Bexar Texas Employee Evaluation Form for Farmer

Description

How to fill out Employee Evaluation Form For Farmer?

Laws and statutes in each domain differ from jurisdiction to jurisdiction.

If you aren't an attorney, it can be challenging to navigate a range of standards when it comes to creating legal documents.

To steer clear of costly legal help when filling out the Bexar Employee Evaluation Form for Farmer, you require a verified template that is valid in your locale.

This is the easiest and most economical method to obtain current templates for any legal needs. Find everything in just a few clicks and maintain your documentation organized with US Legal Forms!

- Check the page details to confirm you have located the correct sample.

- Utilize the Preview option or read the form description if provided.

- Search for another document if there are discrepancies with any of your requirements.

- Click the Buy Now button to acquire the template once you find the right one.

- Choose one of the subscription plans and either Log In or create an account.

- Decide how you want to pay for your subscription (via credit card or PayPal).

- Select the format in which you wish to save the file and click Download.

- Fill out and sign the template on paper after printing it or complete everything electronically.

Form popularity

FAQ

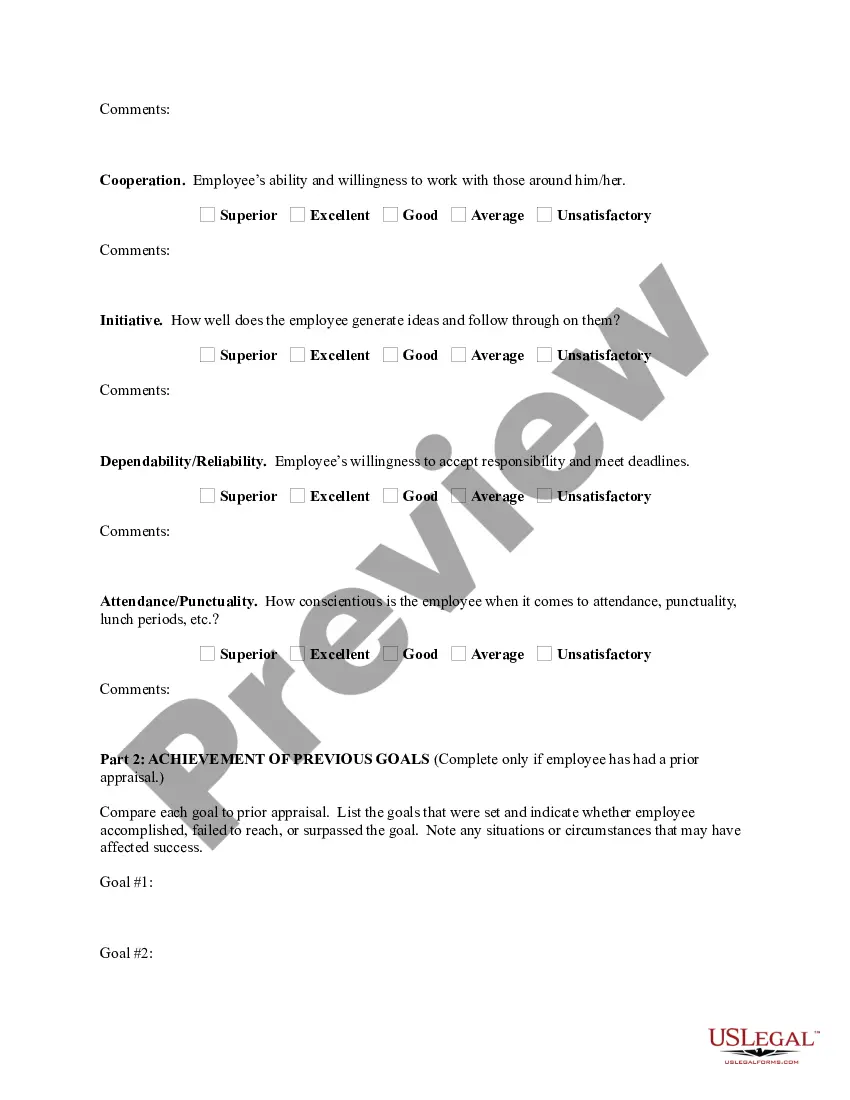

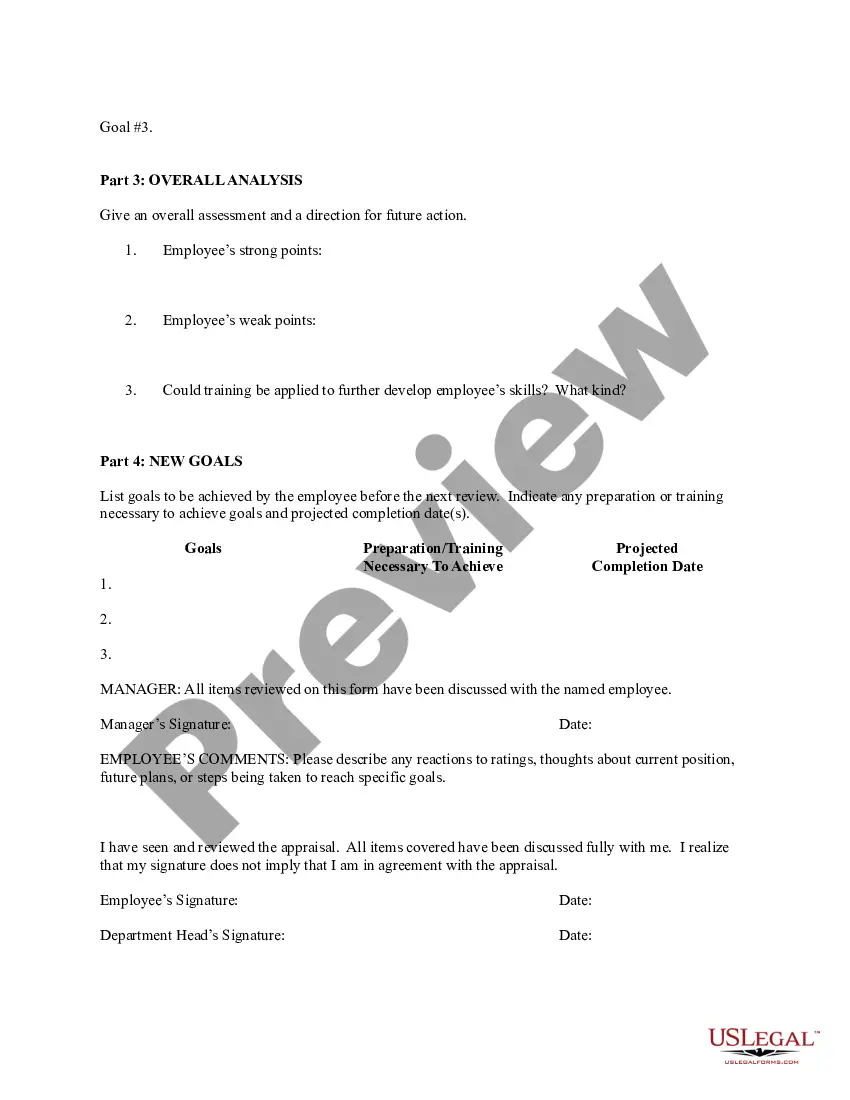

Do prepare thoroughly and provide specific examples during performance reviews. Using the Bexar Texas Employee Evaluation Form for Farmer can help structure your feedback effectively. Don't make the review a one-sided conversation; instead, engage the employee in a dialogue. Also, avoid making comparisons to other employees, as this can discourage and disengage your team member.

An employee evaluation form, such as the Bexar Texas Employee Evaluation Form for Farmer, is a tool used to assess an employee's performance and contributions. It provides a structured format for reviewing skills, achievements, and areas for improvement. This form serves as a foundation for meaningful discussions between employees and supervisors, fostering growth and development in the workplace.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices. PROPERTY SEARCH. Search property by name, address, or property ID.

What is a Homestead Cap? In general, the ASSESSED home value for a homeowner who qualifies for a General Homestead Exemption in the preceding and current year, may not increase more than 10 percent per year.

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

What is a Homestead Cap? In general, the ASSESSED home value for a homeowner who qualifies for a General Homestead Exemption in the preceding and current year, may not increase more than 10 percent per year.

Homestead Limitation (aka Residence Homestead Cap) A homestead limitation is a limitation or cap on the amount of value a property will be taxed from year to year. The appraisal district identifies the homestead limitation amount as the appraised value.

Calculation. Taxes are calculated by subtracting the value of any exemptions and, if applicable, the cap value from the homestead value of the property, and then adding any productivity or non-qualifying value. This result, the taxable value, is then multiplied by the tax rate per $100.

Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices. Interactive map to find Owner, Property ID, Address, etc.

Texas Property Tax Code Sec 23.23 limits increases of the total assessed value to 10% from year to year if the property is under homestead exemption. This 10% increase excludes any improvements added by the property owner. This section does not limit market value increases.