Cook Illinois Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

How long does it typically take you to create a legal document.

Considering that each state has its own laws and regulations for every aspect of life, finding a Cook Employee Payroll Records Checklist that meets all local requirements can be laborious, and acquiring it from a qualified attorney is often expensive.

Many online platforms provide the most common state-specific templates for download; however, utilizing the US Legal Forms library is the most beneficial.

You can print the document or utilize any preferred online editor to fill it out digitally. Regardless of how many times you need to reference the purchased template, all the samples you've saved can be found in your profile by opening the My documents tab. Give it a shot!

- US Legal Forms offers the largest online compilation of templates, organized by states and usage areas.

- In addition to the Cook Employee Payroll Records Checklist, you can discover any particular document needed to operate your business or personal tasks, in accordance with your local criteria.

- Experts validate all samples for their accuracy, so you can be assured of correctly preparing your documentation.

- Using the service is exceptionally simple.

- If you already possess an account on the site and your subscription is active, you simply need to Log In, select the needed template, and download it.

- You can store the document in your profile for future access.

- However, if you are new to the service, there will be a few additional steps to complete before obtaining your Cook Employee Payroll Records Checklist.

- Review the page content.

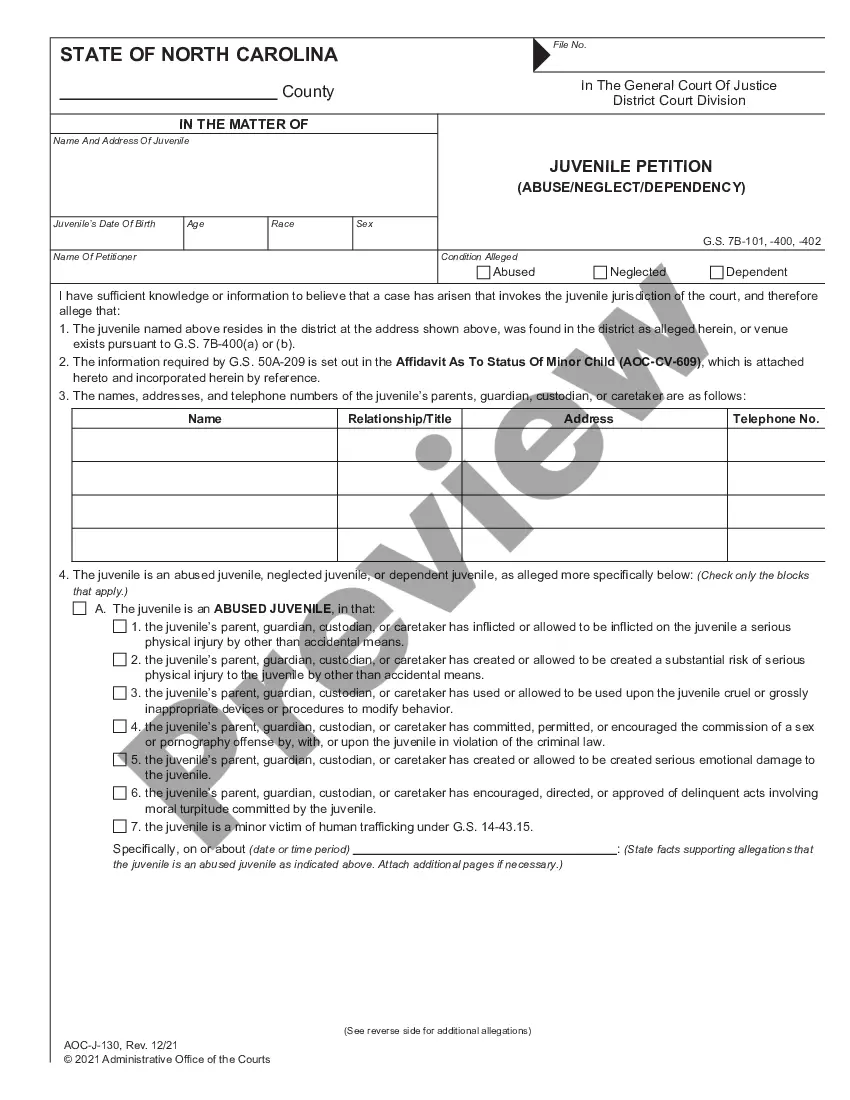

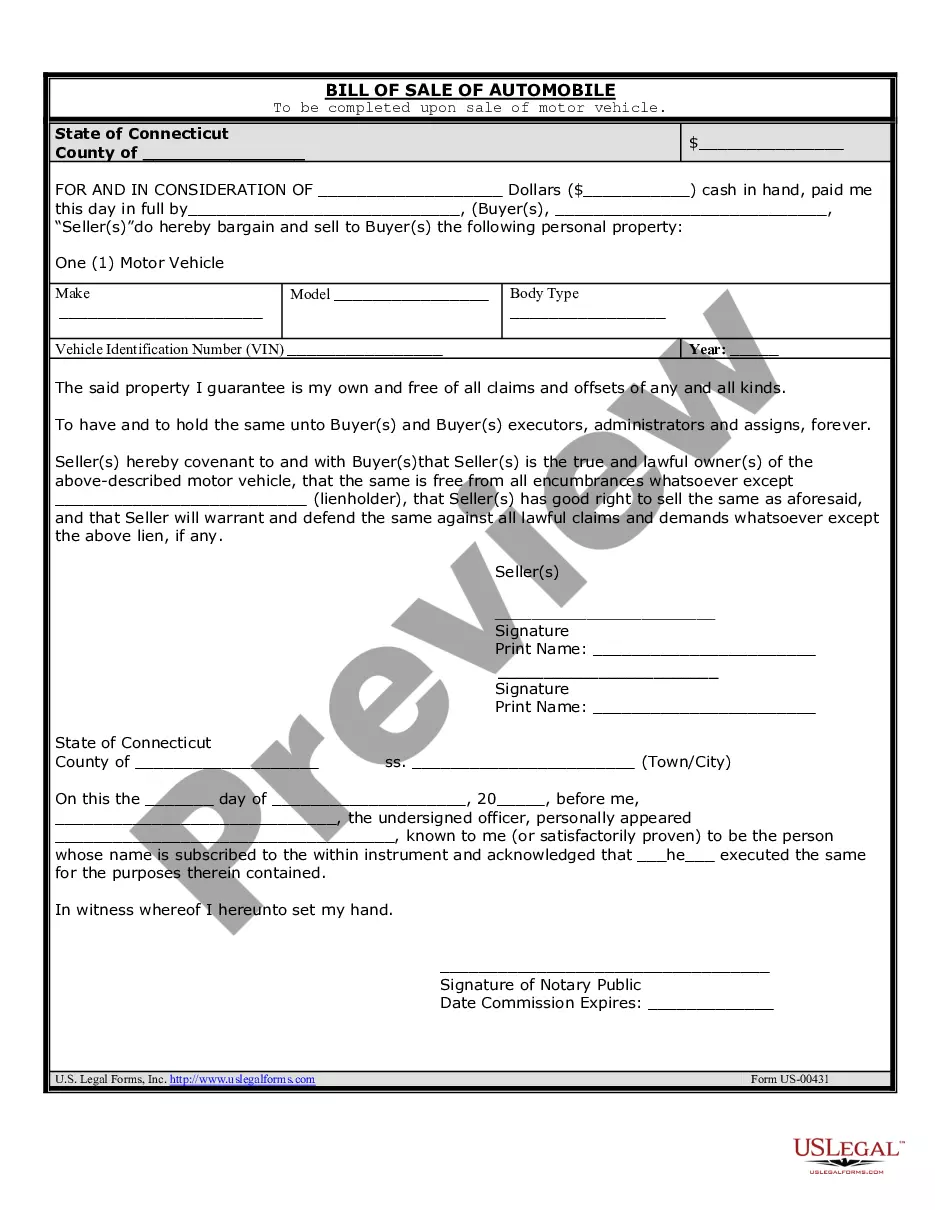

- Examine the description of the template or Preview it (if accessible).

- Search for another document using the related option in the header.

- Click Buy Now when you are certain about the selected document.

- Choose the subscription plan that best suits your needs.

- Create an account on the site or Log In to continue to payment methods.

- Complete the payment using PayPal or your credit card.

- Change the file format if needed.

- Click Download to save the Cook Employee Payroll Records Checklist.

Form popularity

FAQ

You should keep employee payroll records for at least three to four years, depending on federal and state guidelines. This recommendation is part of the Cook Illinois Employee Payroll Records Checklist, which serves as a valuable resource for employers. By adhering to these timelines, you help safeguard your business against potential legal issues and maintain a clear record of your payroll activities.

A payroll clerk should gather several essential records for a new employee, including the signed Form W-4, I-9 verification documents, and direct deposit information. Incorporating these details into your Cook Illinois Employee Payroll Records Checklist can streamline the onboarding process. Ensuring you have these records on file will help prevent issues related to payroll processing down the line.

The IRS generally requires employers to keep payroll records for at least four years. Following the Cook Illinois Employee Payroll Records Checklist helps you align with these federal guidelines. By maintaining thorough and accurate records, your business can avoid potential penalties and ensure compliance with tax regulations.

Employers in Illinois are required to retain payroll records for at least four years. This is a critical aspect of the Cook Illinois Employee Payroll Records Checklist. By adhering to this timeline, you ensure that you can easily provide necessary documents in case of inquiries or audits from regulatory bodies.

In Illinois, you should keep payroll records for a minimum of four years. This duration aligns with the Cook Illinois Employee Payroll Records Checklist, which emphasizes the importance of maintaining clear and accessible documentation. Keeping these records organized can help prevent issues and facilitate easier management of employee payroll information.

You typically need to keep payroll documents for at least three years. This is part of the Cook Illinois Employee Payroll Records Checklist that helps ensure compliance with employment regulations. Retaining these records not only protects your business but also provides the necessary documentation in case of audits or disputes.

Creating an employee checklist can start with identifying key documents needed for payroll, onboarding, and compliance. Organize items such as identification documents, tax forms, and benefit options. By referring to the Cook Illinois Employee Payroll Records Checklist, you can ensure your checklist is comprehensive and tailored to meet your organization's needs.

Filling out a payroll record requires you to gather accurate employee information, including hours worked and wage rates. Use the format specified in the Cook Illinois Employee Payroll Records Checklist to ensure all necessary fields are completed, such as employee name, Social Security number, and payment dates. Accurate records support compliance and help streamline future payroll cycles.

Creating a payroll checklist involves identifying key tasks and dates related to payroll processing. Start by outlining important elements such as employee information collection, time tracking, benefit deductions, and tax calculations. You can enhance your process by using the Cook Illinois Employee Payroll Records Checklist as a guide, ensuring each step is completed accurately and timely.

Employers in Illinois must retain specific records for at least seven years, including payroll records, employee contracts, and tax documents. This practice helps protect against audits and legal disputes. Proper management of these records is crucial, and utilizing a Cook Illinois Employee Payroll Records Checklist can streamline this process. Keeping these records organized ensures you meet legal obligations and maintain transparency.