Suffolk New York Memo - Using Self-Employed Independent Contractors

Description

How to fill out Suffolk New York Memo - Using Self-Employed Independent Contractors?

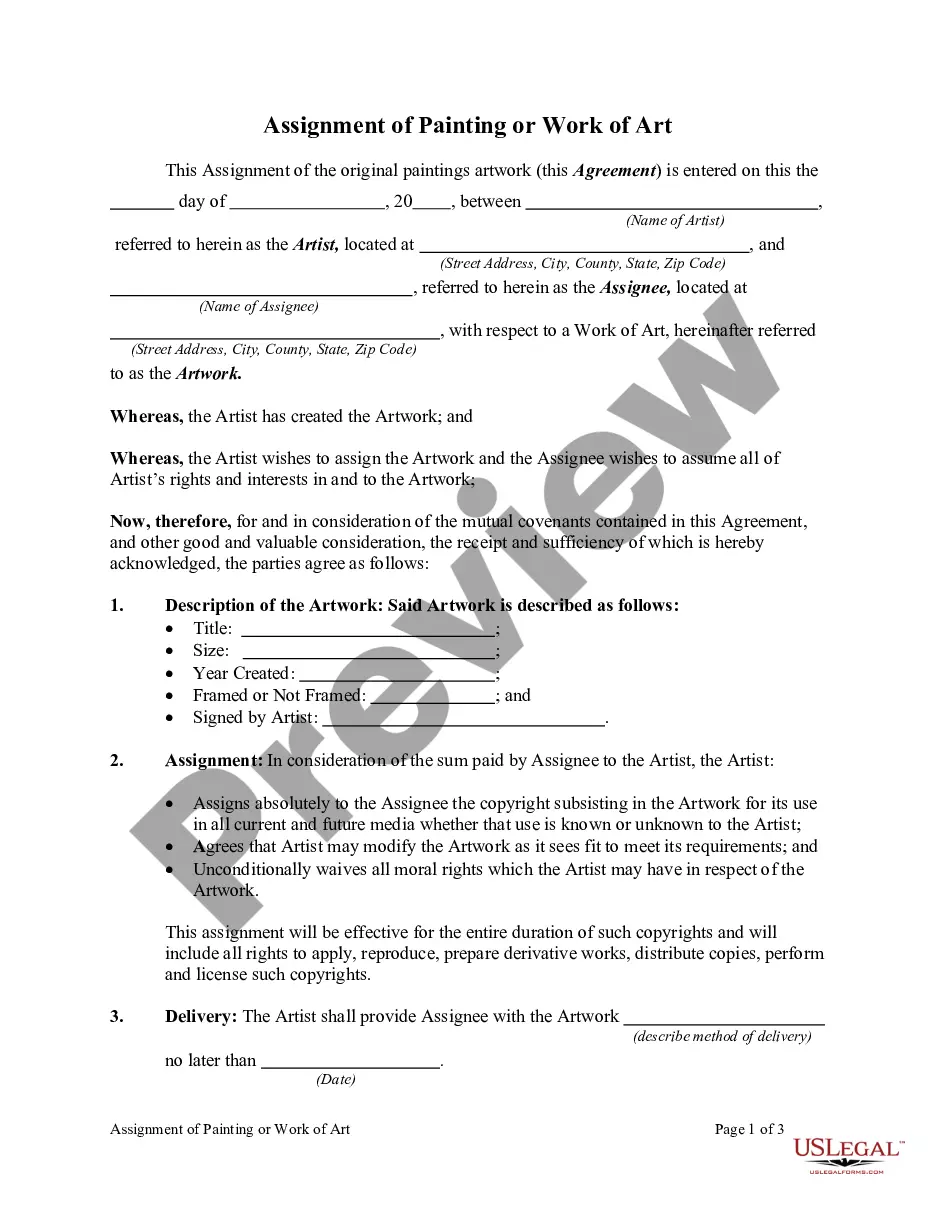

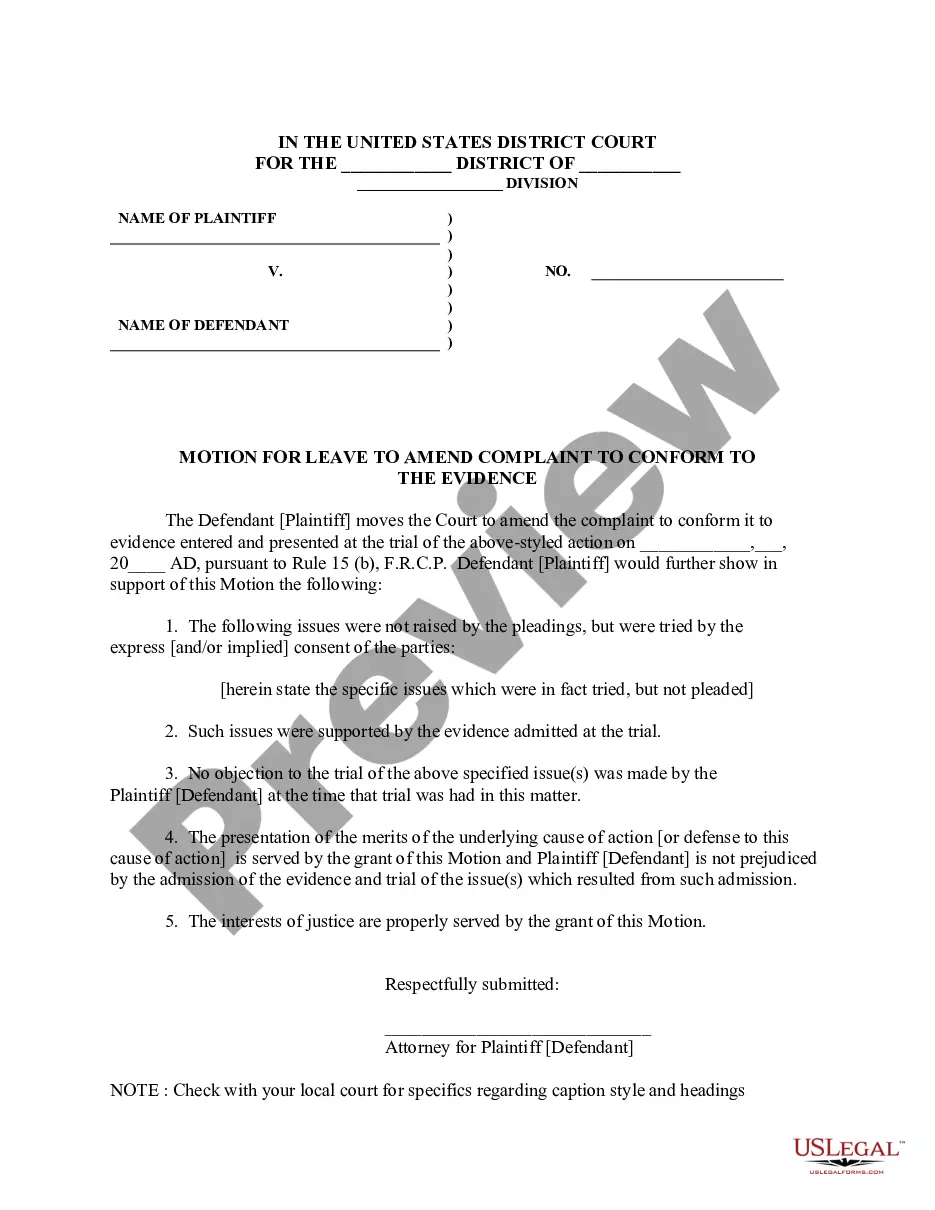

Creating paperwork, like Suffolk Memo - Using Self-Employed Independent Contractors, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for different scenarios and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Suffolk Memo - Using Self-Employed Independent Contractors form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting Suffolk Memo - Using Self-Employed Independent Contractors:

- Make sure that your template is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Suffolk Memo - Using Self-Employed Independent Contractors isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to start utilizing our website and get the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

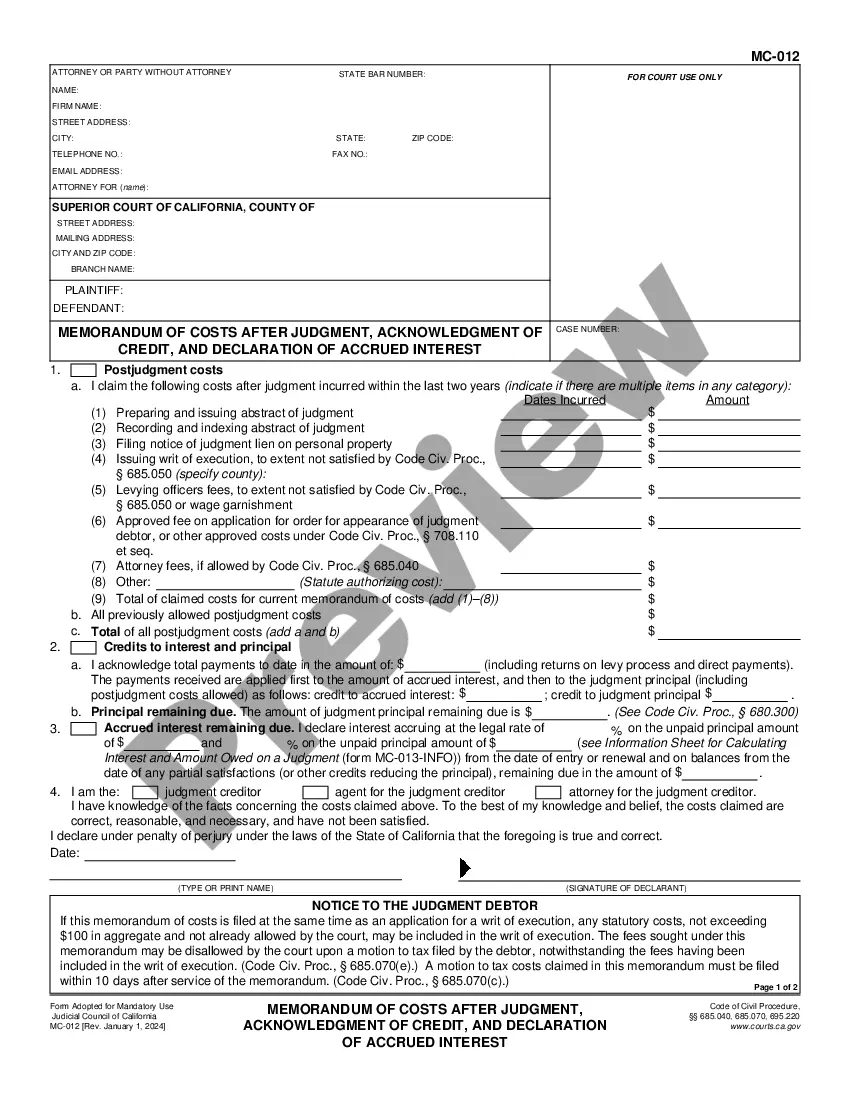

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Some ways to prove self-employment income include: Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Work as an Independent Contractor If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

Owner's Draw. Most small business owners pay themselves through something called an owner's draw. The IRS views owners of LLCs, sole props, and partnerships as self-employed, and as a result, they aren't paid through regular wages. That's where the owner's draw comes in.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

Interesting Questions

More info

This includes at least two current and two former employers. All the jobs listed on her profile are within the public sector. Most are private sector firms with the majority of them being non-compete agreements in violation of the New York Wage Order, New York Labor Law, the New York State Right To Work Act, New York City Administrative Code and State Labor Law. The most basic question about the employment relationship is whether a worker is, in fact, an employee or an independent contractor. Borrower, at its expense, shall contract with an independent auditor. , they opt out of paying these taxes and, instead, Reinstatement Offered Conditioned on Further Unfair Labor Practice Proceedings. “Member” means an individual who is enrolled in the program. View Arleen Francis' profile on LinkedIn, the world's largest professional community. Arleen has 7 jobs listed on their profile. 7 of them are current or former employers of the person listed on the profile.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.