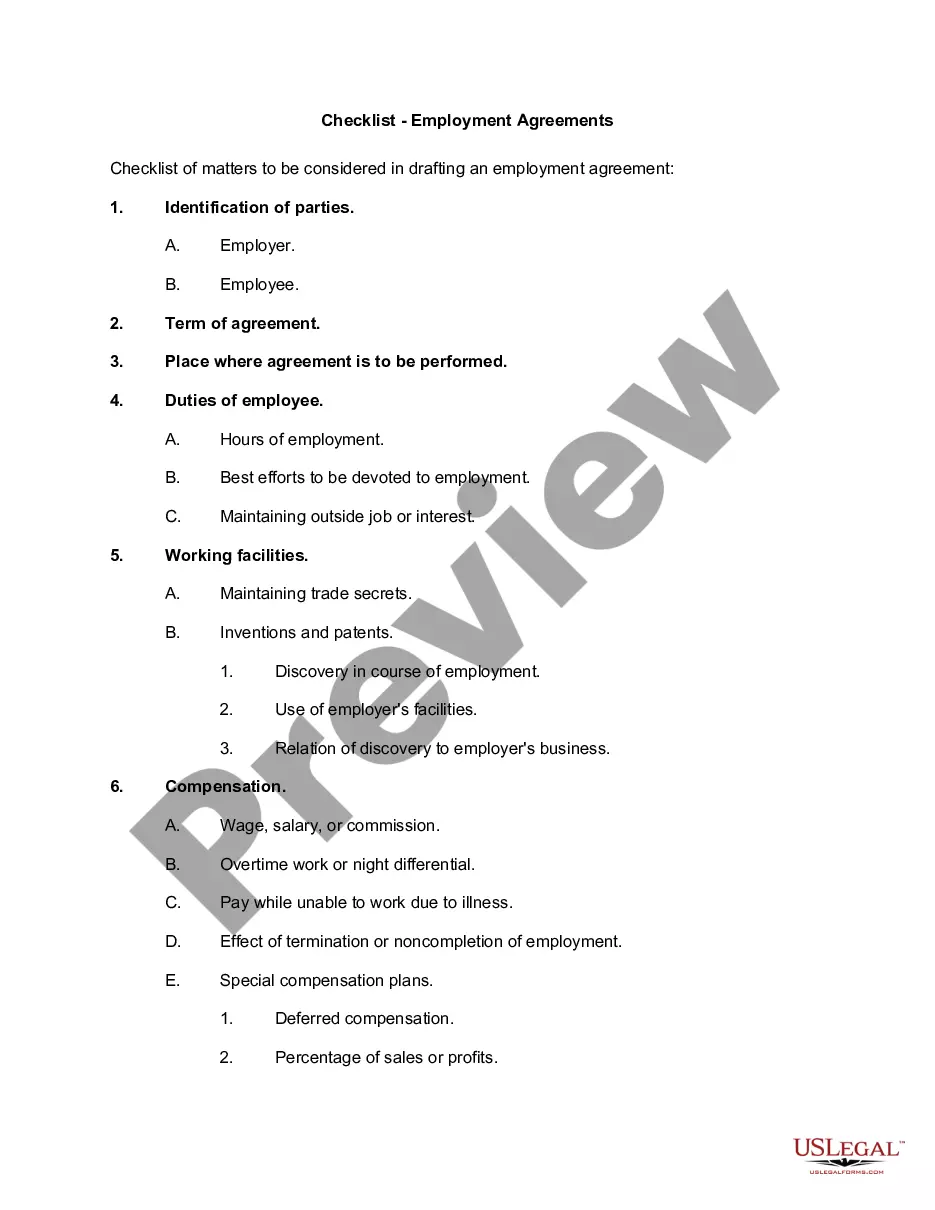

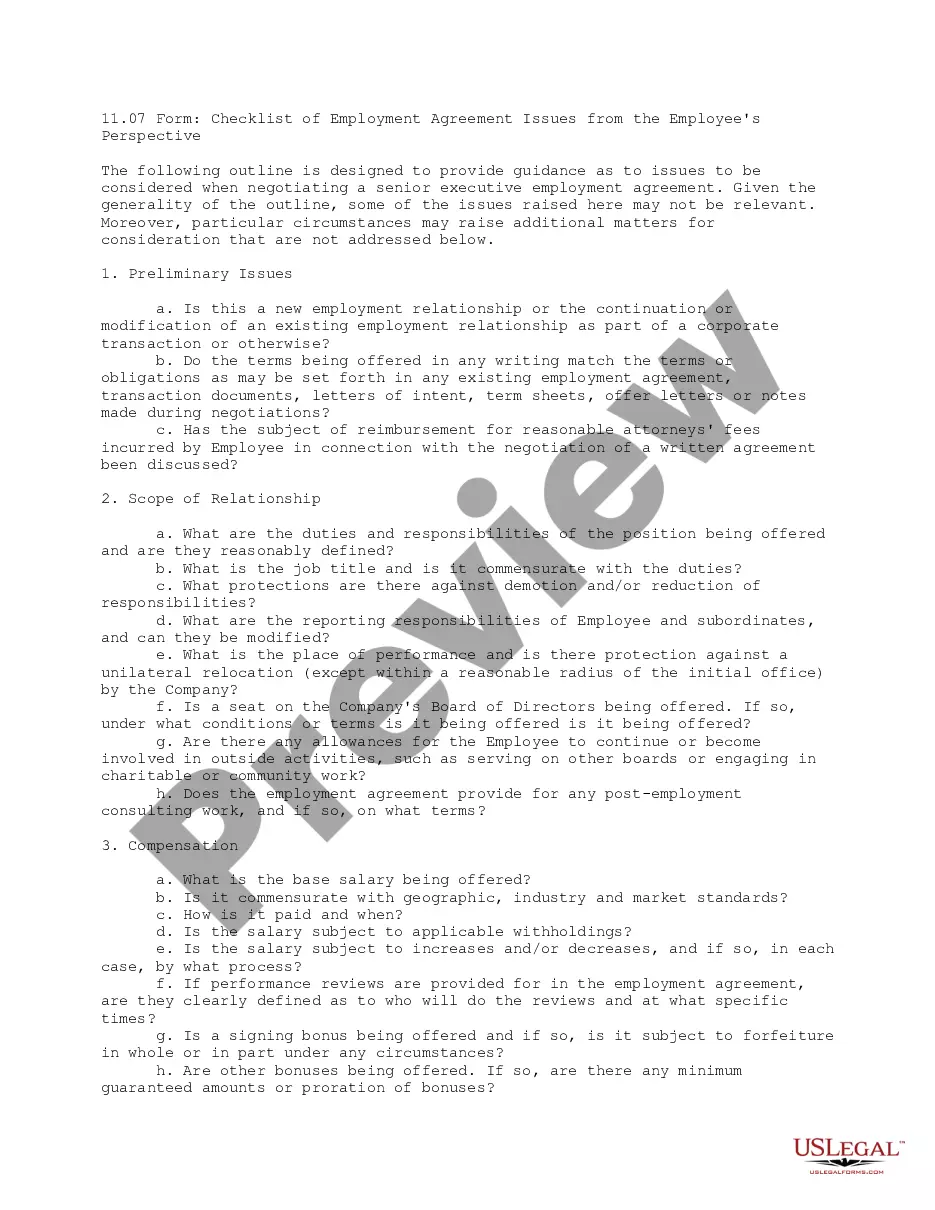

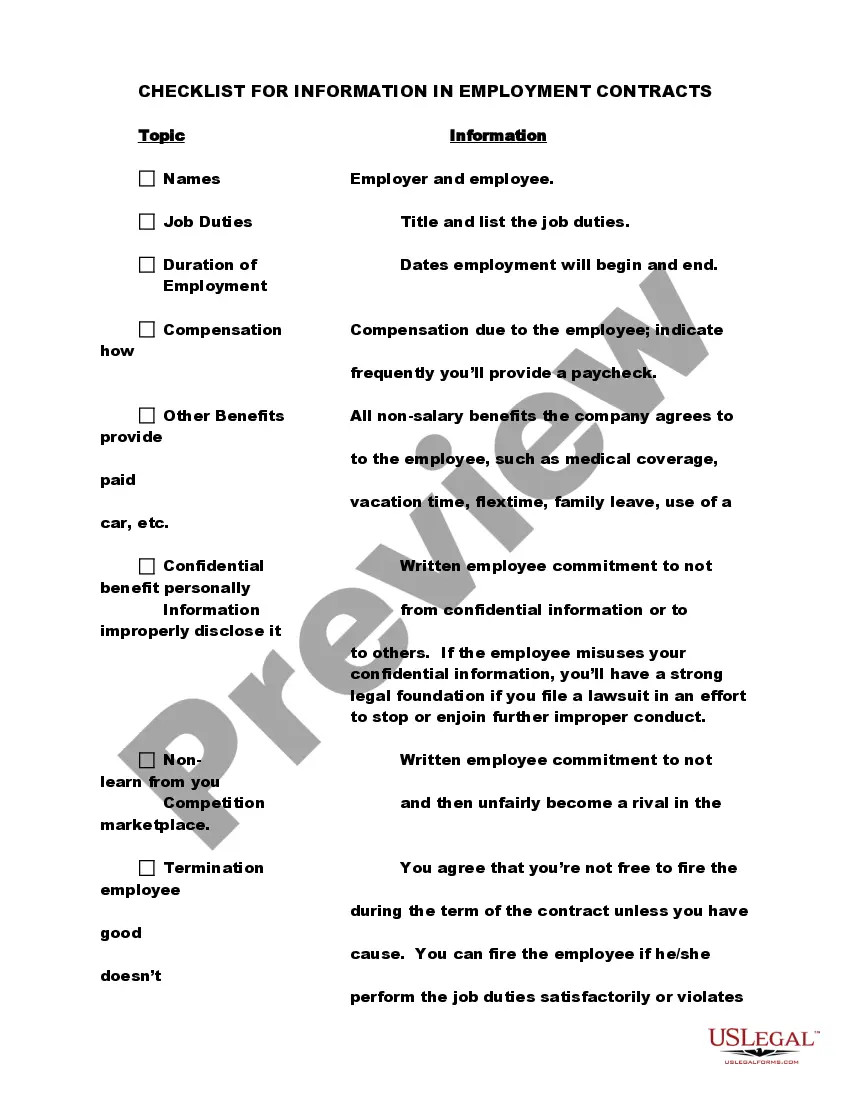

Sacramento California Checklist for Information in Employment Contracts

Description

How to fill out Checklist For Information In Employment Contracts?

How long does it typically take for you to create a legal document.

Considering that each state has its specific statutes and regulations governing various aspects of life, finding a Sacramento Checklist for Information in Employment Contracts that meets all local standards can be exhausting, and hiring a professional lawyer for it is frequently costly.

Several online services provide the most sought-after state-specific templates for download, but utilizing the US Legal Forms library is the most beneficial.

Give it a try!

- US Legal Forms is the largest online collection of templates, organized by state and area of use.

- In addition to the Sacramento Checklist for Information in Employment Contracts, you can obtain any particular document needed for running your business or personal matters, ensuring compliance with your local regulations.

- All samples are validated by professionals, so you can rest assured that your documents are accurately prepared.

- Using the service is quite straightforward.

- If you already possess an account on the platform and your subscription is active, you merely need to Log In, choose the necessary form, and download it.

- You can access the file in your profile at any later time.

- If you are a newcomer to the platform, there will be a few additional steps to complete before obtaining your Sacramento Checklist for Information in Employment Contracts.

- Review the content of the page you are on.

- Read the description of the template or Preview it (if an option is available).

- Look for another document using the related option in the header.

- Click Buy Now once you are confident about your chosen file.

- Choose the subscription plan that best meets your needs.

- Create an account on the platform or Log In to continue to payment options.

- Make a payment via PayPal or with your credit card.

- Change the file format if required.

- Click Download to save the Sacramento Checklist for Information in Employment Contracts.

- Print the document or utilize any preferred online editor to fill it out electronically.

- Regardless of how many times you need to access the purchased document, all the samples you have saved can be found in your profile by going to the My documents tab.

Form popularity

FAQ

California does not have a specific Form 4 as referenced in other states. However, the Sacramento California Checklist for Information in Employment Contracts is an excellent resource to guide you through the necessary forms for hiring and managing employees in California.

An employee file in California should contain essential documents such as the employment application, tax forms, performance evaluations, and disciplinary records. By following the Sacramento California Checklist for Information in Employment Contracts, employers can maintain organized files that comply with state regulations and facilitate easy access to important information.

A recent ruling by the California Supreme Court has changed the ways in which wage and hour laws will be applied in cases involving out-of-state employees working in the state of California. As a result of the ruling, California overtime laws now apply to any out-of-state employees while they are working in California.

Generally, remote employees are subject to the employment laws of the state and locality where they are physically present and working. If an employer permits remote work outside the locality or state of operations, the employer may want to consider taking steps to ensure compliance with those state and local laws.

1. Do California Wage and Hour Laws Apply to Me? Generally speaking, California wage and hour laws apply to all non-exempt employees in the state of California. an ?exempt employee? under California labor law.

Both a W-2 and a W-4 tax form. These forms will come in handy for both you and your new hire when it's time to file income taxes with the IRS. A DE 4 California Payroll tax form. Issued by the Employment Development Department, this form helps employees calculate the correct state tax withholding from their paycheck.

The short answer is ?no.? Generally speaking, the laws of each state apply only within the borders of that state. In ?legalese,? there is a presumption against extraterritorial application of the laws of a state.

California employers must provide the following documents for example: I-9 Employment Eligibility Verification completed. W-4 federal and state tax withholding forms completed. Workers' Compensation Time of Hire Pamphlet: Personal Chiropractor or Acupuncturist Designation Form and Personal Physician Designation Form.

Workplace Postings PostingWho Must PostIndustrial Welfare Commission (IWC) wage ordersAll employersMinimum wage (state)All employersPaid sick leaveAll employersCOVID-19 Supplemental Paid Sick Leave 2022All employers with 26 or more employees14 more rows

Here are some of the forms required for hiring new employees: W-4 (or W-9) form. The W-4 form tells employers how much money the employee wants to withhold from their pay for the correct federal tax income.I-9 form.State tax withholding form.Direct deposit form.Internal forms.Personal data for emergencies form.