute.

The debtor will no longer be personally liable for the debts and therefore has no legal obligation to pay discharged debt. In most cases, creditors are also unable to take collection action against the debtor if the debt has been discharged. Some common dischargeable debts include credit card debt and medical bills.

If you don't work with us to address your debt, we may file a claim or summons with the relevant court of your state or territory. Once the court recognises the debt owed, we may execute on the judgment debt in a number of ways, including by filing and serving a bankruptcy notice.

A Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date the bankruptcy was filed, while a Chapter 13 bankruptcy will fall off your report seven years after the filing date. After the allotted seven or 10 years, the bankruptcy will automatically fall off your credit report.

In most states in Australia, the limitation period for debts is for six (6) years, except in Northern Territory where it is for three (3) years. This means that the creditor can pursue the debt from six (6) years from the date of when: The debt became due and payable; or.

Official Form 309C (For Corporations or Partnerships) Notice of Chapter 7 Bankruptcy Case - No Proof of Claim Deadline.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

A provable debt is one that entitles the creditor to participate in dividends paid in the bankrupt estate. Section 82 of the Bankruptcy Act outlines which debts are provable and sections 83 to 107 provide further detailed information about provable debts.