Suffolk New York Stock Purchase - Letter of Intent

Description

How to fill out Stock Purchase - Letter Of Intent?

Whether you intend to launch your enterprise, engage in a contract, request an update for your identification, or address familial legal matters, you must prepare particular documentation that aligns with your local legislation and regulations.

Locating the appropriate paperwork may require considerable time and effort unless you utilize the US Legal Forms library.

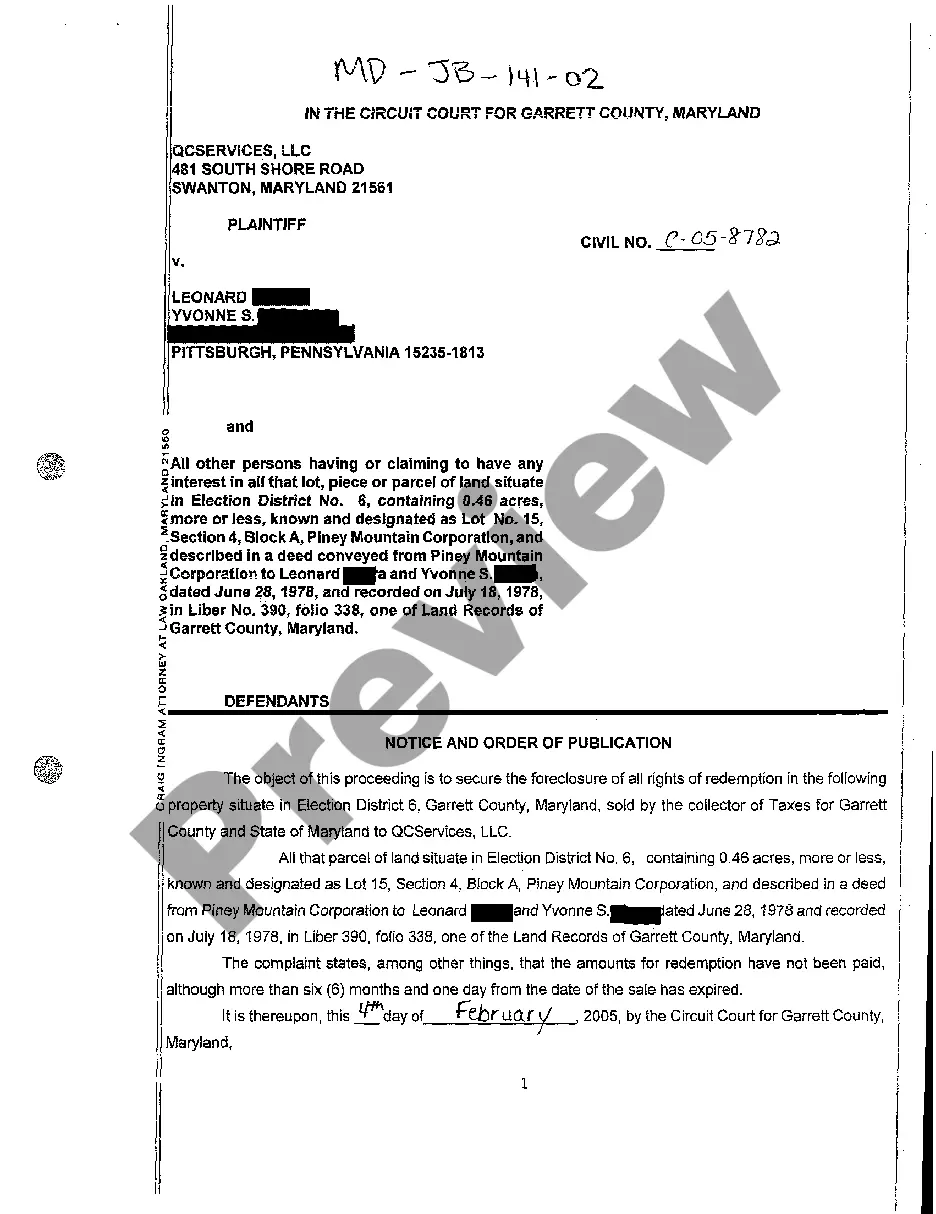

The platform offers users access to over 85,000 professionally drafted and verified legal documents for any personal or business need. All files are organized by state and usage area, so selecting a document like the Suffolk Stock Purchase - Letter of Intent is swift and effortless.

Documents available in our library are multi-usable. With an active subscription, you can access all your previously acquired documents at any time from the My documents section of your profile. Stop wasting time on a continual hunt for current official documentation. Join the US Legal Forms platform and maintain your paperwork in order with the most comprehensive online form library!

- Ensure the template meets your specific needs and complies with state law.

- Review the form description and check the Preview if available on the page.

- Use the search option specifying your state above to discover another template.

- Click Buy Now to acquire the document once you find the correct one.

- Select the subscription plan that best suits you to continue.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Suffolk Stock Purchase - Letter of Intent in your preferred file format.

- Print the document or complete it and sign electronically through an online editor to save time.

Form popularity

FAQ

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

The purchase agreement usually is preceded in the process by a letter of intent (referred to in this article as the LOI). While certain terms in the LOI are legally binding, the LOI is not intended to bind the parties to do the sale itself. The LOI instead expresses the parties' intent to pursue the sale.

Letter of Intent for Business An intent to purchase business agreement isn't legally binding and is simply a notice to begin negotiations to purchase a business. It is a way to put into writing the tentative agreement that was most likely made verbally between the two parties.

Buying a Stock Investment: Stock purchases are when investors buy ownership of the shares of a company. The investor's purchase price is called the cost basis. The goal is to sell the stock at a higher price and realize a profit. A buy order is an instruction to a stockbroker to buy a security.

Identify your letter as a letter of intent to sell shares. Define the company and who is meant by "seller" and "buyer." Include contact information for all the parties. Include the postal and registered address of the company, if they're different. Name every shareholder involved in the sale.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Once the LOI is signed, the next steps are to negotiate the purchase agreement and perform due diligence. These are separate processes, but they usually occur in parallel and take about 90 days to complete.

Follow these steps when writing an LOI: Write the introduction.Describe the transaction and timeframes.List contingencies.Go through due diligence.Include covenants and other binding agreements.State that the agreement is nonbinding.Include a closing date.

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.