Lima Arizona Memo — Using Self-Employed Independent Contractors The Lima Arizona Memo — Using Self-Employed Independent Contractors is a crucial document that outlines the guidelines and requirements for businesses and individuals in Lima, Arizona, who wish to utilize self-employed independent contractors. This memo provides comprehensive information on the legal and operational aspects of engaging with independent contractors in the Lima area, ensuring compliance with local laws and regulations while promoting fair and ethical business practices. Within the Lima Arizona Memo — Using Self-Employed Independent Contractors, several types of memos can be identified, each addressing specific topics related to freelance or independent contractor arrangements. These types include: 1. Compliance Guidelines and Regulations: This memo delves into the legal framework that encompasses the use of self-employed independent contractors in Lima, Arizona. It provides an overview of labor laws, tax requirements, and relevant regulatory bodies that businesses must adhere to when engaging with independent contractors. 2. Worker Classification: This section of the memo discusses the classification of workers as either employees or independent contractors, in accordance with Lima's criteria. It outlines the factors used to determine if a worker is an independent contractor or an employee, such as the level of control, nature of work, and business relationship. 3. Contractual Agreements: This memo type focuses on the importance of establishing clear contractual agreements when engaging with self-employed independent contractors. It highlights the key elements that should be included in contracts, such as scope of work, payment terms, confidentiality clauses, and intellectual property rights, ensuring the protection of both parties involved. 4. Tax Obligations: This memo provides detailed information on tax obligations and reporting responsibilities for businesses and contractors operating in Lima, Arizona. It covers topics such as income tax withholding, self-employment tax, and reporting requirements, helping businesses navigate the complex tax landscape. 5. Benefits and Insurance: This memo type explores the intricacies of providing benefits and insurance coverage for self-employed independent contractors. It offers insights into the various insurance options available, such as professional liability insurance, workers' compensation, and health insurance, enabling businesses to make informed decisions. 6. Compliance Audits and Penalties: This section of the memo outlines the potential consequences of non-compliance with Lima's guidelines for using self-employed independent contractors. It explains the process of compliance audits, potential penalties, fines, and legal ramifications that businesses may face if they fail to adhere to the prescribed rules and regulations. By adhering to the guidelines presented in the Lima Arizona Memo — Using Self-Employed Independent Contractors and its various types, businesses and independent contractors can foster mutually beneficial working relationships while operating within the legal framework, ensuring compliance and fair practices for all parties involved.

Pima Arizona Memo - Using Self-Employed Independent Contractors

Description

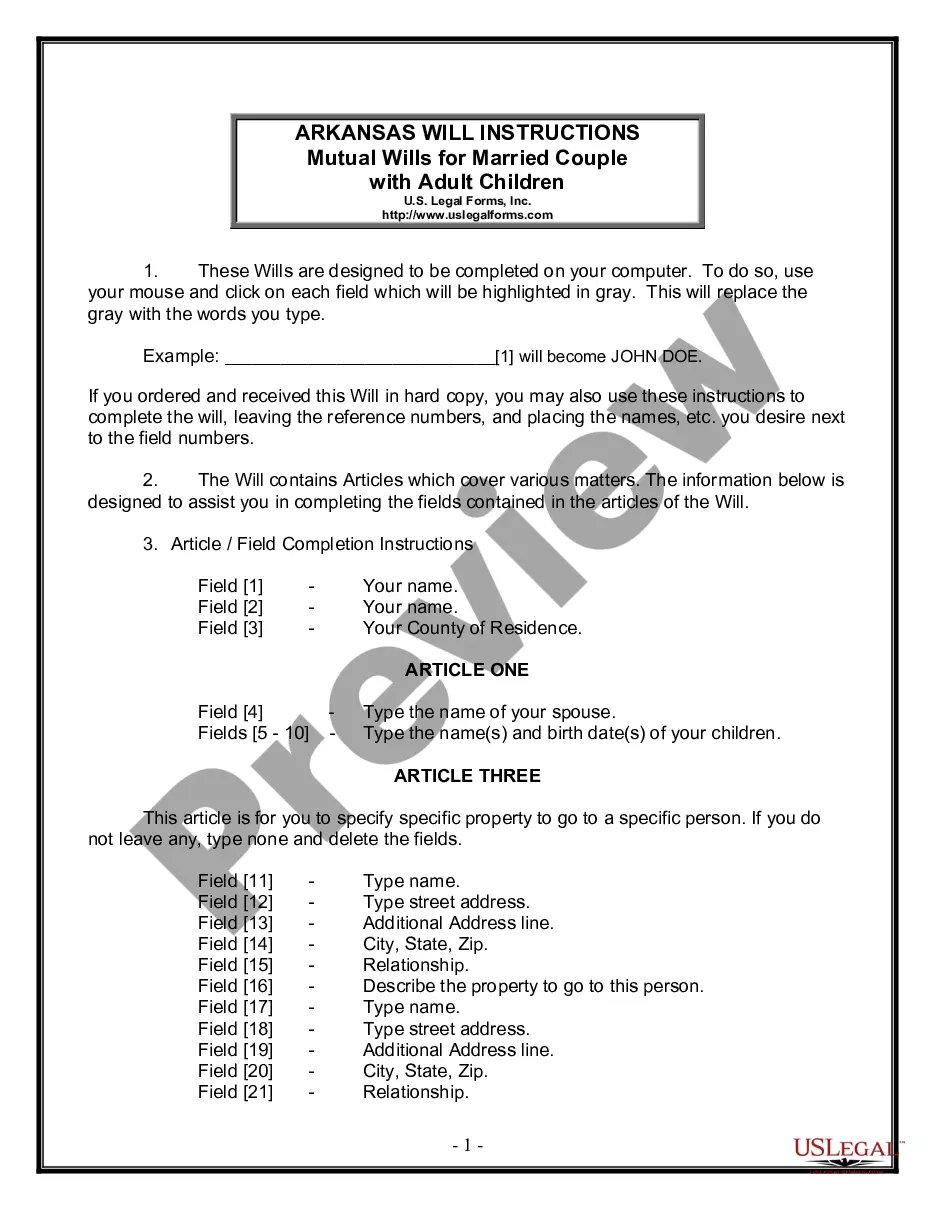

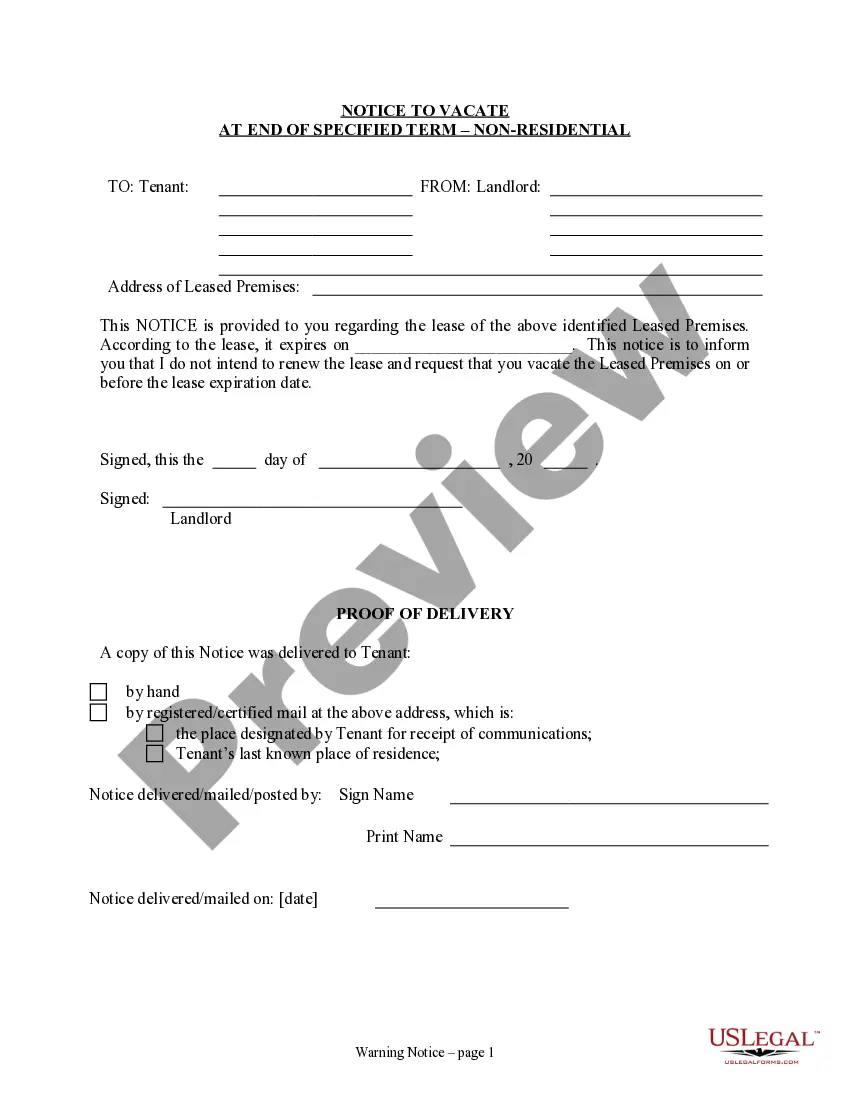

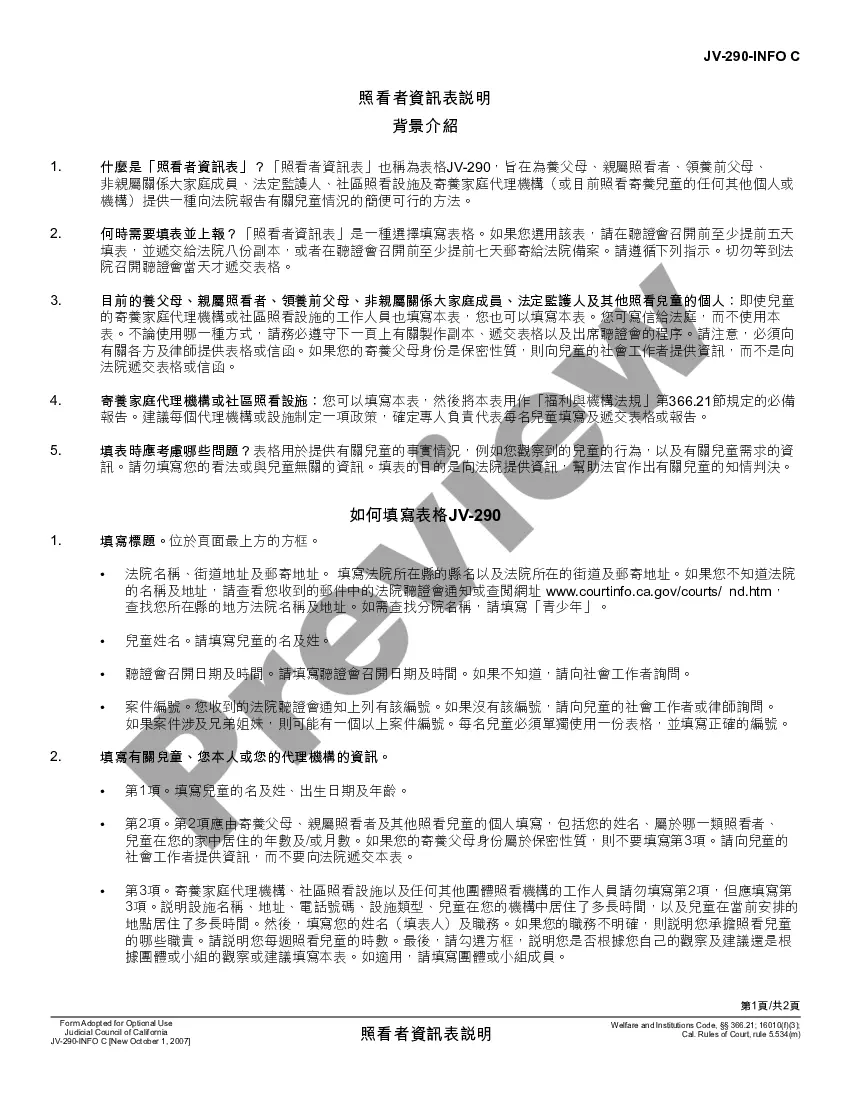

How to fill out Pima Arizona Memo - Using Self-Employed Independent Contractors?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business objective utilized in your region, including the Pima Memo - Using Self-Employed Independent Contractors.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Pima Memo - Using Self-Employed Independent Contractors will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Pima Memo - Using Self-Employed Independent Contractors:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Pima Memo - Using Self-Employed Independent Contractors on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.You may need to make estimated tax payments.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Normally income you received totaling over $600 for non-employee compensation (and/or at least $10 in royalties or broker payments) is reported on Form 1099-MISC. If you are self-employed, you are required to report your self-employment income if the amount you receive from all sources equals $400 or more.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

There are several types of business bank accounts to consider for your independent contracting business. You can consider an account with a local bank as well as an online business bank account. You may prefer mobile banking if you don't need to go into a physical branch and don't need to deposit cash.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To report your income, you should file a Schedule C with your business income and expenses. Also, you should pay a self-employment tax. Without a 1099 Form, independent contractors who earned cash should keep track of their earnings, estimate them and file them at the end of the year no matter what.